IM CANNABIS CORP.

ANNUAL INFORMATION FORM

For the Financial Year Ended December 31, 2020

April 26, 2021

TABLE OF CONTENTS

SCHEDULE "A" - AUDIT COMMITTEE CHARTER

-i-

ANNUAL INFORMATION FORM

In this annual information form ("Annual Information Form" or "AIF"), unless otherwise noted or the context indicates otherwise, the "Company" "IMCC", "we", "us" and "our" refer to IM Cannabis Corp., together with its subsidiaries, on a consolidated basis, and the "Group" refers to the Company, its subsidiaries, and Focus, an Israeli private company over which IMC Holdings exercises "de facto control" under IFRS 10. All dollar amounts referred to in this Annual Information Form are stated in Canadian dollars unless otherwise indicated. IMCC prepares its financial statements in accordance with IFRS as issued by the International Accounting Standards Board.

The information in this Annual Information Form is presented as at December 31, 2020 unless otherwise indicated. All references to the Company's Common Shares and securities issuable into Common Shares such as Warrants, Options, Broker Options, and RSUs are reflected on a post-Consolidation (as defined below) basis unless otherwise indicated or the context requires otherwise.

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Information Form may contain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws (collectively referred to herein as "forward-looking statements"). All statements other than statements of fact may be deemed to be forward-looking statements, including statements with regard to expected financial performance, strategy and business conditions. The words "believe", "plan", "intend", "estimate", "expect", "anticipate", "continue", or "potential", and similar expressions, as well as future or conditional verbs such as "will", "should", "would", and "could" often identify forward-looking statements. These statements reflect management's current beliefs with respect to future events and are based on information currently available to management as of the date of this Annual Information Form including reasonable assumptions, estimates, internal and external analysis and opinions of management considering its experience, perception of trends, current conditions and expected developments as well as other factors that management believes to be relevant as at the date such statements are made.

Without limitation, this Annual Information Form contains forward-looking statements pertaining to:

- 2 -

With respect to the forward looking-statements contained in this Annual Information Form, the Company has made assumptions regarding, among other things:

Readers are cautioned that the above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward-looking statements due to a number of factors and risks. These include:

- 3 -

- 4 -

The foregoing list of risk factors is not exhaustive. Additional information on these and other factors that could affect the business, operations or financial results of the Company are detailed under the heading "Risk Factors" of this Annual Information Form. Unless otherwise indicated, forward-looking statements in this Annual Information Form describe our expectations as of the date of this Annual Information Form. The Company and management caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. The Company and management assume no obligation to update or revise them to reflect new events or circumstances except as required by applicable securities laws.

MARKET AND INDUSTRY DATA

This Annual Information Form contains market and industry data and forecasts obtained from third-party sources, industry publications and publicly available information. The Company believes that the industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third-party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. Although management believes it to be reliable, the Company has not independently verified any of the data from third-party sources referred to in this Annual Information Form, or analyzed or verified the underlying information relied upon or referred to by such sources, or ascertained the underlying economic assumptions relied upon by such sources.

NOTE REGARDING THE COMPANY'S ACCOUNTING PRACTICES

The Company complies with IFRS 10, which applies a single consolidation model using a definition of "control" that requires an investor (as defined in IFRS 10) to consolidate an investee (as defined in IFRS 10) where: (i) the investor has power over the investee; (ii) the investor has exposure or rights to variable returns from involvement with the investee; and (iii) the investor can use its power over the investee to affect the amount of the investor's returns.

Subsequent to the IMC Restructuring, the Company analyzed the terms of the contractual agreements with Focus (including the Commercial Agreements and the Focus Agreement) in accordance with IFRS 10 to conclude whether it should continue to consolidate the accounts of Focus in its financial statements.

- 5 -

Under IFRS 10, consolidation occurs when an investor can exercise control over an investee. Control is achieved through voting rights or other evidence of power. Where there are no direct holdings, under IFRS 10, an investor (as defined in IFRS 10) needs to consider other evidence of power and ability to unilaterally direct an investee's (as defined in IFRS 10) relevant activities. In view of the contractual agreements and the guidance in IFRS 10, notwithstanding that the Company has no direct or indirect ownership of Focus, it has sufficient rights to unilaterally direct the relevant activities (a concept known as "de facto control"), mainly due to the following:

(a) the Company receiving economic benefits from Focus (and the terms of the Commercial Agreements cannot be changed without the approval of the Company);

(b) the Company having the option to purchase the divested 74% interest in Focus held by Oren Shuster, the CEO, director and a promoter of the Company, and Rafael Gabay, a consultant, former director and a promoter of the Company;

(c) Messrs. Shuster and Gabay each being a director of Focus (while Mr. Shuster concurrently being a director, officer and substantial shareholder of the Company and Mr. Gabay concurrently being a substantial shareholder of the Company); and

(d) the Company providing management and support activities to Focus through the Services Agreement.

Accordingly, under IFRS 10, the Company has "de facto control" over Focus, and therefore consolidates the financial results of Focus in the Company's financial statements.

For additional information, please see "Risk Factors - Consolidation of Focus Financial Results under IFRS 10 and Maintenance of Common Control".

CURRENCY AND EXCHANGE RATES

References in this AIF to "CAD", "$", dollars or currency are to the lawful currency of Canada, unless otherwise indicated. In addition, this AIF includes references to (i) "NIS" which means the New Israeli Shekel, the lawful currency of the State of Israel. As of April 23, 2021, the value of one Canadian dollar expressed in NIS, based on the exchange rate available through the Bank of Israel, is NIS 2.6078, and (ii) "USD" which means the United States Dollar, the lawful currency of the United States of America. As of April 16, 2021, the value of one Canadian dollar expressed in USD, based on the exchange rate available through the U.S. Federal Reserve, is USD 0.8001; (iii) "EUR" which means the Euro, the lawful currency of the European Union. As of April 23, 2021, the value of one Canadian dollar expressed in EUR, based on the exchange rate available through the European Central Bank, is EUR 0.6639.

GLOSSARY OF TERMS

Unless otherwise indicated, the following terms used in this Annual Information Form shall have the meanings ascribed to them as set forth below:

"1961 Single Convention on Narcotic Drugs" means the Single Convention on Narcotic Drugs, 1961, an international treaty regarding the international control of narcotic drugs.

"ACMPR" means Access to Cannabis for Medical Purposes Regulations;

"Adjupharm" means Adjupharm GmbH, a company incorporated under the laws of Germany;

"Adjupharm Licenses" has the meaning set out in "Description of the Business - Production, Distribution and Sales in Principal Markets - Europe";

- 6 -

"AMG" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Germany";

"BCBCA" means the Business Corporations Act (British Columbia), as amended, including all regulations promulgated thereunder;

"BfArM" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Germany - Cultivation in Germany and Distribution of Medical Cannabis Cultivated in Germany";

"Board" means the board of directors of the Company as presently constituted;

"Broker Options" means broker compensation options of the Company;

"BtMG" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Germany";

"Cannabis Act" means the Cannabis Act (Canada), as amended, including all regulations promulgated thereunder.

"Cannabis Agency" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Germany - Cultivation in Germany and Distribution of Medical Cannabis Cultivated in Germany";

"Cannabis License" and "Cannabis Licenses", respectively, have the meanings set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Licensing and Authorization for Commercial Activities in the Medical Cannabis Field";

"cannabis oil" means the extract of cannabis inflorescence diluted with oil;

"Cannabis Regulations" has the meaning set out in "Description of the Business - Recreational Cannabis Regulatory Framework in Canada";

"CBD" means cannabidiol;

"CBN" means cannabinol;

"CEO" means chief executive officer;

"CFO" means chief financial officer;

"Commercial Agreements" has the meaning set out in "Corporate Structure - Intercorporate Relationships";

"Common Shares" means at any particular time the issued and outstanding common shares in the capital of the Company at that time;

"Company" means IM Cannabis Corp., a corporation continued under the BCBCA with its registered office located in Vancouver, British Columbia;

"Consolidation" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

- 7 -

"Construction Allegations" has the meaning set out in "Risk Factors - Reliance on Focus Facility";

"COVID-19" means the COVID-19 novel coronavirus;

"CSA Staff Notice 51-352" means Staff Notice 51-352 (Revised) - Issuers with U.S. Marijuana-related Activities of the Canadian Securities Administrators.

