Exhibit 99.3

Management’s Discussion and Analysis

TABLE OF CONTENTS

|

|

|

|

5

|

|

|

6

|

|

|

6

|

|

|

8

|

|

|

11

|

|

|

12

|

|

|

14

|

|

|

20

|

|

|

47

|

2

Management’s Discussion and Analysis

MANAGEMENT’S DISCUSSION AND ANALYSIS

IM Cannabis Corp. (“IM Cannabis” or the “Company”) is a British Columbia company whose business formed on October 11,

2019 as the result of a reverse takeover with IMC Holdings Ltd. (the “Reverse Takeover Transaction”), pursuant to which the Company changed its name from “Navasota Resources Inc.” to “IM Cannabis Corp.” and

changed its business from mining to the international medical cannabis industry. The Company’s common shares (the “Common Shares”) trade under the ticker symbol “IMCC” on both the NASDAQ Capital Market (“NASDAQ”) and the Canadian Securities Exchange (“CSE”) as of March 1, 2021, and November 5, 2019, respectively. The Reverse Takeover Transaction is more fully described under

“Review of Financial Performance – Share Capital – Financial Background”.

This Management’s Discussion and Analysis (“MD&A”) reports on the consolidated financial condition and operating results of IM Cannabis for the year and

three months ended December 31, 2021. Throughout this MD&A, unless otherwise specified, references to “we”, “us”, “our” or similar terms, as well as the “Company” and “IM Cannabis” refer to IM Cannabis Corp., together with its subsidiaries, on a

consolidated basis, and the “Group” refers to the Company, its subsidiaries and Focus Medical Herbs Ltd.

This MD&A should be read in conjunction with the audited consolidated financial statements of the Company and the notes thereto for the years ended December 31, 2021 and 2020, (the “Annual Financial Statements”). References in the below discussion to “Q4 2021” and “Q4 2020” refer to the three months ended December 31, 2021 and December 31, 2020, respectively, and references to “2020” refer to

the year ended December 31, 2020.

The Annual Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”). IFRS requires management to make certain judgments, estimates and assumptions that affect the reported amount of assets and liabilities at the date of the

Annual Financial Statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily indicative of results that may be expected for future periods. The

Annual Financial Statements include the accounts of the Group, which includes, among others, the following entities:

|

Legal Entity

|

Jurisdiction

|

Relationship with the Company

|

||

|

IMC Holdings Ltd. (“IMC Holdings”)

|

Israel

|

Wholly-owned subsidiary

|

||

|

I.M.C. Pharma Ltd. (“IMC Pharma”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

||

|

Focus Medical Herbs Ltd. (“Focus”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto control” under IFRS 10

|

||

|

R.A. Yarok Pharm Ltd. (“Pharm Yarok”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

||

|

Rosen High Way Ltd. (“Rosen High Way”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

||

|

High Way Shinua Ltd. (“HW Shinua”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto” control under IFRS 10

|

||

|

Revoly Trading and Marketing Ltd. dba Vironna Pharm (“Vironna”)

|

Israel

|

Subsidiary of IMC Holdings

|

||

|

Oranim Plus Pharm Ltd. (“Oranim Plus”)

|

Israel

|

Subsidiary of IMC Holdings

|

||

|

Trichome Financial Corp. (“Trichome”)

|

Canada

|

Wholly-owned subsidiary

|

||

|

Trichome JWC Acquisition Corp. (“TJAC”)

|

Canada

|

Wholly-owned subsidiary of Trichome

|

||

|

MYM Nutraceuticals Inc. (“MYM”)

|

Canada

|

Wholly-owned subsidiary of Trichome

|

||

|

SublimeCulture Inc. (“Sublime”)

|

Canada

|

Wholly-owned subsidiary of MYM

|

||

|

Highland Grow Inc. (“Highland”)

|

Canada

|

Wholly-owned subsidiary of MYM International Brands Inc.

|

||

|

Adjupharm GmbH (“Adjupharm”)

|

Germany

|

Subsidiary of IMC Holdings

|

||

3

Management’s Discussion and Analysis

All intercompany balances and transactions were eliminated on consolidation.

All dollar figures in this MD&A are expressed in thousands of Canadian Dollars ($), except per share data and unless otherwise noted. All references to “NIS” are to New Israeli Shekels. All

references to “€” or to “Euros” are to Euros. All references to “US$” or to “U.S. Dollars” are to United States Dollars. The Company’s shares, options, units and warrants are not expressed in thousands. Prices are not expressed in thousands.

NON‑IFRS FINANCIAL MEASURES

Certain non-IFRS financial measures are referenced in this MD&A that do not have any standardized meaning under IFRS, including “Gross Margin”, “EBITDA” and “Adjusted EBITDA”. The Company

believes that these non-IFRS financial measures and operational performance measures, in addition to conventional measures prepared in accordance with IFRS, enable readers to evaluate the Company’s operating results, underlying performance and

prospects in a similar manner to the Company’s management. For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the “Metrics and Non-IFRS

Financial Measures” section of the MD&A.

NOTE REGARDING THE COMPANY’S ACCOUNTING PRACTICES

The Company complies with IFRS 10 to consolidate the financial results of Focus, an Israeli licensed cultivator on the basis of which IMC Holdings exercises “de facto control”. For a full explanation

of the Company’s application of IFRS 10, see “Legal and Regulatory – “Restructuring” and “Legal and Regulatory – Risk Factors - Consolidation of Focus Financial Results under

IFRS 10 and Maintenance of Common Control”.

For the period ended December 31, 2021, the Company analyzed the terms of the definitive agreements with each of Pharm Yarok, Rosen High Way, HW Shinua, Vironna and Oranim

Plus (collectively, the “Consolidated Entities”) in accordance with IFRS 10 and concluded a requirement to consolidate the financial results as of the Consolidated Entities as of the date of signing each

such definitive agreement. Each of such definitive agreements provide the Company with the power to unilaterally make all decisions regarding the financial and operating policies of each of the Consolidated Entities and the right to obtain all

related economic benefits. The Pharm Yarok Transaction, the Vironna Transaction and the Oranim Transaction (as each are further defined herein) were completed in the first quarter of 2022. The completion of the

Pharm Yarok Transaction with respect to HW Shinua remains subject to the IMCA approval, and accordingly the financial results of HW Shinua continue to be consolidated in compliance with IFRS 10. For further information on the closing of

the above transactions, please see “Corporate Highlights and Events”.

4

Management’s Discussion and Analysis

EXECUTIVE SUMMARY

OVERVIEW – CURRENT OPERATIONS IN ISRAEL, CANADA AND GERMANY

IM Cannabis is a leading international cannabis company providing premium cannabis products to medical patients and adult-use recreational consumers. With

operations in Israel, Canada, and Germany, the world’s three largest federally legal cannabis markets, the Company has developed its own proprietary import/export supply chain in order to efficiently deliver premium cannabis to patients and

consumers under a uniform global branding umbrella.

The Company operates in Canada through Trichome and its subsidiaries TJAC and MYM, where it cultivates, processes and sells

premium and ultra-premium cannabis at its own facilities under the WAGNERS and Highland Grow brands for the adult-use market in Canada and exports premium and ultra-premium medical cannabis to Israel and eventually to Germany.

In Israel, the Company cultivates, imports, and distributes cannabis to

local medical patients through its commercial relationship with Focus, with plans to import cannabis to supplement its operations of medical cannabis retail pharmacies, online platforms, distribution centres and logistical hubs operating

through IMC Holdings.

In Germany, the IM Cannabis ecosystem operates through Adjupharm importing and distributing cannabis to pharmacies for patients, acting as the Company’s

entry point to a potential future Europe-wide distribution.

OUR GOAL - DRIVE PROFITABLE REVENUE GROWTH

Our primary goal is to sustainably increase revenue in each of our core markets in order to build long term shareholder value. By focusing on sustainable revenue growth, while actively managing costs

and margins, we believe we can achieve positive EBITDA.

