IM Cannabis Corp.

Management's Discussion and Analysis

For the Three Months Ended March 31, 2021

May 17, 2021

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

IM Cannabis Corp.

Management's Discussion and Analysis

For the Three Months Ended March 31, 2021 and 2020

This Management's Discussion and Analysis ("MD&A") reports on the consolidated financial condition and operating results of IM Cannabis Corp. (the "Company" or "IMCC") for the three months ended March 31, 2021 and 2020. Throughout this MD&A, unless otherwise specified, references to "we", "us", "our" or similar terms, as well as the "Company" and "IMCC" refer to IM Cannabis Corp., together with its subsidiaries, on a consolidated basis, and the "Group" refers to the Company, its subsidiaries and Focus Medical Herbs Ltd.

This MD&A should be read in conjunction with the Company's interim condensed consolidated financial statements for the three months ended March 31, 2021 (the "Interim Financial Statements") and with the Company's annual financial statements as of December 31, 2020, and for the year then ended and accompanying notes ("Annual Financial Statements").

The Interim Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). IFRS requires management to make certain judgments, estimates and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily indicative of results that may be expected for future periods.

The Interim Financial Statements include the accounts of the Company, and the following entities:

|

Legal Entity: |

Relationship with the Company: |

|

IMC Holdings Ltd. ("IMC Holdings") |

Wholly-owned subsidiary |

|

Adjupharm GmbH ("Adjupharm") |

Subsidiary of IMC Holdings |

|

IMC Ventures Ltd. |

Subsidiary of IMC Holdings |

|

I.M.C Farms Israel Ltd. |

Wholly-owned subsidiary of IMC Holdings |

|

I.M.C. - International Medical Cannabis Portugal Unipessoal, Lda. |

Wholly-owned subsidiary of IMC Holdings |

|

Focus Medical Herbs Ltd. ("Focus") |

Private company over which IMC Holdings exercises "de facto control" under IFRS 10, as further described under the Risk Factors section below |

|

Trichome Financial Corp. ("Trichome") |

Wholly-owned subsidiary |

|

Trichome Financial Cannabis GP Inc. |

Wholly-owned subsidiary of Trichome |

|

Trichome Financial Cannabis Manager Inc. |

Wholly-owned subsidiary of Trichome |

|

Trichome Financial Cannabis Private Credit LP |

Limited Partnership, equity accounted investee |

|

Trichome Asset Funding Corp. |

Wholly-owned subsidiary of Trichome |

|

Trichome JWC Acquisition Corp. |

Wholly-owned subsidiary of Trichome |

All intercompany balances and transactions were eliminated on consolidation.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

All amounts in this MD&A are expressed in Canadian Dollars ($) in thousands, unless otherwise noted. Certain amounts are shown in New Israeli Shekel ("NIS"), Euro ("€"), United States dollars ("US$") as noted.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may contain "forward-looking statements" or "forward-looking information," within the meaning of applicable securities legislation (collectively referred to herein as "forward-looking statements" or "forward-looking information"). All statements other than statements of fact may be deemed to be forward-looking statements, including statements with regard to expected financial performance, strategy and business conditions. The words "believe", "plan", "intend", "estimate", "expect", "anticipate", "continue", or "potential", and similar expressions, as well as future or conditional verbs such as "will", "should", "would", and "could" often identify forward-looking statements. These statements reflect management's current expectations and plans with respect to future events and are based on information currently available to management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management considering its experience, perception of trends, current conditions and expected developments as well as other factors that management believes to be relevant as at the date such statements are made.

Without limitation, this MD&A contains forward-looking statements pertaining to:

With respect to the forward looking-statements contained in this MD&A, the Company has made assumptions regarding, among other things:

Readers are cautioned that the above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward-looking statements due to a number of factors and risks. These include:

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Readers are cautioned that the foregoing list of risk factors is not exhaustive. Additional information on these and other factors that could affect the business, operations or financial results of the Company are detailed under the headings "Risks Factors" and "Contingent Liabilities and Commitments" of this MD&A. The Company and management caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. The Company and management assume no obligation to update or revise them to reflect new events or circumstances except as required by applicable securities laws.

FINANCIAL OUTLOOK

The forward-looking information in this MD&A contain statements in respect of estimated revenues. The Company and its management believe that the estimated revenues are reasonable as of the date hereof and are based on management's current views, strategies, expectations, assumptions and forecasts, and have been calculated using accounting policies that are generally consistent with the Company's current accounting policies. These estimates are considered financial outlooks under applicable securities legislation. These estimates and any other financial outlooks or future-oriented financial information included herein have been approved by management of the Company as of the date hereof. Such financial outlooks or future-oriented financial information are provided for the purposes of presenting information about management's current expectations and goals relating to the sales agreements described in the "Corporate Developments" section of this MD&A and other previously announced Focus sales agreements and the future business of the Company. The Company disclaims any intention or obligation to update or revise any future-oriented financial information, whether as a result of new information, future events or otherwise, except as required by securities legislation. Readers are cautioned that actual results may vary materially as a result of a number of risks, uncertainties, and other factors, many of which are beyond the Group's control. See the risks and uncertainties discussed in the "Risk Factors" section and elsewhere in this MD&A and other risks detailed from time to time in the publicly filed disclosure documents of the Company which can be viewed online under the Company's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

NON-IFRS FINANCIAL MEASURES

Certain financial measures used in this MD&A do not have any standardized meaning under IFRS, including "Gross Margin", "EBITDA" and "Adjusted EBITDA". For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the "Metrics and Non-IFRS Financial Measures" section of the MD&A.

OVERVIEW OF THE COMPANY

Company Background

The Company was incorporated pursuant to the Business Corporations Act (British Columbia) on March 7, 1980, under the name "Nirvana Oil & Gas Ltd." On July 12, 2013, in connection with a share consolidation, the Company changed its name to "Navasota Resources Inc.". On June 22, 2018, the Company completed a consolidation of its common shares ("Common Shares") on the basis of one post-consolidation Common Share for every five pre-consolidation Common Shares. On October 4, 2019, in connection with the Reverse Takeover Transaction (as defined below), the Company effected a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every 2.83 pre-consolidation Common Shares and changed its name to "IM Cannabis Corp." On October 11, 2019, the Company completed the Reverse Takeover Transaction and changed its business from mining to the international medical cannabis industry.

On February 12, 2021, in connection with its NASDAQ listing application, the Company effected a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every four (4) pre-consolidation Common Shares.

IMCC is a multi-country operator in the medical and recreational cannabis sector headquartered in Israel with operations in Israel, Germany and Canada.

In Israel, IMC Holdings built the IMC brand of premium medical cannabis products which have been cultivated over the last decade by Focus, an Israeli licensed cultivator over which IMC Holdings exercises "de facto control" under IFRS 10, and its cultivation partners, and sold by Focus in the Israeli market.

Focus holds a license from the MOH to propagate and cultivate medical cannabis in the State of Israel, valid until January 3, 2022 (the "Focus License"). Focus is one of the eight medical cannabis producers initially licensed by Israeli regulatory authorities and has over 10 years of experience in growing high quality medical cannabis products for the Israeli market.

As part of its core Israeli business, the Company offers intellectual property-related services to the medical cannabis industry based on proprietary processes and technologies it developed for the production of medical cannabis products. The Company offers its intellectual property and consulting services to Focus pursuant to certain commercial agreements and receives as consideration for such services a share of Focus' revenues resulting from the sale of medical cannabis products under the IMC brand.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

IMCC currently intends to enter, through its subsidiaries, the distribution and retail segments of the Israeli medical cannabis market, by completing the Panaxia Transaction (as defined below) and by attracting acquisitions of synergistic targets in Israel. Following such vertical integration, IMCC expects to increase its revenue and margins from its Israeli medical cannabis market activities, diversify its business opportunities and gain direct access to medical cannabis patients.

