Exhibit 99.3

Management’s Discussion and Analysis

TABLE OF CONTENTS

|

5

|

|

|

6

|

|

|

6

|

|

|

8

|

|

|

12

|

|

|

14

|

|

|

16

|

|

|

20

|

|

|

48

|

2

Management’s Discussion and Analysis

INTRODUCTION

IM Cannabis Corp. (“IM Cannabis” or the “Company”) is a British Columbia company whose business formed on October

11, 2019 as the result of a reverse takeover with IMC Holdings Ltd. (the “Reverse Takeover Transaction”), pursuant to which the Company changed its name from “Navasota Resources Inc.” to “IM Cannabis Corp.”

and changed its business from mining to the international medical cannabis industry. The Company’s common shares (the “Common Shares”) trade under the ticker symbol “IMCC” on both the NASDAQ Capital Market

(“NASDAQ”) and the Canadian Securities Exchange (“CSE”) as of March 1, 2021 and November 5, 2019, respectively. The Reverse Takeover Transaction is more fully

described under “Review of Financial Performance – Share Capital – Financial Background”.

This Management’s Discussion and Analysis (“MD&A”) reports on the consolidated financial condition and operating results of IM Cannabis for the three

months ended March 31, 2022. Throughout this MD&A, unless otherwise specified, references to “we”, “us”, “our” or similar terms, as well as the “Company” and “IM Cannabis” refer to IM Cannabis Corp., together with its subsidiaries, on a

consolidated basis, and the “Group” refers to the Company, its subsidiaries, Focus Medical Herbs Ltd. and High Way Shinua Ltd.

This MD&A should be read in conjunction with the interim condensed consolidated financial statements of the Company and the notes thereto for the three months ended March 31, 2022 (the “Interim Financial Statements”) and with the Company’s audited annual consolidated financial statements and the notes thereto for the years ended December 31, 2021 and 2020, (the “Annual Financial Statements”). References herein to “Q1 2022” and “Q1 2021” refer to the three months ended March 31, 2022 and March 31, 2021, respectively, and references to “2021” refer to the year ended December 31, 2021.

The Interim Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board (“IASB”). IFRS requires management to make certain judgments, estimates and assumptions that affect the reported amount of assets and liabilities at the date of

the Interim Financial Statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily indicative of results that may be expected for future

periods. The Interim Financial Statements include the accounts of the Group, which includes, among others, the following entities:

|

Legal Entity

|

Jurisdiction

|

Relationship with the Company

|

|

IMC Holdings Ltd. (“IMC Holdings”)

|

Israel

|

Wholly-owned subsidiary

|

|

I.M.C. Pharma Ltd. (“IMC Pharma”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Focus Medical Herbs Ltd. (“Focus”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto control” under IFRS 10

|

|

R.A. Yarok Pharm Ltd. (“Pharm Yarok”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Rosen High Way Ltd. (“Rosen High Way”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

High Way Shinua Ltd. (“HW Shinua”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto” control under IFRS 10

|

|

Revoly Trading and Marketing Ltd. dba Vironna Pharm (“Vironna”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Oranim Plus Pharm Ltd. (“Oranim Plus”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Trichome Financial Corp. (“Trichome”)

|

Canada

|

Wholly-owned subsidiary

|

|

Trichome JWC Acquisition Corp. (“TJAC”)

|

Canada

|

Wholly-owned subsidiary of Trichome

|

|

MYM Nutraceuticals Inc. (“MYM”)

|

Canada

|

Wholly-owned subsidiary of Trichome

|

|

SublimeCulture Inc. (“Sublime”)

|

Canada

|

Wholly-owned subsidiary of TJAC

|

|

Highland Grow Inc. (“Highland”)

|

Canada

|

Wholly-owned subsidiary of MYM International Brands Inc., a wholly-owned subsidiary of MYM

|

|

Adjupharm GmbH (“Adjupharm”)

|

Germany

|

Subsidiary of IMC Holdings

|

3

Management’s Discussion and Analysis

All intercompany balances and transactions were eliminated on consolidation.

All dollar figures in this MD&A are expressed in thousands of Canadian Dollars ($), except per share data and unless otherwise noted. All references to “NIS” are to New Israeli Shekels. All

references to “€” or to “Euros” are to Euros. All references to “US$” or to “U.S. Dollars” are to United States Dollars. The Company’s shares, options, units and warrants are not expressed in thousands. Prices are not expressed in thousands.

NON-IFRS FINANCIAL MEASURES

Certain non-IFRS financial measures are referenced in this MD&A that do not have any standardized meaning under IFRS, including “Gross Margin”, “EBITDA” and “Adjusted EBITDA”. The Company

believes that these non-IFRS financial measures and operational performance measures, in addition to conventional measures prepared in accordance with IFRS, enable readers to evaluate the Company’s operating results, underlying performance and

prospects in a similar manner to the Company’s management. For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the “Metrics and Non-IFRS

Financial Measures” section of the MD&A.

NOTE REGARDING THE COMPANY’S ACCOUNTING PRACTICES

The Company complies with IFRS 10 to consolidate the financial results of Focus, a holder of cultivation license on the basis of which IMC Holdings exercises “de facto control”. For a full

explanation of the Company’s application of IFRS 10, see “Legal and Regulatory – Restructuring” and “Legal and Regulatory – Risk Factors – Consolidation of Focus

Financial Results under IFRS 10 and Maintenance of Common Control”.

For the period ended March 31, 2022, the Company analyzed the terms of the definitive agreements with HW Shinua in accordance with IFRS 10 and concluded a requirement to consolidate the financial

results of HW Shinua as of the date of signing the definitive agreements therewith. The definitive agreement provides the Company with the power to unilaterally make all decisions regarding the financial and operating policies of HW Shinua and

the right to obtain all related economic benefits. The completion of the Pharm Yarok Transaction (as defined below) with respect to HW Shinua remains subject to Israeli Medical

Cannabis Agency (the “IMCA“) approval, and accordingly the financial results of HW Shinua continue to be consolidated in compliance with IFRS 10. For

further information on the Pharm Yarok Transaction, please see “Corporate Highlights and Events” section of the MD&A.

4

Management’s Discussion and Analysis

OVERVIEW – CURRENT OPERATIONS IN ISRAEL, CANADA AND GERMANY

IM Cannabis is a leading international cannabis company providing premium cannabis products to medical patients and adult-use recreational consumers. With operations in Israel,

Canada, and Germany, the world’s three largest federally legal cannabis markets, the Company has developed its own proprietary import/export supply chain in order to efficiently deliver premium cannabis to patients and consumers under a uniform

global branding umbrella.

The Company operates in Canada through Trichome and its subsidiaries TJAC and MYM, where it cultivates, processes and sells premium and ultra-premium cannabis at its own

facilities under the WAGNERS and Highland Grow brands for the adult-use market in Canada, and exports premium and ultra-premium medical cannabis to Israel and eventually to Germany.

In Israel, the Company imports, distributes and sells cannabis to local medical patients by operating medical cannabis retail pharmacies, online platforms, distribution centres

and logistical hubs operating through IMC Holdings’ subsidiaries and Focus.

In Germany, the IM Cannabis ecosystem operates through Adjupharm, importing and distributing cannabis to pharmacies for patients and acting as the Company’s entry point for

potential Europe-wide distribution in the future.

OUR GOAL - DRIVE PROFITABLE REVENUE GROWTH

Our primary goal is to sustainably increase revenue in each of our core markets in order to build long term shareholder value. By focusing on sustainable revenue growth, while actively managing

costs and margins, we believe we can achieve positive EBITDA.

HOW WE PLAN TO ACHIEVE OUR GOAL – FOUR CORE STRATEGIES

Our strategy to grow sustainable revenues consists of:

| • |

Geographic diversification and preparation to target, upon legalization, new adult-use recreational cannabis markets in Germany and Israel, while leveraging the cultivation excellence, consumer insights and

experienced team in the mature Canadian market.

|

| • |

Properly positioned brands with respect to target-market, price, potency and quality, such as the successful mid-2021 launch of WAGNERS in Canada. By Q1 2022, both WAGNERS and Highland Grow were among the top 3

premium and ultra-premium cannabis brands in Ontario (Canada’s largest province) by retail market share.1

|

| • |

High-quality, reliable supply to our customers and patients, leading to recurring sales.

|

| • |

Ongoing introduction of new SKUs to keep consumers and patients engaged.

|

In order to turn increased revenues into positive EBITDA, we plan to focus on spending discipline and cost efficiencies through vertical integration in 2022.