HOW WE PLAN TO ACHIEVE OUR GOAL – FOUR CORE STRATEGIES

Our strategy to grow sustainable revenues consists of:

| • |

Geographic diversification and preparing to target new legal cannabis markets in Germany and Israel, while leveraging the cultivation excellence and consumer insights and experienced team in the mature Canadian

market.

|

| • |

Properly positioned brands with respect to target-market, price, potency and quality, such as the successful mid-2021 launch of WAGNERS in Canada. By Q4 2021, both WAGNERS and Highland Grow were among the top

premium and ultra-premium cannabis brands in Ontario (Canada’s largest province) by retail market share1.

|

| • |

High-quality, reliable supply to our customers and patients, leading to recurring sales.

|

| • |

Ongoing introduction of new SKUs to keep customers and patients engaged.

|

In order to turn increased revenues into positive EBITDA, we plan to focus on spending discipline and cost efficiencies through vertical integration throughout 2022.

1 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period between October 1 – December 31, 2021 for dried flower

product between $7.50 - $9.99/gram and above $12.99/gram.

5

Management’s Discussion and Analysis

RESULTS – SIGNIFICANT REVENUE GROWTH IN 2021

STRATEGY IN DETAIL

GEOGRAPHIES AND NEW MARKETS

The Company operates in the Israeli and German medical markets and the Canadian recreational market.

Israel

In Israel, we continue to expand IMC brand recognition and supply the growing Israeli medical cannabis market with our branded products. In addition to our locally grown

medical cannabis by Focus and its cultivation partners, we are focused on importing premium indoor-grown dried cannabis from our Canadian Facilities (defined below) as well as from world-leading cannabis suppliers. In addition to the benefits of

the Group’s long-term presence in Israel, we believe that with our globally integrated supply chain and coordinated team of compliance, regulatory and purchasing professionals, the Company is well-positioned to address the ongoing needs of

medical cannabis patients in Israel.

Since the beginning of 2021, the Company has focused on entering additional segments of the medical cannabis market in Israel, including the distribution and retail segments. The acquisitions of

Israeli pharmacies Pharm Yarok, Vironna and Oranim Pharm (collectively, the “Israeli Pharmacies”) positions IM Cannabis as one of the largest distributors of medical cannabis in Israel. We are focused on

building a vertically-integrated retail chain, providing IM Cannabis products directly to patients, accessing and leveraging market data as well as providing a deeper understanding of consumer preferences. These acquisitions allow the Company to

increase purchasing power with third-party product suppliers, offers potential synergies with our established call centre and online operations, achieves higher margins on direct to patient sales and creates the opportunity for up-sales across a

growing range of products.

Through the acquisition of the home-delivery services and online pharmacy business operating under the name “Panaxia-to-the-Home” and customer service center

(“Panaxia-to-the-Home Operation”), we plan to stay ahead of consumer trends and provide patients with accessible, at-home delivery. The Company’s acquisition of Rosen High Way, a trading house, and the Panaxia

trading house license (the “Panaxia GDP License”) will expand its sales channels, distribution, delivery and storage capacity and strengthen the Groups’ ability to reach its clients directly. Following the

completion of these transactions in the first quarter of 2022, IMC Holdings has become, through its recently acquired subsidiaries, a licensed medical cannabis retailer in Israel, in the process vertically integrating its Israeli operations. The

Company expects that these developments will increase revenue and margins from its Israeli medical cannabis market activities. For more information, see “Corporate Highlights and Events”.

6

Management’s Discussion and Analysis

Canada

Following the completion of the Trichome Transaction and the MYM Transaction, each acquisition further discussed below in “Corporate Highlights and Events”,

the Company’s global cannabis platform has evolved to include operations in the adult-use recreational cannabis market in Canada, in addition to its established medical cannabis operations in Israel and Germany. Through its wholly-owned subsidiary,

TJAC, Trichome operates as a Canadian Licensed Producer (defined below) of cannabis products in the Canadian cannabis market and sells adult-use recreational cannabis products under the WAGNERS brand.

MYM operates through its wholly-owned subsidiaries, Highland and Sublime, Canadian Licensed Producers. Each of Highland and Sublime produce cannabis products for the adult-use recreational cannabis

market under the Highland Grow brand.

The MYM and Trichome acquisitions are complementary to each other and the larger IM Cannabis ecosystem. The WAGNERS brand operates in the premium cannabis market segment ($7.50-$9.99 per gram at the

consumer level), while Highland operates in the ultra-premium market segment ($12.99+ per gram at the consumer level). In addition, the acquisitions provide an efficient, vertically integrated avenue to provide product to the Israeli and German

markets.

The Canadian cannabis market is more mature than the other jurisdictions in which we operate, yet market growth is still expected to continue to grow in the coming years,

with estimated market growth from $1.07 billion in Q4 2021 ($4.3 billion annualized)2 to $8 billion in annual sales by 20263. The Company continues to capitalize on numerous opportunities to grow its market share within

Canada, including:

| • |

Expanding into new provinces, particularly Quebec, which accounts for approximately 23% of Canada’s population.

|

| • |

Launching new SKUs, products, and formats to meet consumer demand.

|

| • |

Continuing to expand our competitive market share in key markets;

|

| • |

In Ontario, Wagners has increased from 0% market share in January 2021 to over 6% in the premium dried flower segment for the first two months of 20224

|

| • |

Highland now holds over 10% market share in the ultra-premium segment in Ontario in the first two months of 20225

|

| • |

Engaging directly with current and prospective customers, retailers, and consumers to educate them on our high-quality brands.

|

Germany

In Europe, the Company operates in Germany through Adjupharm, its German subsidiary and EU-GMP certified medical cannabis producer and distributor. We continue to lay our foundation in Germany,

currently the largest medical cannabis markets in Europe6. Leveraging our global supply chain, IM Cannabis continues to focus on growing its business in Germany to be well-positioned through

brand recognition in preparation for future regulatory reforms.

Similar to Israel, the Company’s focus in Germany is on importing premium indoor-grown dried cannabis from its Canadian Facilities, which we believe will satisfy the rapid growth in demand for high-THC premium

cannabis across a variety of strains and qualities.

While the Company does not currently distribute products in other European countries, the Company intends to leverage the foundation established by Adjupharm, its new state-of-the-art, approximately

8,000 square foot warehouse space and EU-GMP production facility in Germany, completed in July 2021 (the “Logistics Centre”) and its network of distribution partners to expand into other jurisdictions across

the continent. The Company expects that the Logistics Centre will allow the Company to execute all aspects of its supply chain, including the repackaging of bulk cannabis and distribution capabilities.

2 Based on HiFyre Data for period between October 1 – December 31, 2021.

3 BDSA,

https://www.globenewswire.com/news-release/2021/09/21/2300624/0/en/BDSA-Reports-Global-Cannabis-Sales-Surge-41-YoY-in-2021-Will-Surpass-62-Billion-by-2026.html

4 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period

between January 1 – February 28, 2022 for dried flower product between $7.50 - $9.99/gram.

5 Ibid.

6 The European Cannabis Report – Edition 6, p. 93 - https://prohibitionpartners.com/reports/

7

Management’s Discussion and Analysis

BRANDS

The IMC brand is well-known in the Israeli medical cannabis market. Leveraging its long-term success in the Israeli market, the Company launched the IMC brand in Germany in 2020.

Following the Company’s entry into the Canadian adult-use recreational cannabis market, the Company is now leveraging its vertical integration and applying a multi-country

strategy and using its global platform and exporting its Canadian WAGNERS and Highland Grow brands to the Israeli and German medical cannabis markets. The Company believes that the sale of WAGNERS and Highland Grow into the Israeli and German

markets can satisfy the increasing demand of both Israeli and German patients for indoor grown high-THC premium cannabis.

Israeli Medical Cannabis Business

The Company currently sells the IMC and WAGNERS brands in the Israeli market.

The IMC brand established its reputation in Israel for quality and consistency over the past 10 years. In August 2020, a survey of licensed medical cannabis patients showed that the IMC brand is one

of the top four most popular medical cannabis brands in Israel.7

In association with Focus, the Group maintains a portfolio of strains sold under the IMC umbrella that includes popular medical cannabis dried flowers and full-spectrum cannabis extracts.

