Exhibit 99.3

|

Management’s Discussion and Analysis

|

|

TABLE OF CONTENTS

|

4

|

|

|

6

|

|

|

6

|

|

|

8

|

|

|

11

|

|

|

11

|

|

|

15

|

|

|

40

|

|

|

47

|

|

| 52 |

2

|

Management’s Discussion and Analysis

|

|

INTRODUCTION

IM Cannabis Corp. (“IM Cannabis” or the “Company”) is a British Columbia

company operating in the international medical cannabis industry. The Company’s common shares (the “Common Shares”) trade under the ticker symbol “IMCC” on both the NASDAQ Capital Market (“NASDAQ”) and the Canadian Securities Exchange (“CSE”) as of March 1, 2021, and November 5, 2019, respectively.

This Management’s Discussion and Analysis (“MD&A”) reports on the consolidated financial condition and

operating results of IM Cannabis for the three and six months ended June 30, 2023. Throughout this MD&A, unless otherwise specified, references to “we”, “us”, “our” or similar terms, as well as the “Company” and “IM Cannabis” refer to IM Cannabis

Corp., together with its subsidiaries, on a consolidated basis, and the “Group” refers to the Company, its subsidiaries, and Focus Medical Herbs Ltd.

This MD&A should be read in conjunction with the interim condensed consolidated financial statements of the Company and the notes thereto for the three

and six months ended June 30, 2023 (the "Interim Financial Statements") and with the Company's audited annual consolidated financial statements and the notes thereto for the years ended December 31, 2022 and

2021 (the “Annual Financial Statements”). References herein to “Q2 2023” and “Q2 2022” refer to the three and six months ended June 30, 2023 and June 30, 2022, respectively, and references to “2022” refer to

the year ended December 31, 2022.

The Interim Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). IFRS requires management to make certain judgments, estimates and assumptions that affect the

reported amount of assets and liabilities at the date of the Interim Financial Statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily

indicative of results that may be expected for future periods. The Interim Financial Statements for the three and six months ended June 30, 2023, include the accounts of the Group, which includes, among others, the following entities:

|

Legal Entity

|

Jurisdiction

|

Relationship with the Company

|

|

I.M.C. Holdings Ltd. (“IMC Holdings”)

|

Israel

|

Wholly-owned subsidiary

|

|

I.M.C. Pharma Ltd. (“IMC Pharma”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

I.M.C. Farms Israel Ltd. (“IMC Farms”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Focus Medical Herbs Ltd. (“Focus”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto control” under IFRS 10 Consolidated Financial Statements (“IFRS 10”)

|

|

R.A. Yarok Pharm Ltd. (“Pharm Yarok”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Rosen High Way Ltd. (“Rosen High Way”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Revoly Trading and Marketing Ltd. dba Vironna Pharm (“Vironna”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Oranim Plus Pharm Ltd. (“Oranim Plus”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Adjupharm GmbH (“Adjupharm”)

|

Germany

|

Subsidiary of IMC Holdings

|

|

Trichome Financial Corp. (“Trichome”) *

|

Canada

|

Wholly-owned subsidiary

|

* Discontinued operations. For more information, please see “Corporate Highlights and Events – Key Highlights for the quarter ended June 30,

2023” below.

3

|

Management’s Discussion and Analysis

|

|

All intercompany balances and transactions were eliminated on consolidation. All dollar figures in this MD&A are expressed in thousands of Canadian

Dollars ($), except per share data and unless otherwise noted. All references to “NIS” are to New Israeli Shekels. All references to “€” or to “Euros” are to Euros. All references to “US$” or to “U.S. Dollars” are to United States Dollars. The

Company’s shares, options, units and warrants are not expressed in thousands. Prices are not expressed in thousands.

NON-IFRS FINANCIAL MEASURES

Certain non-IFRS financial measures are referenced in this MD&A that do not have any standardized meaning under IFRS, including “Gross Margin”,

“EBITDA” and “Adjusted EBITDA”. The Company believes that these non-IFRS financial measures and operational performance measures, in addition to conventional measures prepared in accordance with IFRS, enable readers to evaluate the Company’s

operating results, underlying performance and prospects in a similar manner to the Company’s management. For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the “Metrics and Non-IFRS Financial Measures” section of the MD&A.

NOTE REGARDING THE COMPANY’S ACCOUNTING PRACTICES

The Company complies with IFRS 10 to consolidate the financial results of Focus, a holder of an Israeli Medical

Cannabis Agency (the “IMCA”) license which allows it to import and supply cannabis products, on the basis of which IMC Holdings exercises

“de facto control”. For a full explanation of the Company’s application of IFRS 10, see “Legal and Regulatory – Restructuring” and “Legal and Regulatory – Risk Factors”.

OVERVIEW – CURRENT OPERATIONS IN ISRAEL AND GERMANY

IM Cannabis is an international cannabis company that is currently focused on providing premium cannabis products to medical

patients in Israel and Germany, two of the world’s largest federally legal cannabis markets. Until recently, the Company was also actively servicing adult-use recreational consumers in Canada, however the Company has exited operations in Canada and

considers these operations discontinued. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the

strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

In Israel, the Company imports, distributes and

sells cannabis to local medical patients by operating medical cannabis retail pharmacies, online platforms, distribution centers and logistical hubs operating through IMC Holdings’ subsidiaries and Focus, leveraging proprietary data and patient insights. The Company also cultivate its existing proprietary genetics with third-party cultivation facilities in Israel.

In Germany, the IM Cannabis ecosystem operates through Adjupharm, importing and distributing cannabis to pharmacies for patients,

and acting as the Company’s entry point for potential Europe-wide distribution in the future.

4

|

Management’s Discussion and Analysis

|

|

OUR GOAL – DRIVE PROFITABLE REVENUE GROWTH

Our primary goal is to sustainably increase revenue in each of our core markets, to accelerate our path to profitability and long-term shareholder value

while actively managing costs and margins.

HOW WE PLAN TO ACHIEVE OUR GOAL – CORE STRATEGIES

Our strategy of sustainable and profitable growth consists of:

| • |

Continue building on the increasing demand and positive momentum in Israel and

Germany, supported by strategic alliances with Canadian suppliers and a highly skilled sourcing team, to cement its leadership position in markets where the

Company operates.

|

| • |

Develop and execute a long-term growth plan in Germany, based on the strong sourcing infrastructure in Israel which is powered by advanced product knowledge and regulatory expertise establishing, in the Company’s view, a competitive

advantage ahead of proposals for the legalization of recreational cannabis in Germany.

|

| • |

Properly position brands with respect to target-market, price, potency and quality, such as our IMC brand in Israel and Germany.

|

| • |

Strong focus on efficiencies and synergies as a global organization with domestic expertise in Israel and Germany.

|

| • |

High-quality, reliable supply to our customers and patients, leading to recurring sales.

|

| • |

Ongoing introduction of new Stock Keeping Unit (“SKUs”) to keep consumers and patients engaged.

|

| • |

Reorganization of the Company's management and operations by reducing its workforce in Israel by 36% across all functions, to strengthen its focus on core

activities and drive efficiencies to realize sustainable profitability. All actions associated with the workforce reduction were substantially completed by

June 30, 2023.

|

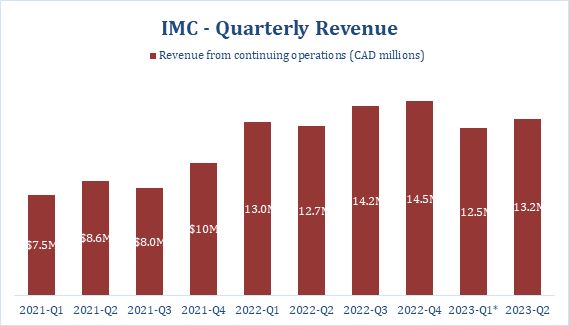

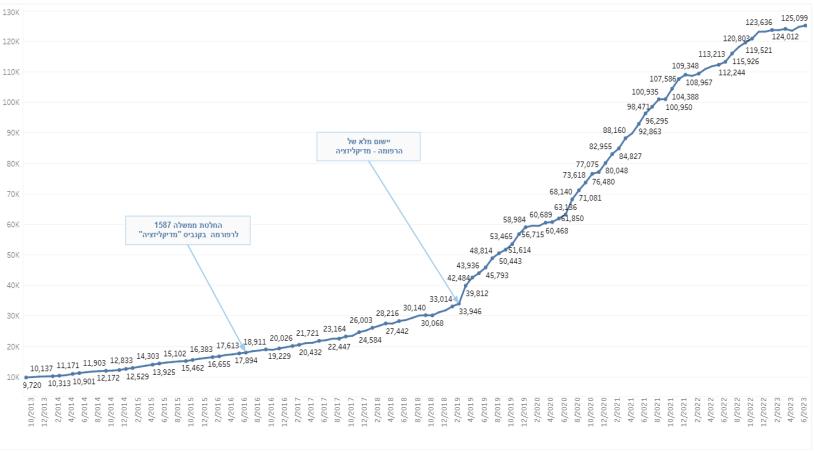

RESULTS – REVENUE OVER QUARTERS

* See Note 1 under “Review of Financial Performance – Summary of Quarterly Results” section of the MD&A.

