Exhibit 99.1

IM CANNABIS CORP.

STATEMENT OF EXECUTIVE COMPENSATION

DATED MAY 20, 2022

The following information is presented in accordance with National Instrument 51-102 – Continuous Disclosure Obligations ("NI 51-102") and Form 51-102F6 – Statement of Executive Compensation ("Form 51-102F6"),

and sets forth compensation for each Named Executive Officer (as defined below) and director of IM Cannabis Corp. (the "Company") during the

financial year ending December 31, 2021. This Statement of Executive Compensation is dated for reference May 20, 2022. All monetary amounts herein are expressed in Canadian Dollars ("$") unless otherwise stated.

STATEMENT OF EXECUTIVE COMPENSATION

Under applicable securities legislation, the Company is required to disclose certain financial and other information relating to the

compensation of the Chief Executive Officer ("CEO"), the Chief Financial Officer ("CFO") and each of the three most highly compensated executive officers of the Company, including any of its subsidiaries, as at the date of this Statement of Executive Compensation whose total compensation

was more than $150,000 for the financial year of the Company ended December 31, 2021, other than the CEO and CFO (collectively the "Named Executive

Officers"), and for the directors of the Company.

Compensation Discussion and Analysis

Introduction

The Compensation Discussion and Analysis section of this Statement of Executive Compensation sets out the

objectives of the Company's executive compensation arrangements, the Company's executive compensation philosophy and the application of this philosophy to the Company's executive compensation arrangements.

When determining the compensation arrangements for the Named Executive Officers, the board of directors of the

Company (the "Board") considers the objectives of: (i) retaining an executive critical to the success of the Company and the enhancement of

shareholder value; (ii) providing fair and competitive compensation; (iii) balancing the interests of management and shareholders of the Company; and (iv) rewarding performance, both on an individual basis and with respect to the business in general.

Benchmarking

In determining the compensation level for each executive, the Board looks at factors such as the relative complexity

of the executive's role within the organization, the executive's performance and potential for future advancement, the compensation paid by other companies in the same industry as the Company, and pay equity considerations.

Elements of Compensation

The compensation paid to executive officers in any year consists of three (3) primary components:

| 1. |

base salary;

|

| 2. |

cash bonuses; and

|

| 3. |

long-term incentives.

|

The Company believes that making a significant portion of executive officers' compensation based on long-term

incentives supports the Company's executive compensation philosophy, as these forms of compensation allow those most accountable for the Company's long-term success to acquire and hold the Company's shares. The key features of these three primary

components of compensation are discussed below:

| 1. |

Base Salary

|

Base salary recognizes the value of an individual to the Company based on his or her role, skill, performance,

contributions, leadership and potential. It is critical in attracting and retaining executive talent in the markets in which the Company competes for talent. Base salaries for executive officers are reviewed annually. Any change in the base salary of

an executive officer is generally determined by an assessment of such executive's performance, a consideration of competitive compensation levels in companies similar to the Company and a review of the performance of the Company as a whole and the

role such executive officer played in such corporate performance.

| 2. |

Cash Bonuses

|

Cash bonuses for the executive officers are determined by reference to the Company's actual performance relative to

objectives and individual contributions toward such performance. All awards made to executive officers are subject to the review and approval of the Company's compensation committee (the "Compensation Committee") and the Board and are examined in absolute terms as well as in relation to peer company performance.

| 3. |

Long Term Incentives

|

Long term incentives, such as options of the Company (the "Options") and restricted share units of the Company (the "RSUs") are provided to focus

management's attention on corporate performance over a period of time longer than one year in recognition of long term horizons for return on investments and strategic decisions. The number of Options and/or RSUs given to each executive officer is

determined by his or her position, past contribution and potential future contributions to the Company and the number and terms of Options and RSU awards previously granted to the executive officer. The securities based awards granted under the stock

option plan (the "Stock Option Plan") and the restricted share unit plan (the "RSU Plan" and together with the Stock Option Plan, the "Securities Based Compensation Arrangements") are

reviewed by the Compensation Committee. The Compensation Committee determines a meaningful level of award for executive officers of the Company. The number of Options and RSUs are also influenced by the number of officers and key employees in the

current year and the likelihood of grants in future years to officers and key employees since the aggregate number of common shares of the Company ("Common

Shares") available for issuance pursuant to all Securities Based Compensation Arrangements cannot exceed 10% of the Company's issued Common Shares on a rolling basis.

Other than the Securities Based Compensation Arrangements, the Company does not have any other long-term incentive

plans pursuant to which securities or cash compensation is intended to serve as an incentive for performance over a period greater than one financial year.