1 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period between January 1, 2022 – March 31, 2022 for dried flower product between $7.50 - $9.99/gram and above $12.99/gram, respectively.

5

Management’s Discussion and Analysis

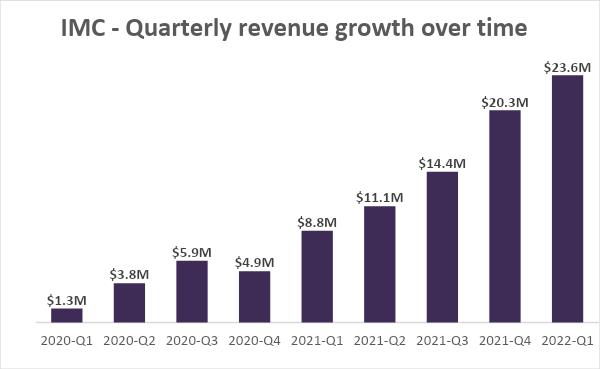

RESULTS – SIGNIFICANT REVENUE GROWTH IN Q1 2022

The Company operates in the Israeli and German medical cannabis markets and the Canadian recreational market.

Israel

In Israel, we continue to expand IMC brand recognition and supply the growing Israeli medical cannabis market with our branded products. The Company offers patients locally grown and imported

medical cannabis through its cultivation partners and continues to focus on importing premium indoor-grown dried cannabis from our licensed cultivation facilities operated by TJAC and MYM in Canada (the “Canadian

Facilities”) and our world-leading cannabis suppliers and supply partners. For more information, see “High-Quality, Reliable Supply – Canada”. In addition to the benefits of the Group’s long-term

presence in Israel, we believe that with our globally integrated supply chain and coordinated team of compliance, regulatory and purchasing professionals, the Company is well-positioned to address the ongoing needs of medical cannabis patients in

Israel.

Since the beginning of 2021, the Company has focused on entering additional segments of the medical cannabis market in Israel, including the distribution and retail segments. The acquisitions of

Israeli pharmacies Pharm Yarok, Vironna and Oranim Pharm (collectively, the “Israeli Pharmacies”) positions IM Cannabis as one of the largest distributors of medical cannabis in Israel. We are focused on

building a vertically-integrated retail chain, providing IM Cannabis products directly to Israeli medical cannabis patients, accessing and leveraging market data as well as providing a deeper understanding of consumer preferences. The acquisition

of the Israeli Pharmacies allows the Company to increase purchasing power with third-party product suppliers, offers potential synergies with our established call centre and online operations, achieves higher margins on direct to patient sales

and creates the opportunity for up-sales across a growing range of products.

6

Management’s Discussion and Analysis

Through the Panaxia Transaction (as defined herein), the Company acquired home-delivery services and an online retail footprint, operating under the name “Panaxia-to-the-Home”,

as well as a customer service centre (“Panaxia-to-the-Home”). The Company’s acquisition of Rosen High Way, a trading house, and the Panaxia trading house license (the “Panaxia

GDP License”) will expand its sales channels, distribution, delivery and storage capacity, and strengthen the Group’s ability to reach its medical cannabis patients directly. Following the acquisition of the Israeli Pharmacies, IMC

Holdings has become, through its recently acquired subsidiaries, a licensed medical cannabis retailer in Israel, and has vertically integrated its Israeli operations. The Company expects that these acquisitions will increase revenue and margins

from its Israeli medical cannabis market activities. For more information see “Corporate Highlights and Events” section of the MD&A.

Canada

Following the completion of the Company’s acquisition of Trichome on March 18, 2021 (the “Trichome Transaction”) and MYM on July 9, 2021 (the “MYM Transaction”), the Company’s global cannabis platform evolved to include operations in the adult-use recreational cannabis market in Canada and supplemented its established medical cannabis operations in

Israel and Germany.

Through its wholly-owned subsidiary, TJAC, Trichome operates as a licensed producer of cannabis products in the Canadian cannabis market and sells adult-use recreational cannabis products under

the popular WAGNERS brand. WAGNERS is widely available at cannabis retailers throughout Canada, with the exception of the province of Quebec.

MYM operates through its wholly-owned subsidiary, Highland, a licensed producer. Each of Highland and Sublime produce cannabis products for the adult-use recreational cannabis market under the

popular Highland Grow brand. Highland Grow is widely available at cannabis retailers throughout Canada, with the exception of the province of Quebec.

The Trichome Transaction and the MYM Transaction are complementary to each other and the larger IM Cannabis ecosystem. The WAGNERS brand targets the premium cannabis market segment (ranging from

$7.50-$9.99 per gram at the consumer level), while Highland targets the ultra-premium market segment (at a price range starting at $12.99 per gram at the consumer level). The Trichome Transaction and the MYM Transaction offer the Company an

efficient, vertically integrated avenue to provide product to the Israeli and German markets.

The Canadian cannabis market is more mature than the other jurisdictions in which we operate, yet market growth is still expected to continue to grow in the coming years, with estimated market

growth from $1.05 billion in Q1 2022 ($4.2 billion annualized)2 to $6.7 billion in annual sales by 2026.3 The Company

continues to capitalize on numerous opportunities to grow its market share within Canada, including:

| ● |

Anticipated expansion into Quebec, which accounts for approximately 23% of Canada’s population.

|

2 Based on HiFyre Data for period between January 1 – March 31, 2022.

3 BDSA,

https://www.globenewswire.com/news-release/2021/09/21/2300624/0/en/BDSA-Reports-Global-Cannabis-Sales-Surge-41-YoY-in-2021-Will-Surpass-62-Billion-by-2026.html

7

Management’s Discussion and Analysis

| ● |

Launching new SKUs, products, and formats to meet consumer demand.

|

| ● |

Continuing to expand competitive market share in key Canadian cannabis markets, of which Ontario is Canada’s largest:

|

| • |

In Ontario, WAGNERS has increased from 0% market share in May 2021 to over 8% in the premium dried flower segment for the month of April 2022.4

|

| • |

Highland held over 10% market share in the ultra-premium segment in Ontario in April 2022.5

|

| ● |

Engaging directly with current and prospective customers, retailers, and consumers, and expanding the number of retail locations our products are available in.

|

Germany

In Europe, the Company operates in Germany through Adjupharm, its German subsidiary and EU-GMP certified medical cannabis producer and distributor. We continue to lay our foundation in Germany,

which is currently the largest medical cannabis market in Europe.6 Leveraging our global supply chain, IM Cannabis continues to focus on growing its business in Germany to be

well-positioned through brand recognition in preparation for future regulatory reforms.

Similar to Israel, the Company’s focus in Germany is on importing premium indoor-grown dried cannabis from its Canadian Facilities, which we believe will satisfy the rapid growth in demand for

high-THC premium cannabis across a variety of strains and qualities.

While the Company does not currently distribute products in other European countries, the Company intends to leverage the foundation established by Adjupharm, its new state-of-the-art,

approximately 8,000 square foot warehouse space and EU-GMP production facility in Germany that was completed in July 2021 (the “Logistics Centre”), and its network of distribution partners to expand into

other jurisdictions across the continent. The Company expects that the Logistics Centre will allow the Company to execute all aspects of its supply chain, including the repackaging of bulk cannabis and distribution capabilities.

The IMC brand is well-known in the Israeli medical cannabis market. Leveraging its long-term success in the Israeli market, the Company launched the IMC brand in Germany in 2020.

Following the Company’s entry into the Canadian adult-use recreational cannabis market, the Company is now leveraging its vertical integration and applying a multi-country strategy and using its

global platform and exporting its Canadian WAGNERS and Highland Grow brands to the Israeli and German medical cannabis markets. The Company believes that the sale of WAGNERS and Highland Grow into the Israeli and German markets can satisfy the

increasing demand of both Israeli and German patients for indoor grown high-THC premium cannabis.