5

|

Management’s Discussion and Analysis

|

|

The Company operates in the Israeli and German medical cannabis markets. Until recently, the Company was also actively servicing adult-use recreational

consumers in Canada, however these operations are discontinued and deconsolidated, effective November 7, 2022, pursuant to IFRS. The Canadian operations were wound-down under the Canadian Companies’ Creditors Arrangement Act (“CCAA”) under the supervision of the Ontario Superior Court of Justice (Commercial List) (the “Court”) (the “CCAA Proceedings”). The

Company has exited operations in Canada Pursuant to an Order of the Court made on April 6, 2023, in which the Court approved a share purchase agreement, selling certain of the Trichome and certain of Trichome's wholly owned subsidiaries

(collectively, the "Trichome Group") to a party that is not related to the Company. The Company announced that it is pivoting its focus and resources to achieve sustainable and profitable growth in its highest

value markets, Israel, Germany and Europe.

In the context of the deconsolidation of the Canadian operations, there are no remaining liabilities to the Company or any of its consolidated subsidiaries

related to the Canadian entities, except tax obligation of $839 related to debt settlement with L5 Capital Inc. (“L5 Capital”). For more information about the debt settlement, see "Debt Settlement with L5

Capital" below.

The CCAA Proceedings are solely in respect of the Trichome Group. As such, the Company’s other assets or subsidiaries, including those in Israel and

Germany, are not parties to the CCAA Proceedings. For more information about the CCAA Proceedings, see “Corporate Highlights and Events – Key Highlights for the quarter ended June 30, 2023” below.

Israel

In Israel, we continue to expand IMC brand recognition and supply the growing Israeli medical cannabis market with our branded products. The Company offers

medical cannabis patients a rich variety of high-end medical cannabis products through strategic alliances with Canadian suppliers supported by a highly skilled sourcing team. In addition to the benefits of the Group’s long-term presence in Israel,

we believe that with our strong sourcing infrastructure in Israel, and advanced product knowledge, regulatory expertise and strong commercial partnerships, the Company is well-positioned to address the ongoing needs and preferences of medical

cannabis patients in Israel.

The Company entered additional segments of the medical cannabis value chain in Israel, namely the distribution and retail segments. The Company, through

IMC Holdings, acquired three licensed pharmacies in 2022, each selling medical cannabis products to patients: (i) Oranim Plus, Israel’s largest pharmacy in Jerusalem and one of the largest in Israel, (ii) Vironna, a leading pharmacy in the Arab

sector, and (iii) Pharm Yarok, the largest pharmacy in the Sharon plain area and the biggest call center in the country (Oranim Plus, Vironna, and Pharm Yarok collectively, the “Israeli Pharmacies”).

The Company has also acquired home-delivery services and an online retail footprint, operating under the name “Panaxia-to-the-Home”,

which includes a customer service center and an Israeli medical cannabis distribution licensed center (the “Panaxia Transaction”), from Panaxia Pharmaceutical Industries Israel Ltd. and Panaxia Logistics Ltd.,

part of the Panaxia Labs Israel, Ltd. group of companies (collectively, “Panaxia”). On June 30, 2023, IMC Pharma, the entity

responsible for operating the trading house that was acquired within the Panaxia Transaction, ceased its operations at the aforementioned licensed center located in Lod, Israel. Consequently, the Company transitioned the operation that was conducted

through IMC Pharma to third-party entities and to its own trading house currently being operated by Rosen High Way and there are no material obligations remained open following closure of the trading house.

6

|

Management’s Discussion and Analysis

|

|

The entrance into the new segments in Israel position IM Cannabis as a large distributor of medical cannabis in Israel. We are strategically focused on

establishing and reinforcing a direct connection with medical cannabis patients, providing direct access to IM Cannabis products, obtaining and leveraging market data and gaining a deeper understanding of consumer preferences. The acquisition of the

Israeli Pharmacies allows the Company to increase purchasing power with third-party product suppliers, offers potential synergies with our established call center and online operations, achieves higher margins on direct sales to patient and creates

the opportunity for up-sales across a growing range of products.

Germany

In Europe, the Company operates in Germany through Adjupharm, its German subsidiary and EU-GMP certified medical cannabis producer and distributor. We

continue to lay our foundation in Germany, which is currently the European market with the largest number of medical cannabis patients.1 Leveraging our global supply chain, IM Cannabis

continues to focus on growing its business in Germany to be well-positioned through brand recognition in preparation for future regulatory reforms.

Similar to Israel, the Company’s focus in Germany is to import premium dried cannabis from its supply partners, which we believe will satisfy the rapid

growth in demand for high-THC premium cannabis across a variety of strains and qualities. In addition, Adjupharm sells cannabis extracts to meet the existing demand in the German market.

In the Company’s view, the strong sourcing infrastructure in Israel, powered by advanced product knowledge and regulatory expertise, will establish a

competitive advantage in Germany ahead of proposals for the legalization of recreational cannabis. This is based on the premise that the German and Israeli markets share a number of common attributes such as robust commercial infrastructure, highly

developed digital capabilities, favourable demographics and customer preferences.

While the Company does not currently distribute products in other European countries, the Company intends to leverage the foundation established by

Adjupharm, its state-of-the-art warehouse and EU-GMP production facility in Germany (the “Logistics Center”), its vast knowledge in the cannabis market and costumers’ preferences and its network of distribution

partners to expand into other jurisdictions across the continent.

Adjupharm received a revised EU-GMP license in May 2022 that permits it to engage in production, cannabis testing and release activities. It allows

Adjupharm to repackage bulk cannabis, to perform stability studies and offer such services to third parties.

1 The European Cannabis Report – Edition 8 https://prohibitionpartners.com/reports/the-european-cannabis-report-8th-edition/?__hstc=102379230.c3806f05dbbd9246bb30c3897deb768c.1680505679399.1680505679399.1680505679399.1&__hssc=102379230.1.1680505679401&__hsfp=3485682252;

Statista Website:https://www.statista.com/outlook/hmo/cannabis/medical-cannabis/germany#analyst-opinion

7

|

Management’s Discussion and Analysis

|

|

The IMC brand is well-known in the Israeli medical cannabis market, with signature reputable brands such as Roma®, highly popular among Israeli consumers.

Building on its long-term success in Israel, the Company launched the IMC brand in Germany in 2020.

Israeli Medical Cannabis Business

The IMC brand has established its reputation in Israel for quality and consistency over the past 10 years and more recently with new high-end,

ultra-premium strains that have made it to the top-sellers list in pharmacies across the country.

The Group maintains a portfolio of strains sold under the IMC umbrella from which popular medical cannabis dried flowers and full-spectrum cannabis

extracts are produced.

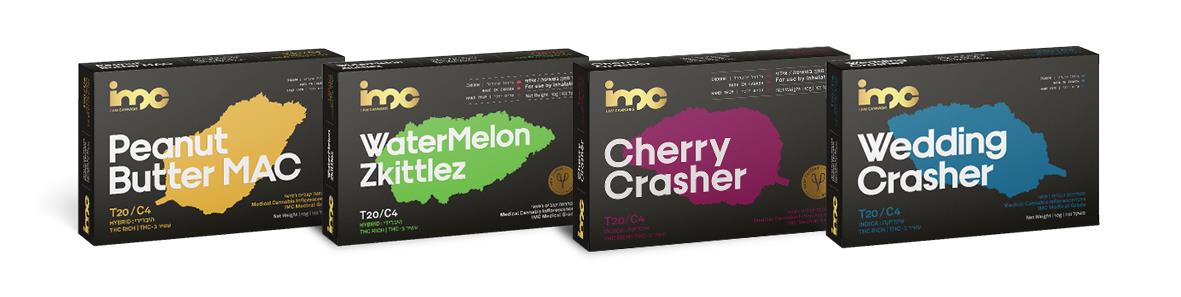

The IMC brand offers four different product lines, leading with the Craft Collection which offers the highest quality Canadian craft cannabis flower and

has established IMC as the leader of the super-premium segment in Israel.

The Craft Collection – The IMC brand’s premium product line with indoor-grown, hand-dried and hand-trimmed high-THC cannabis flowers. The Craft Collection includes exotic and unique cannabis strains such as Cherry

Crasher, Wedding Crasher, Peanut Butter MAC and Watermelon Zkittlez.

|

The Top-Shelf

Collection –offers indoor-grown, high-THC cannabis flowers with strains such as Lemon Rocket, Diesel Drift, Tropicana Gold, Lucy Dreamz and Santa Cruz.