The Compensation Committee and the Board have not formally assessed the implications of the risks associated with

the Company's compensation policies and practices.

Under the stock trading policy adopted by the Company on November 26, 2020, as amended from time to time, executive

officers and directors are strongly discouraged but are not prohibited from purchasing financial instruments; however, the Company does not have any policies which prohibit the

purchase of financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation.

Stock Option Plan

The Stock Option Plan was approved by the shareholders of the Company at the annual and special meeting of shareholders held on July 28,

2021 and replaced the previous stock option plan of the Company (the "Predecessor Stock Option Plan"). The Predecessor Stock Option Plan continues

to exist but only for the purpose of governing the terms of Options that were granted under the Predecessor Stock Option Plan prior to the adoption of the Stock Option Plan.

The purpose of the Stock Option Plan is to provide the Company with the advantages of the incentive inherent in equity ownership on the

part of directors, executive officers, employees and consultants (collectively, the "Eligible Persons") who are responsible for the continued

success of the Company; to create in those Eligible Persons a proprietary interest in, and a greater concern for, the welfare and success of the Company; to encourage Eligible Persons to remain with the Company and any subsidiaries; and to attract

new employees, directors, officers and consultants.

The Stock Option Plan will be administered by the Board, and the Board may delegate its powers, rights and obligations to a committee.

The Company's Compensation Committee will be responsible for determining which directors, officers, employees and consultants shall be granted Options.

The Board will have the authority to grant Options to Eligible Persons and subject to the policies of the Canadian stock exchange upon

which the Common Shares principally trade, will determine the terms and conditions applicable to the exercise of those Options including the number of Common Shares issuable under each Option, the exercise price, the expiry date, vesting conditions,

if any, the nature and duration of the restrictions, if any, to be imposed on the sale or other disposition of Common Shares acquired on exercise of the Option, and the events, if any, that give rise to a termination or expiry of the Option

participant's rights under the Option, and the period in which such termination or expiry can occur. Notwithstanding the foregoing, the maximum term of any Option granted under the Stock Option Plan will be ten years. The Stock Options Plan provides

for a cashless exercise procedure.

The total number of Common Shares that may be reserved for issuance to all directors and executive officers as a group under the Stock

Option Plan and any other Securities Based Compensation Arrangements, in aggregate, will not exceed, at any time, or within any 12-month period, 10% of the issued and outstanding Common Shares, on a non-diluted basis, as at the date of grant of any

Options under the Stock Option Plan.

The total number of Common Shares that may be reserved for issuance and granted to any one Executive (as defined in the Stock Option

Plan) under the Stock Option Plan and all other Securities Based Compensation Arrangements, in aggregate, will not exceed at any time, or within a 12-month period, 5% of the issued and outstanding Common Shares, on a non-diluted basis, as at the date

of grant of any Options under the Stock Option Plan.

The total number of Common Shares that may be reserved for issuance and granted to persons engaging in investor relations activities

under the Stock Option Plan and all other Securities Based Compensation Arrangements, in aggregate, will not exceed at any time, or within a 12-month period, 1% of the issued and outstanding Common Shares, on a non-diluted basis, as at the date of

grant of any Options under the Stock Option Plan.

Annual shareholder approval is not required for the Stock Option Plan. The Board may terminate the Stock Option Plan at any time in its

absolute discretion, without shareholder approval. If the Stock Option Plan is terminated, no further Options will be granted, but the Options then outstanding will continue in full force and effect in accordance with the provisions of the Stock

Option Plan until the time they are exercised or terminated or expire under the terms of the Stock Option Plan and the applicable Option agreement.

RSU Plan

The RSU Plan was approved by shareholders at a special meeting of shareholders held on December 16, 2020. The RSU Plan was established

to provide a financial incentive for employees, consultants and directors of the Company, to devote their best efforts towards the long-term success of the Company's business, by aligning qualified participants' financial interests with those of the

Company and its shareholders, to assist the Company in attracting and retaining individuals with top-level talent, passion, ability, and an overall commitment to the

business of the Company, and to ensure that the total compensation provided to such participants is at competitive levels. Accordingly, the RSU Plan is intended to supplement the Company's other Securities Based Compensation Arrangements provided

that the aggregate issuances under the RSU Plan and all other the Securities Based Compensation Arrangements do not exceed 10% of the issued and outstanding Common Shares on a non-diluted basis immediately prior to the proposed grant of the

applicable RSUs.