"CSE" means the Canadian Securities Exchange;

"Dangerous Drugs Ordinance" means the Dangerous Drugs Ordinance [New Version], 1973 [Hebrew];

"Directive 150" means Directive 150/2016 - IMC-GSP certification, the IMCA directive that sets the standards for the security and protection measures that must be taken throughout the entire supply chain of medical cannabis;1

"Directive 151" means Directive 151/2016 - IMC-GAP certification, the IMCA directive that sets the norms and standards for growing medical cannabis in Israel;2

"Directive 152" means Directive 152/2016 - IMC-GMP certification, the IMCA directive that provides the IMC-GMP rules and standards for the creation and production of medical cannabis goods in Israel;3

"Directive 153" means Directive 153/20163 - IMC-GDP certification, the IMCA directive that sets the conditions for the proper storage and delivery of medical cannabis products in Israel;4

"Dutch Tender" has the meaning set out in "General Development of the Business - Recent Developments - Developments During the Financial Year Ended December 31, 2020";

"EU" means the European Union;

"EU-GACP Standard" means the good agricultural and collection practice standard set out by the European Union and coordinated by the European Medicines Agency for companies that cultivate, harvest and collect cannabis to manufacture, process, package and store;

"EU-GMP Standard" means the good manufacturing practice standard set out by the European Union and coordinated by the European Medicines Agency for manufacturers of medical products intended for the European Union market;

"EUR" has the meaning set out in "Currency and Exchange Rates";

"Export Guidelines" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Medical Cannabis Exports";

"Export Resolution" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Medical Cannabis Exports";

"Final Shelf Prospectus" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

1 Directive 150 [Hebrew] - https://www.health.gov.il/hozer/mmk150_2016.pdf

2 Directive 151 [Hebrew] - https://www.health.gov.il/hozer/mmk151_2016.pdf

3 Directive 152 [Hebrew] - https://www.health.gov.il/hozer/mmk152_2016.pdf

4 Directive 153 [Hebrew] - https://www.health.gov.il/hozer/mmk153_2016.pdf

- 8 -

"Focus" means Focus Medical Herbs Ltd., a company incorporated under the laws of the State of Israel;

"Focus Agreement" has the meaning set out in "Corporate Structure - Intercorporate Relationships";

"Focus Facility" means the propagation and cultivation facility in Moshav Sde Avraham, Israel, operated by Focus pursuant to the Focus Lease Agreement;

"Focus Lease Agreement" means the long-term land lease agreements between Focus and the landowners on which the Focus Facility is built and operated;

"Focus License" has the meaning set out in "Description of the Business - Production, Distribution and Sales in Principal Markets - Israel";

"Galen" means Galen Industries Single Member Societe Anonyme;

"GDPR" means the General Data Protection Regulation (EU) 2016/679;

"German Local Tender" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Germany - Cultivation in Germany and Distribution of Medical Cannabis Cultivated in Germany";

"Group" means, collectively, the Company, its subsidiaries, and Focus, an Israeli private company over which IMC Holdings exercises "de facto control" under IFRS 10;

"IFRS" means International Financial Reporting Standards as issued by the International Accounting Standards Board applicable as at the relevant date;

"IFRS 10" means IFRS 10 Consolidated Financial Statements, the reporting standard under IFRS outlining the requirements for the preparation and presentation of consolidated financial statements when an entity controls one or more other entities;

"IMC-GAP" or "GAP Standard" means the good agricultural practices standard set out by the IMCA in Directive 151, and is required for Israeli cultivation and propagation licenses;

"IMC-GDP" or "GDP Standard" means the good manufacturing practices standard set out by the IMCA in Directive 153, and is required for Israeli transportation, storage and distribution licenses;

"IMC-GMP" or "GMP Standard" means the good manufacturing practices standard set out by the IMCA in Directive 152, and is required for Israeli manufacturing licenses;

"IMC-GSP" or "GSP Standard" means the good security practices standard set out by the IMCA in Directive 150, and is required throughout the Israeli supply chain for cannabis-related activities;

"IMC Holdings" means I.M.C. Holdings Ltd., a limited liability company existing under the laws of the State of Israel;

"IMC Netherlands Holdco" has the meaning set out in "General Development of the Business - Recent Developments - Developments During the Financial Year Ended December 31, 2020";

"IMC Restructuring" has the meaning set out in "Corporate Structure - Intercorporate Relationships";

"IMCA" means the Israeli Medical Cannabis Agency, an agency operated by the MOH;

- 9 -

"IP Agreement" has the meaning set out in "Corporate Structure - Intercorporate Relationships";

"IT systems" has the meaning set out in "Risk Factors - Information Technology";

"kg" means a kilogram;

"Listed Warrants" has the meaning set out in "Description of Capital Structure - Warrants";

"MediPharm Labs" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"MGC" has the meaning set out in "General Development of the Business - Recent Developments - Developments During the Financial Year Ended December 31, 2020";

"MOH" means the Israeli Ministry of Health;

"MOH Allegations" has the meaning set out in "Risk Factors - Reliance on Focus Facility";

"MOH Regulations" means the Dangerous Drugs Ordinance, any amendments of the Dangerous Drugs Ordinance, any regulations enacted by virtue of the Dangerous Drugs Ordinance from time to time, and the regulatory regime introduced by the MOH with respect to the medical cannabis industry in Israel, including the Road Map, Procedure 106, Procedure 109, the Export Resolution and the Export Guidelines;

"NASDAQ" means the NASDAQ Capital Market;

"NGC" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"NGC Supply Agreement" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"NI 52-110" means National Instrument 52-110 - Audit Committees;

"NIS" has the meaning set out in "Currency and Exchange Rates";

"NMCP" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel";

"OBCA" means the Business Corporations Act (Ontario), as amended, including all regulations promulgated thereunder;

"Option Cap" has the meaning set out in "Description of Capital Structure - Options";

"Options" means incentive stock options to purchase Common Shares granted to certain eligible participants of the Company in accordance with the terms of the Stock Option Plan;

"Person" means an individual, partnership, unincorporated association, unincorporated syndicate, unincorporated organization, trust, trustee, executor, administrator or other legal representative;

"Pilot Program" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Medical Cannabis Exports";

- 10 -

"PIPEDA" means the Personal Information Protection and Electronic Documents Act (Canada);

"Preliminary Shelf Prospectus" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"Procedure 106" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Patient Medical Use";

"Procedure 109" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Medical Cannabis Imports";

"Qualified Securities" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"Registration Statement" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"Reverse Takeover Transaction" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Reverse Takeover Transaction";

"Road Map" has the meaning set out in "Medical Cannabis Regulatory Framework in Israel and Germany - Israel - Licensing and Authorization for Commercial Activities in the Medical Cannabis Field";

"RSU" has the meaning set out in "Description of Capital Structure - Restricted Share Units";

"RSU Plan" has the meaning set out in "Description of Capital Structure - Restricted Share Units";

"SEC" means the United States Securities and Exchange Commission;

"Securities Commissions" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"Services Agreement" has the meaning set out in "Corporate Structure - Intercorporate Relationships";

"Shiran" means Shiran Single Member Societe Anonyme;

"Stock Option Plan" has the meaning set out in "Description of Capital Structure - Options";

"Subscription Receipts" has the meaning set out in "General Development of the Business - Recent Developments - The Reverse Takeover Transaction";

"THC" means tetrahydrocannabinol;

"TJAC" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"TJAC Facilities" has the meaning set out in "Production, Distribution and Sales in Principal Markets - Canada";

"TJAC Leases" has the meaning set out in "Production, Distribution and Sales in Principal Markets - Canada";

"Trichome" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

"Trichome Transaction" has the meaning set out in "General Development of the Business - Recent Developments - Developments Following the Financial Year Ended December 31, 2020";

- 11 -

"Unlisted Warrants" has the meaning set out in "Description of Capital Structure - Warrants";

"U.S." means the United States of America;

"USD" has the meaning set out in "Currency and Exchange Rates";

"Warrants" means Common Share purchase warrants of the Company and includes Listed Warrants and Unlisted Warrants; and

"Xinteza" has the meaning set out in "General Development of the Business - Developments Following the Reverse Takeover Transaction";

Words importing the singular number only include the plural and vice versa, and words importing any gender include all genders.