In Europe, IMCC operates through Adjupharm, a German-based subsidiary acquired by IMC Holdings on March 15, 2019. Adjupharm is an EU-GMP certified medical cannabis producer and distributor with wholesale, narcotics handling, manufacturing, procurement, storage and distribution licenses granted by German regulatory authorities that allow for import/export capability with requisite permits (the "Adjupharm Licenses"). Adjupharm serves as the Company's flagship European outpost for sales and distribution.

Adjupharm currently manufactures and distributes IMC-branded medical cannabis products, in addition to other branded medical cannabis products, to pharmacies and distribution partners in Germany pursuant to sales and distribution agreements. Similar to Focus, Adjupharm sources its medical cannabis products from strategic partners, including various pan-European EU-GMP suppliers. While the Company does not currently distribute products in European countries other than Germany, the Company intends to leverage the platform established by Adjupharm in Germany and its network of distribution partners to expand to other jurisdictions across the continent in which medical cannabis is legal.

IMCC expanded operations to Canada through the acquisition of Trichome on March 18, 2021 and its wholly-owned subsidiary, Trichome JWC Acquisition Corp. ("TJAC") d/b/a JWC. TJAC is a Canadian federally licensed producer of cannabis products in the adult-use recreational cannabis market in Canada (the "TJAC License"). TJAC acquired substantially all of the assets of James E. Wagner Cultivation Corp. on August 28, 2020, under a court supervised process pursuant to the Companies' Creditors Arrangement Act (Canada). Trichome is now focused on acquiring related assets to compliment TJAC and leveraging the knowledge, expertise and insights of its employees, management, and founders.

Alongside organic growth targets, IMCC will be further implementing an aggressive and accretive acquisition strategy focusing on attractively valued and highly synergistic targets in Canada. The consolidated revenues of the Group for the three months ended March 31, 2021 was generated mainly from the sale of medical cannabis products in Israel, Germany, and Canada (starting March 18, 2021), by Focus, Adjupharm, and Trichome; respectively. The Group does not engage in any U.S. cannabis-related activities as defined in Canadian Securities Administrators Staff Notice 51-352 (Revised) - Issuers with U.S. Marijuana-Related Activities.

As of March 31, 2021, the Company's major Israeli assets include the Commercial Agreements and the Focus Agreement, as well as its holdings in Xinteza API Ltd. ("Xinteza").

As of March 31, 2021, the Company's major international assets include Trichome in Canada, as well as its holdings in 90.02% of Adjupharm in Germany. As of March 31, 2021, neither the Company nor any of its subsidiaries currently hold, directly or indirectly, any licenses to engage in the propagation, cultivation, production, processing, distribution or sale of medical cannabis products in Israel as required by local legislation. However, under IFRS 10, the Company is required to consolidate the results of Focus, a licensed propagator and cultivator of medical cannabis products under the current Israeli regulatory regime. As such, all financial information in this MD&A is presented on a consolidated basis reflecting the results of the Group. While IMCC does not hold any of the Israeli licenses mentioned above and does not own Focus, it derives a significant portion of its consolidated revenues from Focus' revenue, which is primarily earned from sales of medical cannabis by Focus to pharmacies in Israel. Furthermore, the Company has an option under the Focus Agreement to re-acquire 74% ownership of Focus. For more information, please see at the Risk Factors section below.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Company Products

'IMC' is a well-known medical cannabis brand in Israel. Leveraging its long-term success in the Israeli market, the Company launched the brand in Germany in 2020. The Company believes that the IMC brand in Israel has become synonymous with quality and consistency in the Israeli medical cannabis market and it was chosen as one of the four top favourite brands in Israel.1

In association with Focus, the Company maintains a brand portfolio that includes popular medical cannabis inflorescences such as Roma, Dairy Queen, London, Tel Aviv and Pandora Box, as well as full-spectrum cannabis extracts.

'Roma' is marketed as an elegant strain that is known for its strong impact and influence. Roma was chosen as one of the most favored strains in Israel.2 'Tel-Aviv' is marketed as sativa dominated strain that is known for uplifting the spirit and enhancing creativity. Both Roma and Tel-Aviv contain THC, CBD, and CBN within the following ranges: 16-24% (THC), 0-7% (CBD), and CBN lower than 1.5%.

'London' is marketed as a distinct indica, which stands out due to its flavor and strong influence. 'Dairy Queen' is marketed as a rich, velvety strain with a cherry aroma that may assist with reducing stress and producing calmness. 'Pandora Box' is marketed as a sativa-dominant strain, which confers a sense of spirit uplifting, energy and vitality. London, Dairy Queen, and Pandora Box contain THC, CBD, and CBN within the following ranges: 11-19% (THC), 0-5.5% (CBD), and CBN lower than 1.5%.

All of the products are tested in certified labs according to MOH standards and certified before being packaged and labelled with detailed information about the THC, CBD and CBN content of each product.3

In Germany, the Company sells IMC-branded medical cannabis inflorescence products. The medical cannabis products sold in the German market are branded generically as "IMC" so as to rely on the Company's brand recognition in establishing a foothold with German healthcare professionals.

In Canada, commencing March 18, 2021, following completion of the Trichome Transaction (as defined below), the Company's product portfolio consists of primarily dried inflorescence, pre-rolled cannabis, pressed hash, and kief offerings sold by TJAC under the JWC Brand into the Canadian adult use recreational cannabis market. Dried inflorescence is sold primarily in 3.5 gram, 14 gram, and 28 gram formats, pre-rolls are sold in a 3 x 0.5 gram format, and both hash and kief sold in 1 gram and 2 gram formats. In addition, TJAC sells cannabis on a Business-to-Business ("B2B") basis, having found demand from other cannabis producers in Canada due to TJAC's high-quality indoor, aeroponically-grown cannabis.

_________________________________

1 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (Aug2020, Israel).

2 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (Aug2020, Israel).

3 The actual percentages of THC and CBD content are determined by certified laboratory inspections and disclosed on the label of each IMC-branded medical cannabis product sold in Israel. Depending on such THC and CBD content, each IMC-branded medical cannabis product is labelled based on the following categories, in accordance with MOH Regulations: (a) 'T20/C4' (THC 16-24% and CBD 0-7%); (b) 'T15/C3' (THC 11-19% and CBD 0-5.5%); (c) 'T10/C2' (THC 6-14% and CBD 0-3.8%); (d) 'T10/C10' (THC 6-14% and CBD 6-14%); (e) 'T5/C5' (THC 1-9% and CBD 1-9%); (f) 'T0/C24' (THC 0-0.5% and CBD 20-28%); (g) 'T1/C20' (THC 0-2.5% and CBD 16-24%); (h) 'T3/C15' (THC 0.5-5.5% and CBD 11-19%); and (i) 'T5/C10' (THC 2.5-7.5% and CBD 6-14%). The stated THC, CBD and CBN percentage ranges for the IMC branded strains are expected ranges; the actual percentages, as labelled on product packaging under the IMC brand, may vary or deviate from such ranges.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

In 2021, TJAC will continue to offer its existing product portfolio and plans to introduce additional offerings in the form of new dried inflorescence strains, new packaging formats and a rebranding of its dried inflorescence, pre-rolled cannabis, hash and kief products under the Company's recently-launched Wagners brand. The Company is focused on diversifying its product portfolio, mainly with premium and super premium branded cannabis products both in Israel, in association with Focus, and in the European market through Adjupharm.

Corporate Developments

(i) the Reverse Takeover Transaction and Canadian Liquidity Events

On October 11, 2019, the Company completed a business combination with IMC Holdings resulting in a reverse takeover of the Company by shareholders of IMC Holdings (the "Reverse Takeover Transaction"). The Reverse Takeover Transaction was effected by way of a "triangular merger" between the Company, IMC Holdings and a wholly-owned subsidiary of the Company pursuant to Israeli statutory law.