4 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period between April 1 – April 30,

2022 for dried flower product between $7.50 - $9.99/gram.

5 Ibid for dried flower product

above $12.99/gram.

6 The European Cannabis Report – Edition 6, p. 93 - https://prohibitionpartners.com/reports/

8

Management’s Discussion and Analysis

Israeli Medical Cannabis Business

The Company currently sells the IMC and WAGNERS brands in the Israeli market.

The IMC brand established its reputation in Israel for quality and consistency over the past 10 years. In September 2021, a survey of licensed medical cannabis patients showed that the IMC brand

strain, Roma, is one of the top four most popular selling medical cannabis strain in Israel.7

In association with Focus, the Group maintains a portfolio of strains sold under the IMC umbrella from which popular medical cannabis dried flowers and full-spectrum cannabis extracts are

produced.

In 2021, IMC was rebranded with a refreshed logo, packaging, design language and tone, with a bold new design to better position itself in the competitive Israeli medical cannabis market, also

introducing a variety of available products for medical cannabis patients. The IMC brand launched four different product lines as part of its rebranding:

The Signature Collection – The IMC brand’s high-quality product line with greenhouse grown, high-THC cannabis flowers. The Signature collection of products

currently includes well known cannabis dried flowers such as Roma, Tel Aviv and London as well as newer strains launched in 2021 such as Mango Mint.

The Reserve Collection – The IMC brand’s premium product line with indoor-grown, high-THC cannabis flowers. Launched in Q1 2022 with BC Pink Kush.

The Craft Collection – The IMC brand’s ultra-premium product line with indoor-grown, hang-dried and hand-trimmed, high-THC cannabis flowers. Including exotic and unique

cannabis strains such as Peanut Butter MAC, Wedding Crasher and Alien Sin Mint Cookies.

The Full Spectrum Extracts – The IMC brand’s full spectrum, strain specific cannabis extracts including high-THC Roma oil, balanced Paris oil and Super CBD.

7 According to a survey published in Mako news website (September 2021, Israel) (HE).

9

Management’s Discussion and Analysis

The WAGNERS brand launched in Israel in Q1 2022. For more information, please see “New Product Offerings” section of the MD&A.

Canadian Adult-Use Recreational Cannabis Business

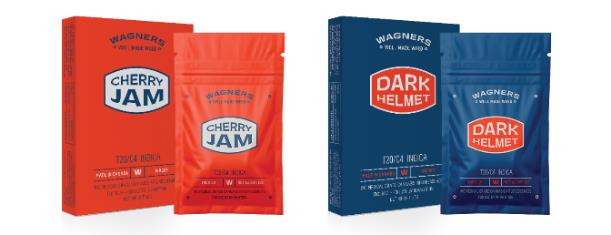

In Canada, the Company’s product portfolio consists of dried flower, pre-rolls and pressed hash offerings under the premium WAGNERS brand and ultra-premium Highland Grow brand. The WAGNERS brand

was launched by TJAC in mid-2021, while the Highland Grow brand was acquired through the acquisition of MYM in July 2021.

The WAGNERS brand offers high-quality cannabis on a consistent basis and at an approachable price point for consumers. The Highland Grow brand offers cannabis consumers ultra-premium product,

curated to their tastes. Both the WAGNERS and Highland Grow brands have proven to be very popular with consumers, each holding a top 3 position in Ontario across their respective price segments (year-to-date in 2022).8

8 Depletion and e-commerce sales data from Ontario Cannabis Store - Sale of Data report for period between January 1 – March

31, 2022 for dried flower product between $7.50 - $9.99/gram and above $12.99/gram, respectively.

10

Management’s Discussion and Analysis

WAGNERS and Highland Grow products are primarily sold in 3.5 gram flower and 3 x 0.5 gram flower pre-roll formats. Other flower formats are available in certain provinces, such as 7 or 14 gram

units. Hash is typically sold in 1, 2 and 4 gram formats.

Key WAGNERS flower strains include Dark Helmet, Cherry Jam, Silverback #4, Pink Bubba, Blue Lime Pie, Purple Clementine, Rainforest Crunch, Golden Ghost OG, Tiki Rain, and Turpy Slurpy:

The Highland Grow brand portfolio includes six core flower strains: Gaelic Fire, Diamond Breath, White Lightning, Sensi Wizard, Cherry Burst, and Gas Tank.

In Q1 2022, the Company commenced distribution of a new brand, Dymond Concentrates, which offers high-quality concentrates such

as THCA diamonds, caviar, live resin, badder and shatter:

11

Management’s Discussion and Analysis

German Medical Cannabis Business

In Germany, the Company sells IMC-branded dried flower products. The medical cannabis products sold in the German market are branded generically as IMC so as to rely on the Company’s brand

recognition in establishing a foothold with German healthcare professionals. The Company’s IMC-branded cannabis products were launched in Germany with one high THC flower strain in 2020. In Q4 2021, Adjupharm launched a flower strain second high

THC strain and two full spectrum extracts. In Q1 2022 Adjupharm launched a third strain, a high CBD flower, to offer a more complete portfolio to German physicians and patients.

In July 2021, Adjupharm was recognized by the German Brand Institute with the “German Brand Award 2021”, recognizing its excellence in brand strategy and creation, communication and integrated

marketing. The competitive advantage in Germany also lies in the Group’s track record, experience and brand reputation in Israel and proprietary data supporting the possible effectiveness of medical cannabis for the treatment of a variety of

conditions.

Israel

Over the last decade, Focus was the primary cultivator of medical cannabis products sold under the IMC brand in the Israeli market, as an IMCA licensee permitted to cultivate medical cannabis at

the Focus cultivation facility (the “Focus Facility”). In April 2022, the Company announced an operational update and a new strategic imperative designed to enhance the Group’s organizational efficiencies.

The Company announced that it would close the Focus Facility in Q2 2022 and focus on leveraging its global import of medical cannabis from its Canadian Facilities and third-party suppliers of quality medical cannabis. To supplement growing

demand, Company will continue to purchase medical cannabis from third-party cultivation facilities in Israel and will rely on its existing inventory of proprietary genetics.

Since 2021, the Company has focused on securing additional supply from its supply partners from outside of Israel, leveraging its improved purchasing capabilities and global presence, as well as

facilitating the import of indoor-grown premium and ultra-premium cannabis from the Canadian Facilities. Importing from the Canadian Facilities aligns with the Company’s strategy of acquiring Trichome and MYM to serve as a long term, reliable

source of supply to both the Israeli and German markets.

Following cultivation in Israel or the import of medical cannabis in accordance with Israeli regulations, the medical cannabis products are then packed by contracted licensed producers of medical

cannabis. The packaged medical cannabis products are then sold by the Group under the Company’s brands to local Israeli pharmacies directly or through contracted distributors.

12

Management’s Discussion and Analysis

Canada

In Canada, our primary customers are provincially-owned cannabis wholesalers who in turn sell to private and public retail locations where the consumer ultimately purchases cannabis products.

The Company supplies the WAGNERS and Highland Grow brands through a combination of internally cultivated production from the Canadian Facilities in Ontario, Quebec, and Nova Scotia. To diversify

the Company’s supply lines, the Company also purchases carefully curated cannabis to match its consumers’ demands and expectations.

The following table describes the Canadian Facilities:

|

Facility

|

Location

|

Description

|

|

Manitou Facility

|

Ontario

|

Flagship 32,050 square metre facility, with approximately 4,340 square metre of cultivation space

|

|

Trillium Facility

|

Ontario

|

Approximately 1,400 square metre processing and cultivation facility

|

|

Sublime Facility

|

Quebec

|

Approximately 930 square metre cultivation and storage facility

|

|

Highland Facility

|

Nova Scotia

|

Approximately 530 square metre cultivation and storage facility

|

The Manitou Facility, Trillium Facility, and Sublime Facility are operated by TJAC and the Highland Facility is operated by Highland. The Canadian facilities are authorized to cultivate and

process cannabis pursuant to their Health Canada-issued licenses (the “TJAC Licenses” and the “MYM License”, respectively), however, only the Trillium Facility and

the Highland Facility hold licenses to sell cannabis on a non-B2B basis.