In 2021, IMC was rebranded with a refreshed logo, packaging, design language and tone, with a bold new design to better position itself in the competitive Israeli medical cannabis market, creating a

variety of available products for medical cannabis patients. The IMC brand launched four different product lines as part of its rebranding:

The Signature Collection – The IMC brand’s high-quality product line with greenhouse grown, high THC cannabis flowers. This collection of products currently

includes well known cannabis dried flowers such as Roma, Tel Aviv and London as well as newer strains launched in 2021 such as Mango Mint.

7 According to a survey carried out by Cannabis Magazine among 519 patients licensed by the MOH to consume medical cannabis (Aug 2020, Israel).

8

Management’s Discussion and Analysis

The Reserve Collection – The IMC brand’s premium product line with indoor-grown, high THC cannabis flowers. Launched in Q1 2022 with BC Pink Kush.

The Craft Collection – The IMC brand’s ultra-premium product line with indoor-grown, hang-dried and hand-trimmed, high THC cannabis flowers. Including exotic and unique cannabis

strains such as Peanut Butter MAC, Wedding Crasher and Alien Sin Mint Cookies.

The Full Spectrum Extracts – The IMC brand’s full spectrum, strain specific cannabis extracts including High THC Roma oil, balanced Paris oil and Super CBD.

The WAGNERS brand launched in Israel during Q1 2022. For more information, please see “New Product Offering”.

Canadian Adult-Use Recreational Cannabis Business

In Canada, the Company’s product portfolio consists of dried flower, pre-rolls and pressed hash offerings under the premium WAGNERS brand and ultra-premium Highland Grow brand. The WAGNERS brand was

launched by TJAC in mid-2021, while the Highland Grow brand was acquired through the acquisition of MYM in July 2021.

The WAGNERS brand offers high-quality cannabis on a consistent basis at an approachable price point for consumers. The Highland Grow brand offers cannabis consumers ultra-premium product, curated to

their tastes. Both the WAGNERS and Highland Grow brands have proven to be very popular with consumers, each holding a top 3 position in Ontario across their respective price segments (year-to-date in 2022).8

8 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period between January 1 – February 28, 2022 for dried flower product between $7.50 - $9.99/gram

and above $12.99/gram.

9

Management’s Discussion and Analysis

WAGNERS and Highland Grow products are primarily sold in 3.5 gram flower and 3 x 0.5 gram flower pre-roll formats. Other flower formats are available in certain provinces, such as 7 or 14 gram

units. Hash is typically sold in 1, 2 and 4 gram formats.

Key WAGNERS flower and pre-roll strains include Cherry Jam, Pink Bubba, Blue Lime Pie, Purple Clementine, Dark Helmet and Silverback #4:

The Highland Grow brand portfolio includes six core flower strains: Gaelic Fire, White Lightning, Sensi Wizard, Cherry Burst, as well as two new strains added in Q4 2021, Gas Tank and Diamond Breath.

German Medical Cannabis Business

In Germany, the Company sells IMC-branded dried flower products. The medical cannabis products sold in the German market are branded generically as IMC so as to rely on the Company’s brand

recognition in establishing a foothold with German healthcare professionals. The Company’s IMC-branded cannabis products were launched in Germany with one high THC flower strain in 2020. In Q4 2021, Adjupharm launched a flower strain second high THC

strain and two full spectrum extracts.

In July 2021, Adjupharm was recognized by the German Brand Institute with the “German Brand Award 2021”, recognizing its excellence in brand strategy and creation, communication and integrated

marketing. The competitive advantage in Germany also lies in the Group’s track record, experience and brand reputation in Israel and proprietary data supporting the possible effectiveness of medical cannabis for the treatment of a variety of

conditions.

10

Management’s Discussion and Analysis

HIGH-QUALITY, RELIABLE SUPPLY

Israel

Over the last decade, Focus was the primary cultivator of medical cannabis products sold under the IMC brand in the Israeli market, as an Israeli IMCA licensee permitted to

cultivate medical cannabis in Israel (the “Focus License”) at the Focus cultivation facility (the “Focus Facility”). To supplement growing demand, Focus entered into

supply agreements with third-party Israeli cultivators. Since 2021, the Company has focused on securing additional supply from its supply partners from outside of Israel, leveraging its improved purchasing capabilities and global presence, as well

as facilitating the import of indoor-grown premium and ultra-premium cannabis from the Canadian Facilities. Importing from the Canadian Facilities aligns with the Company’s strategy in acquiring the Trichome and MYM to serve as a long term,

reliable source of supply to both the Israeli and German markets.

Following cultivation in Israel or import of medical cannabis, in accordance with Israeli regulations, the medical cannabis products are then packed by contracted licensed producers of medical

cannabis. The packaged medical cannabis products are then sold by the Group under the Company’s brands to local Israeli pharmacies directly or through contracted distributors.

Canada

In Canada, our primary customers are provincially-owned cannabis wholesalers who in turn sell to private and public retail locations where the consumer ultimately purchases cannabis products.

The Company supplies the WAGNERS and Highland Grow brands through a combination of internally cultivated production from the Canadian Facilities in Ontario, Quebec, and Nova Scotia. To diversify our

supply lines, we also purchase carefully curated cannabis to match our consumers’ demands and expectations.

The Company operates four facilities in Canada (the “Canadian Facilities”):

|

Facility

|

Location

|

Description

|

|

Manitou Facility

|

Ontario

|

Flagship 32,050 square metre facility, with approximately 4,340 square metre of cultivation space

|

|

Trillium Facility

|

Ontario

|

Approximately 1,400 square metre processing and cultivation facility

|

|

Sublime Facility

|

Quebec

|

Approximately 930 square metre cultivation and storage facility

|

|

Highland Facility

|

Nova Scotia

|

Approximately 530 square metre cultivation and storage facility

|

The Manitou Facility and Trillium Facility (together, the “TJAC Facilities”) are operated by TJAC, and the Sublime Facility and

Highland Facility (together, the “MYM Facilities”) are operated by Sublime and Highland, respectively. The TJAC Facilities, and the MYM Facilities, pursuant to their Health Canada issued licenses (the “TJAC Licenses” and the “MYM Licenses”, respectively) are authorized to cultivate, process and sell cannabis (only the Trillium Facility and the Highland Facility hold a

license to sell).

Germany

The Company continues to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country and developing Adjupharm and the Logistics Centre as the

Company’s European hub. Adjupharm sources its supply of medical cannabis for the German market from various EU-GMP certified European and Canadian suppliers. The completion of the Logistics Centre upgraded Adjupharm’s production technology and

increased its storage capacity to accommodate its anticipated growth. The Company is also focused on exporting products into Germany from its Canadian Facilities, securing a reliable long term source of supply and minimizing the risks inherent in the

supply chain.

11

Management’s Discussion and Analysis

Adjuharm currently holds wholesale, narcotics handling, manufacturing, procurement, storage, distribution and import/export licenses granted to it by the applicable German regulatory authorities (the

“Adjupharm Licenses”).

NEW PRODUCT OFFERINGS

Between our various geographies, the strategy for new products varies given that each market is at a different stage of development with respect to regulatory regimes, patient and customer

preferences and adoption rates.

Israel

|

In conjunction with Focus and its cultivation partners cultivating Israeli-grown cannabis, the Company is also importing premium cannabis from its Canadian Facilities and from third-party supply partners.

Canadian indoor-grown cannabis commands a premium to the Israeli consumer. The Company launched the BC Pink Kush cannabis flowers to its Reserve Collection during Q1 2022, and is planning to launch another cannabis flower, Berlin, to its

Signature Collection in the beginning of Q2 2022.

|

|

The WAGNERS brand launched in Israel during Q1 2022, with premium indoor-grown cannabis from the Canadian Facilities. The WAGNERS brand in Israel offers premium, imported, indoor-grown flower at a

competitive price point for the first time in the Israeli market, due to the Group’s vertically integrated global supply chain reducing costs across the chain.

The WAGNERS brand currently offers its Cherry Jam and Dark Helmet products in Israel with additional products expected to launch later in 2022.

We also plan to launch the Highland Grow brand in Israel later in 2022.