- 12 -

CORPORATE STRUCTURE

Name, Address and Incorporation

The full corporate name of the Company is "IM Cannabis Corp." The Company's head office is located at Kibbutz Glil Yam, Israel and its registered office is located at 550 Burrard Street, Suite 2300, Bentall 5, Vancouver, British Columbia, V6C 2B5, Canada. The Company is a reporting issuer under the laws of each of the Provinces and Territories of Canada.

The Company was incorporated as "Nirvana Oil & Gas Ltd." pursuant to a Certificate of Incorporation issued under the BCBCA on March 7, 1980. Effective July 12, 2013, in connection with a share consolidation, the Company changed its name to "Navasota Resources Inc."

On June 22, 2018, the Company completed a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every 5 pre-consolidation Common Shares.

On October 4, 2019, in connection with the Reverse Takeover Transaction, the Company effected a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every 2.83 pre-consolidation Common Shares and changed its name to "IM Cannabis Corp."

On February 12, 2021, in connection with its NASDAQ listing application, the Company effected the Consolidation on the basis of one (1) post-Consolidation Common Share for every four (4) pre-Consolidation Common Shares.

Intercorporate Relationships

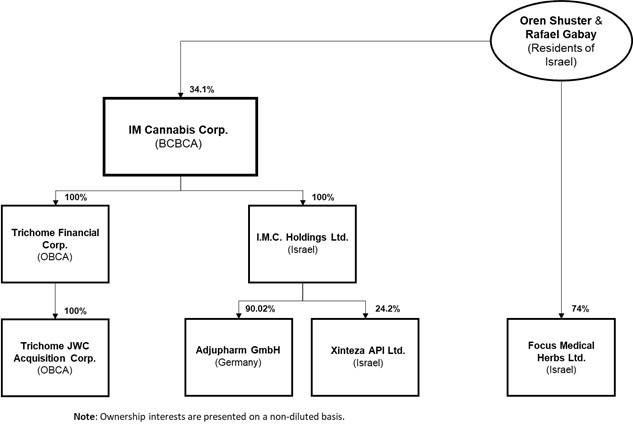

The organizational chart of the Company, including the governing law or the jurisdiction of organization of the Company and each material subsidiary and the percentage of voting securities beneficially owned, or controlled or directed, directly or indirectly, by the Company, is set out below.

- 13 -

Current Israeli law requires the prior approval by the IMCA of the identity of any shareholder owning 5% or more of an Israeli company licensed to engage in cannabis-related activities. For a number of reasons, including the opportunity to leverage a network of multiple Israeli licensed producers cultivating under the IMC brand, and in contemplation of a "go-public transaction" to geographically diversify the Company's share ownership, IMC Holdings restructured its organization on April 2, 2019 (the "IMC Restructuring") resulting in the divestiture to Oren Shuster and Rafael Gabay of its interest in Focus, which is licensed by the MOH to propagate and cultivate cannabis in Israel:

IMC Holdings retains an option with Messrs. Shuster and Gabay to re-acquire the sold interest in Focus at its sole discretion and in accordance with Israeli cannabis regulations, within 10 years of the date of the IMC Restructuring (the "Focus Agreement"). The Focus Agreement sets an aggregate exercise price equal to NIS 765.67 per share of Focus for a total consideration of NIS 2,756,500, that being equal to the price paid by Messrs. Shuster and Gabay for the acquired interests in Focus at the time of the IMC Restructuring. Although the Company does not hold any voting interests in Focus, the Company is permitted to consolidate the accounts of Focus in its financial statements by virtue of its "de facto" control over Focus in accordance with IFRS 10. For more information on the Company's corporate structure with respect to Focus and the Company's accounting practices, please see "Note Regarding the Company's Accounting Practices".

As part of the IMC Restructuring, IMC Holdings and Focus entered into: (i) an agreement in which Focus would use the IMC brand on an exclusive basis for the sale of any cannabis plant and/or cannabis product produced by Focus, either alone or together with other sub-contractors engaged by Focus, among other rights and services (the "IP Agreement"); and (ii) an agreement pursuant to which Focus would use IMC Holdings for certain management and consulting services including: (a) business development services; (b) marketing services; (c) strategic advisory services; (d) locating potential collaborations on a worldwide basis; and (e) financial analysis services (the "Services Agreement" and collectively with the IP Agreement, the "Commercial Agreements").

- 14 -

GENERAL DEVELOPMENT OF THE BUSINESS

The following discussion covers key events during the Company's historical development over the last three completed financial years, as well as certain subsequent events to the date of this Annual Information Form.

History prior to the Reverse Takeover Transaction

The Company historically engaged in mineral resource exploration activities but ceased operations in March 2018 to focus on identifying and evaluating new business opportunities.

The Reverse Takeover Transaction

On October 11, 2019, the Company completed a business combination with IMC Holdings resulting in a reverse takeover of the Company by shareholders of IMC Holdings (the "Reverse Takeover Transaction"). The Reverse Takeover Transaction was effected by way of a "triangular merger" between the Company, IMC Holdings and a wholly-owned subsidiary of the Company pursuant to Israeli statutory law. The Board and management of the Company were reconstituted and subsequently led by Oren Shuster. As a result of the Reverse Takeover Transaction, the Company changed its business from mining to the international medical cannabis industry.

In connection with the Reverse Takeover Transaction, the Company completed a private placement offering of 19,460,527 subscription receipts ("Subscription Receipts") of a wholly-owned subsidiary of the Company at a price of $1.05 per Subscription Receipt for aggregate gross proceeds of approximately $20.4 million. Upon completion of the Reverse Takeover Transaction, each Subscription Receipt was exchanged for one unit comprised of one (1) Common Share and one-half of one (1/2) Warrant. Each whole Warrant was exercisable for one Common Share at an exercise price of $1.30 for a period of 24 months following the closing of the Reverse Takeover Transaction.

On November 5, 2019, the Common Shares began trading on the CSE under the ticker symbol "IMCC".

On November 19, 2019, the Warrants began trading on the CSE under the ticker symbol "IMCC.WT".

Developments Following the Reverse Takeover Transaction

On December 26, 2019, IMC Holdings entered into a share purchase agreement with Xinteza API Ltd. ("Xinteza"), a company with a unique biosynthesis technology, whereby the Company acquired, on an as-converted and fully diluted basis, 25.37% of Xinteza's outstanding share capital, for consideration of US$1,700,000 (approximately $2,223,000, according to the December 24, 2019 exchange rate published by the Bank of Canada) paid in several installments (the "Xinteza SPA"). As of September 30, 2020, the Company has paid all outstanding installments pertaining to the Xinteza SPA. As of December 31, 2020, following further investments by third parties into Xinteza, the Company holds 24.2% of the outstanding share capital of Xinteza on an as-converted and fully diluted basis. Under an exclusive license from Yeda Research & Development Company Ltd., the commercial division of the Weizmann Institute of Science, and based on disruptive plant genetics and metabolomics research led by Professor Asaph Aharoni, Xinteza has been developing advanced proprietary technologies related to the production of cannabinoid-based active pharmaceutical ingredients for the pharmaceutical and food industries using biosynthesis and bio-extraction technologies.