Germany

The Company continues to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country and developing Adjupharm and the Logistics Centre as

the Company’s European hub. Adjupharm sources its supply of medical cannabis for the German market from various EU-GMP certified European and Canadian suppliers. The completion of the Logistics Centre upgraded Adjupharm’s production technology

and increased its storage capacity to accommodate its anticipated growth. The Company is also focused on exporting products into Germany from its Canadian Facilities, which offers Adjupharm a reliable long term source of supply with minimal risks

inherent in the supply chain.

13

Management’s Discussion and Analysis

Adjupharm currently holds wholesale, narcotics handling, manufacturing, procurement, storage, distribution and import/export licenses granted to it by the

applicable German regulatory authorities (the “Adjupharm Licenses”).

Between our various geographies, the strategy for new products varies given that each market is at a different stage of development with respect to regulatory regimes, patient and customer

preferences and adoption rates.

Israel

|

In conjunction with its Israeli cultivation partners growing cannabis in Israel, the Company is also importing premium cannabis from its

Canadian Facilities and third-party suppliers. Canadian indoor-grown cannabis commands a premium to the Israeli consumer.

In Q1 2022, the Company launched the BC Pink Kush cannabis flowers under its Reserve Collection and another cannabis flower product, Berlin,

as part of its Signature Collection.

|

|

The WAGNERS brand launched in Israel in Q1 2022, with premium indoor-grown cannabis from the Canadian Facilities. For the first time in the Israeli market, the WAGNERS brand introduced premium,

imported, indoor-grown flower at a competitive price point, which is due in large part to the Group’s vertically integrated global supply chain reducing costs across the chain.

The WAGNERS brand currently offers its Cherry Jam and Dark Helmet products in Israel with additional products expected to launch later in 2022.

We also plan to launch the Highland Grow brand in Israel later in 2022.

Canada

The Company has amassed a portfolio of more than 150 cannabis strains through the MYM Transaction and is regularly evaluating and bringing new strains to market.

14

Management’s Discussion and Analysis

The Company plans to launch four new strains in Q2 2022: Tiki Rain, Rainforest Crunch, Golden Ghost OG, and Turpy Slurpy:

In Q2 2022, Highland plans to launch pre-rolls in Ontario, which is Canada’s largest provincial cannabis market. Additionally, in Q2 2022, the Company introduced two new

strains in Ontario and other provinces, under the Highland Grow brand: Diamond Breath and Gas Tank.

15

Management’s Discussion and Analysis

The Company’s distributed brand, Dymonds Concentrates, is bringing to market varieties of infused pre-rolls:

Germany

IM Cannabis is also currently in the process of launching its popular Canadian WAGNERS brand in the German medical cannabis market, by importing cannabis flower from its Canadian Facilities. The

expansion of our portfolio shows our commitment to German physicians and patients to provide the best available strains in the global cannabis market, and the opportunity to tailor treatments for each individual medical cannabis patient.

KEY HIGHLIGHTS FOR THE QUARTER ENDED MARCH 31, 2022

In the first quarter of 2022, the Company continued to execute on its 2021 strategy to expand its business operations through the completion of several strategic acquisitions in Israel. The

Company’s key highlights and events for the three months ended March 31, 2022 include:

Supply Partnership for Import of Premium Medical Cannabis to Israel

In Q1 2022, the Group introduced to the Israeli medical cannabis market, cannabis products from Flowr Corporation (“Flowr”), a Canadian licensed producer

of ultra-premium adult-use recreational and medical cannabis products, pursuant to a three-year supply agreement entered between Focus and Flowr and the receipt of the first shipment in Q4 2021.

Strategic Executive Management Changes

On January 13, 2022, the Company announced the following changes to its management team: Yael Harrosh, previously IM Cannabis’s General Counsel, Business Director and Corporate Secretary, was

promoted to global Chief Legal and Operations Officer, effective immediately; Rinat Efrima was appointed the new Chief Executive Officer of IMC Holdings and joined the Company in Q1 2022.

16

Management’s Discussion and Analysis

First Import to Israel of Cannabis from the Company’s Canadian Facility

In Q1 2022, Focus imported premium indoor-grown Canadian cannabis flowers from TJAC and an additional supply partner, marking an important milestone in the execution of the IM Cannabis’ strategic

objectives of vertical integration. The Group commenced the sale of the imported cannabis flowers under its WAGNERS brand in the Israeli medical cannabis market in the first quarter of 2022.

Focus Revolving Credit Facility

In January 2022, Focus entered into a revolving credit facility with Bank Mizrahi (the “Mizrahi Facility”). The Mizrahi Facility is guaranteed by Focus

assets. Advances from the Mizrahi Facility will be used for working capital needs. The Mizrahi Facility has a total commitment of up to NIS 15,000 (approximately $6,000) and has a one-year term for on-going needs and 6-month term for import and

purchase needs. The Mizrahi Facility is renewable upon mutual agreement by the parties. The borrowing base available for draw at any time throughout the Mizrahi Facility and is subject to several covenants to be measured on a quarterly basis. The

Mizrahi Facility bears interest of Israeli prime interest plus 1.5% (estimated to be approximately 3.3%) per annum.

TJAC Revolving Credit Facility

On March 29, 2022, the Company’s subsidiary, TJAC, increased the limit on a revolving credit facility (the “Revolver”) from $10,000 to $15,000, to better support the working capital needs

associated with its global supply chain and the growing demand for its premium Canadian-grown cannabis. In addition, the available borrowing base increased as the Company’s sales and operations increased in size. Amounts drawn under the Revolver

are margined against eligible accounts receivable and inventory and are secured against the assets of the Company’s Canadian subsidiaries. In connection with increasing the limit on the Revolver, the term of the Revolver was extended to May 2023.

For more information on the Revolver, see “Review of Financial Performance – Liquidity and Capital Resources – Additional Liquidity” section of the MD&A.

Entering the Retail Segment in Israel by Acquiring Panaxia’s Largest Retail and Online Pharmacy Business

On March 14, 2022, IMC Holdings acquired from Panaxia Pharmaceutical Industries Israel Ltd. and Panaxia Logistics Ltd., part of the Panaxia Labs Israel Ltd. group of companies (collectively, “Panaxia”), the trading house license (“Panaxia GDP License”) following receipt of the requisite IMCA approval. The transaction (the “Panaxia

Transaction”) is further described in the Company’s annual information form dated March 31, 2022 ((the “Annual Information Form”) that is available on the Company’s SEDAR profile at www.sedar.com.

The Panaxia Transaction includes a further option to acquire, for no additional consideration, a pharmacy from Panaxia, including requisite licenses to dispense and sell medical cannabis to patients, that the Company has exercised (“Panaxia Pharmacy Closing”). The Panaxia Pharmacy Closing is expected to occur in Q3 2022.

17

Management’s Discussion and Analysis

Acquisition of Leading Israeli Retailer and Distributor – Pharm Yarok Group

On March 14, 2022, IMC Holdings completed the acquisition of Pharm Yarok, a leading medical cannabis pharmacy located in central Israel and Rosen High Way trade and distribution centre providing

medical cannabis storage, distribution services and logistics solutions for cannabis companies and pharmacies in Israel, as further described in the Annual Information Form (the “Pharm Yarok Transaction”).

In connection with closing of the Pharm Yarok Transaction, the Company completed a non-brokered private placement with former shareholders of Pharm Yarok and Rosen High Way on March 14, 2022. A total of 523,700 Common Shares were issued at a

deemed price of $2.616 for aggregate proceeds of approximately $1,370. The calculation of the deemed price was based on the average closing price of Common Shares on the CSE over the 8 trading day period immediately preceding March 14, 2022.