In connection with the Reverse Takeover Transaction, the Company completed a private placement offering of 19,460 , 527 subscription receipts (each a "Subscription Receipt") of a wholly-owned subsidiary of the Company ("Finco") at a price of $1.05 per Subscription Receipt for aggregate gross proceeds of $20,43 3 (the "Financing"). Upon the satisfaction or waiver of, among other things, all of the condition precedents to the completion of the Reverse Takeover Transaction, each Subscription Receipt was exchanged for one unit of Finco (a "Finco Unit") with each Finco Unit being comprised of one (1) common share of Finco (a "Finco Share") and one-half (1/2) of one (1) Finco Share purchase warrant (each whole warrant, a "Finco Warrant"). Each whole Finco Warrant was exercisable for one Finco Share at an exercise price of $1.30 until October 11, 2021. Upon closing of the Reverse Takeover Transaction, the Finco Shares and Finco Warrants were exchanged for Common Shares and Common Shares purchase warrants ("Listed Warrants") on economically equivalent terms on a 1:1 basis. A total of 9,730,258 Listed Warrants were issued and listed for trading on the CSE under the ticker "IMCC.WT".

In addition, IMC Holdings granted to the agents who acted on its behalf in connection with the Financing, options to acquire 1,199,326 compensation units (the "2019 Compensation Units") at an exercise price of $1.05 per 2019 Compensation Unit. Upon completion of the Reverse Takeover Transaction, the 2019 Compensation Units were exchanged for compensation options of the Company (the "2019 Compensation Options"). Prior to the Share Consolidation (as defined below), each 2019 Compensation Option consisted of one Common Share and one-half of one Common Share purchase warrant (the "Unlisted Warrants") with each whole Unlisted Warrant exercisable for one Common Share at an exercise price of $1.30 for 36 months following the issuance (until August 30, 2022), with such Unlisted Warrants issued as a result of exercises of 2019 Compensation Options and not listed for trading on any exchanges.

Upon the completion of the Reverse Takeover Transaction, the former holders of IMC Holdings held approximately 84.28% of the issued and outstanding Common Shares and the previous holders of Subscription Receipts held approximately 13.35% of the Common Shares, in each case, on a non-diluted basis.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

On November 5, 2019, the Common Shares began trading on the CSE under the ticker symbol "IMCC".

On February 12, 2021, the Company's shareholders approved at a special meeting the consolidation of all the Company's issued and outstanding Common Shares on a four (4) to one (1) basis (the "Share Consolidation"). Following the Share Consolidation, the number of Listed Warrants, Unlisted Warrants, and 2019 Compensation Options outstanding was not altered; however, the exercise terms were adjusted such that four Listed Warrants are required to be exercised to purchase one Common Share following at an adjusted exercise price of $5.20, four Unlisted Warrants are required to be exercised to purchase one Common Share at an adjusted exercise price of $5.20, and four 2019 Compensation Options are required to be exercised to purchase one unit at an adjusted exercise price of $4.20, with each unit exercisable into one Common Share and one-half of one Unlisted Warrant, with each whole Unlisted Warrant expiring on August 30, 2022 and exercisable to purchase one Common Share at an exercise price of $5.20. The consolidated financial statements give effect to the Share Consolidation for all periods presented.

On March 1, 2021, the Common Shares commenced trading on NASDAQ under the ticker symbol "IMCC", making the Company the first Israeli medical cannabis operator to list its shares on NASDAQ.

As of March 31, 2021 and 2020, there were 9,289,015 and 9,730,235 Listed Warrants outstanding, respectively, and the Company re-measured the Listed Warrants, according to their trading price in the market, in the amount of $9,382 and $34, respectively. For the three months ended March 31, 2021 and 2020, the Company recognized a revaluation gain of $7,060 and $167, respectively, in the consolidated statement of profit or loss and other comprehensive income, in which the unrealized gain is included in finance income (expense).

During the three months ended March 31, 2021, a total of 440,220 Listed Warrants were exercised for 110,055 Common Shares at an adjusted exercise price of $5.20 per Common Share. As a result, the Company recorded receivables at a total amount of $572.

During the three months ended March 31, 2021, a total of 194,992 Unlisted Warrants were exercised for 48,748 Common Shares at an adjusted exercise price of $5.20 per Common Share. As a result, the Company received a total amount of $253.

During the three months ended March 31, 2021, a total of 197,632 2019 Compensation Options were exercised for 49,408 Common Shares and 24,703 Unlisted Warrants. Consequently, the Company received an aggregate adjusted exercise amount of $208.

(ii) Restructuring

Current Israeli law requires prior approval by the Israeli Medical Cannabis Agency ("IMCA") of the identity of any shareholder owning 5% or more of an Israeli company licensed to engage in cannabis-related activities. For a number of reasons, including the opportunity to leverage a network of multiple Israeli licensed producers cultivating under the IMC brand, and in contemplation of a "go-public transaction" to geographically diversify the Company's share ownership, IMC Holdings restructured its organization on April 2, 2019 (the "IMC Restructuring") resulting in the divestiture to Oren Shuster and Rafael Gabay of its interest in Focus, which is licensed by the MOH to propagate and cultivate cannabis in Israel.

IMC Holdings retains an option with Messrs. Shuster and Gabay to re-acquire the sold interest in Focus at its sole discretion and in accordance with Israeli cannabis regulations, within 10 years of the date of the IMC Restructuring (the "Focus Agreement"). The Focus Agreement sets an aggregate exercise price equal to NIS 765.67 per share of Focus for a total consideration of NIS 2,756,500, that being equal to the price paid by Messrs. Shuster and Gabay for the acquired interests in Focus at the time of the IMC Restructuring.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

As part of the IMC Restructuring, IMC Holdings and Focus entered into an agreement in which Focus shall use the IMC brand on an exclusive basis for the sale of any cannabis plant and/or cannabis product produced by Focus, either alone or together with other sub-contractors engaged by Focus (the "IP Agreement"). Focus is also obligated to exclusively use IMC Holdings for certain management and consulting services including: (a) business development services; (b) marketing services; (c) strategic advisory services; (d) locating potential collaborations on a worldwide basis; and (e) financial analysis services (the "Services Agreement" and collectively with the IP Agreement, the "Commercial Agreements").

Under the IP Agreement, IMC Holdings charges Focus an amount equal to 25% of its revenues on a quarterly basis, which shall not be changed without the consent of IMC Holdings, as consideration for Focus' use of certain trademarks, know-how, technology and maintenance services provided by IMC Holdings.

Under the Services Agreement, IMC Holdings charges Focus an amount equal to IMC Holdings' cost of providing certain services to Focus plus a 25% mark-up, which shall not be changed without the consent of IMC Holdings, as consideration for the provision of such services.

Subsequent to the IMC Restructuring, according to accounting criteria in IFRS 10, IMCC is still viewed as effectively exercising control over Focus, and therefore, the accounts of Focus continue to be consolidated with those of the Company.

As a result of the IMC Restructuring, IMCC derives revenue from the Commercial Agreements. IMCC does not directly hold any licenses to engage in the cultivation, production, processing, distribution or sale of medical cannabis in Israel.

(iii) Regulatory Changes in Israel

Changes under the MOH Regulations

Until September 2019, patients licensed for consumption of medical cannabis products by the IMCA received all of their medical cannabis products authorized under their respective licenses at a fixed monthly price of NIS 370, regardless of each patient's authorized amount. As an example, a patient who was to receive 20 grams of medical cannabis products per month would pay the same monthly fee of NIS 370 as a patient who received 180 grams per month. In addition, IMCA assigned patients to a particular licensed medical cannabis producer, from which each patient would exclusively receive their medical cannabis products. Under the previous medical cannabis regulations, Focus distributed approximately 80% of its medical cannabis products via home delivery and the remaining 20% via an IMCA-established distribution outlet.