12

Management’s Discussion and Analysis

Canada

The Company has amassed a portfolio of more than 150 cannabis strains through the MYM Transaction, and we are regularly evaluating and bringing new strains to market. In Q4

2021, we launched Pink Bubba and Blue Lime Pie under the WAGNERS brand. The market reception of Pink Bubba has been strong, rivaling sales of our flagship Canadian strain, Cherry Jam in key markets. We also plan to launch four new strains in Q2 2022;

Tiki Rain, Rainforest Crunch, Golden Ghost OG and Turpy Slurpy:

We have introduced pre-rolls under the Highland Grow brand for cannabis connoisseurs who also value convenience. In addition, we have launched new strains: Diamond Breath and

Gas Tank under Highland Grow brand.

In Q1 2022, we commenced distribution of a new brand, Dymond Concentrates, which will offer high-quality concentrates such as THCA diamonds, caviar, live resin, badder and

shatter:

Germany

IM Cannabis started 2022 with the launch of a high CBD flower strain and is also currently in the process of launching its popular Canadian WAGNERS brand in the German medical cannabis market,

importing cannabis flower from the Canadian Facilities. The expansion of our portfolio shows our commitment to providing German physicians and patients with the best available strains in the global cannabis market, giving them the opportunity to

tailor their treatments to their patients’ individual needs.

13

Management’s Discussion and Analysis

CORPORATE HIGHLIGHTS AND EVENTS

KEY HIGHLIGHTS FOR THE QUARTER AND YEAR ENDED DECEMBER 31, 2021

In 2021 the Company executed on its strategy to expand its business operations through several strategic acquisitions to enter the Canadian adult-use recreational cannabis market and the retail and

distribution segments of the medical cannabis market in Israel. The Company’s key highlights and events for the year ended December 31, 2021 include:

Amendment of Focus’ Commercial Agreements

On January 1, 2021, the Company amended the terms of each of the IP Agreement and the Services Agreement to align the consideration with implementation of the Company’s transfer pricing framework. The amendments to

these agreements constituted a “related party transaction” as such term is defined in Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company was exempt from the formal valuation requirement under Section 5.5(a) and the minority approval requirement under Section 5.7(1)(a) of MI 61-101, respectively, as the fair market value

of the amendments, as determined by the Board, did not exceed 25% of the Company's market capitalization on the date of such amendments.

DTC Eligibility

On January 26, 2021, the Company announced that it received confirmation from The Depository Trust Company (“DTC”) that its Common Shares are eligible for

electronic clearing and settlement through DTC in the United States (“U.S.”)

Share Consolidation

On February 12, 2021, IM Cannabis consolidated all of its issued and outstanding Common Shares on the basis of one (1) post-consolidation Common Share for each four (4) pre-consolidation Common

Shares (the “Share Consolidation”) to meet the NASDAQ minimum share price requirement.

Changes to Board of Directors

On February 22, 2021, IM Cannabis appointed Brian Schinderle and Haleli Barath to its board of directors (the “Board”). Both Mr. Schinderle and Ms. Barath are

independent directors under applicable Canadian and United States securities laws. Concurrently with the foregoing appointments, Rafael Gabay and Steven Mintz resigned from the Board.

Listing on NASDAQ

On March 1, 2021, the Common Shares commenced trading on the NASDAQ under the ticker symbol “IMCC”, making IM Cannabis the first Israeli medical cannabis operator to list its shares on the NASDAQ.

First Supply Partnership for Import of Premium Medical Cannabis to Israel

On March 8, 2021, the Company announced that Focus signed a multi-year supply agreement with GTEC Holdings Ltd. (“GTEC”), a Canadian Licensed Producer of

handcrafted and high quality cannabis, under which Focus will import GTEC’s high-THC medical cannabis flowers into Israel to be sold under the IMC brand. By committing to purchase a minimum quantity of 500 kg of high-THC medical cannabis flower from

GTEC’s subsidiary, Grey Bruce Farms Incorporated, Focus is the exclusive recipient of GTEC cannabis products in the Israeli market for a period of 12 months commencing on the date the first shipment of GTEC products arrives in Israel, with an option

to extend the term of exclusivity by an additional 6 months. The first shipment arrived in Q3 2021 and the Group launched a new category of imported premium indoor medical cannabis products under its well-established brand.

14

Management’s Discussion and Analysis

On June 7, 2021, the Group continued to execute on its strategy of importing premium product and growing its network of strategic supply partners by Focus entering into a three-year supply agreement

with Flowr Corporation (“Flowr”), a Canadian Licensed Producer of ultra-premium adult-use recreational and medical cannabis products. The first shipment from Flowr arrived in Q4 2021. The Group launched the

medical cannabis products from this shipment in Q1 2022.

Entering the Canadian Adult-Use Recreational Market

On March 18, 2021, the Company acquired all of the issued and outstanding shares of Trichome(the “Trichome Transaction”), becoming the first Israeli medical

cannabis operator with established operation in Israel, Germany and Canada, securing its supply of premium indoor cannabis with the objective of exporting into the Israeli medical market and competing in the premium segment of Canada’s adult-use

recreational cannabis market. Trichome is the sole shareholder of TJAC (then doing business as JWC), and is a Canadian Licensed Producer of cannabis products in the adult-use recreational cannabis market. The Trichome Transaction completed pursuant

to a statutory plan of arrangement under the Business Corporations Act (Ontario) in accordance with a definitive agreement entered into on December 30, 2020.

Pursuant to the terms of the Trichome Transaction, former holders of common shares of Trichome (the “Trichome Shares”) and former holders of Trichome convertible instruments

(collectively, the “Trichome Securityholders”) received 0.24525 of a Common Share for each Trichome Share held and each in-the-money convertible instrument of Trichome. Pursuant to the Trichome Transaction,

a total of 10,104,901 Common Shares were issued to the Trichome Securityholders, resulting in former Trichome Securityholders holding approximately 20.06% of the total number of Common Shares (based on 50,370,027 Common Shares issued and

outstanding immediately after closing of the Trichome Transaction). In addition, 100,916 Common Shares were issued to financial advisors in connection with the Trichome Transaction.

Entering the Retail Segment in Israel by Acquiring Panaxia’s Largest Retail and Online Pharmacy Business

On April 30, 2021, IMC Holdings signed a definitive agreement with Panaxia to acquire the Panaxia-to-the-Home Operation, and the Panaxia GDP License from Panaxia Pharmaceutical Industries Israel Ltd.

and Panaxia Logistics Ltd., part of the Panaxia Labs Israel, Ltd. group of companies (the “Panaxia Transaction”). Panaxia-to-the-Home offers medical cannabis patients across Israel the largest selection of

medical cannabis products in Israel through an online platform with temperature-controlled home delivery, along with a call centre for patient support.

On May 30, 2021, the Company completed the first closing of the Panaxia Transaction, pursuant to which the Panaxia-to-the-Home Operation and all intellectual property were transferred to IMC

Holdings., and on March 14, 2022 the Company completed the acquisition of the Panaxia GDP License. For more information, please see “Subsequent Events”.

15

Management’s Discussion and Analysis

Closing of US$35 Million Equity Financing by Overnight Marketed Offering

On May 7, 2021, IM Cannabis closed an overnight marketed offering (the “2021 Offering”) of its Common Shares (“Offered

Shares”) and Common Share purchase warrants (“2021 Offered Warrants”). A total of 6,086,956 Offered Shares at a price of US$5.75 per Offered Share were sold and issued for aggregate gross proceeds of

approximately US$35,000 ($42,502). IM Cannabis also issued 3,043,478 2021 Offered Warrants to purchasers of Offered Shares, for no additional consideration, with each 2021 Offered Warrant exercisable for one Common Share at an exercise price of

US$7.20 for a term of 5 years from the date of closing of the 2021 Offering. The 2021 Offering was completed by way of a final prospectus supplement filed on May 5, 2021. Pursuant to the terms of the 2021 Offering, the agents who acted on the

Company’s behalf in connection with the 2021 Offering, held an over-allotment option to purchase up to an additional 913,044 Offered Shares and 465,522 2021 Offered Warrants on the same terms and conditions for a period of 30 days following the

date of closing of the 2021 Offering which was not exercised.

