IM Cannabis Corp.

Management's Discussion and Analysis

For the Three and Six Months Ended June 30, 2021

August 16, 2021

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

IM Cannabis Corp.

Management's Discussion and Analysis

For the Three and Six Months Ended June 30, 2021 and 2020

This Management's Discussion and Analysis ("MD&A") reports on the consolidated financial condition and operating results of IM Cannabis Corp. (the "Company" or "IMCC") for the three and six months ended June 30, 2021 and 2020. Throughout this MD&A, unless otherwise specified, references to "we", "us", "our" or similar terms, as well as the "Company" and "IMCC" refer to IM Cannabis Corp., together with its subsidiaries, on a consolidated basis, and the "Group" refers to the Company, its subsidiaries and Focus Medical Herbs Ltd.

This MD&A should be read in conjunction with the Company's interim condensed consolidated financial statements for the three and six months ended June 30, 2021 (the "Interim Financial Statements") and with the Company's annual financial statements as of December 31, 2020, and for the year then ended and accompanying notes ("Annual Financial Statements").

The Interim Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). IFRS requires management to make certain judgments, estimates and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily indicative of results that may be expected for future periods.

The Interim Financial Statements include the accounts of the Company, and the following entities:

|

Legal Entity: |

Relationship with the Company: |

|

IMC Holdings Ltd. ("IMC Holdings") |

Wholly-owned subsidiary |

|

Adjupharm GmbH ("Adjupharm") |

Subsidiary of IMC Holdings |

|

IMC Ventures Ltd. |

Subsidiary of IMC Holdings |

|

I.M.C Farms Israel Ltd. |

Wholly-owned subsidiary of IMC Holdings |

|

I.M.C. - International Medical Cannabis Portugal Unipessoal, Lda. |

Wholly-owned subsidiary of IMC Holdings |

|

Focus Medical Herbs Ltd. ("Focus") |

Private company over which IMC Holdings exercises "de facto control" under IFRS 10, as further described under the "Risk Factors" section below |

|

Trichome Financial Corp. ("Trichome") |

Wholly-owned subsidiary |

|

Trichome Financial Cannabis GP Inc. |

Wholly-owned subsidiary of Trichome |

|

Trichome Financial Cannabis Manager Inc. |

Wholly-owned subsidiary of Trichome |

|

Trichome Financial Cannabis Private Credit LP (the "Fund") |

Limited partnership, equity accounted investee |

|

Trichome Asset Funding Corp. |

Wholly-owned subsidiary of Trichome |

|

Trichome JWC Acquisition Corp. ("TJAC") |

Wholly-owned subsidiary of Trichome |

|

Trichome Retail Corp. |

Wholly-owned subsidiary of Trichome |

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

All intercompany balances and transactions were eliminated on consolidation.

All amounts in this MD&A are expressed in Canadian Dollars ($) in thousands, unless otherwise noted. Certain amounts are shown in New Israeli Shekel ("NIS"), Euro ("€"), United States dollars ("US$") as noted.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may contain "forward-looking statements" or "forward-looking information," within the meaning of applicable securities legislation (collectively referred to herein as "forward-looking statements" or "forward-looking information"). All statements other than statements of fact may be deemed to be forward-looking statements, including statements with regard to expected financial performance, strategy and business conditions. The words "believe", "plan", "intend", "estimate", "expect", "anticipate", "continue", or "potential", and similar expressions, as well as future or conditional verbs such as "will", "should", "would", and "could" often identify forward-looking statements. These statements reflect management's current expectations and plans with respect to future events and are based on information currently available to management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management considering its experience, perception of trends, current conditions and expected developments as well as other factors that management believes to be relevant as at the date such statements are made.

Without limitation, this MD&A contains forward-looking statements pertaining to:

With respect to the forward looking-statements contained in this MD&A, the Company has made assumptions regarding, among other things:

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Readers are cautioned that the above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward-looking statements due to a number of factors and risks. These include:

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Readers are cautioned that the foregoing list of risk factors is not exhaustive. Additional information on these and other factors that could affect the business, operations or financial results of the Company are detailed under the headings "Risks Factors" and "Contingent Liabilities and Commitments" of this MD&A. The Company and management caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. The Company and management assume no obligation to update or revise them to reflect new events or circumstances except as required by applicable securities laws.

FINANCIAL OUTLOOK

The forward-looking information in this MD&A contain statements in respect of estimated revenues. The Company and its management believe that the estimated revenues are reasonable as of the date hereof and are based on management's current views, strategies, expectations, assumptions and forecasts, and have been calculated using accounting policies that are generally consistent with the Company's current accounting policies. These estimates are considered financial outlooks under applicable securities legislation. These estimates and any other financial outlooks or future-oriented financial information included herein have been approved by management of the Company as of the date hereof. Such financial outlooks or future-oriented financial information are provided for the purposes of presenting information about management's current expectations and goals relating to the sales agreements described in the "Corporate Developments" section of this MD&A and other previously announced Focus sales agreements and the future business of the Company. The Company disclaims any intention or obligation to update or revise any future-oriented financial information, whether as a result of new information, future events or otherwise, except as required by securities legislation. Readers are cautioned that actual results may vary materially as a result of a number of risks, uncertainties, and other factors, many of which are beyond the Group's control. See the risks and uncertainties discussed in the "Risk Factors" section and elsewhere in this MD&A and other risks detailed from time to time in the publicly filed disclosure documents of the Company which can be viewed online under the Company's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com.

NON-IFRS FINANCIAL MEASURES

Certain financial measures used in this MD&A do not have any standardized meaning under IFRS, including "Gross Margin", "EBITDA" and "Adjusted EBITDA". For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the "Metrics and Non-IFRS Financial Measures" section of the MD&A.

OVERVIEW OF THE COMPANY

Company Background

The Company was incorporated pursuant to the Business Corporations Act (British Columbia) on March 7, 1980, under the name "Nirvana Oil & Gas Ltd." On July 12, 2013, in connection with a share consolidation, the Company changed its name to "Navasota Resources Inc.". On June 22, 2018, the Company completed a consolidation of its common shares ("Common Shares") on the basis of one post-consolidation Common Share for every five pre-consolidation Common Shares. On October 4, 2019, in connection with the Reverse Takeover Transaction (as defined below), the Company effected a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every 2.83 pre-consolidation Common Shares and changed its name to "IM Cannabis Corp.". On October 11, 2019, the Company completed the Reverse Takeover Transaction and changed its business from mining to the international medical cannabis industry.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

On February 12, 2021, in connection with its NASDAQ listing application, the Company effected a consolidation of its Common Shares on the basis of one (1) post-consolidation Common Share for every four (4) pre-consolidation Common Shares.

IMCC is a multi-country operator in the medical and recreational cannabis sector headquartered in Israel with operations in Israel, Europe, and Canada.

Israel

In Israel, IMC Holdings built the IMC brand of premium medical cannabis products which have been cultivated over the last decade by Focus, an Israeli licensed cultivator over which IMC Holdings exercises "de facto control" under IFRS 10, and its cultivation partners, and sold by Focus in the Israeli market.

Focus holds the Focus Licenses, granted by the MOH, to propagate and cultivate medical cannabis in the State of Israel, valid until January 3, 2022. Focus is one of the eight medical cannabis producers initially licensed by Israeli regulatory authorities and has over 10 years of experience in growing high quality medical cannabis products for the Israeli market.

As part of its core Israeli business, the Company offers intellectual property-related services to the medical cannabis industry based on proprietary processes and technologies it developed for the production of medical cannabis. The Company offers its intellectual property and consulting services to Focus pursuant to certain commercial agreements and receives as consideration for such services a share of Focus' revenues resulting from the sale of medical cannabis products under the IMC brand.