The RSU Plan provides that RSUs may be granted by the Board, or if delegated to a committee of the Board, by the Compensation Committee,

to directors, executive officers, employees and consultants of the Company (each an "RSU Participant"). The Compensation Committee determines from time to time the RSU Participants to whom RSUs are granted and the provisions and restrictions with respect to such grant. The Compensation

Committee takes into consideration the present and potential contributions of and the services rendered by the particular RSU Participant to the success of the Company and any other factors which the Compensation Committee deems appropriate and

relevant.

Each RSU entitles the RSU Participant, subject to the RSU Participant's satisfaction of any conditions, restrictions or limitations

imposed under the RSU Plan or RSU grant letter, to receive: (i) one previously unissued Common Share for each RSU; or (ii) a cash payment equal to the number of RSUs multiplied by the fair market value of one Common Share on the vesting date; or

(iii) a combination of (i) and (ii), as determined by the Board or Compensation Committee, on the date when the RSU is fully vested. Concurrent with the determination to grant RSUs to a RSU Participant, the Compensation Committee also determines the

vesting schedule applicable to such RSUs, which shall extend no later than December 15th of the third calendar year following the calendar year in which the grant occurred in respect of the RSUs.

RSU grants are subject to additional limitations under the terms of the RSU Plan. Unless permitted by the Canadian Securities Exchange

(the "CSE") or approved by disinterested shareholders:

| (a) |

the maximum number of RSUs available for grant to any one person under the RSU Plan and any other Securities Based Compensation Arrangements of the Company in a 12

month period is 5% of the total number of Common Shares then outstanding on a non-diluted basis; and

|

| (b) |

the maximum number of Common Shares issuable to insiders of the Company (as a group) under the RSU Plan, together with any other Common Shares issuable under any other

Securities Based Compensation Arrangements, shall not exceed at any time or within any 12 month period, 10% of the issued and outstanding Common Shares on a non-diluted basis at the time of grant.

|

Further, the total number of Common Shares issuable to any RSU Participant performing investor relations activities over any 12 month

period, pursuant to the RSU Plan and together with any other Common Shares issuable under any other Securities Based Compensation Arrangements, cannot exceed 1% of the issued and outstanding number of Common Shares then outstanding on a non-diluted

basis at the time of grant.

The Board or the Compensation Committee, as the case may be, may terminate, discontinue or amend the RSU Plan at any time, provided

that, without the consent of an RSU Participant, such termination, discontinuance or amendment may not in any manner adversely affect such RSU Participant's rights under any RSU granted to such RSU Participant under the RSU Plan.

The Board or the Compensation Committee may, subject to the receipt of shareholder approval and the receipt of any regulatory approval

including any stock exchange approval (where required), make the following amendments to the RSU Plan or RSUs under the RSU Plan:

| (a) |

increase the number of Common Shares which may be issued pursuant to the RSU Plan, other than by virtue of a change in Common Shares, whether by reason of a stock

dividend, consolidation, subdivision or reclassification which adjustment may be made by the Board or Compensation Committee for the number of Common Shares available under the RSU Plan and the number of Common Shares subject to RSUs;

|

| (b) |

amend the definition of "Participant" under the RSU Plan which would have the potential of narrowing, broadening or increasing insider participation;

|

| (c) |

amendments to cancel and reissue RSUs;

|

| (d) |

amendments to the list of amendments to the RSU Plan or RSUs requiring requisite regulatory and shareholder approval and those subject to requisite regulatory approval

(where required) but not subject to shareholder approval;

|

| (e) |

amendments that extend the term of an RSU;

|

| (f) |

amendments to the participation limits including: the maximum number of shares issuable under the RSU Plan, limitations on grants of RSUs to any one person in a

12-month period, grants within a one year period to insiders, and the number of shares issuable to a person providing investor relations activities in any 12-month period; and

|

| (g) |

amendments to the RSU Plan that would permit RSUs, or any other right or interest of a RSU Participant under the RSU Plan, to be assigned or transferred, other than for

normal estate settlement purposes.

|

The Board or the Compensation Committee may, subject to receipt of requisite regulatory approval (where required), but not subject to

shareholder approval, in its sole discretion make all other amendments to the RSU Plan or RSUs under the RSU Plan that are not of the type contemplated above, including, without limitation:

| (a) |

amendments of a housekeeping nature;

|

| (b) |

amendments to the vesting provisions of a RSU or the RSU Plan;

|

| (c) |

amendments to the definitions, other than such definitions noted above;

|

| (d) |

amendments to reflect changes to applicable securities laws; and

|

| (e) |

amendments to ensure that the RSUs granted under the RSU Plan will comply with any provisions respecting income tax and other laws in force in any country or

jurisdiction of which a RSU Participant to whom a RSU has been granted may from time to time be a resident, citizen or otherwise subject to tax therein.

|

Except as otherwise may be expressly provided for under the RSU Plan or pursuant to a will or by the laws of descent and distribution,

no RSU and no other right or interest of a RSU Participant is assignable or transferable, and any such assignment or transfer in violation of the RSU Plan is deemed to be null and void.