The Company also issued a total of 182,609 broker compensation options (the “2021 Broker Compensation Options”) to the agents who acted on its behalf in

connection with the 2021 Offering. Each 2021 Broker Compensation Options is exercisable for one (1) Common Share at an exercise price of US$6.61, at any time following November 5, 2021 until November 5, 2024.

The 2021 Offering was conducted pursuant to a prospectus supplement under the Company’s final base shelf prospectus receipted by the applicable Canadian securities commissions on March 31, 2021 (the

“Base Shelf Prospectus”) and its Registration Statement on Form F-10, which was declared effective on March 31, 2021by the United States Securities and Exchange Commission (the “SEC”).

TJAC Revolving Credit Facility

On May 14, 2021, the Company’s subsidiary, TJAC, entered into a revolving credit facility (the “Revolver”) for $5,000 with a private Canadian creditor. The Revolver has an

initial term of 12 months that can be extended upon the mutual agreement of both parties. Per annum interest is equal to the greater of (i) 9.75% and, (ii) the Toronto Dominion Bank prime rate, plus 7.30%. The Facility has a standby fee of 2.40%

per annum, which is charged against the unused portion. Advanced amounts are secured against the assets of TJAC and Trichome, with Trichome providing a guarantee for the Facility. To maintain the Facility,

TJAC must abide by certain financial covenants, such as the maintenance of a tangible net worth greater than $5,000 and a debt service coverage ratio of 2:1. On September 23, 2021, TJAC increased the limit on the Revolver from $5,000 to $7,500 and

added Highland’s assets to the Revolver borrowing base. The increase will be used to finance TJAC and MYM’s receivables in order to manage the timing of cash flows. On October 18, 2021, TJAC and MYM increased the limit on the Revolver to $10,000.

The increase will be used to finance TJAC and MYM’s receivables in order to manage the timing of cash flows. On March 29, 2022, the limit on the Revolver increased from $10,000 to $15,000 and was renewed for an additional 12 months.

16

Management’s Discussion and Analysis

Acquisition of MYM Nutraceuticals Inc.

On July 9, 2021, the Company, through Trichome, acquired all of the issued and outstanding shares of MYM on July 9 2021 (the “MYM Transaction”). In addition to

acquiring the rights to the Highland Grow brand, a widely-available ultra-premium cannabis brand in Canada with a proven track record, the Company also acquired over 150 strains in its product portfolio that the Company plans to selectively release

to market. The MYM Transaction was completed pursuant to a statutory plan of arrangement under the Business Corporations Act (British Columbia) in accordance with a definitive agreement entered into on March

31, 2021. Pursuant to the terms of the MYM Transaction, former holders of common shares of MYM (the “MYM Shares”) received 0.022 of a Common Share for each MYM Share held. In connection with the MYM

Transaction, a total of 10,073,437 Common Shares were issued to the former holders of MYM Shares, resulting in former MYM shareholders holding approximately 15% of the total number of Common Shares (based on 67,156,470 Common Shares issued and

outstanding immediately after closing of the MYM Transaction).

Completion of German Logistics Centre

In July 2021, the Company completed the Logistics Centre that allows Adjupharm to internally manage all aspects of its supply chain including, the repackaging of bulk cannabis. IM Cannabis expects

that the Logistics Centre will strongly augment Adjupharm’s capabilities as a focal point for the Company’s European strategy. The Logistics Centre doubles Adjupharm’s footprint to approximately 8,000 square feet, upgrades the production facilities

with state-of-the-art technology and increases cannabis storage capacity to seven tonnes.

Acquisition of Leading Israeli Retailer and Distributor - Pharm Yarok Group

On July 28, 2021, IMC Holdings entered into a definitive agreement to acquire100% of the issued and outstanding shares of (i) Pharm Yarok, a leading medical cannabis pharmacy located in central

Israel; (ii) Rosen High Way, a trade and distribution centre providing medical cannabis storage, distribution services and logistics solutions for cannabis companies and pharmacies in Israel; and (iii) HW Shinua, an applicant for a medical cannabis

transportation license (collectively, the “Pharm Yarok Transaction”). The Pharm Yarok Transaction aligns with the Company’s execution of its vertical integration strategy within the Israeli medical cannabis

retail market. The Pharm Yarok Transaction closed in March 2022. For more information, please see “Subsequent Events”.

Acquisition of Leading Israeli Pharmacy – Vironna

On August 16, 2021, IMC Holdings entered into definitive agreement to acquire 51% of the issued and outstanding ordinary shares of Vironna (the “Vironna Transaction”),

a pharmacy licensed to dispense and sell medical cannabis and is one of the leading pharmacies serving patients in the Arab population in Israel. The Vironna Transaction closed in March 2022. For more information, please see “Subsequent Events”.

Acquisition of Jerusalem’s Leading Medical Cannabis Pharmacy- Oranim Pharm

On December 1, 2021, IMC Holdings signed a definitive agreement to acquire 51.3% of the outstanding ordinary shares of Oranim Plus. Oranim Plus holds 99.5% of the rights in Oranim Pharm Partnership

(“Oranim Pharm”). The acquisition will result in IMC Holdings owning 51% of the rights in Oranim Pharm, which is one of the largest pharmacies selling medical cannabis in Israel and the largest pharmacy selling

medical cannabis in the Jerusalem area (the “Oranim Transaction”). The Oranim Transaction closed in March 2022. For more information, please see “Subsequent Events”.

17

Management’s Discussion and Analysis

Executive Changes to Subsidiaries

Effective December 2021, Howard Steinberg was appointed Chief Executive Officer of the following wholly-owned Canadian subsidiaries of IM Cannabis: MYM, Highland and Sublime. Karl Grywacheski was

appointed Chief Financial Officer of Highland.

SUBSEQUENT EVENTS

Strategic Executive Management Changes

On January 13, 2022, the Company announced the following changes to its management team: Yael Harrosh, previously IM Cannabis’s General Counsel, Business Director and Corporate Secretary, was

promoted to global Chief Legal and Operations Officer, effective immediately. Rinat Efrima was appointed the new Chief Executive Officer of IMC Holdings and joined the Company in Q1 2022.

First Import to Israel of Cannabis from the Company’s Canadian Facility

On January 19, 2022, Focus imported premium indoor-grown Canadian cannabis flowers from TJAC, and an additional supply partner, marking an important milestone in the execution of the IM Cannabis’

strategic objectives of vertical integration. The Group commenced the sale of imported cannabis flowers under its WAGNERS brand in the Israeli medical cannabis market as of February 2021.

Focus Revolving Credit Facility

In January 2022, Focus entered into a revolving credit facility with Bank Mizrahi (the “Mizrahi Facility”). The Mizrahi Facility is guaranteed by Focus

assets. Advances from the Mizrahi Facility will be used for working capital needs. The Mizrahi Facility has a total commitment of up to NIS 15,000 (approximately $6,000) and has a one-year term for on-going needs and 6 month term for imports and

purchases needs. The Mizrahi Facility is renewable upon mutual agreement by the parties. The borrowing base available for draw at any time throughout the Mizrahi Facility and is subject to several covenants to be measured on a quarterly basis. The

Mizrahi Facility bears interest of Israeli prime interest plus 1.5% (approximately 3.3%) per annum.

Closing of Pharm Yarok Transaction

On March 14, 2022, the Pharm Yarok Transaction closed upon receipt of all requisite approvals, including the IMCA approval, for an aggregate consideration of NIS 11,900 (approximately $4,600), of

which NIS 8,400 (approximately $3,300) was paid in cash upon signing the definitive agreement, and NIS 3,500 (approximately $1,300) paid upon closing. The acquisition of the outstanding ordinary shares of HW Shinua is pending receipt of the requisite

approval from the IMCA. In connection with closing of the Pharm Yarok Transaction, the Company completed a non-brokered private placement with former shareholders of Pharm Yarok and Rosen High Way on March 14, 2022. A total of 523,700 Common Shares

were issued at a deemed price of $2.616 for aggregate proceeds of approximately $1,370. The calculation of the deemed price was based on the average closing price of Common Shares on the CSE over the 8 trading day period immediately preceding March

14, 2022.