IMCC has started entering, through its subsidiaries, the distribution and retail segments of the Israeli medical cannabis market, by entering into each of the Panaxia Transaction, the Pharm Yarok Acquisition, and the Vironna Transaction and by attracting acquisitions of synergistic targets in Israel. Following such vertical integration, IMCC expects to increase its revenue and margins from its Israeli medical cannabis market activities, diversify its business opportunities and gain direct access to medical cannabis patients.

Europe

In Europe, IMCC operates through Adjupharm, a German-based subsidiary acquired by IMC Holdings on March 15, 2019. Adjupharm is an EU-GMP certified medical cannabis producer and distributor with the Adjupharm Licenses that allow, among other capabilities, for the import/export of medical cannabis with requisite permits. Adjupharm serves as the Company's flagship European outpost for sales and distribution.

Adjupharm currently manufactures and distributes IMC-branded medical cannabis products, in addition to other branded medical cannabis products, to pharmacies and distribution partners in Germany pursuant to sales and distribution agreements. Adjupharm sources its medical cannabis products from strategic partners, including various EU-GMP standard European and Canadian suppliers. While the Company does not currently distribute products in European countries other than Germany, the Company intends to leverage the platform established by Adjupharm in Germany and its network of distribution partners to expand to other jurisdictions across the continent in which medical cannabis is legal.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Canada

IMCC expanded operations to Canada through the acquisition of Trichome on March 18, 2021 with the objective of securing premium indoor cannabis for the Israeli medical market as well as to compete in the premium segment of Canada's adult-use recreational market. Trichome's wholly-owned subsidiary, TJAC holds the TJAC Licenses. TJAC's flagship facility, located near Toronto, cultivates high-quality indoor cannabis using roughly 47,000 square feet of cultivation space. Trichome is focused on acquiring, integrating and managing related assets in Canada to complement IMCC's strategic objectives.

On July 9, 2021, IMCC completed the acquisition of MYM. MYM is a Canadian cultivator, processor, and distributor of premium cannabis via its two wholly owned subsidiaries; SublimeCulture Inc. ("Sublime") in Laval, Quebec, and Highland Grow Inc. ("Highland"), in Antigonish, Nova Scotia. MYM's flagship brand, Highland, is an ultra-premium brand sold in most provinces throughout Canada.

The consolidated revenues of the Group for the three and six months ended June 30, 2021, was generated mainly from the sale of medical cannabis products in Israel, Germany, and Canada (starting March 18, 2021), by Focus, Adjupharm, and Trichome, respectively.

The Group does not engage in any U.S. cannabis-related activities as defined in Canadian Securities Administrators Staff Notice 51-352 (Revised) - Issuers with U.S. Marijuana-Related Activities.

As of June 30, 2021, the Company's major Israeli assets include the Commercial Agreements and the Focus Agreement (as defined herein), as well as its holdings in Xinteza API Ltd. ("Xinteza").

As of June 30, 2021, the Company's major international assets include Trichome in Canada, and 90.02% of Adjupharm in Germany (held through IMC Holdings).

As of June 30, 2021, neither the Company nor any of its subsidiaries currently hold, directly or indirectly, any licenses to engage in the propagation, cultivation, production, processing, distribution or sale of medical cannabis products in Israel as required by local legislation. However, under IFRS 10, the Company is required to consolidate the results of Focus, a licensed propagator and cultivator of medical cannabis products under the current Israeli regulatory regime. As such, all financial information in this MD&A is presented on a consolidated basis reflecting the results of the Group. While IMCC does not hold any of the Israeli licenses mentioned above and does not own Focus, it derives a significant portion of its consolidated revenues from Focus' revenue, which is primarily earned from sales of medical cannabis by Focus to pharmacies in Israel. Furthermore, the Company has an option under the Focus Agreement (as defined herein) to re-acquire 74% ownership of Focus. For more information, please see the "Risk Factors" section below.

Company Products

Israel

'IMC' is a well-known medical cannabis brand in Israel. Leveraging its long-term success in the Israeli market, the Company launched the brand in Germany in 2020. The Company believes that the IMC brand in Israel has become synonymous with quality and consistency in the Israeli medical cannabis market and it was chosen as one of the four top favourite brands in Israel.1

1 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (Aug 2020, Israel).

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

In association with Focus, the Company maintains a brand portfolio that includes popular medical cannabis dried flowers such as Roma, DQ, London, and Tel Aviv, as well as full-spectrum cannabis extracts.

All of the products are tested in certified labs according to MOH standards and certified before being packaged and labelled with detailed information about the THC, CBD and CBN content of each product.2

The following graphic highlights key products sold under the IMC brand in Israel:

Europe

In Germany, the Company sells IMC-branded dried flower products. The medical cannabis products sold in the German market are branded generically as "IMC" so as to rely on the Company's brand recognition in establishing a foothold with German healthcare professionals.

Canada

In Canada, the Company's product portfolio consists of dried flowers, pre-rolled cannabis, pressed hash, and kief offerings sold by TJAC under the WAGNERS brand into the Canadian adult-use recreational cannabis market (rebranded from 'JWC' to 'WAGNERS' in May 2021). The WAGNERS brand competes in the premium segment of the market. Dried flower is sold primarily in 3.5 gram, 14 gram, and 28 gram formats, pre-rolls are sold in a 3 x 0.5 gram format, and both hash and kief sold in 1 gram and 2 gram formats. A new 4 gram hash format was also recently released. Historically TJAC has also sold cannabis on a business-to-business basis, having found demand from other cannabis producers in Canada due to TJAC's high-quality indoor-grown cannabis. With the closing of the MYM Transaction, TJAC expects to optimize the cultivation and brand footprint of both WAGNERS and Highland Grow. IMCC intends to export TJAC's and MYM's premium cannabis strains to the Israeli market as well as selected genetics of their ultra-premium strains to Israel for further fulfillment of its global cultivation and distribution leading platform.

2 The actual percentages of THC and CBD content are determined by certified laboratory inspections and disclosed on the label of each IMC-branded medical cannabis product sold in Israel. Depending on such THC and CBD content, each IMC-branded medical cannabis product is labelled based on the following categories, in accordance with MOH regulations: (a) 'T20/C4' (THC 16-24% and CBD 0-7%); (b) 'T15/C3' (THC 11-19% and CBD 0-5.5%); (c) 'T10/C2' (THC 6-14% and CBD 0-3.8%); (d) 'T10/C10' (THC 6-14% and CBD 6-14%); (e) 'T5/C5' (THC 1-9% and CBD 1-9%); (f) 'T0/C24' (THC 0-0.5% and CBD 20-28%); (g) 'T1/C20' (THC 0-2.5% and CBD 16-24%); (h) 'T3/C15' (THC 0.5-5.5% and CBD 11-19%); and (i) 'T5/C10' (THC 2.5-7.5% and CBD 6-14%). The stated THC and CBD percentage ranges for the IMC branded strains are expected ranges; the actual percentages, as labelled on product packaging under the IMC brand, may vary or deviate from such ranges. The CBN content is lower than 1.5% in all products sold in Israel.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

The following graphic highlights key products sold under the WAGNERS brand:

The Company closed the MYM Transaction on July 9, 2021. Through this acquisition, the Company acquired the rights to the Highland Grow brand. Highland Grow is a well-known, broadly available brand in Canada focused on the ultra-premium segment. Highland sells dried flower and pre-rolled cannabis, with dried flower potency typically above 23% THC. In addition to the proven track record of the Highland Grow brand, MYM holds over 150 strains in its product portfolio that the Company plans to selectively release to market.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

The following graphic highlights key products sold under the Highland Grow brand:

Corporate Developments

(i) the Reverse Takeover Transaction and Liquidity Events

On October 11, 2019, the Company completed a business combination with IMC Holdings resulting in a reverse takeover of the Company by shareholders of IMC Holdings (the "Reverse Takeover Transaction"). The Reverse Takeover Transaction was effected by way of a "triangular merger" between the Company, IMC Holdings and a wholly-owned subsidiary of the Company pursuant to Israeli statutory law.