Inspired by the 1970’s cannabis culture in America, the Top-Shelf Collection targets the growing segment of medical patients who are cannabis culture enthusiasts.

|

|

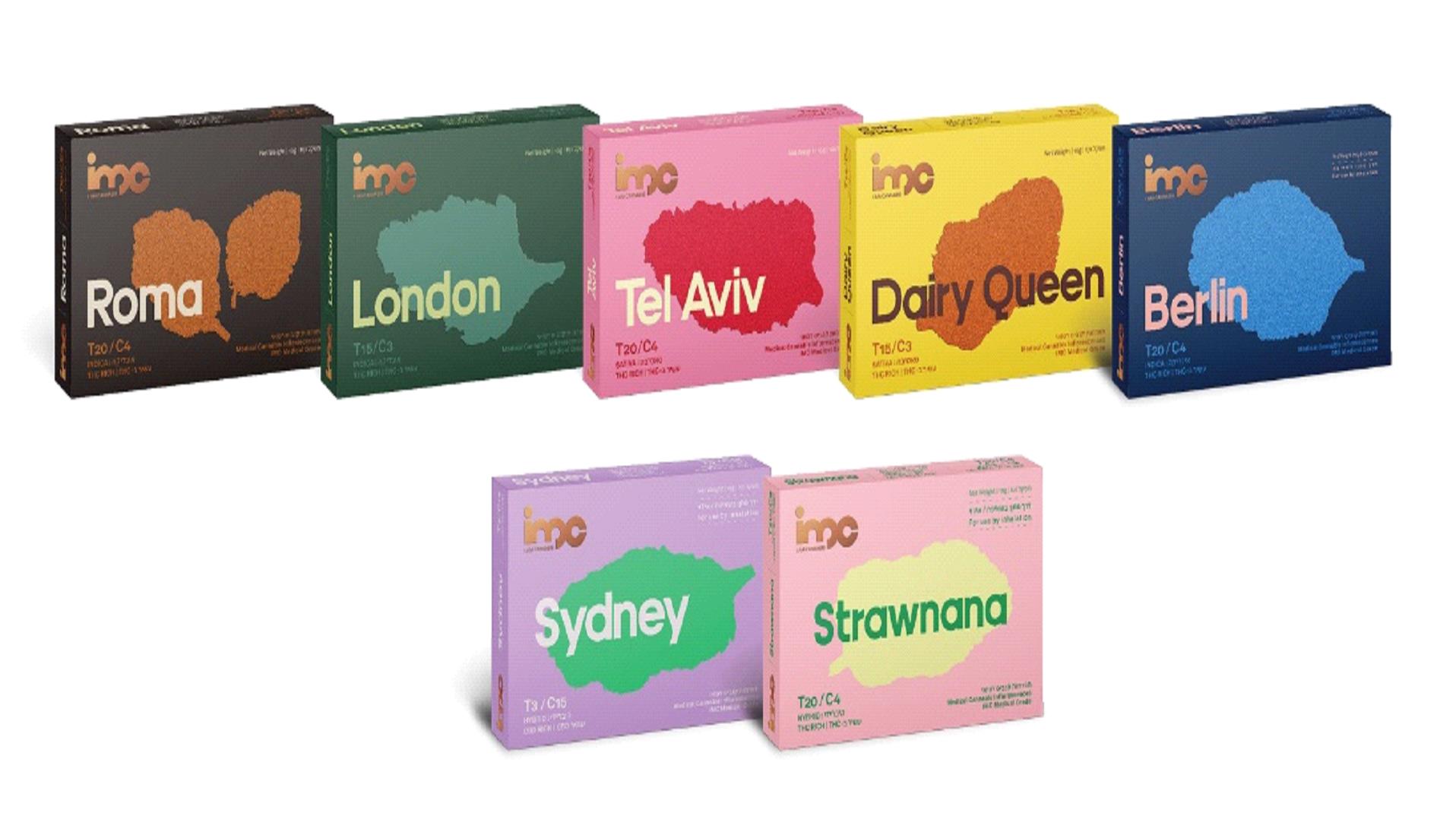

The Signature Collection – The IMC brand’s high-quality product line with greenhouse-grown or indoor grown, high-THC cannabis flowers. The Signature Collection currently includes well known proprietary

cannabis dried flowers such as Roma®, Tel Aviv and London as well as Strawnana, an indoor-grown flower, and Sydney, the Company’s first high-CBD cannabis strain.

8

|

Management’s Discussion and Analysis

|

|

The Full Spectrum Extracts – The IMC brand’s full spectrum, strain-specific cannabis extracts, including high-THC Roma®T20 oil, balanced Paris oil and Super CBD oil and the new Roma® T15 oil, Tel Aviv oil

and DQ.

As part of its recent rebranding the Company expanded its Roma® product portfolio to

include pre-rolls and oils range, offering the widest range of different product SKUs for a single strain in the Israeli market. This delivers a variety of formats of IMC’s most successful, well-known and proprietary strain to Israeli medical

cannabis patients. IMC’s Roma® strain is a high-THC medical cannabis flower that offers a therapeutic continuum and is known for its strength and longevity of effect.

|

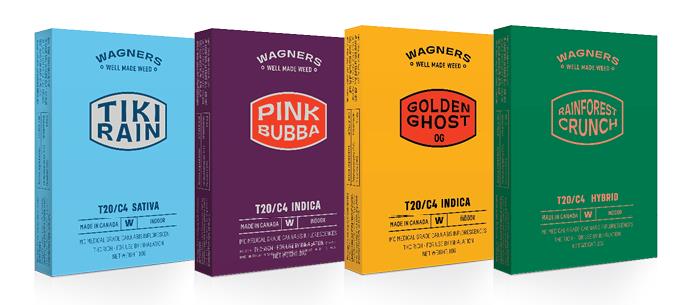

The WAGNERS™ brand launched in Israel in Q1 2022, with indoor-grown cannabis imported from Canada. The WAGNERS™ brand was the first international premium, indoor-grown brand introduced to the Israel cannabis

market, at a competitive price point. The WAGNERS™ brand includes the Dark Helmet, Dark Helmet Minis, Cherry Jam launched in Q1 2022, and Golden Ghost that was launched in Q4 2022. In Q1 2023 The Company launched three additional

products under the WAGNERS™ brand, Pink Bubba, Golden Ghost and Tiki Rain; all an indoor-grown cannabis flowers, with high-THC. In Q2 2023 the Company launched Rainforest Crunch.

|

|

|

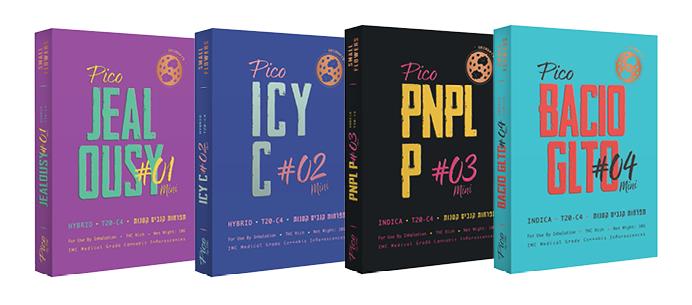

BLKMKT™, the Company’s second Canadian brand, super-premium product line with indoor-grown, hand-dried and hand-trimmed high-THC cannabis flowers The BLKMKT™ includes Jealousy, BACIO GLTO, PNPL P and PARK

FIRE OG

|

|

9

|

Management’s Discussion and Analysis

|

|

THE LOT420 brand launched in Israel in Q2 2023, with super-premium indoor-grown cannabis

imported from Canada with high-THC. The LOT420 includes ICY C and GLTO 33.

The PICO collection (minis)- Under the BLKMKT™ and LOT420 brands, the Company launched a new type of products (small flowers), a super-premium indoor-grown

cannabis imported from Canada with high-THC.

For more information, see “Strategy in Detail – Brands – New Product Offerings”

section of the MD&A.

10

|

Management’s Discussion and Analysis

|

|

German Medical Cannabis Business

In Germany, the Company sells IMC-branded dried flower products and full spectrum extracts. The medical cannabis products sold in the German market are

branded generically as IMC to increase recognition of the Company’s brand in establishing a foothold with German healthcare professionals. The Company’s IMC-branded cannabis products were launched in Germany with one high-THC flower strain in 2020.

In Q4 2021, Adjupharm launched another high-THC flower strain and two full spectrum extracts. In Q1 2022, Adjupharm launched a third strain, a high-CBD flower, to offer a more complete portfolio to German physicians and patients. In Q1 2023,

Adjupharm launched additional two high-THC flower strains, in alignment with the strategic focus on high-THC flowers and patients demand.

The Group’s competitive advantage in Germany lies in its track record, experience and brand reputation and proprietary data supporting the potential

effectiveness of medical cannabis for the treatment of a variety of conditions.