In the event there is any change in the Common Shares, whether by reason of a stock dividend, consolidation, subdivision or

reclassification, an appropriate adjustment will be made by the Board or Compensation Committee in the number of Common Shares available under the RSU Plan and the number of Common Shares subject to any RSUs. If the foregoing adjustment results in a

fractional Common Share, the fraction shall be rounded down to the nearest whole number. All such adjustments are conclusive, final and binding for all purposes of the RSU Plan.

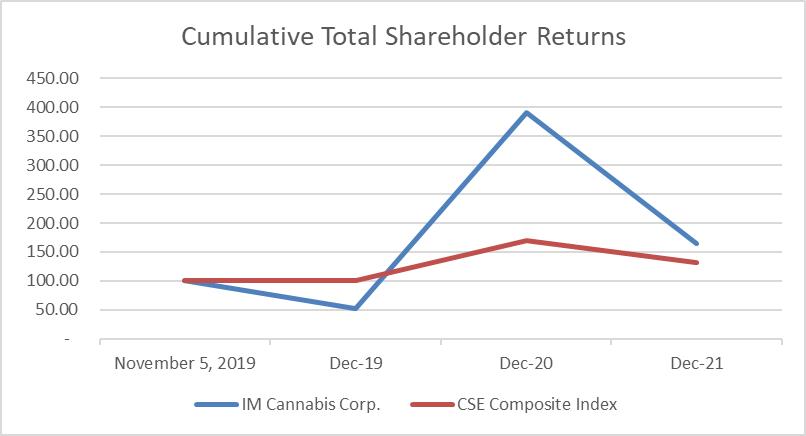

Performance Graph

The following graph compares the cumulative total shareholder return by comparing a $100 investment in Common Shares on November 5, 2019

(the date the Company commenced trading on the CSE following the completion of its reverse takeover transaction with I.M.C. Holdings Ltd.) to the cumulative shareholder return of the CSE Composite Index for the same period.

|

November 5, 2019

|

December 2019

|

December 2020

|

December 2021

|

|

|

IM Cannabis Corp.

|

100.00

|

53.04

|

391.56

|

164.58

|

|

CSE Composite Index

|

100.00

|

99.79

|

170.08

|

130.95

|

The Board is of the view that the Company's management, including each of the Named Executive Officers, delivered excellent value to

shareholders since the completion of the Company's reverse takeover transaction and beginning of trading on the CSE on November 5, 2019. As evidenced by the performance graph above, the Common Shares outperformed the CSE Composite Index during such

period; however, the trend shown in the above graph does not necessarily correspond to the Company's compensation to its Named Executive Officers for such period. The Board considered the high-quality contributions by each executive in achieving

notable milestones in business development and execution of the Company's strategic plans. Executive compensation during this period is reflective of the dedication and loyalty to grow the Company and to continue towards its goal of becoming a

leading global premium cannabis producer and purveyor.

Share-Based and Option-Based Awards

The Company recognizes the importance of share-based and option-based awards for retaining employees and keeping them motivated. New

grants to employees are made based on the role and position of the employee, with consideration given to the limits imposed by the Company's Securities Based Compensation Arrangements.

The role of the Compensation Committee is to review management's recommendations and provide feedback related to security based

compensation. During the two most recently completed financial years, the Company retained the services of PricewaterhouseCoopers ("PwC") and

Niagara Street HR Consulting Inc., respectively ("Niagara"), to provide guidance on the compensation of top management and directors.

Compensation Governance

The Compensation Committee

The Compensation Committee is responsible for, among other things, developing and monitoring the Company's overall

approach to compensation issues and implementing and administering a system of compensation that provides for competitive base salaries. The Compensation Committee

conducts an annual review of the Company's compensation issues and practices, including corporate goals and objectives relative to the compensation of the CEO and other senior officers, and makes a comprehensive set of recommendations to the Board

during each calendar year. The Compensation Committee is comprised of three independent directors, being Ms. Haleli Barath, Ms. Vivian Bercovici, and Mr. Brian Schinderle. During meetings of the Compensation Committee, the primary goal as they relate

to compensation matters are to ensure that the compensation provided to the Named Executive Officers and other senior officers and Executives are determined with regard to the Company's business strategies and objectives, such that the financial

interest of the executive officers are aligned with the financial interest of shareholders, and to ensure that their compensation is fair and reasonable and sufficient to attract and retain qualified and experienced executives. The Company uses the

benchmark method in order to determine the compensation for its directors and executive officers. Under the benchmark method, more than ten similar companies are reviewed in order to ensure that compensation to directors and executive officers is

within the market range.