18

Management’s Discussion and Analysis

Closing of Vironna Transaction

On March 14, 2022, the Vironna Transaction closed upon receipt of all requisite approvals, including the approval of the IMCA. The Vironna Transaction was completed for total consideration of NIS

8,500 (approximately $3,330), comprised of NIS 5,000 (approximately $1,950) in cash and NIS 3,500 (approximately $1,350) in Common Shares issued on closing. In satisfaction of the cash consideration component, NIS 3,750 (approximately $1,470) was

paid at signing of the definitive agreement and the remaining NIS 1,250 (approximately $490) will be paid post-closing of the Vironna Transaction. In satisfaction of the share consideration component, the Company issued 485,362 Common Shares at a

deemed issue price of US$2.209 per share (approximately $2.8092), calculated based on the average closing price of the Common Shares of on the NASDAQ for the 14 trading day period immediately preceding closing. The shares issued are subject to a

staggered three-month lockup commencing on the date of issuance.

Closing of Panaxia Transaction

On March 14, 2022, IMC Holdings acquired the Panaxia GDP License following receipt of the requisite IMCA approval, and assigned it to IMC Pharma in accordance with the

terms of the Panaxia Transaction (the “Panaxia GDP License Closing”). The aggregate consideration for the Panaxia Transaction was NIS 18,700 (approximately $7,200), of which NIS 7,600 (approximately $2,900)

was paid in two cash instalments and NIS 11,100 (approximately $4,300) payable in Common Shares (“Panaxia Consideration Shares”). To satisfy the share consideration component of the Panaxia Transaction, the

Company issued four installments of an aggregate of 934,755 Panaxia Consideration Shares between August 9, 2021 and March 14, 2022, with the deemed price of each instalment of Panaxia Consideration Shares determined based on the average closing

price of the Common Shares on Nasdaq during the 10 trading day period immediately prior to issuance. The fifth and final installment of Panaxia Consideration Shares will be issued following the Panaxia GDP License Closing. The Panaxia Transaction

includes a further option to acquire, for no additional consideration, a pharmacy from Panaxia, including requisite licenses to dispense and sell medical cannabis to patients, that the Company has exercised (“Panaxia

Pharmacy Closing”). The Panaxia Pharmacy Closing is expected to occur in Q3 2022.

Closing of Oranim Transaction

On March 28, 2022, the Oranim Transaction closed upon receipt of all requisite approvals, including the approval of the IMCA. The Oranim Transaction was completed for total consideration of NIS

11,940 (approximately $4,600), comprised of NIS 10,404 (approximately $4,000) and NIS 1,536 (approximately $600) in Common Shares issued on closing. In satisfaction of the cash consideration component, NIS 5,202 (approximately $2,000) paid at signing

of the definitive agreement and NIS 5,202 will be payable in the first quarter of 2023. In satisfaction of the share consideration component, the Company issued 251,001 Common Shares at a deemed issue price of US$1.9 per share (approximately $2.37)

per share, calculated based on the average closing price of the common shares of the Company on the Nasdaq Capital Market for the 14 trading day period immediately preceding March 28, 2022. The shares issued are subject to a staggered three-month

lockup commencing on the date of issuance.

19

Management’s Discussion and Analysis

REVIEW OF FINANCIAL PERFORMANCE

Financial Highlights

Below is the analysis of the changes that occurred for the year and three months ended December 31, 2021 and 2020. Commentary is provided below.

|

For the year ended December 31

|

For the three months ended December 31

|

|||||||||||||||

|

2021

|

2020

|

2021

|

2020

|

|||||||||||||

|

Revenues

|

$

|

54,300

|

$

|

15,890

|

$

|

20,028

|

$

|

4,900

|

||||||||

|

Gross profit before fair value impacts in cost of sales

|

$

|

11,882

|

$

|

8,809

|

$

|

3,773

|

$

|

2,791

|

||||||||

|

Gross margin before fair value impacts in cost of sales (%)

|

22

|

%

|

55

|

%

|

19

|

%

|

57

|

%

|

||||||||

|

Operating Loss

|

$

|

(38,389

|

)

|

$

|

(8,245

|

)

|

$

|

(11,722

|

)

|

$

|

(6,383

|

)

|

||||

|

Loss

|

$

|

(18,518

|

)

|

$

|

(28,734

|

)

|

$

|

(12,488

|

)

|

$

|

(19,976

|

)

|

||||

|

Loss per share attributable to equity holders of the Company - Basic

|

$

|

(0.31

|

)

|

$

|

(0.74

|

) |

$

|

(0.19

|

) |

$

|

(0.125

|

)

|

||||

|

Loss per share attributable to equity holders of the Company - Diluted

|

$

|

(0.66

|

)

|

$

|

(0.74

|

) |

$

|

(0.19

|

) |

$

|

(0.125

|

)

|

||||

|

For the year ended December 31,

|

For the three months ended December 31,

|

|||||||||||||||

|

2021

|

2020

|

2021

|

2020

|

|||||||||||||

|

Average net selling price of dried flower (per Gram) 1

|

$

|

4.90

|

$

|

5.75

|

$

|

5.52

|

$

|

5.51

|

||||||||

|

Average net selling price of other cannabis products (per Gram)2

|

$

|

4.70

|

-

|

$

|

4.07

|

-

|

||||||||||

|

Quantity harvested and trimmed (in Kilograms)3

|

4,770

|

4,564

|

1,998

|

1,610

|

||||||||||||

|

Quantity of other cannabis products sold (in Kilograms)1

|

1,033

|

-

|

503

|

-

|

||||||||||||

|

Quantity of dried flower sold (in Kilograms)

|

8,410

|

2,586

|

2,949

|

1,079

|

||||||||||||

Notes:

| 1. |

Cannabis selling prices in the Canadian market are characterized with lower selling prices than dried flowers the Israeli and German market.

|

| 2. |

Including other cannabis products such as Kief, Hash and Pre-rolls.

|

| 3. |

Harvested flowers, after trimming and ready for manufacturing.

|

The Overview of Financial Performance includes reference to non-IFRS financial measure, “gross margin”, which the Company defines as the difference between revenue and cost of revenues divided by

revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets. For more information on non-IFRS financial measures, see the “Non-IFRS Financial Measures”

and “Metrics and Non-IFRS Financial Measures” sections of the MD&A.

20

Management’s Discussion and Analysis

OPERATIONAL RESULTS

The Company remains positive on the cannabis markets in Israel, Canada and Germany.

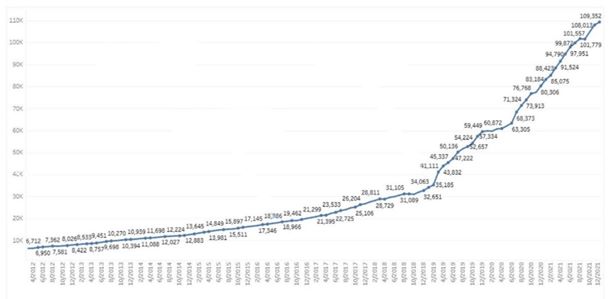

The Company believes that there a number of key factors creating tailwinds to facilitate further industry growth. In Israel, the number of licensed medical patients has

increased by 36% in 2021 and is expected to further grow in the next years and may further benefit from regulatory change liberalizing the cannabis market in Israel. Moreover, the acquisitions of Israeli pharmacies Pharm Yarok, Vironna and Oranim

Pharm (collectively, the “Israeli Pharmacies”) positions IM Cannabis as one of the largest distributors of medical cannabis in Israel. In Canada, the recreational cannabis market is expected to grow from $1.07 billion in Q4 2021 ($4.3 billion

annualized)9 to $8 billion in annual sales by 202610. In Germany, the newly elected coalition government has endorsed the legalization of adult-use cannabis. While no specific legislation has yet been tabled and any

implementation will take time, the Company believes that Germany will be the second largest federally legal, adult-use market in the world. Moreover, in Germany, the Company has seen an increase in the number of private payors of medical

cannabis products, which the Company believes is supportive of its business plan as it relies less on the need for insurance re-imbursement. The outlook for the Company is further supported by its focus on the cultivation and distribution of

premium cannabis products only, which the Company believes to be in the greatest demand in all of its markets, faces less competition, and therefore is less likely to face significant price competition.