In connection with the Reverse Takeover Transaction, the Company completed a private placement offering of 19,460,527 (on a pre-Share Consolidation (as defined below) basis) subscription receipts (each a "Subscription Receipt") of a wholly-owned subsidiary of the Company ("Finco") at a price of $1.05 per Subscription Receipt for aggregate gross proceeds of $20,433 (the "Financing"). Upon the satisfaction or waiver of, among other things, all of the condition precedents to the completion of the Reverse Takeover Transaction, each Subscription Receipt was exchanged for one unit of Finco (a "Finco Unit") with each Finco Unit being comprised of one (1) common share of Finco (a "Finco Share") and one-half (1/2) of one (1) Finco Share purchase warrant (each whole warrant, a "Finco Warrant"). Each whole Finco Warrant was exercisable for one Finco Share at an exercise price of $1.30 until October 11, 2021. Upon closing of the Reverse Takeover Transaction, the Finco Shares and Finco Warrants were exchanged for Common Shares and Common Shares purchase warrants ("Listed Warrants") on economically equivalent terms on a 1:1 basis. A total of 9,730,258 Listed Warrants were issued and listed for trading on the CSE under the ticker "IMCC.WT".

In addition, IMC Holdings granted to the agents who acted on its behalf in connection with the Financing, options to acquire 1,199,326 compensation units (the "2019 Compensation Units") at an exercise price of $1.05 per 2019 Compensation Unit. Upon completion of the Reverse Takeover Transaction, the 2019 Compensation Units were exchanged for compensation options of the Company (the "2019 Compensation Options"). Each 2019 Compensation Option consisted of one Common Share and one-half of one Common Share purchase warrant (the "Unlisted Warrants") with each whole Unlisted Warrant exercisable for one Common Share at an exercise price of $1.30 for 36 months following the issuance (until August 30, 2022), with such Unlisted Warrants issued as a result of exercises of 2019 Compensation Options and not listed for trading on any exchanges.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Upon the completion of the Reverse Takeover Transaction, the former holders of IMC Holdings held approximately 84.28% of the issued and outstanding Common Shares and the previous holders of Subscription Receipts held approximately 13.35% of the Common Shares, in each case, on a non-diluted basis.

On November 5, 2019, the Common Shares began trading on the CSE under the ticker symbol "IMCC".

On February 12, 2021, the Company's shareholders approved at a special meeting the consolidation of all the Company's issued and outstanding Common Shares on a four (4) to one (1) basis (the "Share Consolidation"). Following the Share Consolidation, the number of Listed Warrants, Unlisted Warrants, and 2019 Compensation Options outstanding was not altered; however, the exercise terms were adjusted such that four Listed Warrants are required to be exercised to purchase one Common Share following at an adjusted exercise price of $5.20, four Unlisted Warrants are required to be exercised to purchase one Common Share at an adjusted exercise price of $5.20, and four 2019 Compensation Options are required to be exercised to purchase one unit at an adjusted exercise price of $4.20, with each unit exercisable into one Common Share and one-half of one Unlisted Warrant, with each whole Unlisted Warrant expiring on August 30, 2022 and exercisable to purchase one Common Share at an exercise price of $5.20. The consolidated financial statements give effect to the Share Consolidation for all periods presented.

On March 1, 2021, the Common Shares commenced trading on NASDAQ under the ticker symbol "IMCC", making the Company the first Israeli medical cannabis operator to list its shares on NASDAQ.

As of June 30, 2021, and 2020, there were 7,362,762 and 9,730,258 Listed Warrants outstanding, respectively, re-measured by the Company, according to their trading price in the market, in the amount of $14,643 and $2,024, respectively. For the six months ended June 30, 2021 and 2020, the Company recognized a revaluation gain (loss) of $13,118 and $(7,021), respectively. For the three months ended June 30, 2021 and 2020, the Company recognized a revaluation gain (loss) of $5,989 and $(7,188) in the consolidated statement of profit or loss and other comprehensive income, in which the unrealized gain is included in finance income (expense).

During the six months ended June 30, 2021, a total of 2,366,496 Listed Warrants were exercised for 591,624 Common Shares at an adjusted exercise price of $5.20 per Common Share. As a result, the Company received a total amount of $2,829 and recorded receivables at a total amount of $248.

During the six months ended June 30, 2021, a total of 194,992 Unlisted Warrants were exercised for 48,748 Common Shares at an adjusted exercise price of $5.20 per Common Share. As a result, the Company received a total amount of $255.

During the six months ended June 30, 2021, a total of 197,632 2019 Compensation Options were exercised for 49,408 Common Shares and 24,703 Unlisted Warrants. Consequently, the Company received an aggregate adjusted exercise amount of $208.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

(ii) Restructuring

Current Israeli law requires prior approval by the IMCA, a unit of the MOH, of the identity of any shareholder owning 5% or more of an Israeli company licensed by the IMCA to engage in cannabis-related activities in Israel. For a number of reasons, including the opportunity to leverage a network of multiple Israeli licensed producers cultivating under the IMC brand, and in contemplation of a "go-public transaction" to geographically diversify the Company's share ownership, IMC Holdings restructured its organization on April 2, 2019 (the "IMC Restructuring") resulting in the divestiture to Oren Shuster and Rafael Gabay of its interest in Focus, which is licensed by the IMCA to propagate and cultivate cannabis in Israel.

IMC Holdings retains an option with Messrs. Shuster and Gabay to re-acquire the sold interest in Focus at its sole discretion and in accordance with Israeli cannabis regulations, within 10 years of the date of the IMC Restructuring (the "Focus Agreement"). The Focus Agreement sets an aggregate exercise price equal to NIS 765.67 per share of Focus for a total consideration of NIS 2,756,500, that being equal to the price paid by Messrs. Shuster and Gabay for the acquired interests in Focus at the time of the IMC Restructuring.

As part of the IMC Restructuring, IMC Holdings and Focus entered into an agreement in which Focus shall use the IMC brand on an exclusive basis for the sale of any cannabis plant and/or cannabis product produced by Focus, either alone or together with other sub-contractors engaged by Focus (the "IP Agreement"). Focus is also obligated to exclusively use IMC Holdings for certain management and consulting services including: (a) business development services; (b) marketing services; (c) strategic advisory services; (d) locating potential collaborations on a worldwide basis; and (e) financial analysis services (the "Services Agreement" and collectively with the IP Agreement, the "Commercial Agreements").

Under the IP Agreement, IMC Holdings charges Focus an amount equal to 25% of its revenues on a quarterly basis, which shall not be changed without the consent of IMC Holdings, as consideration for Focus' use of certain trademarks, know-how, technology and maintenance services provided by IMC Holdings.

Under the Services Agreement, IMC Holdings charges Focus an amount equal to IMC Holdings' cost of providing certain services to Focus plus a 25% mark-up, which shall not be changed without the consent of IMC Holdings, as consideration for the provision of such services.

Subsequent to the IMC Restructuring, according to accounting criteria in IFRS 10, the Company is still viewed as effectively exercising control over Focus, and therefore, the accounts of Focus continue to be consolidated with those of the Company.

As a result of the IMC Restructuring, IMCC derives revenue from the Commercial Agreements. IMCC does not directly hold any licenses to engage in the cultivation, production, processing, distribution or sale of medical cannabis in Israel.

(iii) Regulatory Changes in Israel

Changes under the MOH Regulations

Until September 2019, patients licensed for consumption of medical cannabis products by the IMCA received all of their medical cannabis products authorized under their respective licenses at a fixed monthly price of NIS 370, regardless of each patient's authorized amount. As an example, a patient who was to receive 20 grams of medical cannabis products per month would pay the same monthly fee of NIS 370 as a patient who received 180 grams per month. In addition, IMCA assigned patients to a particular licensed medical cannabis producer, from which each patient would exclusively receive their medical cannabis products. Under the previous medical cannabis regulations, Focus distributed approximately 80% of its medical cannabis products via home delivery and the remaining 20% via an IMCA-established distribution outlet.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Under the MOH's new regulations, medical cannabis products are delivered from a licensed producer to a manufacturer, which then delivers to a distributor to distribute to pharmacies. In addition, patients licensed for consumption of medical cannabis products are no longer exclusively assigned to medical cannabis producers and may purchase medical cannabis products from authorized pharmacies at a range of price points without any MOH-regulated price controls.