The Board looks to the past experience of each director in determining the composition of the Compensation

Committee and strives to include a range of skills and experiences when making appointments to ensure the Compensation Committee is comprised of directors that act independently and think analytically about the Company's compensation practices. As a

whole, each of the members of the Compensation Committee have direct experience and skills relevant to their responsibilities in executive compensation, including with respect to enabling such directors in making informed decisions on the suitability

of the Company's compensation policies and practices.

Executive Compensation-Related Fees

"Executive Compensation-Related Fees" consist of fees for professional services billed by each consultant or

advisor, or any of its affiliates, that are related to determining compensation for any of the Company's directors and executive officers. In August 2020, the Company retained PwC to act as its compensation advisor and to build a compensation plan

for the Company's directors and executive officers. PwC billed the Company $14,000 in Executive Compensation-Related Fees for the year ended December 31, 2020. Niagara billed the Company $50,000 in Executive Compensation-Related Fees for the year

ended December 31, 2021.

All Other Fees

"All Other Fees" consist of fees for services that are billed by each consultant or advisor mentioned above and

which are not reported under "Executive Compensation-Related Fees". Neither PwC nor Niagara billed the Company for any other fees during the fiscal years ended December 31, 2021 and December 31, 2020.

Summary Compensation Table

The following table (presented in accordance with Form 51-102F6 under NI 51-102) sets out all direct and indirect

compensation for, or in connection with, services provided to the Company and its subsidiaries for the three most recently completed financial years of the Company in respect of the Named Executive Officers of the Company.

|

Name and Principal Position

|

Year(1)

|

Salary

($)

|

Share-Based Awards

($)

|

Option-Based Awards

($) (7)

|

Non-Equity Incentive Plan Compensation

($)

|

All Other

Compensation ($)

|

Total

Compensation ($)

|

|

|

Annual Incentive Plans

|

Long-Term Incentive Plans

|

|||||||

|

Oren Shuster(1)

CEO and Director

|

2021

|

515,731

|

Nil

|

562,018

|

121,000

|

Nil

|

Nil

|

1,198,749

|

|

2020

|

424,492

|

Nil

|

202,743

|

110,000

|

Nil

|

4,577

|

741,812

|

|

|

2019

|

357,409

|

Nil

|

371,917

|

Nil

|

Nil

|

Nil

|

729,326

|

|

|

Shai Shemesh(2)

CFO

|

2021

|

300,607

|

Nil

|

408,653

|

82,500

|

Nil

|

Nil

|

791,760

|

|

2020

|

249,960

|

Nil

|

112,390

|

75,000

|

Nil

|

Nil

|

437,350

|

|

|

2019

|

164,172

|

Nil

|

98,278

|

Nil

|

Nil

|

Nil

|

262,450

|

|

|

Marc Lustig

Executive Chairman and Director(3) (6)

|

2021

|

264,000

|

1,286,498

|

329,846

|

Nil

|

Nil

|

Nil

|

1,880,344

|

|

2020

|

90,000

|

Nil

|

1,059,085

|

Nil

|

Nil

|

500,000

|

1,649,085

|

|

|

2019

|

99,629

|

Nil

|

699,955

|

Nil

|

Nil

|

Nil

|

799,584

|

|

|

Michael Ruscetta

Chief Executive Officer of a subsidiary(4)

|

2021

|

201,250

|

Nil

|

675,719

|

175,000

|

Nil

|

Nil

|

1,051,969

|

|

2020

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

|

2019

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

|

Howard Steinberg

Chief Executive Officer of a subsidiary(5)

|

2021

|

480,000

|

Nil

|

675,719

|

400,000

|

Nil

|

Nil

|

1,555,719

|

|

2020

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

|

2019

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Notes

| (1) |

Mr. Shuster was appointed CEO and director of the Company on October 11, 2019. Mr. Shuster does not earn consideration for his role as a director of the Company.

|

| (2) |

Mr. Shemesh was appointed CFO of the Company on October 11, 2019.

|

| (3) |

Mr. Lustig was appointed Executive Chairman of the Company on December 29, 2020. Mr. Lustig does not earn consideration for his role as a director of the Company.

|

| (4) |

Mr. Ruscetta is the Chief Executive Officer of Trichome Financial Corp. ("Trichome").