Notwithstanding the above, the Israeli cannabis market has become increasingly competitive and the ability to import premium cannabis from Canada is a key determinant of success in Israel. The

cannabis industry in Canada remains highly competitive and generally oversupplied, particularly in value products, and the ongoing viability of the illicit market. The German has been slower to develop due to the difficulty in medical patients

accessing prescriptions and insurance re-imbursements. In each of the Company’s markets, the Company must navigate evolving customer and patient trends in order to be competitive with other suppliers of cannabis products.

9 Based on HiFyre Data for period between October 1 – December 31, 2021.

10 BDSA, https://www.globenewswire.com/news-release/2021/09/21/2300624/0/en/BDSA-Reports-Global-Cannabis-Sales-Surge-41-YoY-in-2021-Will-Surpass-62-Billion-by-2026.html

21

Management’s Discussion and Analysis

REVENUES AND GROSS MARGINS

Revenues

The main revenues of the Group are generated from sales of medical cannabis products to customers in Israel and Germany as well as products to the recreational market in

Canada. The three reportable geographical segments in which the Company operates are Israel, Canada and Germany.

For the year ended December 31:

|

Israel

|

Canada

|

Germany

|

Adjustments

|

Total

|

||||||||||||||||||||||||||||||||||||

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

|||||||||||||||||||||||||||||||

|

Total revenue

|

$

|

25,431

|

$

|

13,826

|

$

|

20,247

|

-

|

$

|

8,622

|

$

|

2,064

|

-

|

-

|

$

|

54,300

|

$

|

15,890

|

|||||||||||||||||||||||

|

Segment income (loss)

|

$

|

(10,654

|

)

|

$

|

(2,090

|

)

|

$

|

(15,353

|

)

|

-

|

$

|

(5,142

|

)

|

$

|

(3,744

|

)

|

-

|

-

|

$

|

(31,149

|

)

|

$

|

(5,834

|

)

|

||||||||||||||||

|

Unallocated corporate expenses

|

-

|

-

|

-

|

-

|

-

|

-

|

$

|

(7,240

|

)

|

$

|

(2,411

|

)

|

$

|

(7,240

|

)

|

$

|

(2,411

|

)

|

||||||||||||||||||||||

|

Total operating (loss) income

|

$

|

(10,654

|

)

|

$

|

(2,090

|

)

|

$

|

(15,353

|

)

|

-

|

$

|

(5,142

|

)

|

$

|

(3,744

|

)

|

$

|

(7,240

|

)

|

$

|

(2,411

|

)

|

$

|

(38,389

|

)

|

$

|

(8,245

|

)

|

||||||||||||

|

Depreciation and amortization

|

$

|

1,424

|

$

|

617

|

$

|

3,879

|

-

|

$

|

701

|

$

|

73

|

-

|

-

|

$

|

6,004

|

$

|

690

|

|||||||||||||||||||||||

For the three months ended December 31:

|

Israel

|

Canada

|

Germany

|

Adjustments

|

Total

|

||||||||||||||||||||||||||||||||||||

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

2021

|

2020

|

|||||||||||||||||||||||||||||||

|

Total revenue

|

$

|

8,472

|

$

|

5,541

|

$

|

10,116

|

-

|

$

|

1,440

|

$

|

(641

|

)

|

-

|

-

|

$

|

20,028

|

$

|

4,900

|

||||||||||||||||||||||

|

Segment income (loss)

|

$

|

(4,451

|

)

|

$

|

(5,559

|

)

|

$

|

(2,983

|

)

|

-

|

$

|

(2,725

|

)

|

$

|

264

|

-

|

-

|

$

|

(10,159

|

)

|

$

|

(5,295

|

)

|

|||||||||||||||||

|

Unallocated corporate expenses

|

-

|

-

|

-

|

-

|

-

|

-

|

$

|

(1,563

|

)

|

$

|

(1,088

|

)

|

$

|

(1,563

|

)

|

$

|

(1,088

|

)

|

||||||||||||||||||||||

|

Total operating (loss) income

|

$

|

(4,451

|

)

|

$

|

(5,559

|

)

|

$

|

(2,983

|

)

|

-

|

$

|

(2,725

|

)

|

$

|

264

|

$

|

(1,563

|

)

|

$

|

(1,088

|

)

|

$

|

(11,722

|

)

|

$

|

(6,383

|

)

|

|||||||||||||

|

Depreciation and amortization

|

$

|

405

|

$

|

(1

|

)

|

$

|

1,378

|

-

|

$

|

617

|

$

|

20

|

-

|

-

|

$

|

2,400

|

$

|

19

|

||||||||||||||||||||||

The consolidated revenues of the Group for the three and twelve months ended December 31, 2021 was attributed to the sale of medical cannabis products in Israel and Germany. After the acquisition of

Trichome and MYM, the consolidated revenues included revenues from the sale of adult-use recreational cannabis in Canada increasing the consolidated revenue of the Group.

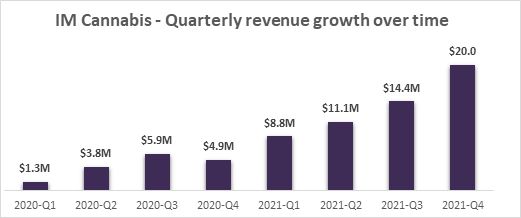

| • |

Revenues for the year ended December 31, 2021 and 2020 were $54,300 and $15,890, respectively, representing an increase of $38,410 or 242%. The increase in revenues was mainly due to the Company’s new

acquisitions done through the year. These acquisitions led to the consolidation of the new subsidiaries both in the Canadian and Israeli market.

|

| • |

Revenues from the Israeli operation were attributed to the sale of medical

cannabis through company agreement with Focus and the consolidation of revenues from company new purchasing of pharmacies.

|

| • |

Revenues from Company Canadian operation are including revenues from the sale of adult-use recreational cannabis in Canada through Company acquisitions of TJAC and MYM.

|

| • |

In Germany Company revenues were attributed to the sale of medical cannabis

through company subsidiary Adjupharm.

|

| • |

Revenues for the three months ended December 31, 2021 and 2020 were $20,028 and $4,900, respectively, representing an increase of $15,128 or 309%.

|

| • |

Total dried flower sold for the year ended December 31, 2021 was 8,410kg at an average selling price of $4.90 per gram compared to 2,586kg for the same period in 2020 at an average selling price of $5.75 per gram, derived mainly from the

lower average selling price per gram the Company benefited from through its Canadian acquisitions of Trichome and MYM.

|

22

Management’s Discussion and Analysis

| • |

Total dried flower sold for the three months ended December 31, 2021 was 2,949 kg at an average selling price of $5.52 per gram compared to 1,079kg for the same period in 2020 at an average selling price of $5.51 per gram.

|

| • |

The increase in revenues related to dried flower in 2021 is attributable to deliveries made under the Focus’ sales agreements to pharmacies, revenues generated from Adjupharm, the consolidation of Trichome, MYM, and the Consolidated

Entities according to the definitive agreement dates for each of the Consolidated Entities.

|

| • |

Total other cannabis product sold for the year ended December 31, 2021 was 1,033kg at an average selling price of $4.70 per gram. Other cannabis products include keef, hash, pre-rolls and more cannabis related products and are.

attributable to the acquisitions of Trichome and MYM during 2021.

|

| • |

Total other cannabis product sold for the three months ended December 31, 2021 was 503kg at an average selling price of $4.07 per gram. The increase in revenues related to other cannabis products for the twelve and three month ended

December 31, 2021 is attributable to the acquisitions of MYM and Trichome and the sales of the WAGNERS, Highland and Sublime brands during 2021.

|

Cost of Revenues

Cost of revenues is comprised of cultivation costs, purchase of materials and finished goods, utilities, salary expenses and import costs, including the purchase of raw materials, production, product

testing, shipping and sales related costs. At harvest, the biological assets are transferred to inventory at their fair value which becomes the deemed cost for the inventory. Inventory is later expensed to the cost of sales when sold. Direct

production costs are expensed through the cost of sales.