In light of the MOH's new regulations, some medical cannabis patient licenses granted under the previous regime are still valid. The medical cannabis patient licenses set to expire during the period from February 1, 2019 to July 31, 2019 were extended by order of the Israeli Supreme Court until further notice by the Court. While these licenses remain valid, the patients who hold these licenses are entitled to receive medical cannabis products pursuant to the price controls and supplier restrictions of the former regime. Additional information on the proceedings pursuant to which the above-referenced order was granted can be found under "Legal Proceedings and Regulatory Actions - Legal Proceedings - Supreme Court of Justice 2335/19".

Following the implementation of the above MOH's new regulations, the Group believes that the Israeli medical cannabis market will continue to benefit from price stability of the premium and super premium medical cannabis products, an increase to the number of physicians certified by the IMCA to prescribe medical cannabis and thus, an increase in the number of licensed medical cannabis patients.

Medical Cannabis Imports

In October 2020, the IMCA issued an updated procedure, titled "Guidelines for Approval of Applications for Importation of Dangerous Drug of Cannabis Type for Medical Use and for Research" ("Procedure 109"), describing the application requirements for cannabis import licenses for medical and research purposes. According to Procedure 109, the following permits and licenses are required to receive a cannabis import license: (1) License to possess medical cannabis and operate in the medical cannabis industry; (2) License to import plant material; (3) Permit to import narcotic drugs; and (4) License to import a dangerous drug.

Medical Cannabis Exports

In October 2020, the MOH launched a new pilot program under which medical cannabis producers would be authorized to export medical cannabis products, subject to the requirement that certain products be made available at a fixed price of NIS 14 per gram to patients in Israel over the age of 21 and NIS 10 per gram to patients under the age of 21 (the "Pilot Program"). The Pilot Program was originally set to expire at the end of Q1 2021 yet continues although not officially extended. Products bearing the IMC brand were offered as part of the Pilot Program during the first and second quarter of 2021.

In December 2020, the IMCA published guidelines for the medical cannabis export permit application process,3 pursuant to which an export permit will only be granted to an applicant if (i) sufficient domestic supply has been secured by such applicant in the variety and quantity that will meet the Israeli level of demand; (ii) the delivery of medical cannabis is made from approved sites; (iii) the applicant has a valid IMC-GDP certification and business license from the IMCA; and (iv) an import permit from the importing country is obtained and attached to the export application.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Legalization of Adult-Use Recreational Cannabis in Israel

As of the date of this MD&A, adult-use recreational cannabis use in Israel is illegal. In November 2020, an Israeli government committee responsible for advancing the cannabis market reform published a report supporting and recommending the legalization of adult-use recreational cannabis in Israel (the "Report"). Based on the Report, the Israeli Ministry of Justice was expected to formulate a bill to begin the legislative process towards the legalization of adult-use recreational cannabis. The government committee made its recommendation for legalization based on the increasing demand for adult-use recreational cannabis in Israel, the importance of maintaining quality standards and limiting uncontrolled products, the need for increased access to cannabis by medical patients and the objective of decreasing the size of the illegal market. The model proposed by the government committee in the Report is similar in nature to the model adopted in Canada, whereby the sale of adult-use recreational cannabis would be channeled through government-licensed dispensaries.

In December 2020, the governing Israeli parliament dissolved and the draft bill became defunct. However, the new government, formed on June 13, 2021, declared and settled in the coalition agreement, its commitment to legalization of adult-use recreational cannabis. Since the formation of the new government, it has commenced an initiative to decriminalize the possession of cannabis for individual recreational adult-use and to legalize the CBD component of cannabis for non-medical use, as the first step towards more comprehensive legislation related to the legalization of recreational cannabis.

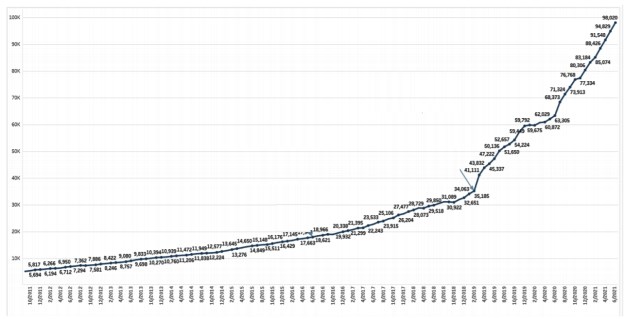

(iv) Israeli Market

The Israeli medical cannabis market has shown dramatic growth over the past several years. It is projected that this growth will continue and according to MOH estimates, the number of patients in Israel licensed by the MOH to consume medical cannabis is expected to reach 120,000 by the end of 2021.

Israeli Market Development 2011-2021

According to MOH monthly publication, as of June 2021, there are 98,020 licensed patients in Israel, and a monthly prescription of 3,585,000 and 2,848,000 grams of cannabis were recorded in June 2021 and December 2020, respectively.4

4 Israel Ministry of Health - licensed patients' data as of June 2021 -

https://www.health.gov.il/Subjects/cannabis/Documents/licenses-status-june-2021.pdf

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

The below reflects the number of licensed medical cannabis patients in Israel over the year 2011 to June 2021:5

(v) Canadian Market

In Canada, recreational cannabis was legalized in October 2018. Under the legalization framework, cannabis cultivators, processors, and retailers must obtain licences from Health Canada to produce or sell cannabis products for recreational consumption, however, consumers do not require a licence to purchase cannabis. In 2020, roughly 27% of Canadians surveyed by Statistics Canada had consumed cannabis in the past 12 months.6 From October 2018 to March 2021, sales of legal recreational cannabis increased by roughly 600%, to nearly $300,000 per month.7 While the Canadian market remains in its infancy, growth has been significant, due partially to the increasing availability of retail cannabis stores. As of December 2020, there were an estimated 1,445 cannabis stores in Canada.8

5 Ministry of Health - licensed patients' data as of June 2021 - https://www.health.gov.il/Subjects/cannabis/Documents/licenses-status-june-2021.pdf

6 Canadian Cannabis Survey 2020: Summary. https://www.canada.ca/en/health-canada/services/drugs-medication/cannabis/research-data/canadian-cannabis-survey-2020-summary.html#a2

7 Retail trade sales by province and territory.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2010000801&pickMembers%5B0%5D=2.30&pickMembers%5B1%5D=3.1&cubeTimeFrame.startMonth=10&cubeTimeFrame.startYear=2018&cubeTimeFrame.endMonth=03&cubeTimeFrame.endYear=2021&referencePeriods=20181001%2C20210301

8 Looking back from 2020, how cannabis use and related behaviours changed in Canada. https://www150.statcan.gc.ca/n1/pub/82-003-x/2021004/article/00001/c-g/c-g01-eng.htm

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

(vi) European Activity

The Company's European strategy is centered in Germany, whose medical cannabis market is currently considered the largest in Europe.9 To develop its operations in Germany, on March 15, 2019, the Company acquired, through IMC Holdings, 100% of the shares of Adjupharm (the "Adjupharm Shares"), a licensed EU-GMP certified medical cannabis producer and distributor. IMC Holdings acquired the Adjupharm Shares for approximately $1,400 (€924 as of the acquisition date) with additional obligations to the sellers including repayment of bank loans of up to $1,030 (€680 as of the acquisition date). These bank loans were repaid by IMC Holdings in May 2019. The Company, through IMC Holdings, currently owns 90.02% of Adjupharm, with the balance owned by Adjupharm's Chief Executive Officer.