- 15 -

Recent Developments

Developments During the Financial Year Ended December 31, 2020

On January 23, 2020, IMC Holdings entered into definitive agreements to establish a medical cannabis cultivation and processing joint venture in Greece with Galen, a Greek company established by a consortium of investors in Greece with extensive experience in the pharmaceutical, media, finance and energy sectors. As a result of the agreements, IMC Holdings acquired ownership of 25% of the paid-up capital of Shiran, a private company incorporated and registered in Greece and originally wholly-owned by Galen, while the remaining 75% remained under the ownership of Galen. Under the agreements, each party is committed to fund the initial capital expenditures, totaling approximately up to EUR 8,000,000 for the construction of an EU-GMP certified cultivation and processing facility in Greece.

Also on January 23, 2020, Shiran, Galen and IMC Holdings signed a preferred supply agreement (the "Galen Supply Agreement"). Under the Galen Supply Agreement, IMC Holdings has the right to purchase up to 25% of the total production of Shiran at a preferred price as determined therein, for an initial period of five years. As of the date of this Annual Information Form, no material capital expenditures have been made towards Shiran given the uncertainty relating to COVID-19 and the Company is deferring any further investment into Greece indefinitely.

On March 17, 2020, the Company held its annual general shareholders' meeting. At the meeting, incumbent director Jesse Kaplan did not seek re-election as a director of the Company and Vivian Bercovici and Rafael Gabay were elected to the Board.

On March 23, 2020, Focus signed a supply agreement (the "Intelicanna Supply Agreement") with Intelicanna Ltd. ("Intelicanna") for the purchase by Focus of a minimum of 500kg and up to 1,000kg of medical cannabis cultivated by Intelicanna. Additional purchases may be made by Focus under the Intelicanna Supply Agreement without a change to the contracted price paid to Intelicanna. The finished products are to be sold to pharmacies in Israel under the IMC brand. The Intelicanna Supply Agreement is in effect for a term of 12 months from the date of the first planting in Intelicanna's facility. Intelicanna has received access to some of Focus' unique and proprietary genetics for the sole purpose of delivering product under the Intelicanna Supply Agreement; however, the genetics remain the exclusive property of Focus. Under the Intelicanna Supply Agreement, Intelicanna is responsible for all production activities under Focus' supervision and quality control practices throughout the growing process at Intelicanna's site.

On March 30, 2020, Focus signed a binding three-year sales agreement for the sale of IMC-branded medical cannabis products (the "March 2020 Pharmacy Sales Agreement") to three pharmacies in Jerusalem operating under the Oranim Pharm and Medi Plus banners. Pursuant to the March 2020 Pharmacy Sales Agreement, Focus is to supply such pharmacies with a total of 800kg of medical cannabis products annually for a period of three years, commencing in 2021, for an aggregate amount of 2,400kg of medical cannabis products at a contracted price.

On March 31, 2020, Focus signed a supply agreement with Way of Life Ltd., an IMC-GAP certified cultivator ("Way of Life"), and Cannation Ltd., an IMC-GAP applicant ("Cannation", and together with Way of Life, the "Suppliers") to purchase a total of approximately 2,600kg of medical cannabis per year for an aggregate amount of up to 7,800kg of medical cannabis products over three years. Of the aggregate amount to be supplied under the agreement, delivery of 6,200kg was contingent upon Cannation receiving its IMC-GAP certification. All finished products produced from the medical cannabis supplied under such supply agreement will be sold under the IMC brand to pharmacies in Israel. Under the supply agreement, the Suppliers obtained access to some of Focus' unique and proprietary genetics for the sole purpose of cultivating and delivering medical cannabis under the supply agreement; however, the genetics would remain the exclusive property of Focus. In addition, Focus received access to the Suppliers' growing facilities to monitor the entire growing process. As Focus has secured the necessary supply to fulfill its delivery obligations under its pharmacy sales agreements and support its Israeli operations, and following the expiration of the milestone for Cannation to obtain IMC-GAP certification, the supply agreement with Cannation was terminated on November 24, 2020.

- 16 -

On April 2, 2020, the Company announced that Adjupharm had received the necessary approvals from regulatory authorities to begin imports and sales of medical cannabis products under the IMC brand to German patients.

On April 6, 2020, Focus signed a binding two-year sales agreement for the sale of medical cannabis products under the IMC brand with Shor Tabachnik pharmacies ("Tabachnik") (the "Tabachnik Sales Agreement"). According to the Tabachnik Sales Agreement, Focus will sell to Tabachnik 1,000kg of medical cannabis products under the IMC brand annually for the duration of the Tabachnik Sales Agreement at an agreed upon price beginning in 2021.

On April 13, 2020, Focus signed a binding three-year agreement for the sale of 13,575kg of medical cannabis products under the IMC brand to Super-Pharm (Israel) Ltd., the largest pharmacy chain in Israel ("Super-Pharm") (the "SP Sales Agreement"). According to the SP Sales Agreement, Focus will sell to Super-Pharm a total of 13,575kg of medical cannabis products under the IMC brand over the next three years. Medical cannabis products sold under the SP Sales Agreement will include both dry inflorescence and extract products at an agreed upon price.

On April 13, 2020, Focus signed a one-year binding agreement for the sale of 1,000kg of medical cannabis products under the IMC brand to Panaxia Labs Israel, Ltd. at an agreed upon price.

On April 14, 2020, Focus signed an agreement for the sale of up to 1,500kg of medical cannabis products under the IMC brand to Max Pharm Ltd. ("Max Pharm") over a three year period (the "MP Sales Agreement"). Under the MP Sales Agreement, Focus will sell to Max Pharm a total of 500kg of medical cannabis products under the IMC brand annually at an agreed upon price beginning in 2021. Max Pharm has an option to purchase an additional 500kg of medical cannabis products from Focus in each of 2021, 2022 and 2023, for a total volume of up to 3,000kg over three years.

On April 21, 2020, Focus signed a binding three-year agreement for the sale of 12,600kg of medical cannabis products under the IMC brand to PharmYarok Ltd. ("PharmYarok") (the "PY Sales Agreement"). According to the PY Sales Agreement, Focus will sell to PharmYarok a total of 12,600kg of medical cannabis products under the IMC brand between 2021 and 2023 at an agreed upon price, subject to PharmYarok meeting certain regulatory requirements. Medical cannabis products sold under the PY Sales Agreement may include both dry inflorescence and extract products.

On April 26, 2020, Focus signed a three-year definitive supply agreement (the "Megadim Supply Agreement") with an IMC-GAP certified independent farmer located in Megadim, Israel and licensed to cultivate medical cannabis. Under the Megadim Supply Agreement, Focus will purchase a total of up to 8,060kg of medical cannabis over three years at an agreed upon price, of which approximately 7,500kg was contingent upon the supplier meeting quality criteria set under the Megadim Supply Agreement. All finished products created from the medical cannabis pursuant to the Megadim Supply Agreement will be sold by Focus under the IMC brand to pharmacies in Israel. On February 10, 2021, the Company announced the amendment to the Megadim Supply Agreement, to reflect the supply of only three harvests of medical cannabis being purchased by Focus. Under such amendment and subject to the terms therein, upon payment for all three harvests, the Megadim Supply Agreement will be terminated. Following this change, approximately 570 kg of medical cannabis are to be provided to Focus.

- 17 -

On May 7, 2020, the Company announced that Adjupharm received purchase orders for an aggregate of 360kg of IMC-branded medical cannabis products pursuant to certain distribution agreements entered into with German distributors in March 2020.

On May 8, 2020, Adjupharm received regulatory confirmation for the import of up to 5,800kg of medical cannabis products into Germany from foreign suppliers under the Adjupharm Licenses within a 12-month period. Such confirmation allows Adjupharm to import either bulk products, such as dry inflorescences and dronabinol, or extract products for end-products, at specified quantities set out in the confirmation.

On May 12, 2020, the Company announced that Adjupharm received a purchase commitment from a distributor in Germany for 465kg of IMC-branded medical cannabis products over a 12-month period.

On May 26, 2020, Focus received its first shipment of 200kg of imported medical cannabis from Spain-based Linneo Health S.L, the Company's EU-GMP certified supply partner for medical cannabis, to be sold in Israel under the IMC brand starting in June 2020.