Acquisition of Leading Israeli Pharmacy – Vironna

On March 14, 2022, IMC Holdings completed the acquisition of 51% of the issued and outstanding ordinary shares of Vironna (the “Vironna Transaction”), as

further described in the Annual Information Form. Vironna is a pharmacy licensed to dispense and sell medical cannabis and one of the leading pharmacies serving patients in the Arab population in Israel. The Vironna Transaction closed upon

receipt of all requisite approvals, including the approval of the IMCA. The Vironna Transaction was completed for total consideration of NIS 8,500 (approximately $3,330), comprised of NIS 5,000 (approximately $1,900) in cash and NIS 3,500

(approximately $1,350) in Common Shares issued on closing. In satisfaction of the cash consideration component, NIS 3,750 (approximately $1,400) was paid at signing of the definitive agreement and the remaining NIS 1,250 (approximately $490) will

be paid post-closing of the Vironna Transaction. In satisfaction of the share consideration component, the Company issued 485,362 Common Shares at a deemed issue price of US$2.209 per share (approximately $2.809), calculated based on the average

closing price of the Common Shares on the NASDAQ for the 14 trading day period immediately preceding closing. The shares issued are subject to a staggered three-month lockup commencing on the date of issuance.

Acquisition of Jerusalem’s Leading Medical Cannabis Pharmacy – Oranim Pharm

On March 28, 2022, IMC Holdings completed the acquisition of 51% of the rights in Oranim Pharm Partnership (“Oranim Pharm”), through the acquisition of

Oranim Plus, as further described in the Annual Information Form (the “Oranim Transaction”). Oranim Pharm is one of the largest pharmacies selling medical cannabis in Israel and the largest pharmacy selling

medical cannabis in the Jerusalem area the Oranim Transaction closed upon receipt of all requisite approvals, including the approval of the IMCA. In satisfaction of the cash consideration component, NIS 5,202 (approximately $2,100) were paid at

signing of the definitive agreement and NIS 5,202 will be payable in the first quarter of 2023, pursuant to new payment terms agreed by the parties. In satisfaction of the share consideration component, the Company issued 251,001 Common Shares at

a deemed issue price of US$1.9 per share (approximately $2.37) per share, calculated based on the average closing price of the common shares of the Company on the NASDAQ for the 14 trading day period immediately preceding March 28, 2022. The

shares issued are subject to a staggered three-month lockup commencing on the date of issuance.

18

Management’s Discussion and Analysis

Closure of Sde Avraham Farm in Israel

At the end of the first quarter of 2022, the Company resolved new strategic imperatives designed to enhance organizational efficiency and reduce operating costs while further responding to the

increased demand for premium, indoor-grown Canadian cannabis from Israeli consumers. As part of these changes, Focus decided to close its Sde Avraham cultivation farm that it owns and operates. Focus has an exclusive commercial agreement with IM

Cannabis to distribute its production under the IMC brand. Focus will complete the closure of the Sde Avraham cultivation farm during the second quarter of 2022. The closure of Sde Avraham farm will allow the Company to better leverage its fully

licensed import-export supply chain and focus on importing premium and ultra-premium products from its subsidiaries in Canada and other leading Canadian suppliers. IM Cannabis will continue to support the cultivation sector in Israel by

concentrating on purchasing from third-party cultivation facilities in Israel that have advanced technological greenhouses and will rely on existing inventory of proprietary genetics.

SUBSEQUENT EVENTS

Biome Grow Inc. Default

On April 4, 2022, the Company issued a Notice of Event of Default and Acceleration (the “Notice of Default”) to Biome Grow Inc. and its subsidiary,

Cultivator Catalyst Corp. (together the “Borrowers”) for a total outstanding principal plus accrued and unpaid interest of approximately $2,680 (the “Loan”), after several failed attempts to engage the

Borrowers regarding an extension and repayment of the Loan. On April 20, 2022, the Company issued a demand letter to the Borrower seeking immediate payment, along with a Notice to Enforce Security pursuant to section 244 of the Bankruptcy and

Insolvency Act (Canada). On May 3, 2022, MYM filed an application with the Ontario Supreme Court to appoint a receiver to take control of the Borrower’s assets, including the security, to effect repayment of the Loan. In July 2020, approximately

one year prior to the Company’s acquisition of MYM, MYM entered into the Loan and related security agreements with the Borrowers. As part of the Loan, the Borrowers agreed to repay all outstanding principal and accrued and unpaid interest no

later than January 31, 2022. The amount of the Loan and interest payable is secured by assets held in escrow by the Borrowers pursuant to a general security agreement.

19

Management’s Discussion and Analysis

FINANCIAL HIGHLIGHTS

Below is the analysis of the changes that occurred for the three months ended March 31, 2022. Commentary is provided below.

|

For the three months ended March 31

|

For the year ended December 31

|

|||||||||||

|

2022

|

2021

|

2021

|

||||||||||

|

Revenues

|

$

|

23,569

|

$

|

8,767

|

$

|

54,300

|

||||||

|

Gross profit before fair value impacts in cost of sales

|

$

|

6,354

|

$

|

4,627

|

$

|

11,882

|

||||||

|

Gross margin before fair value impacts in cost of sales (%)

|

27

|

%

|

53

|

%

|

22

|

%

|

||||||

|

Operating Loss

|

$

|

(11,549

|

)

|

$

|

(1,705

|

)

|

$

|

(38,389

|

)

|

|||

|

Net income (loss)

|

$

|

(10,741

|

)

|

$

|

4,715

|

$

|

(18,518

|

)

|

||||

|

Net income (loss) per share attributable to equity holders of the Company - Basic

|

$

|

(0.14

|

)

|

$

|

0.11

|

$

|

(0.31

|

)

|

||||

|

Loss per share attributable to equity holders of the Company - Diluted

|

$

|

(0.17

|

)

|

$

|

(0.06

|

)

|

$

|

(0.66

|

)

|

|||

|

For the three months ended March 31,

|

For the year ended December 31,

|

|||||||||||

|

2022

|

2021

|

2021

|

||||||||||

|

Average net selling price of dried flower (per Gram) 1

|

$

|

6.23

|

$

|

4.94

|

$

|

4.90

|

||||||

|

Average net selling price of other cannabis products (per Gram)2

|

$

|

2.76

|

-

|

$

|

4.70

|

|||||||

|

Quantity harvested and trimmed (in Kilograms)3

|

1,744

|

131

|

4,770

|

|||||||||

|

Quantity of other cannabis products sold (in Kilograms)1

|

1,085

|

-

|

1,033

|

|||||||||

|

Quantity of dried flower sold (in Kilograms)

|

3,035

|

1,185

|

8,410

|

|||||||||

Notes:

| 1. |

Cannabis selling prices in the Canadian market are characterized by lower selling prices than dried flowers in the Israeli and German market.

|

| 2. |

Including other cannabis products such as Concentrates, Kief, Hash and Pre-rolls.

|

| 3. |

Harvested flowers, after trimming and ready for manufacturing.

|

20

Management’s Discussion and Analysis

The Overview of Financial Performance includes reference to “Gross Margin”, which is a non-IFRS financial measure that the Company defines as the difference between revenue and cost of revenues

divided by revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets. For more information on non-IFRS financial measures, see the “Non-IFRS Financial

Measures” and “Metrics and Non-IFRS Financial Measures” sections of the MD&A.