Between our various geographies, the strategy for new products varies given that each market is at a different stage of development with respect to

regulatory regimes, patient and customer preferences and adoption rates.

Israel

In Q2 2023 The Company launched the PICO collection (minis) with four new products, PICO Jealousy, PICO ICY C, PICO PNPL P and PICO BACIO GLTO. The Company

also launched three additional products under the BLKMKT™ brand, Jealousy, BACIO GLTO and PARK FIRE OG and two under the LOT420 brand, ICY C and GLTO 33. All strains are indoor-grown cannabis flowers, with high-THC. In addition, the Company launched

one new product under the WAGNERS™ brand, Rainforest Crunch. All products allow a wide range of offerings in all three categories, Indica, Sativa and Hybrid category.

Israel

Over the last decade, Focus Medical was the primary cultivator of medical cannabis products sold under the IMC brand in the Israeli market. Until July

2022, Focus Medical held an IMCA license to cultivate medical cannabis at its cultivation facility (the “Focus Facility”). In Q2 2022, the Company closed the Focus Facility to concentrate on leveraging its

skilled sourcing team and strategic alliances with Canadian suppliers as well as the import of medical cannabis from its Canadian Facilities. In July 2022, Focus Medical received an IMCA license which allows it to continue to import cannabis products

and supply medical cannabis to patients through licensed pharmacies despite the closure of the Focus Facility (the “Focus New License”). Besides Focus Medical, which holds the Focus New License, the Group has

other entities with a license to import medical cannabis and supply medical cannabis to patients through licensed pharmacies. To supplement growing demand, the Company plans to continue its relationships with third-party cultivation facilities in

Israel for the propagation and cultivation of the Company’s existing proprietary genetics and for the development of new products.

11

|

Management’s Discussion and Analysis

|

|

Pursuant to the applicable Israeli cannabis regulations, following the cultivation or import of medical cannabis, medical cannabis products are then

packaged by contracted GMP licensed producers of medical cannabis. The packaged medical cannabis products are then sold by the Group under the Company’s brands to local Israeli pharmacies directly or through contracted distributors.

Germany

The Company continues to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country and

developing Adjupharm and its Logistics Center as the Company’s European hub. Adjupharm sources its supply of medical cannabis for the German market and from various EU-GMP certified European and Canadian suppliers. The Logistics Center is EU-GMP

certified, upgrading Adjupharm’s production technology and increasing its storage capacity to accommodate its anticipated growth. Adjupharm holds the certification for primary repackaging, making it one of a handful of companies in Germany fully

licenced to repack bulk.

Adjupharm currently holds wholesale, narcotics handling, manufacturing, procurement, storage, distribution, and import/export licenses granted to it by the applicable German regulatory authorities (the “Adjupharm Licenses”).

CORPORATE HIGHLIGHTS AND EVENTS

KEY HIGHLIGHTS FOR THE QUARTER ENDED JUNE 30, 2023

In Q2 2023, the Company continued to focus on its efforts and resources on growth in the Israeli and German cannabis markets with a goal of reaching

profitability in 2023. The Company’s key highlights and events for the second quarter ended June 30, 2023, include:

NASDAQ Compliance Notice and Common Share Consolidation

In order to maintain the listing of the Common Shares on the Nasdaq, the Company must comply with Nasdaq’s continued listing requirements which require,

amongst other things, that the Common Shares maintain a minimum bid price of at least US$1.00 per share (the “Minimum Share Price Listing Requirement”)

On April 10, 2023, the Company received written

notification from Nasdaq (the “Notification Letter”) that the closing bid price of the Common Shares had fallen below US$1.00 per share over a period of 30 consecutive business days, with the result that the Company was not in compliance with the Minimum Share Price

Listing Requirement. The Notification Letter provided that the Company has until October 9, 2023, being 180 calendar days following receipt of such notice to regain

compliance with the Minimum Share Price Listing Requirement for a minimum of 10 consecutive business days.

On June 13, 2023, the Company announced that on June

12, 2023, it has received formal notice from The Nasdaq stating that the Company has regained compliance with Minimum Share Price Listing Requirement. From May 26, 2023 through June 9, 2023, a period of 10 consecutive trading days, the closing bid price of the Company's listed securities was greater than $1.00 per share. Accordingly, the Company has

regained compliance with Listing Rule 5550(a)(2) and the matter has been closed.

12

|

Management’s Discussion and Analysis

|

|

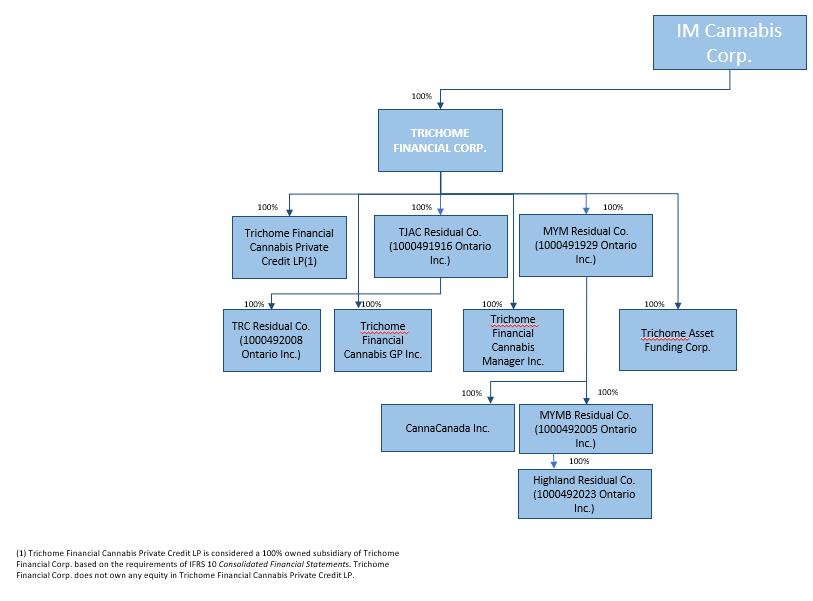

Canadian Restructuring

Pursuant to an order of the Court made on April 6,2023 in the CCAA Proceedings (the “Reverse Vesting Order”), the

Court approved a share purchase agreement (the “Share Purchase Agreement”) dated March 28, 2023 among Trichome Financial Corp. (“Trichome” or the “Vendor”), 1000370759 Ontario Inc. (the “Purchaser”), Trichome JWC Acquisition Corp. (“TJAC”), Trichome Retail Corp. (“TRC”), MYM Nutraceuticals Inc. (“MYM”), MYM International Brands Inc. (“MYMB”) and Highland Grow Inc. (“Highland”, and collectively with TJAC, TRC, MYM and MYMB, the “Purchased Entities”). the Purchased Entities and its business and operations were sold to a party that is not related to the

Company. Thus, the Company has exited operations in Canada and considers these operations discontinued. The Share Purchase Agreement is solely in respect of the Purchased Entities. As such, the Company’s other assets or subsidiaries, including those

in Israel and Germany, will not be affected by it.

The Share Purchase Agreement contemplated a reverse vesting transaction pursuant to which Trichome agreed to sell to the Purchaser, and the Purchaser

agreed to purchase, all of the issued and outstanding shares in the capital of TJAC and MYM owned by Trichome for a purchase price of $3,375 along with certain deferred consideration. Pursuant to the Share Purchase Agreement and the Reverse Vesting

Order, the Purchased Entities retained the Purchased Entities’ assets, contracts and liabilities (the “Assumed Liabilities”) specified in the Share Purchase Agreement free and clear of any claims other than the

Assumed Liabilities, and all other assets (the “Excluded Assets”), contracts (the “Excluded Contracts”), and liabilities (the “Excluded

Liabilities”) of the Purchased Assets were transferred to, and assumed by, five newly created corporations being 1000491916 Ontario Inc. ("TJAC Residual Co."), 1000492008 Ontario Inc. ("TRC Residual Co."), 1000491929 Ontario Inc. ("MYM Residual Co."), 1000492005 Ontario Inc. ("MYMB Residual Co.") and 1000492023 Ontario

Inc. ("Highland Residual Co.", and collectively with TJAC Residual Co., TRC Residual Co., MYM Residual Co. and MYMB Residual Co., the “Residual Corporations”), the shares

of which are owned directly or indirectly by Trichome. The closing of the transactions contemplated by the Share Purchase Agreement occurred on April 6, 2023.

13

|

Management’s Discussion and Analysis

|

|

Trichome’s organizational structure pursuant to the Share Purchase Agreement is as follows:

Court materials filed in connection with Trichome's CCAA Proceedings can be found at: https://www.ksvadvisory.com/insolvency-cases/case/trichome.