|

| (5) |

Mr. Steinberg is the Chief Executive Officer of Trichome JWC Acquisition Corp (“TJAC”) and MYM Nutraceuticals Inc.(“MYM”)

|

| (6) |

On September 21, 2021 the Company granted Mr. Lustig 550,000 RSUs.

|

| (7) |

The Company used the Black-Scholes pricing model as the methodology to calculate the grant date fair value, and relied on the following the key assumptions and

estimates for each calculation under the following assumptions: (i) risk free interest rate of 0.42% to 1.97% (ii) expected dividend yield of 0%; (iii) expected volatility of 76.28% to 82.31%; and (iv) a term of 5 to 10 years. The

Black-Scholes pricing model was used to estimate the fair value as it is the most accepted methodology.

|

Outstanding Option-Based Awards and Share-Based Awards

The following table is a summary of all outstanding option-based awards and share-based awards of Named Executive

Officers as at December 31, 2021.

|

Option-based Awards

|

Share-based Awards

|

||||||

|

Name

|

Number of

securities underlying unexercised options(1) (2)

(#)

|

Option exercise price

($)(3)

|

Option expiration date

|

Value of

unexercised

in-the-money options(3) ($)

|

Number of shares or units of shares that have not vested

(#)

|

Market or

payout value of share-based awards that have not vested(4)

($)

|

Market or payout value of vested share-based awards not paid out or distributed

($)

|

|

Oren Shuster

CEO and Director

|

62,500

750,000

500,000 |

4.00

5.87

1.60

|

June 9, 2025

May 19, 2026

January 4, 2029 |

13,750

Nil 1,310,000 |

Nil

|

Nil

|

Nil

|

|

Shai Shemesh

CFO

|

37,500

201,650

62,500 |

4.00

5.87

1.60

|

June 9, 2025

May 19, 2026

April 7, 2029 |

8,250

Nil 163,750 |

Nil

|

Nil

|

Nil

|

|

Marc Lustig

Executive Chairman and Director

|

675,000

|

1.60

|

September 11, 2029

|

1,768,500

|

320,994

|

1,354,595

|

Nil

|

|

Michael Ruscetta

Chief Executive Officer of a subsidiary

|

232,500

|

10.02

|

March 18, 2026

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Howard Steinberg

Chief Executive Officer of a subsidiary

|

232,500

|

10.02

|

March 18, 2026

|

Nil

|

Nil

|

Nil

|

Nil

|

Notes

| (1) |

Each Option entitles the holder to purchase one Common Share.

|

| (2) |

On February 12, 2021, the Company completed a consolidation of its Common Shares on a 4:1 basis. The figures reported in this table are presented on a 4:1

post-consolidation basis.

|

| (3) |

Calculated using the closing market price of the Common Shares on the CSE on December 31, 2021 of $4.22 and subtracting the exercise price of in-the-money Options,

including unvested. These Options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise.

|

| (4) |

Calculated using the closing market price of the Common Shares on the CSE on December 31, 2021 of $4.22.

|

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth for each Named Executive Officer, the value of option-based awards and share-based

awards that vested during the year ended December 31, 2021 and the value of non-equity incentive plan compensation earned during the year ended December 31, 2021.

|

Name

|

Option-based awards – Value vested during the year

($)

|

Share-based awards – Value vested during the year ($)

|

Non-equity incentive plan compensation – Value earned during the year

($)

|

|

Oren Shuster

CEO

|

562,018

|

Nil

|

Nil

|

|

Shai Shemesh

CFO

|

408,653

|

Nil

|

Nil

|

|

Marc Lustig

Executive Chairman and Director

|

329,846

|

1,286,498

|

Nil

|

|

Michael Ruscetta

Chief Executive Officer of a subsidiary

|

675,719

|

Nil

|

Nil

|

|

Howard Steinberg

Chief Executive Officer of a subsidiary

|

675,719

|

Nil

|

Nil

|

PENSION PLAN BENEFITS

There are no pension plan benefits in place for the Named Executive Officers or the directors of the Company.

EXTERNAL MANAGEMENT COMPANIES

Except as described below, none of the Named

Executive Officers or directors of the Company have been retained or employed by an external management company which has entered into an understanding, arrangement or agreement with the Company to provide executive management services to the

Company, directly or indirectly.

Mr. Steinberg provides his services as the Chief Executive Officer of the Company's subsidiary, MYM Nutraceuticals Inc., through a

private company operating as an external management company.

Mr. Shuster provides his services as the Chief Executive Officer of the Company's subsidiary, IMC Holdings Ltd., through a private

company operating as an external management company.