OPERATIONAL RESULTS

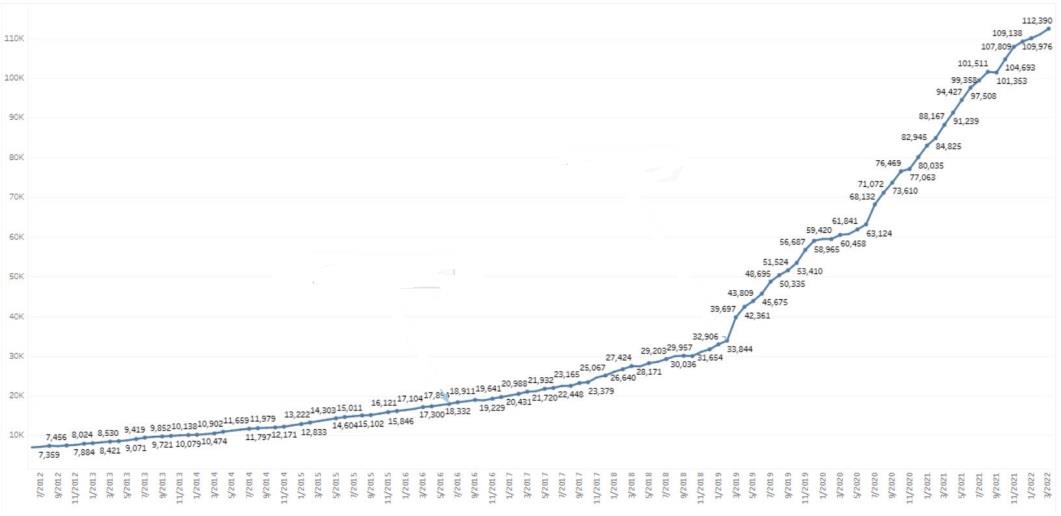

The Company believes that there are a number of key factors creating tailwinds to facilitate further industry growth. In Israel, the number of licensed medical patients has increased by 36% in

2021 and is expected to continue growing in the coming years and may further benefit from regulatory change liberalizing the cannabis market in Israel. Moreover, the acquisitions of the Israeli Pharmacies positions IM Cannabis as one of the

largest distributors of medical cannabis in Israel. In Canada, the adult-use recreational cannabis market is expected to grow from $1.07 billion in Q4 2021 ($4.3 billion annualized)9 to

$6.7 billion in annual sales by 2026.10 In Germany, the newly elected coalition government has endorsed the legalization of adult-use cannabis. While no specific legislation has yet been

tabled and any implementation will take time, the Company believes that Germany has the potential to be the second largest federally legal, adult-use market in the world. Additionally, the Company has seen an increase in the number of patients

paying out-of pocket for medical cannabis products in Germany, which the Company believes is supportive of its business plan as it relies less on the need for patients insurance coverage for re-imbursement. The outlook for the Company is further

supported by its focus on the cultivation and distribution of premium cannabis products exclusively, which the Company believes to be in the greatest demand in all of its markets, faces less competition, and therefore is less likely to face

significant price competition. Notwithstanding the above, the Israeli cannabis market has become increasingly competitive and the ability to import premium cannabis from Canada is a key determinant of success in Israel. The cannabis industry in

Canada remains highly competitive and generally oversupplied, particularly in value products, and in part due to the ongoing viability of the illicit market. The German medical cannabis market has been slower to develop due to the difficulty in

medical patients accessing prescriptions and insurance re-imbursements. In each of the Company’s markets, the Company must navigate evolving customer and patient trends in order to be competitive with other suppliers of medical cannabis products.

9 Based on HiFyre Data for period between October 1 – December 31, 2021.

10 BDSA, https://www.globenewswire.com/news-release/2021/09/21/2300624/0/en/BDSA-Reports-Global-Cannabis-Sales-Surge-41-YoY-in-2021-Will-Surpass-62-Billion-by-2026.html

21

Management’s Discussion and Analysis

REVENUES AND GROSS MARGINS

Revenues

The main revenues of the Group are generated from sales of medical cannabis products to customers in Israel and Germany as well as products to the recreational market in Canada. The three

reportable geographical segments in which the Company operates are Israel, Canada and Germany.

For the three months ended March 31:

|

Israel

|

Canada

|

Germany

|

Adjustments

|

Total

|

||||||||||||||||||||||||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||||||||||||||||||||

|

Revenues

|

$

|

12,403

|

$

|

4,344

|

$

|

10,568

|

$

|

1,256

|

$

|

598

|

$

|

3,167

|

$

|

-

|

$

|

-

|

$

|

23,569

|

$

|

8,767

|

||||||||||||||||||||

|

Inter-segment revenues

|

$

|

-

|

$

|

-

|

$

|

663

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

(663

|

)

|

$

|

-

|

$

|

-

|

$

|

-

|

|||||||||||||||||||

|

Total revenues

|

$

|

12,403

|

$

|

4,344

|

$

|

11,231

|

$

|

1,256

|

$

|

598

|

$

|

3,167

|

$

|

(663

|

)

|

$

|

-

|

$

|

23,569

|

$

|

8,767

|

|||||||||||||||||||

|

Segment income (loss)

|

$

|

(6,620

|

)

|

$

|

1,040

|

$

|

(2,690

|

)

|

$

|

763

|

)

|

$

|

(1,028

|

)

|

$

|

230

|

$

|

-

|

$

|

-

|

$

|

(10,338

|

)

|

$

|

507

|

|||||||||||||||

|

Unallocated corporate expenses

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

(1,211

|

)

|

$

|

(2,212

|

)

|

$

|

(1,211

|

)

|

$

|

(2,212

|

)

|

||||||||||||||||

|

Total operating (loss) income

|

$

|

(6,620

|

)

|

$

|

1,040

|

$

|

(2,690

|

)

|

$

|

(763

|

)

|

$

|

(1,028

|

)

|

$

|

230

|

$

|

(1,211

|

)

|

$

|

(2,212

|

)

|

$

|

(11,549

|

)

|

$

|

(1,705

|

)

|

||||||||||||

|

Depreciation & amortization

|

$

|

407

|

$

|

306

|

$

|

1,368

|

$

|

61

|

$

|

62

|

$

|

18

|

$

|

-

|

$

|

-

|

$

|

1,837

|

$

|

385

|

||||||||||||||||||||

The consolidated revenues of the Group for the three months ended March 31, 2022 were attributed to the sale of medical cannabis products in Israel and Germany, as well as from the sale of

adult-use recreational cannabis in Canada.

| ● |

Revenues for the three months ended March 31, 2022 and 2021 were $23,569 and $8,767, respectively, representing an increase of $14,802 or 169%. The increase in revenues was mainly attributed to the acquisitions

in Israel and Canada since March 31, 2021.

|

| ● |

Revenues from the Israeli operation were attributed to the sale of medical cannabis through the Company’s agreement with Focus and the consolidation of revenues from the Company’s acquisition of the Israeli

Pharmacies.

|

| ● |

Revenues from the Company’s Canadian operation include revenues from the sale of adult-use recreational cannabis in Canada through the acquisitions of TJAC and MYM.

|

| ● |

In Germany, Company revenues were attributed to the sale of medical cannabis through the Company’s subsidiary Adjupharm.

|

| ● |

Total dried flower sold for the three months ended March 31, 2022 was 3,035kg at an average selling price of $6.23 per gram compared to 1,185kg for the same period in 2021 at an average selling price of $4.94

per gram, derived mainly from the higher average selling price per gram the Company recognized through the acquisition of the Israeli pharmacies in Israel.

|

22

Management’s Discussion and Analysis

| ● |

The increase in revenues related to dried flower in the three months ended March 31, 2022 is attributable to deliveries made under the Focus’ sales agreements to pharmacies and revenues generated from Adjupharm,

Trichome, MYM, and the Israeli subsidiaries.

|

| ● |

Total other cannabis product sold for the three months ended March 31, 2022 was 1,085kg at an average selling price of $2.76 per gram as compared to $nil in the three months ended March 31, 2021. Other cannabis

products include kief, hash and pre-rolls and are attributable to Trichome and MYM and the sales of the WAGNERS, Highland and Sublime brands in 2022.

|

Cost of Revenues

Cost of revenues is comprised of cultivation costs, purchase of materials and finished goods, utilities, salary expenses and import costs, including the purchase of raw materials, production,

product testing, shipping and sales related costs. At harvest, the biological assets are transferred to inventory at their fair value which becomes the deemed cost for the inventory. Inventory is later expensed to the cost of sales when sold.

Direct production costs are expensed through the cost of sales.