The Company continues to develop Adjupharm as its European hub and to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country. The Company's objective is to capture a significant market share in Germany by working directly with pharmacies and with distributors to increase market reach for products bearing the IMC brand. The Company currently has approximately 8,000 square feet of warehousing and GMP Standard production capacity in Germany, following the recent completion of an expansion process of its facility to a new, state-of-the-art logistics centre, upgrading its production technology and increasing its storage capacity to seven tons of cannabis.

Adjupharm sources its supply of medical cannabis for the German market from various EU-GMP standard European and Canadian suppliers, and is actively seeking additional supply partners to diversify its source of supply of premium and super premium cannabis products and minimize the risks inherent in the supply chain.

Adjupharm relies on its sales and distribution agreements to supply and distribute IMC-branded products to distribution partners or directly to German pharmacies. There are approximately 19,000 community pharmacies in Germany, each of which is permitted to create and dispense medications, including medical cannabis, pursuant to physician prescriptions.10 In the first quarter of 2021, Adjupharm completed the expansion of its internal and external sales department and is focused on increasing physician awareness and engagement to drive sales of IMC-branded medical cannabis products. In July 2021, Adjupharm was recognized by the German Brand Institute with the "German Brand Award 2021", recognizing its excellence in brand strategy and creation, communication and integrated marketing. The competitive advantage in Germany also lies in the Group's track record and brand reputation in Israel and proprietary data supporting the effectiveness of medical cannabis for the treatment of a variety of conditions.

The Company has also engaged in exploratory operations to expand to Portugal and Greece, by establishing a wholly-owned subsidiary in Portugal in October 2018, and a joint venture in Greece (25% owned by IMCC), however it has deferred any further investment in these jurisdictions indefinitely in light of the uncertainty related to COVID-19.

Due to the impact of the COVID-19 pandemic on Germany in the first quarter of 2021, the Company, through Adjupharm, leveraged its established distribution platform to enter into several reseller agreements of COVID-19 antigen test kits. Such engagement of Adjupharm is expected to facilitate and further enhance its business relationship with pharmacies in Germany and support its distribution platform for medical cannabis. Due to the evolving impact of the COVID-19 worldwide, and in light of the uncertainty related to it, the Company has suspended sales of test kits in the German market and is examining potential demand for test kits in Israel. For more information, please see "Strategic Developments".

9 Health Europa, June 23, 2020. https://www.healtheuropa.eu/exploring-growth-in-the-european-medical-cannabis-market/100849/

10 Federal Union of German Associations of Pharmacists: Figures Data Facts 2020.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

(vii) Investment in Xinteza

On December 26, 2019, IMC Holdings entered into a share purchase agreement with Xinteza, a company with a unique biosynthesis technology, whereby the Company acquired, on an as-converted and fully diluted basis, 25.37% of Xinteza's outstanding share capital, for consideration of US$1,700 (approximately $2,100 as of June 30, 2021) paid in several installments (the "Xinteza SPA"). As of June 30, 2021, the Company has paid all outstanding installments pertaining to the Xinteza SPA and holds 24.2% of the outstanding share capital of Xinteza on an as-converted and fully diluted basis.

Under an exclusive license from Yeda Research & Development Company Ltd., the commercial division of the Weizmann Institute of Science, and based on disruptive plant genetics and metabolomics research led by Professor Asaph Aharoni, Xinteza has been developing advanced proprietary technologies relating to the production of cannabinoid-based active pharmaceutical ingredients for the pharmaceutical and food industries using biosynthesis and bio-extraction technologies.

(viii) Strategic Developments:

1. On April 1, 2021, the Company entered into a definitive agreement to acquire MYM pursuant to a plan of arrangement completed under the Business Corporations Act (British Columbia).

2. On April 1, 2021, Trichome was repaid on its loan to Heritage Cannabis Holdings Corp. The total payout was for proceeds of $4,727, of which $4,705 was principal with the remaining balance representing accrued interest. The loan was an acquired asset from the Trichome Transaction.

3. On April 23, 2021, Trichome was repaid on its loan to Good Buds Company International Inc. The total payout was for proceeds of $3,128, of which $2,900 was principal with the remaining balance representing accrued interest. The loan was an acquired asset from the Trichome Transaction.

4. On April 30, 2021, IMC Holdings, signed a definitive agreement (the "Panaxia Agreement") with Panaxia in connection with the Panaxia Transaction. Pursuant to the Panaxia Agreement, IMC Holdings will acquire Panaxia's trading house license and in-house pharmacy activities, certain distribution assets and an option to purchase a pharmacy with licenses to sell medical cannabis to patients, for an aggregate purchase price of NIS 18.7 million (approximately $7,200), comprised of NIS 7.6 million (approximately $2,900) in cash and NIS 11.1 million (approximately $4,300) in Common Shares (the "Panaxia Consideration Shares"). To satisfy the share consideration component, the Company will issue up to five instalments of Panaxia Consideration Shares. The deemed price of each Panaxia Consideration Share is calculated based on the average closing price of the Common Shares on NASDAQ over the 10 trading day period immediately preceding the date of issuance. The Panaxia Transaction will close in two stages, with the option of a third stage. The initial closing was completed on May 30, 2021, at which time all online-related activities and related intellectual property were transferred to IMC Holdings. The second closing is expected to occur upon receipt of MOH approval. Upon the second closing, IMC Holdings will acquire the Panaxia IMC-GDP License, which allows the holder to store and distribute medical cannabis in Israel. The Panaxia Transaction also includes an option for a third closing (the "Panaxia Option"), whereby IMC Holdings would acquire Panaxia's pharmacy, including the Panaxia Pharmacy Licenses for additional payment in the amount equal to the medical cannabis inventory of the pharmacy at the time of exercise. The Panaxia Option will become effective as of February 15, 2022.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

5. On May 10, 2021, the Company completed an overnight marketed offering (the "Offering") of 6,086,956 Common Shares (each an "Offered Share") at a price of US$5.75 per Offered Share for aggregate gross proceeds of approximately US$35,000. The Company also issued 3,043,478 warrants to purchasers of Offered Shares for no additional consideration that entitle the holders to purchase Common Shares of the Company at an exercise price of US$7.20 for a term of 5 years from the closing date. The Offering costs incurred amounted to approximately $3,800, out of which, approximately $1,100 were recorded in the Company's consolidated statements of profit or loss income of expense and approximately $2,700 offset premium. The Offering was conducted pursuant to the Company's Registration Statement and Final Shelf Prospectus, made effective on March 31, 2021, by the SEC and the applicable Securities Commissions in Canada, respectively. On May 5, 2021, the Company filed a final prospectus supplement in Canada, which also was filed with the SEC.

6. On May 30, 2021, the Company completed the first closing of the Panaxia Transaction, pursuant to which all online-related activities and related intellectual property were transferred to the Company.

7. On June 4, 2021, Focus entered into a three-year supply agreement (the "Flowr Agreement") with The Flowr Corporation ("Flowr"). Flowr is a Canadian licensed producer of ultra-premium adult-use recreational and medical cannabis products. Pursuant to the Flowr Agreement, and subject to the satisfaction of applicable regulatory and import requirements, Focus will import Flowr's ultra-premium cannabis strains into Israel.

8. On June 7, 2021, Farmako GmbH terminated the distribution agreement entered into with Adjupharm on September 9, 2020.

9. On June 29, 2021, Adjupharm entered into a two-year supply agreement with The Green Organic Dutchman Ltd. (the "TGOD Agreement" and "TGOD", respectively), pursuant to which Adjupharm will add TGOD's organic strains to Adjupharm's portfolio, ordering a minimum of 300 kg in the first year and a 400 kg minimum in the second year, subject to appropriate regulatory approvals. Under the TGOD Agreement, TGOD will supply medical cannabis for an IMC-exclusive strain to be launched in Germany later this year.