Mr. Lustig provides his services as the Executive Chairman of the Company, through a private company operating as an external management

company.

TERMINATION AND CHANGE OF CONTROL BENEFITS

Other than described below, no Named Executive Officer has

entered into an arrangement with the Company or a subsidiary of the Company that provide for payments to the Named Executive Officers in connection with any termination or change of control beyond any payment that a Named Executive Officer may be

entitled to pursuant to applicable employment standard law:

Oren Shuster

As at December 31, 2021, Mr. Shuster performed the services of Chief Executive Officer of IMC Holdings Ltd., through a private company

acting as an external management company ("Shuster Management Company"). The Shuster Management Company was paid a monthly fee of $42,000 per month

(plus VAT). Either the Company (through its subsidiary) or the Shuster Management Company may terminate the agreement at any time for any reason upon three months' notice with continuing payments during such notice period. The Company through its

subsidiary) may terminate the agreement forthwith for cause without notice. As of March 1, 2022, Mr. Shuster performs the services of Chief Executive Officer of the Company, under substantially similar terms.

Michael Ruscetta

The Company's subsidiary, Trichome, entered into an

executive employment contract with Mr. Ruscetta effective May 4, 2018. Under this contract Mr. Ruscetta is entitled to base salary compensation of $175,000 per annum, cash incentive award equal to 100% of the base salary, and certain grants of securities

based awards that are subject to vesting conditions. In the event that Mr. Ruscetta is terminated for cause, Trichome may terminate Mr. Ruscetta's employment without notice

and securities based awards, whether vested or unvested, will immediately terminate. If Mr. Ruscetta is terminated without cause or Trichome is subject to a change of control in which over 50% of the voting shares of Trichome is acquired,

directly or indirectly, by any person and Mr. Ruscetta is terminated in connection with such change of control, Mr. Ruscetta will be provided with notice or pay in lieu of notice equal to ongoing payment of base salary, pro-rata average bonus and

continuation of benefits coverage for a period equal to six months plus one month for every year of service completed after May 7, 2019. If Mr. Ruscetta is terminated without cause , vested securities based awards will continue on their terms and

unvested securities based awards will terminate. If Trichome is subject to a change of control, all unvested securities will be payable in accordance with their terms.

Howard Steinberg

Mr. Steinberg performs the services of Chief Executive Officer of TJAC and MYM through a private company acting as an external

management company ("Steinberg Management Company"). The Steinberg Management Company is paid a monthly fee of $40,000 per month (plus HST) and

$100,000 per quarter (plus HST). Either the Company (through its subsidiary) or the Steinberg Management Company may terminate the agreement at any time upon three months' notice with continuing payments during such notice period, pro-rated for any

partial month or quarter. The Company (through its subsidiary) may also terminate the agreement immediately and pay a termination fee equal to three months` notice, pro-rated for any partial month or quarter.

DIRECTOR COMPENSATION

The objective of the Company's compensation program for directors is to attract and retain members of the Board of a quality and nature

that will enhance the sustainable profitability and growth of the Company. Director compensation is intended to provide an appropriate level of remuneration considering the experience, responsibilities, time requirements and accountability of their

roles.

Director Compensation Table

The following table sets out certain information respecting

the compensation paid to directors of the Company who were not Named Executive Officers during the year ended December 31, 2021.

|

Name

|

Fees earned ($)

|

Share-based awards

($)

|

Option-based awards ($)

(5)

|

Non-equity incentive plan compensation ($)

|

Pension value ($)

|

All other compensation ($)

|

Total ($)

|

|

Vivian Bercovici Director

|

89,400

|

Nil

|

156,013

|

Nil

|

Nil

|

Nil

|

245,413

|

|

Haleli Barath(1)

Director

|

85,425

|

Nil

|

350,820

|

Nil

|

Nil

|

Nil

|

436,245

|

|

Brian Schinderle(2)

Director

|

87,112

|

Nil

|

350,820

|

Nil

|

Nil

|

Nil

|

437,932

|

|

Steven Mintz(3) Director

|

14,750

|

Nil

|

5,364

|

Nil

|

Nil

|

Nil

|

20,114

|

|

Rafael Gabay(4) Director

|

14,750

|

Nil

|

174,302

|

Nil

|

Nil

|

Nil

|

189,052

|

Notes

| (1) |

Ms. Barath was appointed on February 22, 2021.

|

| (2) |

Mr. Schinderle was appointed on February 22, 2021.

|

| (3) |

Mr. Mintz resigned on February 22, 2021.Mr. Mintz remained engaged as a consultant after his resignation until November 22, 2021.