The fair value of biological assets is categorized within Level 3 of the fair value hierarchy. The inputs and assumptions used in determining the fair value of biological assets include:

| 1. |

Selling price per gram - calculated as the weighted average historical selling price for all strains of cannabis sold by the Group, which is expected to approximate future selling prices.

|

| 2. |

Post-harvest costs - calculated as the cost per gram of harvested cannabis to complete the sale of cannabis plants post-harvest, consisting of the cost of direct and indirect materials, depreciation and labor as well as labelling and

packaging costs.

|

| 3. |

Attrition rate - represents the weighted average percentage of biological assets which are expected to fail to mature into cannabis plants that can be harvested.

|

| 4. |

Average yield per plant - represents the expected number of grams of finished cannabis inventory which are expected to be obtained from each harvested cannabis plant.

|

| 5. |

Stage of growth - represents the weighted average number of weeks out of the average weeks growing cycle that biological assets have reached as of the measurement date. The growing cycle is

approximately 12 weeks.

|

23

Management’s Discussion and Analysis

The following table quantifies each significant unobservable input, and also provides the impact that a 10% increase/decrease in each input would have on the fair value of biological assets grown

by the Company:

|

10% change as of

|

||||||||||||||||

|

March 31,

2022

|

December 31,

2021

|

March 31,

2022

|

December 31,

2021

|

|||||||||||||

|

In CAD

|

In Thousands of CAD

|

|||||||||||||||

|

Average selling price per gram of dried cannabis

|

$

|

3.79

|

$

|

3.64

|

$

|

474

|

$

|

296

|

||||||||

|

Average post-harvest costs per gram of dried cannabis

|

$

|

0.77

|

$

|

1.16

|

$

|

280

|

$

|

140

|

||||||||

|

Attrition rate

|

27

|

%

|

27

|

%

|

410

|

100

|

||||||||||

|

Average yield per plant (in grams)

|

48

|

47

|

392

|

228

|

||||||||||||

|

Average stage of growth

|

53

|

%

|

47

|

%

|

387

|

212

|

||||||||||

| ● |

The cost of revenues for the three months ended March 31, 2022 and 2021 were $17,215 and $4,140, respectively, representing an increase of $13,075 or 316%.

|

Focus, Highland and TJAC expect net cost of revenues to vary from quarter to quarter based on the number of pre-harvest plants, after harvest plants, the strains being grown and technological progress in the trimming

machines.

Gross Profit

The Company’s formula for calculating gross profit includes:

| ● |

production costs (current period costs that are directly attributable to the cannabis growing and harvesting process);

|

| ● |

materials and finished goods purchase costs;

|

| ● |

a fair value adjustment on sale of inventory (the change in fair value associated with biological assets that were transferred to inventory upon harvest); and

|

| ● |

a fair value adjustment on growth of biological assets (the estimated fair value less cost to sell of biological assets as at the reporting date).

|

Gross profit also includes the net change in fair value of biological assets, inventory expensed and production costs. Biological assets consist of cannabis plants at various after-harvest stages

which are recorded at fair value less costs to sell after harvest.

Gross profit for the three months ended March 31, 2022 and 2021 was $6,570 and $5,028, respectively, representing an increase of $1,542 or 31%.

24

Management’s Discussion and Analysis

Gross profit included gains (losses) from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $216 and $401 for the three months ended

March 31, 2022 and 2021, respectively. Fair value adjustments were impacted primarily due to lower valuation to unrealized biological assets during the three months ended March 31, 2022.

EXPENSES

General and Administrative

General and administrative expenses for the three months ended March 31, 2022 and 2021 were $9,042 and $4,913, respectively, representing an increase of $4,129 or 84%.

The increase in the general and administrative expense is mainly attributable to the growing corporate activities in Israel and Canada following the Company’s acquisitions in 2021. The expenses

derived mainly from professional services, legal fees and other consulting services. The general and administrative expenses are comprised mainly from salaries to employees in the amount of $3,192, professional fees in the amount of $2,022,

depreciation and amortization in the amount of $920, and insurance costs in the amount of $841.

Selling and Marketing

Selling and marketing expenses for the three months ended March 31, 2022 and 2021 were $3,720 and $1,190, respectively, representing an increase of $2,530 or 213%. The increase in the selling and

marketing expenses was due mainly to the Company’s increased marketing efforts in Israel, brand launch in Germany, and increased distribution expenses relating to the growth in sales and consolidation of selling and marketing expenses of entities

acquired in 2021.

Share-Based Compensation

Share-based compensation expense for the three months ended March 31, 2022 and 2021 was $1,610 and $630, respectively, representing an increase $980 or 156%. The increase was mainly due to the

grant of new incentive stock options (“Options”).

Financing

Financing income (expense), net, for the three months ended March 31, 2022 and 2021 was $555 and $6,923, respectively, representing a decrease of $6,368 or 92%. The change for the period was

mainly due to the updated valuation of the Company’s 2019 Broker Compensation Options, the 2019 Listed Warrants, the 2019 Unlisted Warrants, the 2021 Broker Compensation Options and the 2021 Offered Warrants (collectively, the “Warrants”) and other financial instruments affected by the Company’s decreased share price in the amount of $2,688 and $7,160 respectively.

NET INCOME/LOSS

Net income (loss) for the three months ended March 31, 2022 and 2021 was $(10,741) and $4,715, respectively, representing a net loss increase of $15,456 or 328%. The net loss increase related to

factors impacting net income from operations described above, and finance income driven by revaluation of warrants and other financial instruments in the amount of $2,688, which were recorded against liability on the grant day and were

re-evaluated at March 31, 2022 through profit or loss.

25

Management’s Discussion and Analysis

NET INCOME (LOSS) PER SHARE BASIC AND DILUTED

Basic loss per share is calculated by dividing the net profit attributable to holders of Common Shares by the weighted average number of Common Shares outstanding during the period. Diluted

profit per Common Share is calculated by adjusting the earnings and number of Common Shares for the effects of dilutive warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the denominator in

calculating diluted profit per Common Share excludes unissued Common Shares related to Options as they are antidilutive. Basic Income (Loss) per Common Share for the three months ended March 31, 2022 and 2021 were $(0.14) and $0.11 per Common

Share, respectively.

Diluted Income (Loss) per Common Share for the three months ended March 31, 2022 and 2021 were $(0.17) and $(0.06) per Common Share, respectively.

TOTAL ASSETS

Total assets as at March 31, 2022 were $281,068, compared to $287,388 as at December 31, 2021, representing a decrease of $6,320 or 2%. This decrease was primarily due to restructuring of and the

resulting depreciation of right-of-use assets and property plant and equipment in the amount of approximately $3,385.

Intangible Assets

On March 18, 2021, the Trichome Transaction was completed whereby the Company acquired all of the issued and outstanding securities of Trichome for a total Common Share consideration valued at

approximately $99,028. Upon completion of the Trichome Transaction, the businesses of IM Cannabis and Trichome have been combined.

| ● |

Through the Trichome Transaction, the Company recognized goodwill of approximately $67,269 and intangible assets, primarily attributed to the cultivation license, worth approximately $6,458 (based on a

preliminary purchase price allocation). The goodwill arising on acquisition is attributed to the expected benefits from the synergies of the combination of the activities of the Company and Trichome, as well as value attributed to the

assembled workforce, which is included in goodwill. The goodwill recognized is not expected to be deductible for income tax purposes.

|

| ● |

The Company recognized the fair value of the assets acquired and liabilities assumed in the business combination according to a provisional measurement. The purchase consideration and the fair value of the

acquired assets and liabilities may be adjusted within 12 months from the acquisition date. At the date of final measurement, adjustments are generally made by restating comparative information previously determined provisionally. As of

the date of the Interim Financial Statements, a final valuation for the fair value of the identifiable assets acquired and liabilities assumed by an external valuation specialist had been obtained.

|

26

Management’s Discussion and Analysis

On July 9, 2021, the Company completed the MYM Transaction. As a result, the company recognized goodwill of approximately $39,932 and intangible assets consisting of brand name and customer

relationships worth approximately $17,200 (based on a preliminary purchase price allocation study). The goodwill arising on acquisition is attributed to the expected benefits from the synergies of the combination of the activities of the Company

and MYM, as well as value attributed to the assembled workforce, which is included in goodwill. The goodwill recognized is not expected to be deductible for income tax purposes.

| ● |

The Company recognized the fair value of the assets acquired and liabilities assumed in the business combination according to a provisional measurement. As of the date of the approval of the Interim Financial

Statements, a final valuation for the fair value of the identifiable assets acquired and liabilities assumed by an external valuation specialist has not been obtained. The purchase consideration and the fair value of the acquired assets

and liabilities may be adjusted within 12 months from the acquisition date. At the date of final measurement, adjustments are generally made by restating comparative information previously determined provisionally.

|

Investment in Xinteza

On December 26, 2019, IMC Holdings entered into a share purchase agreement with Xinteza API Ltd. (“Xinteza”), a company with a unique

biosynthesis technology, whereby the Company acquired, on an as-converted and fully diluted basis, 25.37% of Xinteza’s outstanding share capital, for consideration of US$1,700 (approximately $2,165 as of December 31, 2021) paid in several

installments (the “Xinteza SPA”). As of March 31, 2022, the Company has paid all outstanding installments pertaining to the Xinteza SPA and currently holds 23.35% of the outstanding share capital of Xinteza on an as-converted and fully diluted

basis. On February 24, 2022, IMC Holdings entered into a simple agreement for future equity with Xinteza, under which IMC Holdings paid US$100 (approximately $125), in exchange for right to certain shares of Xinteza.