10. On June 25, 2021, Adjupharm entered a three-year supply agreement (the "NMC Agreement") with Natural Medco Ltd. ("NMC") pursuant to which Adjupharm will order up to 660 kg of NMC's EU-GMP-certified medical cannabis strains. Adjupharm has an option under the NMC Agreement to increase the quantity of medical cannabis to be supplied and to include additional strains. Adjupharm expects NMC's products to be delivered under the NMC Agreement to be launched in Germany in the second half of 2021.

Subsequent Events

1. On July 9, 2021, the Company closed the MYM Transaction, implemented in accordance with the terms and conditions of the arrangement agreement dated March 31, 2021, between IMCC, MYM and Trichome, which resulted in the acquisition by IMCC of all of the issued and outstanding shares of MYM (the "MYM Shares") in exchange for 0.022 of a Common Share for each MYM Share. In connection with the MYM Transaction, a total of 10,073,437 Common Shares have been issued to the former holders of MYM Shares, resulting in former MYM shareholders holding approximately 15% of the total number of Common Shares (based on 67,156,470 Common Shares issued and outstanding immediately after closing).

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

2. On July 28, 2021, IMC Holdings entered into a definitive agreement in respect of the Pharm Yarok Acquisition. The aggregate consideration for the Pharm Yarok Acquisition is approximately $4,600 (NIS 11,900), of which approximately $1,300 (NIS 3,500) shall be invested in the Company at closing in consideration for Common Shares by the shareholders of Pharm Yarok Group. Closing of the Pharm Yarok Acquisition is conditional upon receipt of all requisite approvals, including from the MOH. Pharm Yarok is a leading medical cannabis pharmacy and trade company located in central Israel; Rosen High Way, a trade and distribution centre providing medical cannabis storage, distribution services and logistics solutions for cannabis companies and pharmacies in Israel; and HW Shinua, an applicant for a medical cannabis transportation license from the IMCU, the receipt of which would permit HW Shinua to transport large quantities of medical cannabis to and from Pharm Yarok's pharmacy and Rosen High Way's distribution centre and to and from third parties in the medical cannabis sector, including medical cannabis growing facilities, pharmacies, manufacturers and distribution centres across Israel.

3. On July 30, 2021, in connection with the Panaxia Transaction, the Company issued the first instalment of 142,007 Consideration Shares at a price of US$5.009 per Consideration Share, representing an aggregate value equal to approximately US$ 711 with up to four additional instalments to follow (each, an "Additional Panaxia Instalment"). The next three Additional Panaxia Instalments will be issued on the last trading day of each of the next three months. The fourth Additional Panaxia Instalment will be issued upon the later of (i) four months from the issuance of the first instalment of Consideration Shares; or (ii) the second closing of the Panaxia Transaction, which is subject to the approval of the MOH.

4. On August 3, 2021, IMC Holdings and cbdMD executed a binding letter of intent that will grant IMC Holdings an exclusive right to import, sell, distribute and market cbdMD products in Israel using the cbdMD brand name and trademark, subject to the legalization of hemp-derived CBD for non-medical purposes in Israel.

5. On August 16, 2021, IMC Holdings entered into definitive agreement with Vironna in connection with the Vironna Transaction to acquire 51% of the issued and outstanding ordinary shares of Vironna, for an aggregate consideration of approximately $3,300 (NIS 8,500), comprised of $1,950 (NIS 5,000) in cash and $1,350 (NIS 3,500) in Common Shares to be issued at closing date (the "Vironna Share Consideration"). Closing of the Vironna Transaction is conditional upon receipt of all requisite approvals, including from the MOH. To satisfy the Vironna Share Consideration, the Company will issue number of Common Shares calculated based on the average closing price of the Common Share on NASDAQ over the 14 trading days period immediately preceding the date of issuance. Vironna is a leading pharmacy licensed to dispense and sell medical cannabis to licensed medical cannabis patients, located in central Israel and is one of the leading pharmacies in serving patients pertaining to the Arab population in Israel.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Company Outlook

Israel

In Israel, the Company, through the Commercial Agreements, continues to expand the IMC brand recognition, and supply, in association with Focus, the growing medical cannabis market in Israel with products bearing the IMC brand. With the expected high growth of the Israeli medical cannabis market, the Company is well positioned to reap the benefits of its long-term presence and strong brand recognition, expecting a continued increase in revenues and profitability. In addition, the Company intends to enter, through its subsidiaries, additional segments of the medical cannabis market in Israel, including the distribution and retail segments, by completing the Panaxia Transaction, the Pharm Yarok Acquisition, and the Vironna Transaction. Following such vertical integration, the Company expects to increase its revenue and margins from its Israeli medical cannabis market activities, diversify its business opportunities and gain direct access to medical cannabis patients to benefit from market knowledge and trends. Furthermore, the Group is focused on diversifying its product portfolio with premium and super premium medical cannabis products, leveraging its Canadian cultivation facilities that is expected to result in additional opportunities to export premium cannabis products to both Israel and Germany.

Europe

The Company's objective within Europe is to capitalize on the increasing demand for medical cannabis products and to bring the well-established IMC brand and its product portfolio to European patients. The Company's operating track record, accumulation of data and brand reputation in Israel is a competitive advantage in gaining traction within the German and European markets and building support among physicians who prescribe medical cannabis products.

Canada

Following the successful completion of the Trichome Transaction on March 18, 2021 and the MYM Transaction on July 9, 2021, IMCC plans to integrate and manage its assets in Canada with a goal of maximizing Company-wide revenue and margins.

Additionally, the Company will continue to drive organic growth from Canadian operations through active portfolio management of its products, additional SKU launches, boosting cultivation efficiency, and adding to the number of points of distribution across the country.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Overview of Financial Performance

| For the six months ended June 30, |

For the three months ended June 30, |

For the Year ended December 31, |

|||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||

| Net Revenues | $ | 19,879 | $ | 5,097 | $ | 11,112 | $ | 3,757 | $ | 15,890 | |||||

|

Gross profit before fair value impacts in cost of sales |

$ | 5,229 | $ | 2,656 | $ | 602 | $ | 2,025 | $ | 8,809 | |||||

|

Gross margin before fair value impacts in cost of sales (%) |

26% | 52% | 5% | 54% | 55% | ||||||||||

| Operating Loss | $ | (12,422 | ) | $ | (1,191 | ) | $ | (10,717 | ) | $ | (2,855 | ) | $ | (8,245 | ) |

| Loss | $ | (374 | ) | $ | (9,496 | ) | $ | (5,089 | ) | $ | (9,696 | ) | $ | (28,734 | ) |

|

Loss per share attributable to equity holders of the Company - Basic |

$ | (0.00 | ) | $ | (0.07 | ) | $ | (0.10 | ) | $ | (0.06 | ) | $ | (0.74 | ) |

|

Loss per share attributable to equity holders of the Company - Diluted (in CAD) |

$ | (0.28 | ) | $ | (0.07 | ) | $ | (0.23 | ) | $ | (0.06 | ) | $ | (0.74 | ) |

The Overview of Financial Performance includes reference to "gross margin", which is a non-IFRS financial measure. Non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. The Company defines gross margin as the difference between revenue and cost of revenues divided by revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets.

Operational Results - Medical Cannabis

| For the Six Months Ended June 30, |

For the Three months ended June 30, |

For the Year ended December 31, |

|||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||||

|

Average net selling price of dried flower (per Gram) |

$ | 4.33 | $ | 5.51 | $ | 3.92 | $ | 4.77 | $ | 5.75 | |||||||

|

Average net selling price of other cannabis products (per Gram)1 |

$ | 3.68 | - | $ | 3.18 | - | - | ||||||||||

|

Quantity harvested and trimmed (in Kilograms)2 |

1,282 | 1,542 | 1,151 | 1,542 | 2,545 | ||||||||||||

|

Quantity of other cannabis products sold (in Kilograms)1 |

203 | - | 158 | - | - | ||||||||||||

|

Quantity of dried flower sold (in Kilograms) |

3,028 | 723 | 1,842 | 525 | 2,586 | ||||||||||||

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Notes:

(1) Including other cannabis products such as Kief, Hash and Pre-rolls.