On June 12, 2020, the Company signed a binding term sheet for the exclusive distribution rights of CannEpil® in Israel for a period of five years (the "CannEpil Term Sheet"), subject to CannEpil® meeting requirements under applicable laws to be qualified as a legal drug in Israel. CannEpil® is a phytocannabinoid medicine developed by MGC Pharmaceuticals Ltd. ("MGC") for the treatment of refractory epilepsy. According to the CannEpil Term Sheet, IMCC would be responsible for the registration, promotion and distribution of CannEpil® in Israel. IMCC would also obtain all necessary permits and licenses for importation and commercialization. MGC would continue to own all intellectual property rights associated with CannEpil® and its continued research and development.

On June 18, 2020, Focus received its first imported shipment of medical cannabis from a Canadian EU-GMP certified medical cannabis cultivator. The shipment was comprised of approximately 200kg of medical cannabis to be sold by Focus under the IMC brand to pharmacies in Israel.

In July 2020, Adjupharm entered into several binding medical cannabis sales agreements with the following distributors in Germany: Zur Rose Pharma GmbH ("Zur Rose"), Axicorp Group, Canymed GmbH and Materia Deutschland GmbH. These additional distributors brought Adjupharm's total number of contracted German distributors to seven, with definitive purchase commitments with such distributors totaling 1,525kg of medical cannabis products bearing the IMC brand to be delivered in Germany over a 12-month period. A settlement to terminate the medical cannabis sales agreement with Zur Rose was reached on March 30, 2021.

On July 24, 2020, Focus signed a supply agreement with Ever Green Solomon Pharma Ltd ("Ever Green") (the "Ever Green Supply Agreement"), an IMC-GAP certified cultivator, for the purchase of all of the medical cannabis production cultivated by Ever Green in an 86,000 square feet area of its facility, over a period of five years, with an option for Focus to extend the term by an additional five years, for a total term of up to 10 years. The finished products created from medical cannabis delivered pursuant to the Ever Green Supply Agreement will be sold by Focus to pharmacies in Israel under the IMC brand.

On July 28, 2020, the Company established a wholly-owned subsidiary in the Netherlands, IM Cannabis Holding NL B.V. ("IMC Netherlands Holdco"), which subsequently established another Dutch entity, IMC Holland B.V. ("Holland B.V."), in which 60% is owned by IMC Netherlands Holdco, and the remaining 40% is owned by a group of four individuals with expertise in the Dutch cannabis market. Holland B.V. was incorporated for the purpose of applying for a Dutch governmental tender (the "Dutch Tender") and to establish a full cannabis supply chain to coffee shops in the Dutch municipalities participating in the Dutch Tender. On November 27, 2020, the Company received notice that its application for the Dutch Tender was not accepted. Accordingly, Holland B.V. was liquidated effective as of December 18, 2020. As of the date of this Annual Information Form, the Company is exploring other strategic opportunities involving successful applicants of the Dutch Tender but does not currently have any material operations in the jurisdiction.

- 18 -

On September 8, 2020, Adjupharm signed distribution agreements for the sale of IMC-branded medical cannabis products with Cansativa GmbH and Ilios Sante GmbH.

On September 9, 2020, Adjupharm signed a distribution agreement for the sale of IMC-branded medical cannabis products with Farmako GmbH, bringing its total number of contracted German distributors to ten.

On September 15, 2020, the Company imported its first shipment of medical cannabis from its EU-GMP supply partner into Germany for distribution and sale through its German distributors, under the IMC brand.

On September 23, 2020, the Company officially launched the IMC brand in Germany as four of the Company's German distribution partners received shipments of medical cannabis products for sale in the German medical cannabis market. The first product bearing the IMC brand available to customers was the High THC T20/1 medical cannabis inflorescences.

On October 8, 2020, the Company applied to list its Common Shares on the NASDAQ Capital Market under the trading symbol "IMCC", subject to the satisfaction of all applicable listing and regulatory requirements, including registration of the Common Shares with the SEC, and satisfaction of NASDAQ listing requirements.

On December 16, 2020, the Company's shareholders approved a special resolution authorizing a share consolidation of the Common Shares at a ratio of between three (3) and eight (8) pre-consolidation Common Shares for every one post-consolidation Common Share, to be implemented at the discretion of the Board.

On December 29, 2020, Marc Lustig was appointed as Executive Chairman of the Company.

On December 30, 2020, the Company entered into a definitive agreement with Trichome Financial Corp. ("Trichome"), to combine their businesses pursuant to a plan of arrangement to be completed under the OBCA (the "Trichome Transaction").

Developments Following the Financial Year Ended December 31, 2020

On January 26, 2021, the Company announced that it received confirmation from The Depository Trust Company ("DTC") that its Common Shares are eligible for electronic clearing and settlement through DTC in the U.S.

On February 12, 2021, the Company consolidated all of its issued and outstanding Common Shares on a four (4) to one (1) basis (the "Consolidation"). Following the Consolidation, the number of Listed Warrants outstanding was not altered; however, the exercise terms were adjusted such that four Listed Warrants are exercisable for one Common Share following the payment of an adjusted exercise price of $5.20.

- 19 -

On February 22, 2021, the Company appointed Brian Schinderle and Haleli Barath to the Board. Both Mr. Schinderle and Ms. Barath are independent directors under applicable Canadian and United States securities laws. Concurrently with these appointments, Rafael Gabay and Steven Mintz resigned from the Board.

On March 1, 2021, the Company's Common Shares commenced trading on NASDAQ under the ticker symbol "IMCC", making the Company the first Israeli medical cannabis operator to list its shares on NASDAQ.

On March 8, 2021, the Company announced that Focus signed a multi-year supply agreement with GTEC Holdings Ltd. ("GTEC"), a Canadian licensed producer of handcrafted and high quality cannabis (the "GTEC Agreement"). According to the GTEC Agreement, Focus will import GTEC's high-THC medical cannabis inflorescence into Israel to be sold under the IMC brand. With the arrival of these commercial shipments, the Company will launch a new category of imported premium indoor medical cannabis products under its well-established brand. The import of the Canadian-grown high-THC strains from GTEC's subsidiary, Grey Bruce Farms Incorporated ("GBF"), is expected to commence in Q2 2021, subject to fulfilling all regulatory requirements in relation to such import, including compliance with MOH regulations and receipt of a valid export license from Health Canada. According to the GTEC Agreement, Focus will purchase a minimum quantity of 500kg of high-THC medical cannabis inflorescence from GBF and will be the exclusive recipient of GTEC cannabis products in the Israeli market for a period of 12 months from the date that the first shipment of GTEC products arrives in Israel (the "Exclusive Term"). The Exclusive Term can be extended under the terms of the GTEC Agreement by an additional 6 months.

On March 12, 2021, the Company filed a preliminary short form base shelf prospectus (the "Preliminary Shelf Prospectus") with the securities commissions or similar securities regulatory authorities in each of the provinces and territories of Canada (the "Securities Commissions"), and on March 15, 2021, the Company filed a corresponding shelf registration statement on Form F-10, with the SEC under the Multijurisdictional Disclosure System ("MJDS") established between Canada and the United States.

On March 12, 2021, Adjupharm entered into a supply agreement with Northern Green Canada Inc. ("NGC") (the "NGC Supply Agreement"). Under the terms of the NGC Supply Agreement, NGC will provide Adjupharm with three new strains of medical cannabis products, to be distributed under the IMC brand to German pharmacies pursuant to Adjupharm's distribution agreements with its German distribution partners. Shipments from NGC are expected to commence in Q2 2021.

On March 18, 2021, the Company acquired all of Trichome's issued and outstanding shares (the "Trichome Shares") and closed the Trichome Transaction that was previously announced on December 30, 2020. Pursuant to the terms of the Trichome Transaction, former holders of Trichome Shares and former holders of Trichome convertible instruments (the "Trichome Securityholders") received 0.24525 of a Common Share for each Trichome Share held and each in-the-money convertible instrument of Trichome. As a result of the Trichome Transaction, a total of 10,104,901 Common Shares were issued to the Trichome Securityholders, resulting in former Trichome Securityholders holding approximately 20.06% of the total number of issued and outstanding Common Shares immediately after closing. In addition, 100,916 Common Shares were issued to financial advisors for advisory fees in connection with the Trichome Transaction.