TOTAL LIABILITIES

Total liabilities as at March 31, 2022 were $82,708, compared to $82,443 at December 31, 2021, representing an decrease of $265 or nil%. The decrease was mainly due to a decrease of $3,203 in

purchase consideration payable and $2,675 in Warrants, offset by an increase of $6,024 in bank loans and $1,080 in trade payables.

27

Management’s Discussion and Analysis

LIQUIDITY AND CAPITAL RESOURCES

For the three months ended March 31, 2022, the Company recorded revenues of $23,569. In addition, Company collected $333 in proceeds from the exercises of warrants, 2019 Broker Compensation

Options (defined below) and Options.

In the plan for use of available funds mentioned in the Company’s Base Shelf Prospectus, the Company have provided the following information:

|

Uses of Available Funds (Net)

|

Amount ($)

|

Actual amount used ($)

|

Variances

|

|||||||||

|

CAPEX Activities

|

$

|

4,340

|

$

|

2,758

|

$

|

(1,582

|

)

|

|||||

|

M&A and investments

|

$

|

14,880

|

$

|

16,510

|

$

|

1,630

|

||||||

|

Working capital

|

$

|

11,750

|

$

|

11,750

|

$

|

-

|

||||||

|

General corporate activities

|

$

|

8,652

|

$

|

8,604

|

$

|

48

|

||||||

|

TOTAL

|

$

|

39,622

|

$

|

39,622

|

$

|

-

|

||||||

Variances in use of proceeds:

Capital Expenditure Activities – The Company made an analysis process regarding its capital expenditure activities in Israel at the end of 2021. Due to its strategic review the company lowered

its capital expenditure investments in Israel.

M&A Activity – Following the completion of the Trichome Transaction and MYM Transaction, the Company continued its M&A strategy in Israel and paid additional $1,630 in connection with the

acquisitions of the Israeli Pharmacies.

Additional Liquidity

On May 14, 2021, the Company’s subsidiary, TJAC, entered into the Revolver for $5,000 with a private Canadian creditor. The Revolver has an initial term of 12 months that can be extended upon the

mutual agreement of both parties. Per annum interest is equal to the greater of (i) 9.75% and, (ii) the Toronto Dominion Bank prime rate, plus 7.30%. The Revolver has a standby fee of 2.40% per annum, which is charged against the unused portion.

Advanced amounts are secured against the assets of TJAC and Trichome, with Trichome providing a guarantee for the Revolver. To maintain the Revolver, TJAC must abide by certain financial covenants, such as

the maintenance of a tangible net worth greater than $5,000 and a debt service coverage ratio of 2:1. On September 23, 2021, TJAC increased the limit on the Revolver from $5,000 to $7,500 and added Highland’s assets to the Revolver borrowing

base. The increase will be used to finance TJAC and MYM’s receivables in order to manage the timing of cash flows. On October 18, 2021, TJAC and MYM increased the limit on the Revolver to $10,000. The increase will be used to finance TJAC and

MYM’s receivables in order to manage the timing of cash flows. On March 29, 2022, the limit on the Revolver increased from $10,000 to $15,000 and was renewed for an additional 12 months.

28

Management’s Discussion and Analysis

In January 2022, Focus entered into the Mizrahi Facility which is guaranteed by certain Focus assets. Advances from the Mizrahi Facility will be used for working capital needs. The Mizrahi

Facility has a total commitment of up to NIS 15,000 (approximately $6,000) and has a one-year term for on-going needs and 6-month term for imports and purchases needs. The Mizrahi Facility is renewable upon mutual agreement by the parties. The

borrowing base available for draw at any time throughout the Mizrahi Facility and is subject to several covenants to be measured on a quarterly basis. The Mizrahi Facility bears interest of Israeli prime interest plus 1.5% (approximately 3.3%)

per annum.

The Company believes that the generated cash flow from working capital in the different jurisdictions in which it operates, as well as future financing rounds and debt raises will meet all of its

future capital requirements. In evaluating its capital requirements and the ability to fund the execution of its strategy, the Company believes it has adequate availability to meet its working capital and other operating requirements, fund growth

initiatives and capital expenditures, settle its liabilities, and repay scheduled principal and interest payments on debt for at least the next twelve months.

The Company has ensured that it has access to public capital markets through its CSE and NASDAQ listings and continues to review and pursue selected external financing sources to ensure adequate

financial resources. These potential sources include, but are not limited to (i) obtaining financing from traditional or non-traditional investment capital organizations and (ii) obtaining funding from the sale of the Company’s securities. There

can be no assurance that we will gain adequate market acceptance for our products or be able to generate sufficient positive cash flow to achieve our business plans. We expect to continue funding these purchases with our available cash, cash

equivalents and short-term investments. Therefore, we are subject to risks including, but not limited to, our inability to raise additional funds through financings to support our continued development, including capital expenditure requirements,

operating requirements and to meet our liabilities and commitments as they come due.

As at March 31, 2022, the Company had a working capital surplus of $25,647, compared to working capital surplus of $29,955 as at December 31, 2021. The decrease in working capital of $4,308 was

primarily due to increase in inventory, trade and other receivables, offset by trade and other payables including purchase consideration payable. As of March 31, 2022, the Company had a cash balance of $10,315.

As at March 31, 2022, the Group’s financial liabilities consisted of accounts payable and other accounts payable which have contractual maturity dates within one year. The Group manages its

liquidity risk by reviewing its capital requirements on an ongoing basis. Based on the Group’s working capital position at March 31, 2022, management considers liquidity risk to be low.

As at March 31, 2022, the Group has identified the following liquidity risks related to financial liabilities (undiscounted):

|

Less than one year

|

1 to 5 years

|

6 to 10 years

|

> 10 years

|

|||||||||||||

|

Contractual Obligations

|

$

|

28,738

|

$

|

11,478

|

$

|

14,342

|

-

|

|||||||||

29

Management’s Discussion and Analysis

The maturity profile of the Company’s other financial liabilities (trade payables, other account payable and accrued expenses, and warrants) as of March 31, 2022 are less than one year.

|

Payments Due by Period

|

||||||||||||||||||||

|

Contractual Obligations

|

Total

|

Less than one year

|

1 to 3 years

|

4 to 5 years

|

After 5 years

|

|||||||||||||||

|

Debt

|

$

|

25,903

|

$

|

25,525

|

$

|

378

|

$

|

-

|

$

|

-

|

||||||||||

|

Finance Lease Obligations

|

$

|

28,519

|

$

|

3,077

|

$

|

5,845

|

$

|

5,255

|

$

|

14,342

|

||||||||||

|

Operating Leases

|

$

|

136

|

$

|

136

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||

|

Purchase Obligations1

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||

|

Other Obligations2

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||

|

Total Contractual Obligations

|

$

|

54,558

|

$

|

28,738

|

$

|

6,223

|

$

|

5,255

|

$

|

14,342

|

||||||||||

Notes:

1 “Purchase Obligation” means an agreement to purchase goods or services that is enforceable and legally binding on the Company that specifies all significant terms, including: fixed

or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

2 “Other Obligations” means other financial liabilities reflected on the Company’s statement of financial position.

The Interim Financial Statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will continue in operation for the