(2) Harvested flowers, after trimming and ready for manufacturing.

Review of Operations for the Three and Six Months Ended June 30, 2021 and 2020

Net Revenues

The Group operates in one reporting segment. The main revenues of the Group are generated from sales of medical cannabis products to customers in Israel and Germany as well as products to the recreational market in Canada.

Revenues for the six months ended June 30, 2021 and 2020 were $19,879 and $5,097, respectively, representing an increase of $14,782 or 290%. Revenues for the three months ended June 30, 2021 and 2020 were $11,112 and $3,757, respectively, representing an increase of $7,355 or 196%. Total dried flower sold for the six months ended June 30, 2021 was 3,028kg at an average selling price of $4.33 per gram compared to 723kg for the six months ended June 30, 2020 at an average selling price of $5.51 per gram, derived mainly from the lower average selling price per gram in the Canadian market. Total dried flower sold for the three months ended June 30, 2021 was 1,842kg at an average selling price of $3.92 per gram compared to 525kg for the three months ended June 30, 2020 at an average selling price of $4.77 per gram. The increase in revenues related to dried flower for the six and three months ended June 30, 2021 is attributable to deliveries made under the Focus' sales agreements to pharmacies, as well as to revenues generated from Adjupharm, full quarter consolidation of Trichome activities and one month consolidation of Panaxia activities. Total other cannabis product sold for the six months ended June 30, 2021 was 203kg at an average selling price of $3.68 per gram compared to nil for the six months ended June 30, 2020 at an average selling price of nil per gram. Total other cannabis product sold for the three months ended June 30, 2021 was 158kg at an average selling price of $3.18 per gram compared to nil for the three months ended June 30, 2020 at an average selling price of $nil per gram. The increase in revenues related to other cannabis products for the six and three month ended June 30, 2021 is attributable to TJAC brands after the consolidation of Trichome activities.

Cost of Revenues

The cost of revenues includes the purchase of raw materials, production, product testing, shipping and sales related costs. At harvest, the biological assets are transferred to inventory at their fair value which becomes the deemed cost for the inventory. Inventory is later expensed to the cost of sales when sold. Direct production costs are expensed through the cost of sales.

The cost of revenues for the six months ended June 30, 2021 and 2020 were $14,650 and $2,441, respectively, representing an increase of $12,209 or 500%. Cost of revenues for the three months ended June 30, 2021 and 2020 were $10,510 and $1,732, respectively, representing an increase of $8,778 or 507%. Cost of revenues is comprised of cultivation costs, purchase of materials and finished goods, utilities, salary expenses and import costs. Focus and TJAC expect net cost of sales to vary from quarter to quarter based on the number of pre-harvest plants, after harvest plants, the strains being grown and technological progress in the trimming machines.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Gross Profit

Included in the Company's calculation of gross profit are the following:

production costs (current period costs that are directly attributable to the cannabis growing and harvesting process);

materials and finished goods purchase costs

a fair value adjustment on sale of inventory (the change in fair value associated with biological assets that were transferred to inventory upon harvest);

a fair value adjustment on growth of biological assets (the estimated fair value less cost to sell of biological assets as at the reporting date).

Included in gross profit is the net change in fair value of biological assets, inventory expensed and production costs. Biological assets consist of cannabis plants at various after-harvest stages which are recorded at fair value less costs to sell after harvest.

Gross profit for the six months ended June 30, 2021 and 2020 was $4,460 and $6,580, respectively, representing a decrease of $2,120 or 32%. For the three months ended June 30, 2021 and 2020 gross profit (loss) was $(568) and $1,988, respectively, representing a decrease of $2,556 or (129%). Gross profit included gains (losses) from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $(769) and $3,924 for the six months ended June 30, 2021 and 2020, respectively. Losses from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold for the three months ended June 30, 2021 and 2020 were $(1,170) and $(37), respectively. Gross Margin for the second quarter of 2021 was impacted primarily by the previously disclosed delays in contracted shipments to Germany from its primary supply partner as well as temporary production constraints in Canada which were resolved during the third quarter of 2021.

Expenses

General and Administrative

General and administrative expenses for the six months ended June 30, 2021 and 2020 were $12,388 and $5,026, respectively, representing an increase of $7,362 or 146%. For the three months ended June 30, 2021 and 2020, general and administrative expenses were $7,475 and $3,096, respectively, representing an increase of $4,379 or 141%. The increase in the general and administrative is mainly attributable to the growing corporate activities in Israel, Germany, and Canada, professional services derived from legal fees and other consulting services, among other, in relation to the NASDAQ listing and M&A processes in the amount of $3,968 (including share-based expenses to financial advisors of approximately $990), salaries to employees in the amount of $3,506 and insurance costs in the amount of $1,117.

Selling and Marketing

Selling and marketing expenses for the six months ended June 30, 2021 and 2020 were $2,485 and $1,184, respectively, representing an increase of $1,301 or 110%. For the three months ended June 30, 2021, selling and marketing expenses were $1,296, compared to $707 for the three months ended June 30, 2020, representing an increase of $589 or 83%. The increase in the selling and marketing expenses was due mainly to the Company's increased marketing efforts in Israel and brand launch in Germany, as well as increased distribution expenses relating to the increase in sales and full quarter consolidation of Trichome's results.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Research and Development

Research and development expenses for the six months ended June 30, 2021 and 2020 were $6 and $134, respectively, representing a decrease of $128 or 96%. For the three months ended June 30, 2021 and 2020, research and development expenses were $5 and $107, respectively, representing a decrease of $102 or 95%. The decrease for the six and three months ended June 30, 2021 was primarily associated with the COVID-19 pandemic, which caused delays in new projects in Greece and Portugal.

Share-Based Compensation

Share-based compensation expense for the six months ended June 30, 2021 and 2020 was $2,003 and $1,427, respectively, representing an increase $576 or 40%. For the three months ended June 30, 2021 and 2020, share-based compensation expense was $1,373 and $933, respectively, representing an increase of $440 or 47%. The increase was mainly due to the grant of new incentive stock options ("Options"), resulting from the decrease of the Company's share price.

Financing

Financing income (expense), net, for the six months ended June 30, 2021 and 2020 was $12,588 and $(7,161), respectively, representing an increase of $19,749 or 276%. For the three months ended June 30, 2021 and 2020, financing income (expense) was $5,665 and $(6,878), respectively, representing an increase of $12,543 or 182%. The change was mainly due to $13,049 finance income arising from valuation update of the Warrants and other financial instruments, which was affected by the Company's decreased share price.

Depreciation and Amortization

Depreciation and amortization expenses for six months ended June 30, 2021, and 2020 were $1,643 and $428, respectively, representing an increase of $1,215 or 284%. For the three months ended June 30, 2021 and 2020, Depreciation and amortization expenses were $1,258 and $331, respectively, representing an increase of $927 or 280%. Depreciation and amortization expenses are impacted by the adoption of IFRS 16 Leases, depreciation of PP&E, as well as the amortization of intangible assets mainly following the acquisition of Adjupharm and Trichome.

Net Income (Loss)

Net income (loss) for the six months ended June 30, 2021 and 2020 was $(374) and $(9,496), respectively, representing a net loss decrease of $9,122 or 96%. For the three months ended June 30, 2021 and 2020, Net loss was $5,089 and $9,696 respectively, representing a net income decrease of $4,607 or 48%. The net income decrease related to factors impacting net income from operations described above, and finance income driven by revaluation of Warrants and other financial instruments in the amount of $13,049, which were recorded against liability on the grant day and were re-evaluated at June 30, 2021 through profit or loss.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Net Income (Loss) per share Basic and Diluted

Basic loss per share is calculated by dividing the net profit attributable to common shareholders of the Company by the weighted average number of Common Shares outstanding during the period. Diluted profit per Common Share is calculated by adjusting the earnings and number of Common Shares for the effects of dilutive Warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the denominator in calculating diluted profit per Common Share excludes unissued Common Shares related to Options as they are antidilutive. Basic Income (Loss) per Common Share for the six months ended June 30, 2021 and 2020 were nil and ($0.07) per Common Share, respectively. For the three months ended June 30, 2021 and 2020 were $(0.10) and $(0.52) respectively.