Under the MOH's new regulations, medical cannabis products are delivered from a licensed producer to a manufacturer, which then delivers to a distributor to distribute to pharmacies. In addition, patients licensed for consumption of medical cannabis products are no longer exclusively assigned to medical cannabis producers and may purchase medical cannabis products from authorized pharmacies at a range of price points without any MOH-regulated price controls.

In light of the MOH's new regulations, some medical cannabis patient licenses granted under the previous regime are still valid. The medical cannabis patient licenses set to expire during the period from February 1, 2019 to July 31, 2019 were extended by order of the Israeli Supreme Court until further notice by the Court. While these licenses remain valid, the patients who hold these licenses are entitled to receive medical cannabis products pursuant to the price controls and supplier restrictions of the former regime. Additional information on the proceedings pursuant to which the above-referenced order was granted can be found under "Legal Proceedings and Regulatory Actions - Legal Proceedings - Supreme Court of Justice 2335/19".

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Following the implementation of the above MOH's new regulations, the Group believes that the Israeli medical cannabis market will continue to benefit from price stability of the premium and super premium medical cannabis products, an increase to the number of physicians certified by the IMCA to prescribe medical cannabis and thus, an increase in the number of licensed medical cannabis patients.

Medical Cannabis Imports

In October 2020, the MOH issued an updated procedure, titled "Guidelines for Approval of Applications for Importation of Dangerous Drug of Cannabis Type for Medical Use and for Research" ("Procedure 109"), describing the application requirements for cannabis import licenses for medical and research purposes. According to Procedure 109, the following permits and licenses are required to receive a cannabis import license: (1) License to possess medical cannabis and operate in the medical cannabis industry; (2) License to import plant material; (3) Permit to import narcotic drugs; and (4) License to import a dangerous drug.

Medical Cannabis Exports

In October 2020, the MOH launched a new pilot program under which medical cannabis producers would be authorized to export medical cannabis products, subject to the requirement that certain products be made available at a fixed price of NIS 14 per gram to patients in Israel over the age of 21 and NIS 10 per gram to patients under the age of 21 (the "Pilot Program"). Each participating company would decide the selection of medical cannabis products made available under the Pilot Program. The Pilot Program was planned for an initial period of three months and was extended in January 2021. As products bearing the IMC brand are offered as part of the Pilot Program, IMC-branded products are eligible for immediate application for export permits.

In December 2020, the IMCA published guidelines for the medical cannabis export permit application process4 (the "Export Guidelines"), pursuant to which an export permit will only be granted to an applicant if (i) sufficient domestic supply has been secured by such applicant in the variety and quantity that will meet the Israeli level of demand; (ii) the delivery of medical cannabis is made from approved sites; (iii) the applicant has a valid IMC-GDP certification and business license from the IMCA; and (iv) an import permit from the importing country is obtained and attached to the export application. The term to apply for export permits under the program, according to the Export Guidelines, were set to expire at the end of Q1 2021. Further extensions are considered by the IMCA based on the success of the Pilot Program.

Legalization of Adult-Use Recreational Cannabis in Israel

As of the date of this MD&A, adult-use recreational cannabis use in Israel is illegal. In November 2020, an Israeli government committee responsible for advancing the cannabis market reform published a report supporting and recommending the legalization of adult-use recreational cannabis in Israel (the "Report"). Based on the Report, the Israeli Ministry of Justice was expected to formulate a bill to begin the legislative process towards the legalization of adult-use recreational cannabis. The government committee made its recommendation for legalization based on the increasing demand for adult-use recreational cannabis in Israel, the importance of maintaining quality standards and limiting uncontrolled products, the need for increased access to cannabis by medical patients and the objective of decreasing the size of the illegal market. The model proposed by the government committee in the Report is similar in nature to the model adopted in Canada, whereby the sale of adult-use recreational cannabis would be channeled through government-licensed dispensaries.

_________________________________

4 Directive 110, December 2020 [Hebrew] - https://www.health.gov.il/hozer/CN_110.pdf

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

In December 2020, the governing Israeli parliament dissolved and general elections were held on March 23, 2021. All such legislative initiatives were suspended and there is no certainty regarding their renewal following a formation of a new government.

(iv) Israeli Market

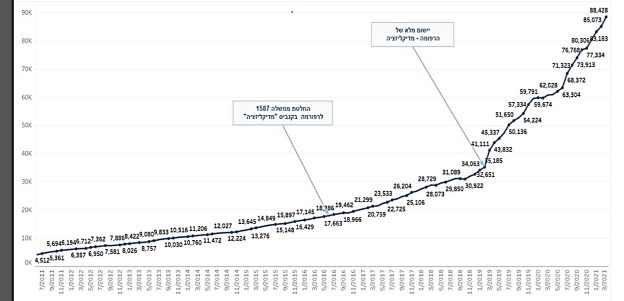

The Israeli medical cannabis market has shown dramatic growth over the past several years. It is projected that this growth will continue and according to MOH estimates, the number of patients in Israel licensed by the MOH to consume medical cannabis is expected to reach 120,000 by the end of 2021.

Israeli Market Development 2011-2021

According to MOH monthly publication, as of March 2021, there are 88,428 licensed patients in Israel, and a monthly prescription of 2,848,000 and 3,190,000 grams of cannabis were recorded in December 2020 and March 2021, respectively.5

The below reflects the number of licensed medical cannabis patients in Israel over the year 2011 to March 2021:

_________________________________

5 https://www.health.gov.il/Subjects/cannabis/Documents/licenses-status-march-2021.pdf

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

(v) European Activity

The Company's European strategy is centered in Germany, whose medical cannabis market is currently considered the largest in Europe.6 To develop its operations in Germany, on March 15, 2019, the Company acquired, through IMC Holdings, 100% of the shares of Adjupharm (the "Adjupharm Shares"), a licensed EU-GMP certified medical cannabis distributor. IMC Holdings acquired the Adjupharm shares for €924 thousands (approximately $1,400 as of the acquisition date) with additional obligations to the sellers including repayment of bank loans of up to €680 thousands (approximately $1,030 as of the acquisition date). These bank loans were repaid by IMC Holdings in May 2019. The Company, through IMC Holdings, currently owns 90.02% of Adjupharm, with the balance owned by Adjupharm's Chief Executive Officer.

The Company continues to develop Adjupharm as its European hub and to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country. Led by Adjupharm's Chief Executive Officer Mr. Richard Balla, the Company's objective is to capture a significant market share in Germany by working directly with distributors to increase market reach for products bearing the IMC brand. The Company currently has approximately 3,200 square feet of warehousing and GMP Standard production capacity in Germany and is in process to expand its facilities by an additional 3,200 square feet. Adjupharm sources its supply of medical cannabis for the German market from EU-GMP certified suppliers.

Adjupharm relies on its sales and distribution agreements to supply and distribute IMC-branded products to distribution partners in Germany, which are then distributed to German pharmacies. There are approximately 19,000 community pharmacies in Germany, each of which is permitted to create and dispense medications, including medical cannabis, pursuant to physician prescriptions.7 Adjupharm recently completed the expansion of its internal and external sales department and is focused on increasing physician awareness and engagement to drive sales of IMC-branded medical cannabis products. The competitive advantage in Germany lies in the Group's track record and brand reputation in Israel and proprietary data supporting the effectiveness of medical cannabis for the treatment of a variety of conditions.

The Company is actively seeking additional cultivation partners to diversify its sources of supply of premium and super premium cannabis products and further develop its European presence.