- 20 -

On March 29, 2021, Adjupharm entered into a supply agreement with MediPharm Labs Corp. ("MediPharm Labs") for certain medical cannabis extract products to be delivered by MediPharm Labs over an initial two-year term with an automatic two-year extension period.

On March 31, 2021, in connection with the Preliminary Shelf Prospectus, the Company filed a final short form base shelf prospectus (the "Final Shelf Prospectus") with the Securities Commissions and a corresponding shelf registration statement on Form F-10 (the "Registration Statement") with the SEC. The Final Shelf Prospectus and the Registration Statement enable the Company to offer up to USD 250,000,000 (or its equivalent in other currencies) of Common Shares, warrants, subscription receipts, debt securities, units (collectively, the "Qualified Securities"), or any combination of such Qualified Securities from time to time, during the 25-month period that the Final Shelf Prospectus is effective. The specific terms of any offering under the Final Shelf Prospectus and the intended use of the net proceeds will be established in a prospectus supplement, which will be filed with the Securities Commissions and the SEC in connection with any such offering.

In March 2021, Adjupharm entered into two supply agreements with supply partners in China, under which Adjupharm shall buy COVID-19 rapid antigen test kits. Concurrently, Adjupharm entered into several resale agreements with reseller partners in Germany, under which Adjupharm shall sell the COVID-19 antigen test kits supplied from the China-based suppliers, to be distributed to pharmacies and retailers in Germany.

On April 1, 2021, the Company entered into a definitive agreement to acquire MYM Nutraceuticals Inc. ("MYM"), pursuant to a plan of arrangement to be completed under the OBCA (the "MYM Transaction"). MYM is a Canadian cultivator, processor, and distributor of premium cannabis via its two wholly owned subsidiaries - Highland Grow Inc., in Antigonish, Nova Scotia and SublimeCulture Inc., in Laval, Quebec. Under the terms of the MYM Transaction, the shareholders of MYM will receive 0.022 Common Shares for each common share of MYM. Upon completion of the MYM Transaction, former MYM shareholders will own approximately 14.5% of the Company. The completion of the MYM Transaction is expected to occur before the end of 2021, and it will be subject to required court, securityholder and regulatory approvals.

DESCRIPTION OF THE BUSINESS

General

The Company is a multi-country operator in the medical and recreational cannabis sector headquartered in Israel and with operations in Israel, Germany and Canada.

In Israel, IMC Holdings built the IMC brand of premium medical cannabis products which have been cultivated over the last decade by Focus, an Israeli licensed cultivator over which IMC Holdings exercises "de facto control" under IFRS 10, and its cultivation partners, and sold by Focus in the Israeli market. As part of its core Israeli business, the Company offers intellectual property-related services to the medical cannabis industry based on proprietary processes and technologies it developed for the production of medical cannabis products. The Company offers its intellectual property and consulting services to Focus pursuant to the Commercial Agreements and receives as consideration for such services a share of Focus' revenues resulting from the sales of medical cannabis products under the IMC brand. During the twelve month period ended December 31, 2020, the revenues generated by Focus formed a significant portion of the Company's total revenues. The Company is currently focused on implementing its global expansion strategy with the penetration of both the European and Canadian cannabis markets.

In Europe, the Company operates in Germany through Adjupharm, a German-based subsidiary and EU-GMP certified medical cannabis producer and distributor, which provides the Company with a platform to establish and entrench its brand in Germany and other European jurisdictions, applying the experience it gained in the Israeli market. The Company's European presence is augmented by strategic alliances with a network of certified distributors and suppliers across the continent and internationally. The Company's objective within Europe is to capitalize on the increasing demand for medical cannabis products and to bring the well-established IMC brand and its product portfolio to European patients. The Company's operating track record, accumulation of data and brand reputation in Israel is a competitive advantage to gain traction in the German and European markets and build support among physicians that prescribe medical cannabis products. The Company has engaged in exploratory operations to expand to Portugal and Greece, however it has deferred any further investment in these jurisdictions indefinitely in light of the uncertainty related to COVID-19. The Company has also engaged in exploratory efforts in the Netherlands and is seeking collaborative opportunities with successful applicants of the Dutch Tender, however it does not currently have any material operations in the jurisdiction.

- 21 -

The Company has long-term plans to expand its European operations by engaging in strategic acquisitions across Europe.

Following the successful completion of the Trichome Transaction on March 18, 2021, the Group's global platform now includes the adult-use recreational cannabis market in Canada, in addition to its established distribution channels for medical cannabis in Israel through Focus and in Germany through Adjupharm.

In Canada, the Company operates through Trichome, a Canadian-based subsidiary, and through Trichome JWC Acquisition Corp. ("TJAC") d/b/a JWC, a wholly-owned subsidiary of Trichome and Canadian federally licensed producer of cannabis products in the adult-use recreational cannabis market in Canada. TJAC acquired substantially all of the assets of James E. Wagner Cultivation Corp. on August 28, 2020, under a court supervised process pursuant to the Companies' Creditors Arrangement Act (Canada). Trichome is now focused on acquiring related assets to compliment TJAC and leveraging the knowledge, expertise and insights of its employees, management and founders. Furthermore, the Company expects TJAC's premium indoor cultivation facility in Canada to serve as a long-term source of premium cannabis supply for the Group.

The Company is focused on further implementing an aggressive and accretive acquisition strategy focusing on attractively valued and highly synergistic targets in Canada, including its proposed acquisition of MYM. Additionally, the Group is focused on diversifying its product portfolio with premium and super premium medical cannabis products, leveraging its Canadian acquisition strategy that is expected to result in additional opportunities to export premium cannabis products to both Israel and Germany.

Due to the impact of the COVID-19 pandemic on Germany in the first quarter of 2021, the Company, through Adjupharm, leveraged its established distribution platform to enter into several reseller agreements of COVID-19 antigen test kits. Such engagement of Adjupharm is expected to facilitate and further enhance its business relationship with pharmacies in Germany and support its distribution platform for medical cannabis. In light of the uncertainty related to COVID-19, the Company will examine the continued demand of the German market for such test kits prior to any further engagement relating thereto. For more information, please see "General Development of Business - Recent Developments".

The consolidated revenue of the Group has been generated from the sale of medical cannabis products to customers in Israel and Germany by Focus and Adjupharm, respectively. Following the completion of the Trichome Transaction, Trichome's revenues generated from its cannabis financing activities and subsidiary activities will also be included in such consolidated revenue.The Group does not engage in any U.S. cannabis-related activities as defined in CSA Staff Notice 51-352.

Neither the Company nor any of its subsidiaries currently hold, directly or indirectly, any licenses to engage in the propagation, cultivation, production, processing, distribution or sale of medical cannabis products in Israel. However, under IFRS 10, the Company is required to consolidate the results of Focus, an Israeli licensed propagator and cultivator of medical cannabis products. Focus operates under the regulations of medical cannabis products by the MOH through the IMCA to propagate and cultivate medical cannabis products in Israel. All of Focus' operations are performed pursuant to the Dangerous Drugs Ordinance and the related regulations issued by IMCA. While IMCC does not hold any of the Israeli licenses mentioned above and does not own Focus, it derives a significant portion of its consolidated revenues from Focus' revenue, which is primarily earned from the medical cannabis sales agreements that Focus has with various pharmacies in Israel. Furthermore, the Company has an option under the Focus Agreement to re-acquire 74% ownership of Focus. For more information, please see "Corporate Structure - Intercorporate Relationships" and "Note Regarding the Company's Accounting Practices".