Debt Settlement with L5 Capital

On May 8th, 2023, the Company announced that on May 5th, 2023, it has closed the securities for debt settlement transaction with L5 Capital (the “Debt Settlement”). Pursuant to the Debt Settlement, the Company settled outstanding indebtedness of $838 (approximately US$615) through issuing 492,492 Units at a price of US$1.25 per Unit. Each Unit consists of

one Common Share of the Company and one Common Share purchase Warrant. Each Warrant entitles L5 Capital to purchase one additional Common Share at an exercise price of US$1.50 per Common Share for a period of 36 months from the date of issuance. All

securities issued are subject to a statutory hold period of four months and one day from the date of issuance in accordance with applicable Canadian securities legislation.

Statement of Executive Compensation

On May 19th, 2023, the Company filed its Statement of Executive Compensation in accordance with National Instrument 51-102 – Continuous

Disclosure Obligations ("NI 51-102") and Form 51-102F6 – Statement of Executive Compensation ("Form 51-102F6"), which sets forth compensation for each Named Executive Officer (as defined therein) and director of the Company during the financial year

ending December 31, 2022.

SUBSEQUENT EVENTS

Short-term loan agreement

On July 3rd, 2023, the Company entered into a short-term loan agreement with a non-financial institution in the amount of NIS 1,000

(approx. $358) (the "Loan Agreement" and "Loan").

The Loan bears interest rate of 10% and will be repaid in October 2023, according to the Loan Agreement terms.

NASDAQ Compliance Notice

In order to maintain the listing of the Common Shares

on the Nasdaq, the Company must comply with Nasdaq’s continued listing requirements which require, amongst other things, that the Common Shares maintain a minimum bid price of at least US$1.00 per share (the “Minimum Share Price Listing Requirement”).

On August 1, 2023, the Company received written

notification from Nasdaq (the “Notification Letter”)

that the closing bid price of the Common Shares had fallen below US$1.00 per share over a period of 30 consecutive business days, with the result that the Company was not in compliance with the Minimum Share Price Listing Requirement. The

Notification Letter provided that the Company has until January 16, 2024, being 180 calendar days following receipt of such notice to regain compliance with the Minimum Share Price Listing Requirement for a minimum of 10 consecutive business

days.

14

|

Management’s Discussion and Analysis

|

|

FINANCIAL HIGHLIGHTS

Below is the analysis of the changes that occurred for the three and six months ended June 30, 2023, with further commentary provided below.

|

For the six months

ended June 30,

|

For the three months

ended June 30, |

For the Year ended December 31,

|

||||||||||||||||||

|

2023(1)

|

2022*

|

2023

|

2022*

|

2022*

|

||||||||||||||||

|

Net Revenues

|

$

|

25,736

|

$

|

25,704

|

$

|

13,207

|

$

|

12,703

|

$

|

54,335

|

||||||||||

|

Gross profit before fair value impacts in cost of sales

|

$

|

6,977

|

$

|

5,681

|

$

|

3,734

|

$

|

2,595

|

$

|

11,291

|

||||||||||

|

Gross margin before fair value impacts in cost of sales (%)

|

27

|

%

|

22

|

%

|

28

|

%

|

20

|

%

|

21

|

%

|

||||||||||

|

Operating Loss

|

$

|

(5,368

|

)

|

$

|

(14,484

|

)

|

$

|

(1,752

|

)

|

$

|

(5,624

|

)

|

$

|

(30,791

|

)

|

|||||

|

Loss

|

$

|

(4,572

|

)

|

$

|

(10,783

|

)

|

$

|

(3,706

|

)

|

$

|

(3,701

|

)

|

$

|

(24,922

|

)

|

|||||

|

Loss per share attributable to equity holders of the Company – Basic (in CAD)

|

$

|

(0.33

|

)

|

$

|

(1.32

|

)

|

$

|

(0.26

|

) |

$

|

(0.49

|

) |

$

|

(3.13

|

)

|

|||||

|

Loss per share attributable to equity holders of the Company - Diluted (in CAD)

|

$

|

(0.33

|

)

|

$

|

(2.09

|

) |

$

|

(0.26

|

) |

$

|

(0.89

|

) |

$

|

(3.81

|

)

|

|||||

|

For the Six Months

Ended June 30,

|

For the Three months

ended June 30,

|

For the Year ended December 31,

|

||||||||||||||||||

|

2023

|

2022*

|

2023

|

2022*

|

2022*

|

||||||||||||||||

|

Average net selling price of dried flower (per Gram)

|

$

|

5.60

|

$

|

7.67

|

$

|

5.04

|

$

|

7.27

|

$

|

7.12

|

||||||||||

|

Quantity of dried flower sold (in Kilograms)

|

3,970

|

3,007

|

2,128

|

1,592

|

6,794

|

|||||||||||||||

* From continuing operations

Note 1 - The figures disclosure here for the six months ended June 30, 2023 have been

updated and adjust the Company’s previously filed unaudited interim financial statements as of March 31, 2023. The updates and adjustments are immaterial. See also Note 1 under “Review of Financial Performance – Summary of Quarterly Results” section of the MD&A for additional information.

15

|

Management’s Discussion and Analysis

|

|

The Overview of Financial Performance includes reference to “Gross Margin”, which is a non-IFRS financial measure that the Company defines as the

difference between revenue and cost of revenues divided by revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets. For more information on non-IFRS financial measures, see the “Non-IFRS Financial Measures” and “Metrics and Non-IFRS Financial Measures” sections of the MD&A.

OPERATIONAL RESULTS

In each of the markets in which the Company operates, the Company must navigate evolving customer and patient trends in order to continue to be competitive

with other suppliers of medical cannabis products.

The Company believes that there are several key factors creating tailwinds to facilitate further industry growth. In Israel, the number of licensed medical

patients continues to increase and currently stands at 125,099 as of June 2023. This figure is expected to continue growing in the coming years and may further benefit from regulatory change liberalizing the cannabis market in Israel. Moreover, the

acquisitions of the Israeli Pharmacies positions IM Cannabis as a large distributor of medical cannabis in Israel. As the Israeli cannabis market has become increasingly competitive, the ability to import premium cannabis from Canada is a key

determinant of the Company’s success in Israel.

The German medical cannabis market has been slower to develop due to the difficulty in medical patients accessing prescriptions and insurance

reimbursements. The Company has, however, seen an increase in the number of patients paying out-of-pocket for medical cannabis products in Germany, which the Company believes is supportive of its business plan as it relies less on the need for

patient’s insurance coverage for re-imbursement.

The newly elected coalition government in Germany has endorsed the legalization of adult-use cannabis. While no specific legislation has yet been tabled

and any implementation is expected to take time, the Company believes that Germany has the potential to be the second largest federally legal, adult-use market in the world.

The Company’s outlook in Germany is further supported by its focus on the cultivation and distribution of premium and ultra-premium cannabis products

exclusively, which the Company believes to be in the greatest demand in all of its markets. In comparison to other markets, the Company faces less competition in Germany and therefore is less likely to face significant price competition.

The Company is focusing its resources on reinforcing and further pursuing growth opportunities in Israel, Germany and Europe, implementing a leaner

organization strategy with the primary focus on achieving profitability in 2023.

16

|

Management’s Discussion and Analysis

|

|

REVENUES AND GROSS MARGINS

REVENUES

The revenues of the Group from continuing operations are primarily generated from sales of medical cannabis products to customers in Israel and Germany.

The reportable geographical segments in which the Company operates are Israel and Germany.

For the six months ended June 30:

|

Israel

|

Germany

|

Adjustments

|

Total

|

|||||||||||||||||||||||||||||

|

2023(*)

|

2022

|

2023(*)

|

2022

|

2023(*)

|

2022

|

2023(*)

|

2022

|

|||||||||||||||||||||||||

|

Revenues

|

$

|

23,109

|

$

|

24,206

|

$

|

2,627

|

$

|

1,498

|

$

|

-

|

$

|

-

|

$

|

25,736

|

$

|

25,704

|

||||||||||||||||

|

Segment loss

|

$

|

(1,842

|

)

|

$

|

(10,143

|

)

|

$

|

(767

|

)

|

$

|

(2,009

|

)

|

$

|

-

|

$

|

-

|

$

|

(2,609

|

)

|

$

|

(12,152

|

)

|

||||||||||

|

Unallocated corporate expenses

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

(2,759

|

)

|

$

|

(2,332

|

)

|

$

|

(2,759

|

)

|

$

|

(2,332

|

)

|

||||||||||||

|

Total operating (loss)

|

$

|

(1,842

|

)

|

$

|

(10,143

|

)

|

$

|

(767

|

)

|

$

|

(2,009

|

)

|

$

|

(2,759

|

)

|

$

|

(2,332

|

)

|

$

|

(5,368

|

)

|

$

|

(14,484

|

)

|

||||||||

|

Income (loss) before tax

|

$

|

(4,200

|

)

|

$

|

(13,342

|

)

|

$

|

(1,096

|

)

|

$

|

(2,266

|

)

|

$

|

549

|

$

|

(3,593

|

)

|

$

|

(4,747

|

)

|

$

|

(12,015

|

)

|

|||||||||

|

Depreciation, amortization

|

$

|

1,509

|

$

|

1,232

|

$

|

78

|

$

|

83

|

$

|

-

|

$

|

-

|

$

|

1,587

|

$

|

1,315

|

||||||||||||||||

* See Note 1 under “Review of Financial Performance – Financial Highlights” section of the MD&A.