|

| (4) |

Mr. Gabay resigned on February 22, 2021. Mr. Gabay remained engaged as a consultant after his resignation until December 31, 2021.

|

| (5) |

The Company used the Black-Scholes pricing model as the methodology to calculate the grant date fair value, and relied on the following the key assumptions and

estimates for each calculation under the following assumptions: (i) risk free interest rate of 0.42% to 1.78% (ii) expected dividend yield of 0%; (iii) expected volatility of 79.83% to 82.01%; and (iv) a term of 5 to 10 years. The

Black-Scholes pricing model was used to estimate the fair value as it is the most accepted methodology.

|

Directors' Outstanding Option-Based Awards and Share-Based Awards

The following table sets forth for each of the Company's directors, other than directors who are also currently

Named Executive Officers, all share-based awards and option-based awards outstanding at the end of the year ended December 31, 2021.

|

Option-based Awards

|

Share-based Awards

|

||||||

|

Name

|

Number of

securities underlying unexercised options(1) (2)

(#)

|

Option exercise price

($)(2)

|

Option expiration date

|

Value of

unexercised

in-the-money options(3) ($)

|

Number of shares or units of shares that have not vested

(#)

|

Market or payout value of share-based awards that have not vested

($)

|

Market or payout value of vested share-based awards not paid out or distributed

($)

|

|

Vivian Bercovici

|

52,500

30,000

|

4.00

5.87

|

June 9, 2025

May 19, 2026

|

11,550

Nil

|

Nil

|

Nil

|

Nil

|

|

Haleli Barath(4)

|

90,000

|

10.00

|

February 28, 2026

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Brian Schinderle(5)

|

90,000

|

10.00

|

February 28, 2026

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Steven Mintz(6)

|

250,000

|

1.60

|

September 11, 2029

|

905,500

|

Nil

|

Nil

|

Nil

|

|

Rafael Gabay(7)

|

45,000

|

4.00

|

June 9, 2025

|

218,250

|

Nil

|

Nil

|

Nil

|

Notes

| (1) |

Each Option entitles the holder to purchase one Common Share.

|

| (2) |

On February 12, 2021, the Company completed a consolidation of its Common Shares on a 4:1 basis. The figures reported in this table are presented on a 4:1

post-consolidation basis.

|

| (3) |

Calculated using the closing market price of the Common Shares on the CSE on December 31, 2021 of $4.22 and subtracting the exercise price of in-the-money Options,

including unvested. These Options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise.

|

| (4) |

Ms. Barath was appointed on February 22, 2021.

|

| (5) |

Mr. Schinderle was appointed on February 22, 2021.

|

| (6) |

Mr. Mintz resigned from his tenure as a director on February 22, 2021 and continued giving consulting services until full termination of the consulting agreement on

December 31, 2021. Mr. Mintz exercised 208,312 Options on February 22, 2022 and his remaining Options expired on the same day.

|

| (7) |

Mr. Gabay resigned from his tenure as a director on February 22, 2021 and continued giving consulting services until full termination of the consulting agreement on

December 31, 2021. All Options granted to Mr. Gabay expired without being exercised on April 15, 2022.

|

Directors' Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth for each of the Company's directors, other than directors who are also currently

Named Executive Officers, the value of option-based awards and share-based award that vested during the year ended December 31, 2021 and the value of non-equity incentive plan compensation earned during the year ended December 31, 2021.

|

Name

|

Option-based awards – Value vested during the year

($)

|

Share-based awards – Value vested during the year ($)

|

Non-equity incentive plan compensation – Value earned during the year

($)

|

|

Vivian Bercovici

|

156,013

|

Nil

|

Nil

|

|

Haleli Barath(1)

|

350,820

|

Nil

|

Nil

|

|

Brian Schinderle(2)

|

350,820

|

Nil

|

Nil

|

|

Steven Mintz(3)

|

5,364

|

Nil

|

Nil

|

|

Rafael Gabay(4)

|

174,302

|

Nil

|

Nil

|

Notes

| (1) |

Ms. Barath was appointed on February 22, 2021.

|

| (2) |

Mr. Schinderle was appointed on February 22, 2021.

|

| (3) |

Mr. Mintz resigned from his tenure as a director on February 22, 2021 and continued giving consulting services until full termination of the consulting agreement on

December 31, 2021. Mr. Mintz exercised 208,312 Options on February 22, 2022 and his remaining Options expired on the same day.

|

| (4) |

Mr. Gabay resigned from his tenure as a director on February 22, 2021 and continued giving consulting services until full termination of the consulting agreement on

December 31, 2021. All Options granted to Mr. Gabay expired without being exercised on April 15, 2022.

|