- 22 -

Principal Products and Brands

"IMC" is a well-known medical cannabis brand in Israel. Leveraging its long-term success in the Israeli market, the Company launched the brand in Germany in 2020. The Company believes that the IMC brand has become synonymous with quality and consistency in the Israeli medical cannabis market and it was chosen as one of the top four favourite brands in Israel.5

In association with Focus, the Company maintains a brand portfolio that includes popular medical cannabis inflorescences such as Roma, Dairy Queen, London, Tel Aviv and Pandora Box, as well as full-spectrum cannabis extracts:

'Roma' is marketed as an elegant strain that is known for its strong impact and influence. Roma was chosen as one of the most favoured strains in Israel.6 'Tel-Aviv' is marketed as sativa dominated strain that is known for uplifting the spirit and enhancing creativity. Both Roma and Tel-Aviv contain THC, CBD, and CBN within the following ranges: 16-24% (THC), 0-7% (CBD), and CBN lower than 1.5%.

'London' is marketed as a distinct indica, which stands out due to its flavor and strong influence. 'Dairy Queen' is marketed as a rich, velvety strain with a cherry aroma that may assist with reducing stress and producing calmness. 'Pandora Box' is marketed as a sativa dominate strain, which confers a sense of spirit uplifting, energy and vitality. London, Dairy Queen, and Pandora Box contain THC, CBD, and CBN within the following ranges: 11-19% (THC), 0-5.5% (CBD), and CBN lower than 1.5%.

5 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (August 2020, Israel).

6 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (Aug2020, Israel).

- 23 -

All of the products are tested in certified labs according to MOH standards and certified before being packaged and labelled with detailed information about the THC, CBD and CBN content of each product.7

Israeli patients using IMC branded products reported8 improvements of 60% in oncology patients health status, 80.5% in rheumatoid arthritis, 58% in back pain, 42% in Post Traumatic Stress Disorder (PTSD), 38% insomnia patients sleep quality, and of other influences such as calm, appetite and libido.

In Germany, the Company sells an IMC-branded medical cannabis inflorescence products. The medical cannabis product sold in the German market is branded generically as "IMC" so as to rely on the Company's name recognition in establishing a foothold with German consumers.

In March 2021, Adjupharm launched a new medical cannabis inflorescence product with THC and CBD levels of 17% and 1%, respectively, under the IMC brand. The new product will be distributed pursuant to Adjupharm's distribution agreements with its German distribution partners.

In Canada, commencing March 18, 2021, following completion of the Trichome Transaction, the Company's product portfolio consists of primarily dried inflorescence, pre-rolled cannabis, pressed hash and kief offerings sold by TJAC under the JWC brand into the Canadian adult use recreational cannabis market. Dried inflorescence is sold primarily in 3.5 gram, 14 gram and 28 gram formats, all pre-rolls were sold in a 3 x 0.5 gram format and both hash and kief sold in 1 gram and 2 gram formats.

In 2021, TJAC will continue to offer its existing product portfolio and plans to introduce additional offerings in the form of new dried inflorescence strains, new packaging formats and a rebranding of its dried inflorescence, pre-rolled cannabis, hash and kief products under the company's recently launched Wagners Brand.

New Products

In March 2021, Adjupharm launched a new medical cannabis inflorescence product with THC and CBD levels of 17% and 1%, respectively, under the IMC brand. The new product will be distributed pursuant to Adjupharm's distribution agreements with its German distribution partners.

In March 2021, Adjupharm entered into a supply agreement with MediPharm Labs, which will enable Adjupharm, subject to the fulfilment of applicable regulatory and import requirements, to launch a new category of IMC-branded extracts in Germany. This will include a range of specially formulated high THC, balanced THC and CBD cannabis oil products expected to launch in Germany in the second half of 2021.

The Group intends to, subject to applicable laws and regulatory approvals, distribute CannEpil®, a phytocannabinoid medicine developed by MGC, to be used for the treatment of refractory epilepsy. The distribution of CannEpil® is subject to the execution of a definitive distribution agreement.

7 (1) The actual percentages of THC and CBD content are determined by certified laboratory inspections and disclosed on the label of each IMC-branded medical cannabis product sold in Israel. Depending on such THC and CBD content, each IMC-branded medical cannabis product is labelled based on the following categories, in accordance with MOH Regulations: (a) 'T20/C4' (THC 16-24% and CBD 0-7%); (b) 'T15/C3' (THC 11-19% and CBD 0-5.5%); (c) 'T10/C2' (THC 6-14% and CBD 0-3.8%); (d) 'T10/C10' (THC 6-14% and CBD 6-14%); (e) 'T5/C5' (THC 1-9% and CBD 1-9%); (f) 'T0/C24' (THC 0-0.5% and CBD 20-28%); (g) 'T1/C20' (THC 0-2.5% and CBD 16-24%); (h) 'T3/C15' (THC 0.5-5.5% and CBD 11-19%); and (i) 'T5/C10' (THC 2.5-7.5% and CBD 6-14%). For all IMC-branded medical cannabis products, CBN content is less than or equal to 1.5%. The stated THC, CBD and CBN percentage ranges for the IMC branded strains are expected ranges; the actual percentages, as labelled on product packaging under the IMC brand, may vary or deviate from such ranges.

8 An independent clinical survey evaluated the effect of IMC branded strains on 652 Israeli medical cannabis patients licensed by the MOH for consuming medical cannabis products. The survey was managed, to the request of the Company, by an independent CRO - MediCaNL Israel, with data collected by third party survey and polling company iPanel, and analyzed by Dr. Nira Morag, senior lecturer, biostatistics department, Tel Aviv University.

- 24 -

The Group intends to, subject to applicable laws and regulatory approvals, distribute CannEpil®, a phytocannabinoid medicine developed by MGC, to be used for the treatment of refractory epilepsy. The distribution of CannEpil® is subject to the execution of a definitive distribution agreement.

Revenue

The following table shows the sales figures in dollars for each category of products that accounted for 15% or more of the total consolidated revenue of the Company for the financial years ended December 31, 2020 and 2019, derived from (a) sales to entities in which the Company maintains an investment accounted for by the equity method; (b) sales to customers, other than those referred to in (a); and (c) sales or transfers to controlling shareholders.

|

Revenue By Product Type |

||||

|

Financial Year |

Medical Cannabis |

Medical Cannabis |

Other |

Total |

|

2020 |

$4,673,000 |

$8,697,000 |

$2,520,000 |

$15,890,000 |

|

2019 |

$2,907,000 |

$3,405,000 |

$2,762,000 |

$9,074,000 |

Notes:

(1) IMC-branded medical cannabis products marked and sold under the category 'T15/C3', reflecting THC content of 11-19% and CBD content of 0-5.5%.

(2) IMC-branded medical cannabis products marked and sold under the category 'T20/C4', reflecting THC content of 16-24% and CBD content of 0-7%.

Production, Distribution and Sales in Principal Markets

Israel

The Company does not directly produce or distribute medical cannabis products in Israel. Pursuant to the Commercial Agreements, Focus propagates and cultivates medical cannabis products to be distributed under the IMC brand. Finished medical cannabis products are sold by Focus under the IMC brand to local pharmacies in Israel through contracted distributors. Focus holds a license from the MOH to propagate and cultivate medical cannabis in the State of Israel (the "Focus License"). Focus is one of the eight medical cannabis producers initially licensed by Israeli regulatory authorities and has over 10 years of experience in growing high quality medical cannabis products for the Israeli market. The MOH recently renewed the Focus License to be valid until January 3, 2022. All of Focus' operations are performed pursuant to the Dangerous Drugs Ordinance and the related regulations issued by IMCA.

Focus currently operates the Focus Facility, which has a total of approximately 300,000 square feet of cultivation capacity and a current annual output capability of up to 5,000kg of medical cannabis. Focus supplements its cultivation and production output by securing supply agreements with third-party cultivators to deliver medical cannabis for sale under the IMC brand.

- 25 -

The Company is actively seeking to provide its intellectual property, know-how and services to other Israeli medical cannabis producers.