The Company has also engaged in exploratory operations to expand to Portugal and Greece, by establishing a wholly-owned subsidiary in Portugal in October 2018, and a joint venture in Greece (25% owned by IMCC), however it has deferred any further investment in these jurisdictions indefinitely in light of the uncertainty related to COVID-19.

Due to the impact of the COVID-19 pandemic on Germany in the first quarter of 2021, the Company, through Adjupharm, leveraged its established distribution platform to enter into several reseller agreements of COVID-19 antigen test kits. Such engagement of Adjupharm is expected to facilitate and further enhance its business relationship with pharmacies in Germany and support its distribution platform for medical cannabis. In light of the uncertainty related to COVID-19, the Company will examine the continued demand of the German market for such test kits prior to any further engagement relating thereto. For more information, please see "Strategic Developments".

_________________________________

6 Health Europa, June 23, 2020. https://www.healtheuropa.eu/exploring-growth-in-the-european-medical-cannabis-market/100849/

7 Federal Union of German Associations of Pharmacists: Figures Data Facts 2020.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

(vi) Investment in Xinteza

On December 26, 2019, IMC Holdings entered into a share purchase agreement with Xinteza, a company with a unique biosynthesis technology, whereby the Company acquired, on an as-converted and fully diluted basis, 25.37% of Xinteza's outstanding share capital, for consideration of US$1,700 (approximately $2,200 as of December 2019) paid in several installments (the "Xinteza SPA"). As of March 31, 2021, the Company has paid all outstanding installments pertaining to the Xinteza SPA and holds 24.2% of the outstanding share capital of Xinteza on an as-converted and fully diluted basis.

Under an exclusive license from Yeda Research & Development Company Ltd., the commercial division of the Weizmann Institute of Science, and based on disruptive plant genetics and metabolomics research led by Professor Asaph Aharoni, Xinteza has been developing advanced proprietary technologies relating to the production of cannabinoid-based active pharmaceutical ingredients for the pharmaceutical and food industries using biosynthesis and bio-extraction technologies.

(vii) Strategic Developments:

1. On March 1, 2021, the Common Shares commenced trading on NASDAQ under the ticker symbol "IMCC", making the Company the first Israeli medical cannabis operator to list its shares on NASDAQ.

2. On March 8, 2021, the Company announced that Focus signed a multi-year supply agreement with GTEC Holdings Ltd. ("GTEC"), a Canadian licensed producer of handcrafted and high-quality cannabis (the "GTEC Agreement"). According to the GTEC Agreement, Focus will import GTEC's high-THC medical cannabis inflorescence into Israel to be sold under the IMC brand. With the arrival of these commercial shipments, the Company will launch a new category of imported premium indoor medical cannabis products under its well-established brand. The import of the Canadian-grown high-THC strains from GTEC's subsidiary, Grey Bruce Farms Incorporated ("GBF"), is expected to commence in Q2 2021, subject to fulfilling all regulatory requirements in relation to such import, including compliance with MOH regulations and receipt of a valid export license from Health Canada. According to the GTEC Agreement, Focus will purchase a minimum quantity of 500 kg of high-THC medical cannabis inflorescence from GBF and will be the exclusive recipient of GTEC cannabis products in the Israeli market for a period of 12 months from the date that the first shipment of GTEC products arrives in Israel (the "Exclusive Term"). The Exclusive Term can be extended under the terms of the GTEC Agreement by an additional 6 months.

3. On March 12, 2021, the Company filed a preliminary short form base shelf prospectus (the "Preliminary Shelf Prospectus") with the securities commissions or similar securities regulatory authorities in each of the provinces and territories of Canada (the "Securities Commissions"), and on March 15, 2021, the Company filed a corresponding shelf registration statement on Form F-10, with the United States Securities and Exchange Commission (the "SEC") under the Multijurisdictional Disclosure System ("MJDS") established between Canada and the United States.

On March 31, 2021, in connection with the Preliminary Shelf Prospectus, the Company filed a final short form base shelf prospectus (the "Final Shelf Prospectus") with the Securities Commissions and a corresponding shelf registration statement on Form F-10 (the "Registration Statement") with the SEC. The Final Shelf Prospectus and the Registration Statement enable the Company to offer up to US$250,000 (or its equivalent in other currencies) of Common Shares, warrants, subscription receipts, debt securities, units (collectively, the "Qualified Securities"), or any combination of such Qualified Securities from time to time, during the 25-month period that the Final Shelf Prospectus is effective. The specific terms of any offering under the Final Shelf Prospectus and the intended use of the net proceeds will be established in a prospectus supplement, which will be filed with the Securities Commissions and the SEC in connection with any such offering.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

4. On March 12, 2021, Adjupharm entered into a supply agreement with Northern Green Canada Inc. ("NGC") (the "NGC Supply Agreement"). Under the terms of the NGC Supply Agreement, NGC will provide Adjupharm with three new strains of medical cannabis products, to be distributed under the IMC brand to German pharmacies pursuant to Adjupharm's distribution agreements with its German distribution partners. Shipments from NGC are expected to commence in the second quarter of 2021.

5. On March 18, 2021, the Company acquired all of Trichome's issued and outstanding shares (the "Trichome Shares") and closed the Trichome Transaction that was previously announced on December 30, 2020. Pursuant to the terms of the Trichome Transaction, former holders of Trichome Shares and former holders of Trichome convertible instruments (the "Trichome Securityholders") received 0.24525 of a Common Share for each Trichome Share held and each in-the-money convertible instrument of Trichome. As a result of the Trichome Transaction, a total of 10,104,901 Common Shares were issued to the Trichome Securityholders, resulting in former Trichome Securityholders holding approximately 20.06% of the total number of issued and outstanding Common Shares immediately after closing. In addition, 100,916 Common Shares were issued to financial advisors for advisory fees in connection with the Trichome Transaction.

6. On March 29, 2021, Adjupharm entered into a supply agreement with MediPharm Labs Corp. ("MediPharm Labs") for certain medical cannabis extract products to be delivered by MediPharm Labs over an initial two-year term with an automatic two-year extension period.

7. On March 30, 2021, Zur Rose Pharma GmbH ("Zur Rose") and the Company entered into a termination settlement agreement in connection with the sales agreements announced in July 2020 according to Zur Rose's request, and under which Adjupharm received a termination fee. According to the termination agreement no inventory will be transferred from Zur Rose to Adjupharm or vice versa.

8. During March 2021, Adjupharm entered into two supply agreements with supply partners in China, under which Adjupharm shall buy COVID-19 rapid antigen test kits. Concurrently, Adjupharm entered into several resale agreements with reseller partners in Germany, under which Adjupharm shall sell the COVID-19 antigen test kits supplied from the China-based suppliers, to be distributed to pharmacies and retailers in Germany.

Subsequent Events

9. On April 1, 2021, the Company entered into a definitive agreement to acquire MYM and its licensed producer subsidiary Highland Grow Inc., pursuant to a plan of arrangement to be completed under the OBCA. Under the terms of the MYM Transaction, the shareholders of MYM will receive 0.022 Common Shares for each common share of MYM. Upon completion of the MYM Transaction, MYM former shareholders will own approximately 14.5% of the Company. The completion of the MYM Transaction is expected to occur before the end of 2021, and it will be subject to required court, securityholder and regulatory approvals.

10. On April 1, 2021, through its wholly owned subsidiary, Trichome, the Company was repaid on its loan to Heritage Cannabis Holdings Corp. The total payout was for proceeds of $4,727, of which $4,705 was principal with the remaining balance representing accrued interest. The loan was an acquired asset from the Trichome Transaction.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

11. On April 23, 2021, through its wholly owned subsidiary, Trichome, the Company was repaid on its loan to Good Buds Company International Inc. The total payout was for proceeds of $3,128, of which $2,900 was principal with the remaining balance representing accrued interest. The loan was an acquired asset from the Trichome Transaction.