The consolidated revenues of the Group from continuing operations for the six months ended June 30, 2023, were attributed to the sale of medical cannabis

products in Israel and Germany.

| ● |

Revenues for the six months

ended June 30, 2023 and 2022 were $25,736 and $25,704, respectively, representing an increase of $32 or 0%. Revenues

for the three months ended June 30, 2023 and 2022 were $13,207 and $12,703, respectively, representing an increase of $504 or 4%. The increase in revenues is attributed both to the increase in the quantity of medical cannabis products sold, off set by

lower average selling price per gram due to high competition.

|

| ● |

Revenues from the Israeli operation were attributed to the sale of medical cannabis through the Company’s agreement with Focus Medical and the revenues from the Israeli Pharmacies the Company owns, mostly from

cannabis products.

|

| ● |

In Germany, Company revenues were attributed to the sale of medical cannabis through Adjupharm.

|

| ● |

Total dried flower sold for the six months ended June 30, 2023, was 3,970kg at an average selling price of $5.60 per gram compared to 3,007kg for the same period in 2022 at an average

selling price of $7.67 per gram, mainly attributable to the higher average selling price per gram the Company recognized through selling premium cannabis products. Total dried flower sold for the three months ended June 30, 2023, was

2,128kg at an average selling price of $5.04 per gram compared to 1,592kg for the same period in 2022 at an average selling price of $7.27 per gram.

|

17

|

Management’s Discussion and Analysis

|

|

COST OF REVENUES

Cost of revenues is comprised of purchase of raw materials and finished goods, import costs, production costs, product laboratory testing, shipping and

salary expenses. Inventory is later expensed to the cost of sales when sold. Direct production costs are expensed through the cost of sales.

The cost of revenues from continuing operations for the six months ended June 30, 2023 and 2022 were $18,759 and $20,023, respectively, representing a

decrease of $1,264 or 6%. The cost of revenues from continuing operations for the three months ended June 30, 2023 and 2022 were $9,473 and $10,108, respectively, representing a decrease of $635 or 6%.

GROSS PROFIT

Gross profit from continuing operations for the six months ended June 30, 2023, and 2022 was $6,360 and $4,606, respectively, representing an increase of $1,754 or 38%. Gross profit from continuing operations for the

three months ended June 30, 2023, and 2022 was $3,456 and $2,201, respectively, representing an increase of $1,255 or 57%.

Gross profit included losses from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $(617) and

$(1,075) for the six months ended June 30, 2023, and 2022, respectively. Loss from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $(278) and $(394) for the three months ended June 30,

2023, and 2022, respectively. Fair value adjustments were impacted primarily due to lower valuation to unrealized biological assets during the six months ended June 30, 2023.

EXPENSES

GENERAL AND ADMINISTRATIVE

General and administrative expenses from continuing operations for the six months ended June 30, 2023, and 2022 were $5,563 and $7,284, respectively, representing a decrease of $1,721 or 24%. For the three months ended

June 30, 2023, and 2022 general and administrative expenses from continuing operations were $2,389 and $3,337, respectively, representing a decrease of $948 or 28%.

The decrease in the general and administrative expense is attributable mainly to salaries to employees. The general and administrative expenses are

comprised mainly from salaries to employees in the amount of $1,008, professional fees in the amount of $2,199, depreciation and amortization in the amount of $407 and insurance costs in the amount of $1,007.

SELLING AND MARKETING

Selling and marketing expenses from continuing operations for the six months ended June 30, 2023, and 2022 were $5,427 and $5,581, respectively,

representing a decrease of $154 or 3%. For the three months ended June 30, 2023, and 2022 selling and marketing expenses from continuing operations were $2,622 and $3,120, respectively, representing a decrease of $498 or 16%. The decrease in the

selling and marketing expenses was due mainly to the decrease of marketing costs in Israel, following the restructuring plan executed in the first quarter of 2023.

18

|

Management’s Discussion and Analysis

|

|

RESTRUCTURING EXPENSES

On April 6, 2022, Focus Medical announced its decision, from March 30, 2022, to close the Focus Facility in Israel and therefore the Company recorded

restructuring expenses related to impairment of property, plant and equipment, biological assets and right of use asset and liabilities, in the total amount of $4,383.

On March 8, 2023, the Company announced its strategy plan in Israel of reorganization of the company's management and operations in order to strengthen its focus on core activities and drive efficiencies to realize

sustainable profitability. The Company reduced its workforce in Israel by 36% across all functions (including executives). Therefore, the Company recorded restructuring expenses for the six months ended June 30, 2023 related mainly to salaries to

employees in the amount of $617.

SHARE-BASED COMPENSATION

Share-based compensation expense from continuing operations for the six months ended June 30, 2023, and 2022 was $121 and $1,842, respectively, representing a decrease of $1,721 or 93%. For the three months ended June

30, 2023, and 2022 share-based compensation income (expense) from continuing operations was $137 and ($732), respectively, representing an increase of income of $869 or 119%. The increase of income was mainly due to the cancellation of incentive

stock options (“Options”) held by employees who are no longer working for the Company.

FINANCING

Financing income, net, for the six months ended June 30, 2023, and 2022 was $621 and $2,583, respectively, representing a decrease of $1,962 or 76% in the financing income. For the three months ended June 30, 2023, and

2022 financing income (expense), net, was $(2,114) and $1,030, respectively, representing a decrease of $3,144 or 305% in the financing income.

The change for the year was mainly due to the updated Company’s warrants valuation that was impacted by the Company’s decreased share price leading to

financial income (expense) in the amount of $3,304 and 5,697 in the six months ended June 30, 2023 and 2022, respectively.

NET INCOME/LOSS

Net loss for the six months ended June 30, 2023, and 2022 was $4,572 and $29,719, respectively, representing a net loss decrease of $25,147 or 85%. For the three months ended June 30, 2023, and 2022 net loss was $3,706

and $18,978, respectively, representing a net loss increase of $15,272 or 80%. The net loss decrease related to factors impacting net income described above, and loss from discontinued operations in the amount of ($18,936) recorded in the six month

ended June 30, 2022 related to the discontinued operations in Canada.

NET INCOME (LOSS) PER SHARE BASIC AND DILUTED

Basic loss per share is calculated by dividing the net profit attributable to holders of Common Shares by the weighted average number of Common Shares outstanding during the period. Diluted profit per Common Share is

calculated by adjusting the earnings and number of Common Shares for the effects of dilutive warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the denominator in calculating diluted profit per

Common Share excludes unissued Common Shares related to Options as they are antidilutive. Basic Loss per Common Share from continuing operations for the six months ended June 30, 2023, and 2022 were $(0.33) and $(1.32) per Common Share,

respectively. For the three months ended June 30, 2023, and 2022 Basic Loss per Common Share from continuing operations were $(0.26) and $(0.49) per Common Share, respectively.

19

|

Management’s Discussion and Analysis

|

|

Diluted Loss per Common Share from continuing operations for the six months ended June 30, 2023, and 2022 were $(0.33) and $(2.09) per Common Share, respectively. For the three months ended June 30, 2023, and 2022

Diluted Loss per Common Share from continuing operations were $(0.26) and $(0.89) per Common Share, respectively.

TOTAL ASSETS

Total assets as of June 30, 2023 were $55,750, compared to $60,676 as of December 31, 2022, representing a decrease of $4,926 or 8%. This decrease was primarily due to the reduction of cash and cash equivalents in the

amount of $1,128 and reduction of inventory of $2,101. Additional decrease is attributed to the effect of translation of items denominated in NIS in the Company’s balance sheet.

INVESTMENT IN XINTEZA

On December 26, 2019, IMC Holdings entered into a share purchase agreement with Xinteza API Ltd. (“Xinteza”), a company with a unique biosynthesis

technology, whereby the Company acquired, on an as-converted and fully diluted basis, 25.37% of Xinteza’s outstanding share capital, for consideration of US$1,700 (approximately $2,165 as of December 31, 2021) paid in several installments (the “Xinteza SPA”). The Company has paid all outstanding installments pertaining to the Xinteza SPA and currently holds 23.35% of the outstanding share capital of Xinteza on an as-converted and fully diluted basis. On

February 24, 2022, IMC Holdings entered into a simple agreement for future equity with Xinteza, under which IMC Holdings paid US$100 (approximately $125), in exchange for the right to certain shares of Xinteza.