The fair value of biological assets is categorized within Level 3 of the fair value hierarchy. The inputs and assumptions used in determining the fair value of biological assets include:

| 1. |

Selling price per gram - calculated as the weighted average historical selling price for all strains of cannabis sold by the Group, which is expected to approximate future selling prices.

|

| 2. |

Post-harvest costs - calculated as the cost per gram of harvested cannabis to complete the sale of cannabis plants post-harvest, consisting of the cost of direct and indirect materials, depreciation and labor as well as labelling and

packaging costs.

|

| 3. |

Attrition rate - represents the weighted average percentage of biological assets which are expected to fail to mature into cannabis plants that can be harvested.

|

| 4. |

Average yield per plant - represents the expected number of grams of finished cannabis inventory which are expected to be obtained from each harvested cannabis plant.

|

| 5. |

Stage of growth - represents the weighted average number of weeks out of the average weeks growing cycle that biological assets have reached as of the measurement date. The growing cycle is

approximately 12 weeks.

|

23

Management’s Discussion and Analysis

The following table quantifies each significant unobservable input, and also provides the impact that a 10% increase/decrease in each input would have on the fair value of biological assets grown by

the Company:

|

For the year ended December 31,

|

10% change in thousands as at

December 31,

|

|||||||||||||||

|

2021

|

2020

|

2021

|

2020

|

|||||||||||||

|

Average selling price per gram of dried cannabis (in CAD)

|

$

|

3.64

|

$

|

6.01

|

$

|

296

|

$

|

8.86

|

||||||||

|

Average post-harvest costs per gram of dried cannabis (in CAD)

|

$

|

1.16

|

$

|

0.83

|

$

|

140

|

$

|

0.23

|

||||||||

|

Attrition rate

|

27

|

%

|

5

|

%

|

100

|

0.4 3

|

||||||||||

|

Average yield per plant (in grams)

|

47

|

54

|

228

|

7.64

|

||||||||||||

|

Average stage of growth

|

47

|

%

|

4

|

%

|

212

|

7.64

|

||||||||||

| • |

The cost of revenues for the year ended December 31, 2021 and 2020 were $42,418 and $7,081, respectively, representing an increase of $35,337 or 499%.

|

| • |

Cost of revenues for the three months ended December 31, 2021 and 2020 were $16,255 and $2,109, respectively, representing an increase of $14,146 or 671%.

|

Focus, Highland and TJAC expect net cost of sales to vary from quarter to quarter based on the number of pre-harvest plants, after harvest plants, the strains being grown and technological progress in the trimming

machines.

Gross Profit

The Company’s formula for calculating gross profit includes:

| • |

production costs (current period costs that are directly attributable to the cannabis growing and harvesting process);

|

| • |

materials and finished goods purchase costs;

|

| • |

a fair value adjustment on sale of inventory (the change in fair value associated with biological assets that were transferred to inventory upon harvest); and

|

| • |

a fair value adjustment on growth of biological assets (the estimated fair value less cost to sell of biological assets as at the reporting date).

|

24

Management’s Discussion and Analysis

Gross profit also includes the net change in fair value of biological assets, inventory expensed and production costs. Biological assets consist of cannabis plants at various after-harvest stages

which are recorded at fair value less costs to sell after harvest.

Gross profit in 2021 was $10,296 representing a decrease of $172 or 2% over the one year period when compared to 2020.

Gross profit for the three months ended December 31, 2021 and 2020 gross profit was $4,311 and $507, respectively, representing an increase of $3,804 or 750%.

Gross profit included gains (losses) from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $(1,586) and $1,659 for the year ended

December 31, 2021 and 2020, respectively. Fair value adjustments were impacted primarily due to less valuation to unrealized biological assets during the twelve months ended 2021.

Gains (losses) from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold for the three months ended December 31, 2021 and 2020 were $538 and

$(2,284), respectively. Fair value adjustments were impacted primarily due to higher realization of biological assets during the three months ended 2021.

EXPENSES

General and Administrative

There was an increase in the general and administrative expense which is mainly attributable to the growing corporate activities in Israel, Canada, and Germany, professional services derived from

legal fees and other consulting services, among others, in relation to the NASDAQ listing, the 2021 Offering and acquisitions in the amount of $11,814, including share-based expenses to financial advisors of approximately $807, salaries to employees

in the amount of $9,900, depreciation and amortization in the amount of $2,827 and insurance costs in the amount of $2,871.

General and administrative expenses for the year ended December 31, 2021 and 2020 were $32,219 and $11,549, respectively, representing an increase of $20,670 or 179%.

For the three months ended December 31, 2021 and 2020, general and administrative expenses were $9,575 and $4,191, respectively, representing an increase of $5,384 or 128%.

Selling and Marketing

Selling and marketing expenses for the year ended December 31, 2021 and 2020 were $8,995 and $3,782, respectively, representing an increase of $5,213 or 138%. For the three months ended December 31,

2021, selling and marketing expenses were $4,341, compared to $1,448 for the three months ended December 31, 2020, representing an increase of $2,893 or 200%. The increase in the selling and marketing expenses was due mainly to the Company’s

increased marketing efforts in Israel, brand launch in Germany, and increased distribution expenses relating to the increase in sales and consolidation of selling and marketing expenses of entities acquired in 2021.

25

Management’s Discussion and Analysis

Share-Based Compensation

Share-based compensation expense for the year ended December 31, 2021 and 2020 was $7,471 and $3,382, respectively, representing an increase $4,089 or 121%. For the three months ended December 31,

2021 and 2020, share-based compensation expense was $2,117 and $1,251, respectively, representing an increase of $866 or 69%. The increase was mainly due to the grant of new incentive stock options (“Options”).

Financing

Financing income (expense), net, for the year ended December 31, 2021 and 2020 was $20,376 and $(20,227), respectively, representing an increase of $40,603 or 201%. For the three months ended

December 31, 2021 and 2020, financing income was $436 and $14,252, respectively, representing an decrease of $13,816 or 97%. The change for the year was mainly due to $21,638 finance income arising mainly from the updated valuation of the Company’s

Warrants (defined below) and other financial instruments affected by the Company’s decreased share price.

NET INCOME/LOSS

Net loss for the year ended December 31, 2021 and 2020 was $(18,518) and $(28,734), respectively, representing a net loss decrease of $10,216 or 36%. For the three months ended December 31, 2021 and

2020, Net loss was $(12,488) and $(19,976) respectively, representing a net loss increase of $7,488 or 37%. The net income decrease related to factors impacting net income from operations described above, and finance income driven by revaluation of

warrants and other financial instruments in the amount of $21,638, which were recorded against liability on the grant day and were re-evaluated at December 31, 2021 through profit or loss.

NET INCOME (LOSS) PER SHARE BASIC AND DILUTED

Basic loss per share is calculated by dividing the net profit attributable to holders of Common Shares by the weighted average number of Common Shares outstanding during the

period. Diluted profit per Common Share is calculated by adjusting the earnings and number of Common Shares for the effects of dilutive warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the

denominator in calculating diluted profit per Common Share excludes unissued Common Shares related to Options as they are antidilutive. Basic Income (Loss) per Common Share for the year ended December 31, 2021 and 2020 were $(0.31) and $(0.74) per

Common Share, respectively. For the three months ended December 31, 2021 and 2020 were $(0.19) and $(0.13) respectively.

Diluted Income (Loss) per Common Share for the year ended December 31, 2021 and 2020 were $(0.66) and $(0.74) per Common Share, respectively. Diluted Income (Loss) per Common Share for the three

months ended December 31, 2021 and 2020 were $(0.19) and $(0.13), respectively.

TOTAL ASSETS

Total assets as at December 31, 2021 were $287,388, compared to $38,116 as at December 31, 2020, representing an increase of $249,272 or 654%. This increase was primarily due to the consolidation of