12. On April 30, 2021, the Company announced that its wholly-owned Israeli subsidiary, IMC Holdings, signed a definitive agreement (the "Panaxia Agreement") with Panaxia Pharmaceutical Industries Israel Ltd. and Panaxia Logistics Ltd. (collectively "Panaxia") (the "Panaxia Transaction"). Pursuant to the Panaxia Agreement, IMC Holdings will acquire Panaxia's trading house license and in-house pharmacy activities, certain distribution assets and an option to purchase a pharmacy with licenses to sell medical cannabis to patients , for an aggregate purchase price of $7.2 million, comprised of $2.9 million in cash and $4.3 million in Common Shares (the "Panaxia Consideration Shares"). The Panaxia Transaction will close in two stages, with the option of a third stage. Upon the initial closing, all online-related activities and intellectual property will transfer to IMC Holdings. The second closing, which is subject to MOH approval, is expected to occur on or before July 30, 2021, or upon receipt of MOH approval. Upon the second closing, Panaxia will transfer its IMC-GDP license, which allows the holder to store and distribute medical cannabis in Israel, to IMC Holdings or its subsidiary (the "Panaxia IMC-GDP License"). The Panaxia Transaction includes an option to acquire Panaxia's pharmacy (the "Panaxia Option"), including licenses to dispense and sell to cannabis patients (the "Panaxia Pharmacy Licenses") for additional payment in the amount equal to the medical cannabis inventory of the pharmacy at the time of exercise, which will become effective as of February 15, 2022.

13. On May 10, 2021, the Company completed an overnight marketed offering (the "Offering") of 6,086,956 Common Shares (each an "Offered Share") at a price of US$5.75 per Offered Share for aggregate gross proceeds of approximately US$35 million. The Company also issued 3,043,478 Common Share purchase warrants (each a "2021 Warrant") to purchasers of Offered Shares, for no additional consideration, that entitle the holders to purchase Common Shares of the Company at an exercise price of US$7.20 for a term of 5 years from the day of closing. Pursuant to the terms of the Offering, the agents hold an over-allotment option to purchase up to an additional 913,044 Offered Shares and 456,522 2021 Warrants on the same terms and conditions for a period of 30 days following the day of closing. The Offering was conducted pursuant to the Company's Registration Statement and Final Shelf Prospectus, made effective on March 31, 2021, by the SEC and the Securities Commissions, respectively. On May 5, 2021, the Company filed a final prospectus supplement (the "Prospectus Supplement") in Canada, which also was filed with the SEC.

Company Outlook

In Israel, the Company, through the Commercial Agreements, continues to expand the IMC brand recognition, and supply., in association with Focus, the growing medical cannabis market in Israel with products bearing the IMC brand. With the expected high growth of the Israeli medical cannabis market, the Company is well positioned to reap the benefits of its long-term presence and strong brand recognition, and it expects continued increases in revenues, as well as increased profitability. In addition, the Company intends to enter, through its subsidiaries, additional segments of the medical cannabis market in Israel, including the distribution and retail segments, by completing the Panaxia Transaction and further acquisitions of synergistic targets in Israel. Following such vertical integration, the Company expects to increase its revenue and margins from its Israeli medical cannabis market activities, diversify its business opportunities and gain direct access to medical cannabis patients to benefit from market knowledge and trends. Furthermore, the Group is focused on diversifying its product portfolio with premium and super premium medical cannabis products, leveraging its Canadian acquisition strategy that is expected to result in additional opportunities to export premium cannabis products to both Israel and Germany.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

The Company's objective within Europe is to capitalize on the increasing demand for medical cannabis products and to bring the well-established IMC brand and its product portfolio to European patients. The Company's operating track record, accumulation of data and brand reputation in Israel is a competitive advantage in gaining traction within the German and European markets and building support among physicians who prescribe medical cannabis products.

In Canada, following the successful completion of the Trichome Transaction on March 18, 2021, IMCC's global platform now includes the adult-use recreational cannabis market, in addition to its established distribution channels for medical cannabis in Israel through Focus and in Germany through Adjupharm. Additionally, the Company's senior management team now includes extensive experience in acquisitions and restructuring to capitalize on consolidating a targeted list of attractively valued and highly synergistic assets.

Trichome is now focused on acquiring related assets to compliment TJAC and leveraging the knowledge, expertise and insights of its employees, management and founders. Furthermore, the Company expects TJAC's premium indoor, aeroponic cultivation facilities in Canada to serve as a long-term source of premium cannabis supply for the Group.

Alongside its organic growth targets, IMCC will continue with an aggressive and accretive acquisition strategy focusing on attractively valued and highly synergistic targets in Canada, including its proposed acquisition of MYM, a Canadian cultivator, processor and distributor of premium cannabis via its two wholly-owned subsidiaries - Highland Grow Inc., in Antigonish, Nova Scotia and SublimeCulture Inc., in Laval, Quebec. IMCC believes that successful completion of the MYM Transaction will enhance IMCC's focus on premium and super premium branded cannabis products in Canada, expand its distribution capabilities and fast track the entrance of JWC brand (soon to be relaunched as "Wagners") into new markets. Highland Grow in particular is known for its super premium products and is well received by consumers in the Canadian market.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Overview of Financial Performance

|

|

For the three months |

|

For the Year ended |

|

|||

|

|

2021* |

|

2020 |

|

2020 |

2019 |

|

|

Net Revenues |

$ 8,767 |

|

$ 1,340 |

|

$ 15,890 |

$ 9,074 |

|

|

Gross profit before fair value impacts in cost of sales |

$ 4,627 |

|

$ 631 |

|

$ 8,809 |

$ 4,313 |

|

|

Gross margin before fair value impacts in cost of sales (%) |

53% |

|

47% |

|

55% |

48% |

|

|

Operating Income (Loss) |

$ (1,705) |

|

$ 1,664 |

|

$ (8,245) |

$ (10,275) |

|

|

Net Income (Loss) |

$ 4,715 |

|

$ 200 |

|

$ (28,734) |

$ (7,419) |

|

|

Net Income (Loss) per share attributable to equity holders of the Company - Basic |

$ 0.11 |

|

$ (0.01) |

|

$ (0.74) |

$ (0.23) |

|

|

Net Income (Loss) per share attributable to equity holders of the Company - Diluted (in CAD) |

$ (0.06) |

|

$ (0.01) |

|

$ (0.74) |

$ (0.23) |

|

*Includes the results of operations of Trichome from March 18, 2021 to March 31, 2021

The Overview of Financial Performance includes reference to "gross margin", which is a non-IFRS financial measure. Non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. The Company defines gross margin as the difference between revenue and cost of revenues divided by revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Operational Results - Medical Cannabis

|

|

|

For the three months |

|

For the Year ended |

|

||||

|

|

|

2021* |

|

2020 |

|

2020 |

|

2019 |

|

|

Average net selling price |

|

$ 4.94 |

|

$ 5.11 |

|

$ 5.75 |

|

$ 3.39 |

|

|

Quantity harvested |

|

131 |

|

- |

|

4,564 |

|

2,351 |

|

|

Quantity sold |

|

1,185 |

|

198 |

|

2,586 |

|

2,180 |

|

*Includes the results of operations of Trichome from March 18, 2021 to March 31, 2021

Review of Operations for the three months ended March 31, 2021 and 2020

Net Revenues

The Group operates in one reporting segment. The main revenues of the Group are generated from sales of medical cannabis products to customers in Israel.

Revenues for the three months ended March 31, 2021 and 2020 were $8,767 and $1,340 respectively, representing an increase of $7,427 or 554%. Total product sold for the three months ended March 31, 2021 was 1,185 kg at an average selling price of $4.94 per gram compared to 198 kg at an average selling price of $5.11 per gram for the three months ended March 31, 2020. The increase in revenues for the three months ended March 31, 2021 is attributable to deliveries made under the Focus' sales agreements to pharmacies, as well as to revenues generated from Adjupharm and commencing consolidation of Trichome activities as of March 18, 2021.