Europe

The Company replicated its Israeli business strategy and established its medical cannabis brand in the European market through Adjupharm, a certified EU-GMP distributor in Germany with wholesale, narcotics handling, manufacturing, procurement, storage and distribution licenses granted by German regulatory authorities that allow for import/export capability with requisite permits (the "Adjupharm Licenses"). Adjupharm serves as the Company's flagship European outpost for sales and distribution.

Adjupharm currently manufactures and distributes IMC-branded medical cannabis products, in addition to other branded medical cannabis products, to pharmacies and distribution partners in Germany pursuant to sales and distribution agreements. Similar to Focus, Adjupharm sources its medical cannabis products from strategic partners, including various pan-European EU-GMP suppliers. While the Company does not currently distribute products in other European countries other than in Germany, the Company intends to leverage the platform established by Adjupharm in Germany and its network of distribution partners to expand to other jurisdictions across the continent in which medical cannabis is legal.

Germany

The Company's European strategy is centered in Germany, whose medical cannabis market is currently considered the largest in Europe.9 Adjupharm serves as the Company's principal operating hub in the German market and was originally acquired by IMC Holdings in early 2019. The Company, through IMC Holdings, currently owns 90.02% of Adjupharm, with the balance owned by Adjupharm's CEO.

The Company continues to develop Adjupharm as its European hub and to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country. Led by Adjupharm's CEO Richard Balla, the Company's objective is to capture a significant market share in Germany by working directly with distributors to increase market reach for products bearing the IMC brand. The Company currently has an approximately 3,200 square feet EU-GMP production and warehousing facility in Germany and is in the process of expanding its facilities by an additional 3,200 square feet. Adjupharm sources its supply of medical cannabis for the German market from EU-GMP certified suppliers.

Adjupharm relies on its sales and distribution agreements to supply and distribute IMC-branded products to distribution partners in Germany, which are then distributed to German pharmacies. There are approximately 19,000 community pharmacies in Germany, each of which is permitted to create and dispense medications, including medical cannabis, pursuant to physician prescriptions.10 Adjupharm recently completed the expansion of its internal and external sales department and is focused on increasing physician awareness and engagement to drive sales of IMC-branded medical cannabis products. The competitive advantage in Germany lies in the Group's track record and brand reputation in Israel and proprietary data supporting the effectiveness of medical cannabis for the treatment of a variety of conditions.

9 Health Europa, June 23, 2020. https://www.healtheuropa.eu/exploring-growth-in-the-european-medical-cannabis-market/100849/

10 Federal Union of German Associations of Pharmacists: Figures Data Facts 2020.

- 26 -

The Company is actively seeking additional supply partners to diversify its sources of supply of premium and super premium cannabis products and further develop its European presence. For more details on Adjupharm's agreements with third-party distributors, see "General Development of the Business - Recent Developments".

Canada

Commencing March 18, 2021, following completion of the Trichome Transaction, the Company is acting in the adult-use recreational cannabis market in Canada, through Trichome, and TJAC, Trichome's wholly owned subsidiary. TJAC holds Standard Processing, Standard Cultivation and Sale for Medical Purposes licenses (collectively the "TJAC Licenses") issued to it by Health Canada, which are permitting it to cultivate, produce and sell cannabis products in Canada. Trichome was formed in 2017 as a specialty finance company focused on providing flexible and creative capital solutions to the global legal cannabis market, due to the lack of credit availability in the industry, extremely high equity valuations, and lack of business and industry maturity. From 2018 to 2020, Trichome provided secured financing to numerous companies in the cannabis sector, including licensed producers and retail operators. This strategy provided attractive rates of return on invested capital with downside protection given Trichome's high underwriting standards and the unique transaction structures employed.

Trichome is currently focused on supporting TJAC's operations and growing the related cannabis production platform by acquiring and restructuring cannabis assets that are complimentary to, and synergistic with TJAC.

TJAC operates an approximately 117,000 square feet indoor cultivation facility (the "Indoor Facility"), with approximately 80,000 square feet of space for the cultivation of cannabis. All of TJAC's cultivation occurs at this site, as well as certain processing activities, such as plant drying, bucking and trimming. Current cultivation capacity at the Indoor Facility is approximately 7,000kg per year, with the potential for approximately twice the amount of production in the next 12-24 months, subject to capital investment and procedural optimization. In addition, TJAC operates another facility of an approximately 15,000 square feet, which is the site where certain processing and all packaging, sales and shipping activities of the business occur (collectively with the Indoor Facility, the "TJAC Facilities"). The TJAC Facilities are located in in Kitchener, Ontario and are operated pursuant to certain lease agreements (the "TJAC Leases").

Like all licensed producers, TJAC is required to sell and distribute its products directly and only to the provinces of Ontario, British Columbia and New Brunswick, from which retail operators purchase their inventory. Licensed producers are not permitted to sell directly to retailer locations in such provinces. In Saskatchewan, TJAC sells its product to a third-party, intermediary wholesaler who then sells and distributes TJAC's product to the province's retail stores. In addition, TJAC has authorization to sell into Prince Edward Island and expects to do so in the coming months. TJAC is also in the process of applying for authorizations to distribute its cannabis portfolio in Alberta and Manitoba and is exploring partnership arrangements to facilitate the distribution of its products in Quebec through an authorized third-party licensed producer.

- 27 -

From time to time, TJAC has entered and may again enter into one-time, business-to-business purchase or supply agreements with other licensed producers, as may be required to back-fill its own purchase orders from the provinces (in the case of a purchase agreement) or back-fill another licensed producer's supply requirements (in the case of a supply agreement).

TJAC is in the late stages of winding up its medical sales program and will no longer fulfill sales directly to medical patients, effective as of May 1, 2021.

Specialized Skill and Knowledge

The Group relies on the expertise of its personnel to provide value to its clients. The Group has over 10 years of experience in cultivating, propagating and processing cannabis under the guidance of experienced master grower, Doron Reznik. Following the IMC Restructuring, IMC Holdings retained its master grower to continue providing cannabis cultivation and production advice exclusively to Focus and Focus' third-party cultivation partners.

Competitive Conditions

The medical and recreational cannabis industry in which the Group operates is, and is expected to remain, very competitive. Cannabis companies compete primarily on a regional basis, and competition may vary significantly from region to region at any particular time. The cannabis sector is in a high growth phase, with market participants engaged in significant expansion across global legal jurisdictions. The Company is working to achieve a leadership position in the cannabis industry by taking advantage of IMC brand recognition, earning superior margins as a fully integrated business, and leveraging its vast know-how and experience.

The Company faces competition in Israel among similar intellectual property-related service providers and from other established brands in the domestic market. The Company expects that its experience and track record, attained via the combination of Focus' operations over the past decade and IMC brand recognition, will distinguish its offerings from competitors in the Israeli market. Focus also competes with other licensed cultivators and purveyors of medical cannabis brands offering products to local pharmacies.

The Company's European operations will face competition from other entities licensed to cultivate, produce and distribute medical cannabis products in each respective jurisdiction. In Germany, Adjupharm will compete with a number of licensed distributors including currently established entities, expected new market entrants, and domestic producers of cannabis. Competitors vary from well-capitalized businesses with substantial operations and revenues to smaller or newer market entrants.

Components

The Group's ability to operate the business is dependent on its ability to source raw materials, skilled labour, and equipment from its supply partners around the world. In particular, required production inputs include but are not limited to biological assets, utilities, product packaging, and specialized equipment for propagating and cultivating cannabis. Although the Group does not foresee an issue with the availability of these inputs as needed, the Group is wary of any increases in pricing for such inputs. If prices of inputs were to significantly increase, this may cause a material adverse effect on the Group's business operations and financial condition. See "Risk Factors - Reliance on Key Business Inputs" below for additional details.

- 28 -

Intangible Properties

The Company relies on the licensing of its brand in Israel to widen its reach and offer branding, marketing and other related services to participants in the Israeli medical cannabis industry. The Group also plans to rely on the IMC brand to facilitate the distribution of cannabis products in international markets. The Group owns trademarks and trade secrets that allow it to serve a range of cannabis industry participants.