TOTAL LIABILITIES

Total liabilities as of June 30, 2023, were $34,212, compared to $36,879 at December 31, 2022, representing an decrease of $2,667 or 7%. The decrease was

mainly due to the reduction in trade payables in the amount of $5,931, a decrease in other accounts payables in the amount of $1,227, off set by increase in bank loans and credit facilities in the amount of $2,231, and an increase in fair value of

warrants in the amount of $3,681. Additional decrease is attributed to the effect of translation of items denominated in NIS in the Company’s balance sheet.

LIQUIDITY AND CAPITAL RESOURCES

For the six months ended June 30, 2023, the Company recorded revenues of $25,736. In addition, the Company hasn’t collected any proceeds from the exercises of Options.

The Company can face liquidity fluctuations from time to time, resulting from delays in sales and slow inventory movements.

In January 2022, Focus entered into a revolving credit facility with an Israeli bank, Bank Mizrahi (the “Mizrahi Facility”).

The Mizrahi Facility is guaranteed by Focus assets. Advances from the Mizrahi Facility will be used for working capital needs. The Mizrahi Facility has a total commitment of up to NIS 15 million (approximately $6,000) and has a one-year term for

on-going needs and 6 months term for imports and purchases needs. The Mizrahi Facility is renewable upon mutual agreement by the parties. The borrowing base is available for draw at any time throughout the Mizrahi Facility and is subject to several

covenants to be measured on a quarterly basis (the “Mizrahi Facility Covenants”).

20

|

Management’s Discussion and Analysis

|

|

The Mizrahi Facility bears interest at the Israeli Prime interest rate plus 1.5%. As of June 30, 2023, Focus did not meet certain covenants under the

Mizrahi Facility. During the first quarter of 2023 the Company reduced total commitment to NIS 10,000 (approx. $3,600) and as of June 30, 2023 Focus has drawn down $nil in respect of the Mizrahi Facility.

On May 17, 2023, the Company and Bank Mizrahi entered a new credit facility with total commitment of up to NIS 10,000 (approximately $3,600) (the “New Mizrahi Facility”). The New Mizrahi Facility consists of NIS 5,000 credit line and NIS 5,000 loan to be settled with 24 monthly installments from May 2023. This loan bears interest at the Israeli Prime interest

rate plus 2.9%. As of June 30, 2023 Focus has drawn down $3,448 in respect of the new Mizrahi facility (comprised of approx. $1,793 credit line and $1,655 loan).

The Company's CEO and director, provided to the bank a personal guarantee in the amount of the outstanding borrowed amount, allowing the New Mizrahi

Facility to remain effective.

On August 24, 2022, the Company announced a private placement for aggregate gross proceeds of up to $6,500 (US$5 million) (the “Private Placement”). In

this Private Placement the Company issued 599,999 Common Shares for a total amount of $3,756 (US$3 million) including investments by the Company’s management and executives. Issuance costs of this transaction amounted to $178.

Between January 16, 2023 to February 16, 2023, the Company completed the LIFE Offering, comprised of an aggregate of 2,828,248 Units issued and sold under

the Life Offering for an aggregate gross proceeds of US$3,535, such amount exclusive of 131,700 Units issued to a director of the Company as part of the LIFE Offering whose subscription price was satisfied by the settlement of US$164 in debt owed by

the Company to the director.

Concurrently, the Company completed the Concurrent Offering, comprised of an aggregate of 2,317,171 Units issued and sold under the Concurrent Offering for

aggregate gross proceeds of US$2,896.

As of June 30, 2023, the Group's cash and cash equivalents totaled $1,321 and the Group's working capital from continuing operations (current assets minus current liabilities) amounted to $2,293. In the six months

ended June 30, 2023, the Group had an operating loss from continuing operation of ($5,368) and negative cash flows from operating activities of ($13,212).

The Group’s current operating budget includes various assumptions concerning the level and timing of cash receipts from sales and cash outlays for

operating expenses and capital expenditures, including cost saving plans and restructuring actions taken in 2022 and in June 2023. The Company’s board of directors approved a cost saving plan, implemented in whole or in part, to allow the Company to

continue its operations and meet its cash obligations. The cost saving plan consists of cost reduction due to efficiencies and synergies, which include mainly the following steps: discontinuing operation of loss-making activities, reduction in

payroll and headcount, reduction in compensation paid to key management personnel (including layoffs of key executives), operational efficiencies and reduced capital expenditures.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The Interim Financial Statements do not include any

adjustments relating to the recoverability and classification of assets or liabilities that might be necessary should the Company be unable to continue as a going concern.

21

|

Management’s Discussion and Analysis

|

|

As of June 30, 2023, the Group’s financial liabilities consisted of accounts payable which have contractual maturity dates within one year. The Group

manages its liquidity risk by reviewing its capital requirements on an ongoing basis. Based on the Group’s working capital position on June 30, 2023, management considers liquidity risk to be moderate.

As of June 30, 2023, the Group has identified the following liquidity risks related to financial liabilities (undiscounted):

|

Less than one year

|

1 to 5 years

|

6 to 10 years

|

> 10 years

|

|||||||||||||

|

Contractual Obligations

|

$

|

12,096

|

$

|

1,318

|

$

|

-

|

$

|

-

|

||||||||

The maturity profile of the Company’s other financial liabilities (trade payables, other account payable and accrued expenses, and warrants) as of June 30, 2023, are less than

one year.

|

Payments Due by Period

|

||||||||||||||||||||

|

Contractual Obligations

|

Total

|

Less than one year

|

1 to 3 years

|

4 to 5 years

|

After 5 years

|

|||||||||||||||

|

Debt

|

$

|

11,856

|

$

|

11,477

|

$

|

379

|

$

|

-

|

$

|

-

|

||||||||||

|

Finance Lease Obligations

|

$

|

1,558

|

$

|

619

|

$

|

730

|

$

|

209

|

$

|

-

|

||||||||||

|

Total Contractual Obligations

|

$

|

13,414

|

$

|

12,096

|

$

|

1,109

|

$

|

209

|

$

|

-

|

||||||||||

The Annual Financial Statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will

continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. The Annual Financial Statements do not include any adjustments to the amounts and classification

of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. Such adjustments could be material.

SHARE CAPITAL

The Company’s authorized share capital consists of an unlimited number of Common Shares without par value 13,394,136 of which were issued and outstanding as at the date hereof. The Common Shares confer upon their

holders the right to participate in the general meeting with each Common Share carrying the right to one vote on all matters. The Common Shares also allow holders to receive dividends if and when declared and to participate in the distribution of

surplus assets in the case of liquidation of the Company.

OTHER SECURITIES

As of June 30, 2023, the Company also has the following outstanding securities which are convertible into, or exercisable or exchangeable for, voting or

equity securities of the Company: 421,602 Options, 4,586 restricted share units and 18,261 2019 Broker Compensation Options (as defined below), 294,348 2021 Offered Warrants (as defined below) and 5,769,611 2023 LIFE Offering Warrants.

22

|

Management’s Discussion and Analysis

|

|

FINANCIAL BACKGROUND

On October 11, 2019, the Company completed the Reverse Takeover Transaction, effected by way of a “triangular merger” between the Company, IMC Holdings and

a wholly owned subsidiary of the Company pursuant to Israeli statutory law.

In connection with the Reverse Takeover Transaction, the Company completed a private placement offering of 19,460,527 subscription receipts (each a “Subscription Receipt”) on a pre-2021 Share Consolidation basis (as defined below) of a wholly owned subsidiary of the Company at a price of $1.05 per Subscription Receipt for aggregate gross proceeds of $20,433.

Upon completion of the Reverse Takeover Transaction, each Subscription Receipt was exchanged for one unit comprised of one (1) common share and one-half of one (1/2) warrant (each whole warrant, a “2019 Listed Warrant”).

Each 2019 Listed Warrant was exercisable for one Common Share at an exercise price of $1.30 until October 11, 2021. A total of 9,730,258 2019 Listed Warrants were issued and listed for trading on the CSE under the ticker “IMCC.WT”. The 2019 Listed

Warrants expired on October 11, 2021.

The Company also issued to the agent who acted on its behalf in connection with the Reverse Takeover Transaction, a total of 1,199,326 2019 Broker

Compensation Options (the “2019 Broker Compensation Options”). Following the 2021 Share Consolidation, the 2019 Broker Compensation Options were adjusted to require four 2019 Broker Compensation Options to be

exercised for one underlying unit at an adjusted exercise price of $4.20, with each unit exercisable into one Common Share and one-half of one Common Share purchase warrant (the “2019 Unlisted Warrants”).

Following the 2021 Share Consolidation, the 2019 Unlisted Warrants were adjusted to require four 2019 Unlisted Warrants to be exercised for one Common Share at an adjusted exercise price of $5.20. The 2019 Broker Compensation Options and the 2019

Unlisted Warrants expired on August 2022.

On February 12, 2021, the Company consolidated all of its issued and outstanding Common Shares on the basis of one (1) post-consolidation Common Share for

each four (4) pre-consolidation Common Shares (the “2021 Share Consolidation”) to meet the NASDAQ minimum share price requirement.