Cost of Revenues

The cost of revenues includes production, testing, shipping and sales related costs. At harvest, the biological assets are transferred to inventory at their fair value which becomes the deemed cost for the inventory. Inventory is later expensed to the cost of sales when sold. Direct production costs are expensed through the cost of sales.

The cost of revenues for the three months ended March 31, 2021 and 2020 were $4,140 and $709, respectively, representing an increase of $3,431 or 484%. Cost of revenues is comprised of cultivation costs, purchase of materials and finished goods, utilities, salary expenses and import costs, as well as certain adjustments made by the Company in order to adhere to the Israeli MOH's new regulation. Focus expects net cost of sales to vary from quarter to quarter based on the number of pre-harvest plants, after harvest plants, the strains being grown and technological progress in the trimming machines.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Gross Profit

Included in the Company's calculation of gross profit are the following:

• production costs (current period costs that are directly attributable to the cannabis growing and harvesting process);

• materials and finished goods purchase costs

• a fair value adjustment on sale of inventory (the change in fair value associated with biological assets that were transferred to inventory upon harvest);

• a fair value adjustment on growth of biological assets (the estimated fair value less cost to sell of biological assets as at the reporting date).

Included in gross profit is the net change in fair value of biological assets, inventory expensed and production costs. Biological assets consist of cannabis plants at various after-harvest stages which are recorded at fair value less costs to sell after harvest.

Gross profit for the three months ended March 31, 2021 and 2020 was $5,028 and $4,592, respectively, representing an increase of $436 or 9%. Gross profit included gains from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $401 and $3,961 for the three months ended March 31, 2021 and 2020, respectively.

Expenses

General and Administrative

General and administrative expenses for the three months ended March 31, 2021 and 2020 were $4,913 and $1,930, respectively, representing an increase of $2,983 or 155%. The increase in the general and administrative is mainly attributable to the growing corporate activities in Israel, Germany, and Canada, professional services derived from legal fees and other consulting services, among other, in relation to the NASDAQ listing and M&A processes in the amount of $2,654 (including share based expenses to financial advisors of approximately $990), salaries to employees in the amount of $1,186, and insurance costs in the amount of $352.

Selling and Marketing

Selling and marketing expenses for the three months ended March 31, 2021 and 2020 were $1,189 and $477, respectively, representing an increase of $712 or 149%. The increase in the selling and marketing expenses was due mainly to the Company's increased marketing efforts in Israel and brand launch in Germany as well as increased distribution expenses relating to the increase in sales.

Research and Development

Research and development expenses for the three months ended March 31, 2021 and 2020 were $1 and $27, respectively, representing a decrease of $26 or 96%. The decrease for the three months ended March 31, 2021 was primarily associated with the COVID-19 pandemic, which caused delays in new projects in Greece and Portugal.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Share-Based Compensation

Share-based compensation expense for the three months ended March 31, 2021 and 2020 was $630 and $494, respectively, representing an increase $136 or 28%. The increase was mainly due to the grant of new incentive stock options ("Options"), offset by the decrease in the fair value adjustment of consultants' options, resulting from the decrease of the Company's share price.

Financing

Financing income (expense), net, for the three months ended March 31, 2021 and 2020 was $6,923 and $(283), respectively, representing an increase of $7,206 or 2,546%. The change was mainly due to $7,060 finance income arising from valuation update of the Warrants, which was affected by the Company's decreased share price.

Depreciation and Amortization

Depreciation and amortization expenses for three months ended March 31, 2021 and 2020 were $385 and $96, respectively, representing an increase of $289 or 301%. Depreciation and amortization expenses are impacted by the adoption of IFRS 16 Leases, renewal of Focus' greenhouses and Focus' purchase of additional production equipment, as well as the amortization of intangible assets mainly following the acquisition of Adjupharm and Trichome.

Net Income (Loss)

Net income for the three months ended March 31, 2021 and 2020 was $4,715 and $200, respectively, representing a net income increase of $4,515 or 2,258%. The net increase related to factors impacting net income from operations described above, and finance income driven by revaluation of Warrants in the amount of $7,060, which were recorded against liability on the grant day and were re-evaluated at March 31, 2021 through profit or loss.

Net Income (Loss) per share Basic and Diluted

Basic loss per share is calculated by dividing the net profit attributable to common shareholders of the Company by the weighted average number of common shares outstanding during the period. Diluted profit per Common Share is calculated by adjusting the earnings and number of Common Shares for the effects of dilutive Warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the denominator in calculating diluted profit per Common Share excludes unissued Common Shares related to Options as they are antidilutive. Basic Income (Loss) per Common Share for the three months ended March 31, 2021 and 2020 were $0.11 and ($0.06) per Common Share, respectively.

Diluted Income (Loss) per Common Share for the three months ended March 31, 2021 and 2020 were ($0.03 ) and ($0.01) per Common Share, respectively.

Total Assets

Total assets as at March 31, 2021 were $166,251, compared to $38,116 as at December 31, 2020, representing an increase of $128,135 or 336%. This increase was primarily due to the consolidation of Trichome, following the Trichome Transaction, leading to recognition of goodwill and intangible assets of an aggregate amount of approximately $74,730, property plant and equipment of approximately $13,100, increase in right-of-use assets of approximately $11,050 and approximately $8,500 of loan receivables.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Total Liabilities

Total liabilities as at March 31, 2021 were $48,160, compared to $25,506 at December 31, 2020, representing an increase of $22,654 or 89%. The increase was primarily due to an increase of $12 ,132 in Other accounts payable and accrued expenses and an increase of $11,155 in Lease liabilities, offset by a decrease of $7,158 in Warrants liability.

Intangible Assets

On March 15, 2019, IMC Holdings acquired Adjupharm, a licensed EU-GMP producer with wholesale, narcotics handling and import/export licenses for medical cannabis. As part of its global expansion and penetration plan into the European market, IMC acquired 100% of Adjupharm's issued and outstanding shares for €924 thousands (approximately $1,400).

Through the acquisition of Adjupharm, the Company recognized $1,287 in intangible assets and goodwill. The goodwill arising on the acquisition was attributed to the expected benefits from the synergies of the combination of the activities of the Company and Adjupharm.

The goodwill recognized is not expected to be deductible for income tax purposes.

The Company recognized and updated the fair value of the assets acquired and liabilities assumed in the business combination according to a final valuation made by an external valuation specialist.

On March 18, 2021, IMCC acquired Trichome, a Canadian-based cannabis company. The Trichome Transaction was completed pursuant to the terms and subject to the conditions of arrangement agreement dated December 30, 2020, whereby the Company agreed to acquire all the issued and outstanding Trichome Shares under a statutory plan of arrangement under the Business Corporations Act (Ontario). As a result of the Trichome Transaction, the businesses of IMCC and Trichome have been combined. Upon completion of the Trichome Transaction, the total Common Share Consideration valued at approximately $99,028.

Through the acquisitions of Trichome, the Company recognized goodwill of approximately $68,272 and intangible assets, primarily cultivation license, of approximately $6,458 (based on preliminary purchase price allocation study). The goodwill arising on acquisition is attributed to the expected benefits from the synergies of the combination of the activities of the Company and Trichome, as well as value attributed to the assembled workforce, which is included in goodwill. The goodwill recognized is not expected to be deductible for income tax purposes.