Diluted Income (Loss) per Common Share for the six months ended June 30, 2021 and 2020 were $(0.28) and $(0.07) per Common Share, respectively. Diluted Income (Loss) per Common Share for the three months ended June 30, 2021 and 2020 were $(0.23) and $(0.52), respectively.

Total Assets

Total assets as at June 30, 2021 were $200,036, compared to $38,116 as at December 31, 2020, representing an increase of $161,920 or 425%. This increase was primarily due to the consolidation of Trichome, following the Trichome Transaction, leading to recognition of goodwill and intangible assets of an aggregate amount of approximately $68,446, property plant and equipment of approximately $15,193, increase in right-of-use assets of approximately $11,130 and approximately $9,927 of working capital. Additional increase of $39,622 in cash derived from the Company's financing round at May 2021.

Total Liabilities

Total liabilities as at June 30, 2021 were $56,405, compared to $25,506 at December 31, 2020, representing an increase of $30,899 or 121%. The increase was primarily due to an increase of $11,533 in other accounts payable and accrued expenses and an increase of $12,529 in lease liabilities.

Intangible Assets

On March 15, 2019, IMC Holdings acquired Adjupharm, a licensed EU-GMP producer with wholesale, narcotics handling and import/export licenses for medical cannabis. As part of its global expansion and penetration plan into the European market, IMCC acquired 100% of Adjupharm's issued and outstanding shares for €924 (approximately $1,400).

Through the acquisition of Adjupharm, the Company recognized $1,287 in intangible assets and goodwill. The goodwill arising on the acquisition was attributed to the expected benefits from the synergies of the combination of the activities of the Company and Adjupharm.

The goodwill recognized is not expected to be deductible for income tax purposes.

The Company recognized and updated the fair value of the assets acquired and liabilities assumed in the business combination according to a final valuation made by an external valuation specialist.

On March 18, 2021, IMCC acquired Trichome, a Canadian-based cannabis company. The Trichome Transaction was completed pursuant to the terms and subject to the conditions of arrangement agreement dated December 30, 2020, whereby the Company agreed to acquire all the issued and outstanding Trichome Shares under a statutory plan of arrangement under the Business Corporations Act (Ontario). As a result of the Trichome Transaction, the businesses of IMCC and Trichome have been combined. Upon completion of the Trichome Transaction, the total Common Share consideration valued at approximately $99,028.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

Through the acquisitions of Trichome, the Company recognized goodwill of approximately $68,446 and intangible assets, primarily the cultivation license, worth approximately $6,458 (based on a preliminary purchase price allocation study). The goodwill arising on acquisition is attributed to the expected benefits from the synergies of the combination of the activities of the Company and Trichome, as well as value attributed to the assembled workforce, which is included in goodwill. The goodwill recognized is not expected to be deductible for income tax purposes.

The Company recognized the fair value of the assets acquired and liabilities assumed in the business combination according to a provisional measurement. As of the date of the approval of the Interim Financial Statements, a final valuation for the fair value of the identifiable assets acquired and liabilities assumed by an external valuation specialist has not been obtained. The purchase consideration and the fair value of the acquired assets and liabilities may be adjusted within 12 months from the acquisition date. At the date of final measurement, adjustments are generally made by restating comparative information previously determined provisionally.

Liquidity and Capital Resources

For the six months ended June 30, 2021, the Company generated revenues of $19,879 and received $3,353 in proceeds from the exercises of Warrants, compensation options and Options. Prior to receiving these proceeds, the Company financed its operations and met its capital requirements primarily through the October 2019 equity financing, upon the Reverse Takeover Transaction and listing on the CSE and NASDAQ. The Company believes that the generated cash flow form working capital in the different jurisdictions on which it operates, as well as the additional expected exercises of Warrants and future financing rounds will meet all its future requirements. In evaluating its capital requirements, including the impact, if any, on the Company from the COVID-19 pandemic, and the ability to fund the execution of its strategy, the Company believes it has adequate availability to meet its working capital and other operating requirements, fund growth initiatives and capital expenditures, settle its liabilities, and repay scheduled principal and interest payments on debt for at least the next twelve months.

The Company has ensured that it has access to public capital markets through its CSE and NASDAQ listings, and continues to review and pursue selected external financing sources to ensure adequate financial resources. These potential sources include, but are not limited to, (i) obtaining financing from traditional or non-traditional investment capital organizations and (ii) obtaining funding from the sale of the Company's securities. There can be no assurance that we will gain adequate market acceptance for our products or be able to generate sufficient positive cash flow to achieve our business plans. We expect to continue funding these purchases with our available cash, cash equivalents and short-term investments. Therefore, we are subject to risks including, but not limited to, our inability to raise additional funds through financings to support our continued development, including capital expenditure requirements, operating requirements and to meet our liabilities and commitments as they come due. As at June 30, 2021, the Company had a working capital surplus of $54,321, compared to working capital of $20,874 as at December 31, 2020. The increase in working capital of $33,447 was primarily due to increase in inventory, trade and other receivables, offset by advances to suppliers. As of June 30, 2021, the Company had an unaudited cash balance of $34,050.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

As at June 30, 2021, the Group's financial liabilities consisted of accounts payable and other accounts payable which have contractual maturity dates within one year. The Group manages its liquidity risk by reviewing its capital requirements on an ongoing basis. Based on the Group's working capital position at June 30, 2021, management considers liquidity risk to be low.

As at June 30, 2021, the Group has identified the following liquidity risks related to financial liabilities:

|

|

Less than |

1 to 5 |

6 to 10 |

|

> 10 |

|

Lease liabilities |

$ 2,495 |

$ 10,462 |

$ 12,034 |

|

$ 3,828 |

The maturity profile of the Company's other financial liabilities (trade payables, other account payable and accrued expenses, and warrants) as of June 30, 2021 are less than one year.

| Contractual Obligations | Payments Due by Period | ||||||||||||||

| Total | Less than one year |

1 to 3 years | 4 to 5 years | After 5 years |

|||||||||||

| Debt | $ | 1,515 | $ | 1,515 | $ | - | $ | - | $ | - | |||||

| Finance Lease Obligations | $ | 28,818 | $ | 2,495 | $ | 5,429 | $ | 5,302 | $ | 15,862 | |||||

| Operating Leases | $ | 19 | $ | 19 | $ | - | $ | - | $ | - | |||||

| Purchase Obligations | $ | 4,902 | $ | 4,902 | $ | - | $ | - | $ | - | |||||

| Other Obligations | $ | - | $ | - | $ | - | $ | - | $ | - | |||||

| Total Contractual Obligations | $ | 35,254 | $ | 8,931 | $ | 5,429 | $ | 5,032 | $ | 15,862 | |||||

The Interim Financial Statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. The Interim Financial Statements do not include any adjustments to the amounts and classification of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. Such adjustments could be material.

Share Capital

The Company's authorized share capital consists of an unlimited number of Common Shares without par value, 57,083,034 of which were issued and outstanding as of June 30, 2021.

The Common Shares confer upon their holders the right to participate in the general meeting with each Common Share having one voting right on all matters. The Common Shares also allow holders to receive dividends if and when declared and to participate in the distribution of surplus assets in the case of liquidation of the Company.

IM Cannabis Corp.

Management’s Discussion and Analysis (Canadian dollars, in thousands)

As of June 30, 2021, the Company also has the following outstanding securities which are convertible into, or exercisable or exchangeable for, voting or equity securities of the Company: 3,543,225 Options, 1,840,690 Listed Warrants, 3,060,344 Unlisted Warrants and 252,905 2019 Compensation Options.

Operating, Financing and Investing Activities