The Company recognized the fair value of the assets acquired and liabilities assumed in the business combination according to a provisional measurement. As of the date of the approval of the Interim Financial Statements, a final valuation for the fair value of the identifiable assets acquired and liabilities assumed by an external valuation specialist has not been obtained. The purchase consideration and the fair value of the acquired assets and liabilities may be adjusted within 12 months from the acquisition date. At the date of final measurement, adjustments are generally made by restating comparative information previously determined provisionally.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Liquidity and Capital Resources

For the three months ended March 31, 2021, the Company generated revenues of $8,767 and received $526 in proceeds from the exercises of Warrants, Compensation Options and Options. Prior to receiving these proceeds, the Company financed its operations and met its capital requirements primarily through the October 2019 equity financing, upon the Reverse Takeover Transaction and listing on the CSE. The Company's objectives when managing its liquidity and capital resources are to generate enough cash to fund the Company's operating and working capital requirements as well as its strategy of being listed on NASDAQ. The Company believes that the generated cash flow form working capital in the different jurisdictions on which it operates, as well as the additional expected exercises of Warrants and future financing rounds will meet all its future requirements. In evaluating its capital requirements, including the impact, if any, on the Company from the COVID-19 pandemic, and the ability to fund the execution of its strategy, the Company believes it has adequate availability to meet its working capital and other operating requirements, fund growth initiatives and capital expenditures, settle its liabilities, and repay scheduled principal and interest payments on debt for at least the next twelve months.

The Company has ensured that it has access to public capital markets through its CSE and NASDAQ listings, and continues to review and pursue selected external financing sources to ensure adequate financial resources. These potential sources include, but are not limited to, (i) obtaining financing from traditional or non-traditional investment capital organizations and (ii) obtaining funding from the sale of the Company's securities. There can be no assurance that we will gain adequate market acceptance for our products or be able to generate sufficient positive cash flow to achieve our business plans. We expect to continue funding these purchases with our available cash, cash equivalents and short-term investments. Therefore, we are subject to risks including, but not limited to, our inability to raise additional funds through financings to support our continued development, including capital expenditure requirements, operating requirements and to meet our liabilities and commitments as they come due. As at March 31, 2021, the Company had a working capital surplus of $30,508, compared to working capital of $23,905 as at March 31, 2020. The increase in working capital of $6,603 was primarily due to increase in inventory, trade and other receivables, offset by increase in trade and other payables. As of March 31, 2021, the Company had an unaudited cash balance of $1,252 and no debt.

As at March 31, 2021, the Group's financial liabilities consisted of accounts payable and other accounts payable which have contractual maturity dates within one year. The Group manages its liquidity risk by reviewing its capital requirements on an ongoing basis. Based on the Group's working capital position at March 31, 2021, management considers liquidity risk to be low.

As at March 31, 2021, the Group has identified the following liquidity risks related to financial liabilities:

| Less than one year |

1 to 5 years |

6 to 10 years |

> 10 years |

|||||||||

| Lease liabilities | $ | 2,030 | $ | 9,368 | $ | 11,983 | $ | 4,432 |

The maturity profile of the Company's other financial liabilities (trade payables, other account payable and accrued expenses, and warrants) as of March 31, 2021 are less than one year.

The Interim Financial Statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. The Interim Financial Statements do not include any adjustments to the amounts and classification of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. Such adjustments could be material.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Share Capital

The Company's authorized share capital consists of an unlimited number of Common Shares without par value, 50,498,009 of which were issued and outstanding as of March 31, 2021.

The Common Shares confer upon their holders the right to participate in the general meeting with each Common Share having one voting right on all matters. The Common Shares also allow holders to receive dividends if and when declared and to participate in the distribution of surplus assets in the case of liquidation of the Company.

As of March 31, 2021, the Company also has the following outstanding securities which are convertible into, or exercisable or exchangeable for, voting or equity securities of the Company: 3,582,389 Options, 2,322,259 Listed Warrants, 16,866 Unlisted Warrants and 252,905 2019 Compensation Options on a post consolidation basis.

Operating, Financing and Investing Activities

The following table highlights the Company's cash flow activities for the three months ended March 31, 2021 and 2020 and year ended December 31,2020 and 2019:

| For the three months ended March 31, |

For the year ended December 31, |

|||||||||||

| Net cash provided by (used in): | 2021 | 2020 | 2020 | 2019 | ||||||||

| Operating activities | $ | (7,791 | ) | $ | (2,008 | ) | $ | (7,919 | ) | $ | (5,959 | ) |

| Investing activities | $ | (549 | ) | $ | (851 | ) | $ | (4,075 | ) | $ | (3,775 | ) |

| Financing activities | $ | 470 | $ | (59 | ) | $ | 6,740 | $ | 17,051 | |||

| Effect of foreign exchange | $ | 237 | $ | 695 | $ | 213 | $ | (982 | ) | |||

| Increase (Decrease) in cash | $ | (7,633 | ) | $ | (2,223 | ) | $ | (5,041 | ) | $ | 6,335 | |

Operating activities used cash of $7,791 for the three months ended March 31, 2021 as compared to $2,008 for the three months ended March 31, 2020. This variance is primarily due to increase in the business activities of the Company including corporate expenses for salaries, professional fees and marketing expenses in Israel, Germany and Canada as well as costs related to the NASDAQ listing and M&A processes. In the three months ended March 31, 2021, cash was primarily used to increase operating activities in connection with the Company's operations in Germany and the preparation of its Israeli operations to deliver medical cannabis under the Focus' sales agreements to pharmacies.

Investing activities used cash of $549 for the three months ended March 31, 2021, as compared to $851 for the three months ended March 31, 2020. Cash was used primarily for the purchase of production equipment for Focus and Adjupharm.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Financing activities provided by cash of $470 for the three months ended March 31, 2021, as compared to $(59) for the three months ended March 31, 2020. Most of the cash provided mainly due to $461 proceeds from exercise of Warrants.

Selected quarterly financial information

| For the three months ended | March 31, 2021 |

December 31, 2020 |

September 30, 2020 |

June 30, 2020 |

||||||||

| Net Revenues | $ | 8,767 | $ | 4,900 | $ | 5,893 | $ | 3,757 | ||||

| Net income (Loss) | $ | 4,715 | $ | (19,976 | ) | $ | 738 | $ | (9,696 | ) | ||

| Basic net income (Loss) per share (in CAD): | $ | 0.11 | $ | (0.50 | ) | $ | 0.00 | $ | (0.52 | ) | ||

| Diluted net income (Loss) per share (in CAD): | $ | (0.06 | ) | $ | (0.50 | ) | $ | 0.00 | $ | (0.52 | ) |

| For the three months ended | March 31, 2020 |

December 31, 2019 |

September 30, 2019 |

June 30, 2019 |

||||||||

| Net Revenues | $ | 1,340 | $ | 2,479 | $ | 2,326 | $ | 2,314 | ||||

| Net income (Loss) | $ | 200 | $ | 1,693 | $ | (1,915 | ) | $ | (610 | ) | ||

| Basic net income (Loss) per share (in CAD): | $ | (0.003 | ) | $ | 0.015 | $ | (0.014 | ) | $ | (0.008 | ) | |

| Diluted net income (Loss) per share (in CAD): | $ | (0.003 | ) | $ | 0.015 | $ | (0.014 | ) | $ | (0.008 | ) |

On a quarterly basis, apart from the results of the first quarter of 2020 which were considered by the Company as preparation period for successful delivery of medical cannabis products under the Focus' sales agreement to pharmacies, and the results of the fourth quarter of 2020 which were affected by the COVID-19 outcomes on the German market, the Company has consistently increased revenues, which reflects the Company's expansion strategy.

| IM Cannabis Corp. |

| Management's Discussion and Analysis (Canadian dollars, in thousands) |

Metrics and Non-IFRS Financial Measures

This MD&A makes reference to certain non-IFRS financial measures including "Gross Margin", "EBITDA", and "Adjusted EBITDA". These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management's perspective. Accordingly, these measures should neither be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.