On November 17, 2022, the Company completed a second share consolidation (the “2022 Share Consolidation”) by

consolidating all its issued and outstanding Common Shares on the basis of one (1) post-Consolidation Common Share for each ten (10) pre-Consolidation Common Shares.

On May 7, 2021, the Company completed an offering (the “2021 Offering”) for a total of 6,086,956 Common Shares and

3,043,478 Common Share purchase warrants (the “2021 Offered Warrants”). Following the 2022 Share Consolidation, the 2021 Offered Warrant were adjusted to require the (10) 2021 Offered Warrant to be exercised

for one (1) Common Share at an adjusted exercise price of US$72 for a term of 5 years from the date of closing of the 2021 Offering. On November 17, 2022, a shareholder who had participated in the 2021 Offering surrendered his Warrant Certificate of

10,000 Warrant Shares and declared that he has no rights associated with the underlying shares of the Warrant Certificate.

The Company also issued a total of 182,609 broker compensation options (the “2021 Broker Compensation Options”) to

the agents who acted on its behalf in connection with the 2021 Offering. Following the 2022 Share Consolidation, the 2021 Broker Compensation Option were adjusted to require the (10) 2021 Broker Compensation Options for one (1) Common Share at an

adjusted exercise price of US$66.1, at any time following November 5, 2021, until November 5, 2024. There are 182,609 2021 Broker Compensation Options outstanding.

23

|

Management’s Discussion and Analysis

|

|

As of June 30, 2023, and December 31, 2022, there were 6,063,959 and 304,348 warrants outstanding, respectively, re-measured by the Company, using the Black-Scholes pricing model, in the amount of $3,689 and $8,

respectively. For the six months ended June 30, 2023, and 2022, the Company recognized a revaluation gain in the consolidated statement of profit or loss and other comprehensive income of $3,304 and $5,704, respectively. For the three months ended

June 30, 2023, and 2022, the Company recognized a revaluation gain (loss) in the consolidated statement of profit or loss and other comprehensive income, of $(66) and $3,028, respectively, in which the unrealized gain is included in finance income.

OPERATING, FINANCING AND INVESTING ACTIVITIES

The following table highlights the Company’s cash flow activities for the six and three months ended June 30, 2023 and 2022, and for the year ended

December 31, 2022:

|

For the Six Months

Ended June 30, |

For the three months

ended June 30,

|

For the Year ended December 31,

|

||||||||||||||||||

|

Net cash provided by (used in):

|

2023

|

2022

|

2023

|

2022

|

2022

|

|||||||||||||||

|

Operating activities

|

$

|

(13,212

|

)

|

$

|

(8,158

|

)

|

$

|

(5,861

|

)

|

$

|

(27

|

)

|

$

|

(12,340

|

)

|

|||||

|

Investing activities

|

$

|

(553

|

)

|

$

|

29

|

$

|

(86

|

)

|

$

|

(122

|

)

|

$

|

(793

|

)

|

||||||

|

Financing activities

|

$

|

10,677

|

$

|

4,388

|

$

|

3,473

|

$

|

(239

|

)

|

$

|

6,612

|

|||||||||

|

Effect of foreign exchange

|

$

|

1,960

|

$

|

(3,594

|

)

|

$

|

2,376

|

$

|

(4,418

|

)

|

$

|

(2,168

|

)

|

|||||||

|

Increase (Decrease) in cash

|

$

|

(1,128

|

)

|

$

|

(7,335

|

)

|

$

|

(98

|

)

|

$

|

(4,806

|

)

|

$

|

(8,689

|

)

|

|||||

Operating activities from continuing operations used cash of $13,212 and $8,158 for the six months ended June 30, 2023, and 2022, respectively. For the three months ended June 30, 2023 and 2022, operating activities

used cash of $5,861 and $27, respectively. This variance is primarily due to increase in the business activities of the Company including row materials purchases, corporate expenses for salaries, professional fees and marketing expenses in Israel

and Germany and related to the corporate activities in Canada.

Investing activities from continuing operations used cash of $553 and cash provided of $(29) for the six months ended June 30, 2023, and 2022,

respectively. For the three months ended June 30, 2023 and 2022, investing activities used cash of $86 and $122, respectively. Increase derived mainly from purchase of property, plant and equipment in the amount of $553.

Financing activities from continuing operations provided cash of $10,677 and $4,388 for the six months ended June 30, 2023, and 2022, respectively. For the three months ended June 30, 2023 and 2022, financing

activities provided cash of $3,473 and used cash of $(239), respectively. Majority of the increase derived from issuance of share capital and warrants in the amount of $8,273, set of by receipt of bank loan in the amount of $6,047 in 2022.

24

|

Management’s Discussion and Analysis

|

|

SELECTED ANNUAL INFORMATION – CONTINUING OPERATIONS

|

For the year ended

|

December 31,

2022 |

December 31,

2021

|

December 31,

2020

|

|||||||||

|

Revenues

|

$

|

54,335

|

$

|

34,053

|

$

|

15,890

|

||||||

|

Net Loss

|

$

|

(24,922

|

)

|

$

|

(664

|

)

|

$

|

(28,734

|

)

|

|||

|

Basic net income (Loss) per share:

|

$

|

(3.13

|

)

|

$

|

0.02

|

$

|

(1.86

|

)

|

||||

|

Diluted net income (Loss) per share:

|

$

|

(3.81

|

)

|

$

|

(3.62

|

)

|

$

|

(1.86

|

)

|

|||

|

Total assets

|

$

|

60,676

|

$

|

129,066

|

$

|

38,116

|

||||||

|

Total non-current liabilities

|

$

|

3,060

|

$

|

21,354

|

$

|

19,237

|

||||||

SUMMARY OF QUARTERLY RESULTS

|

For the three months ended

|

June 30, 2023

|

March 31, 2023 (1)

|

December 31, 2022

|

September 30, 2022

|

||||||||||||

|

Revenues

|

$

|

13,207

|

$

|

12,529

|

$

|

14,461

|

$

|

14,170

|

||||||||

|

Net Loss

|

$

|

(3,706

|

)

|

$

|

(866

|

)

|

$

|

(9,651

|

)

|

$

|

(4,532

|

)

|

||||

|

Basic net income (Loss) per share:

|

$

|

(0.26

|

)

|

$

|

(0.05

|

)

|

$

|

(1.32

|

)

|

$

|

(0.06

|

)

|

||||

|

Diluted net loss per share:

|

$

|

(0.26

|

)

|

$

|

(0.05

|

)

|

$

|

(1.28

|

)

|

$

|

(0.06

|

)

|

||||

|

For the three months ended

|

June 30, 2022

|

March 31, 2022

|

December 31, 2021

|

September 30, 2021

|

||||||||||||

|

Revenues

|

$

|

12,703

|

$

|

13,001

|

$

|

9,912

|

$

|

8,040

|

||||||||

|

Net income (Loss)

|

$

|

(3,736

|

)

|

$

|

(7,081

|

)

|

$

|

(8,363

|

)

|

$

|

828

|

|||||

|

Basic net income (Loss) per share:

|

$

|

(0.27

|

)

|

$

|

(0.14

|

)

|

$

|

(0.19

|

)

|

$

|

(0.06

|

)

|

||||

|

Diluted net income (Loss) per share:

|

$

|

(0.30

|

)

|

$

|

(0.14

|

)

|

$

|

(0.19

|

)

|

$

|

(0.06

|

)

|

||||

Note 1 - The quarterly figures disclosure here for the three months ended March 31, 2023

have been updated and adjust the Company’s previously filed unaudited interim financial statements as of March 31, 2023. The updates and adjustments are immaterial.

25

|

Management’s Discussion and Analysis

|

|

METRICS AND NON-IFRS FINANCIAL MEASURES

This MD&A makes reference to “Gross Margin”, “EBITDA”, and “Adjusted EBITDA”. These financial measures are not recognized measures under IFRS and do

not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by

providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should neither be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

Management defines Gross Margin as the difference between revenue and cost of goods sold divided by revenue (expressed as a percentage), prior to the

effect of a fair value adjustment for inventory and biological assets. Management defines EBITDA as income earned or lost from operations, as reported, before interest, tax, depreciation and amortization. Adjusted EBITDA is defined as EBITDA,

adjusted by removing other non-recurring or non-cash items, including the unrealized change in fair value of biological assets, realized fair value adjustments on inventory sold in the period, share-based compensation expenses, and revaluation

adjustments of financial assets and liabilities measured on a fair value basis. Management believes that Adjusted EBITDA is a useful financial metric to assess its operating performance on a cash adjusted basis before the impact of non-recurring or

non-cash items. The closest IFRS metric to EBITDA and Adjusted EBITDA is “operating loss”.

The non-IFRS financial measures can provide investors with supplemental measures of our operating performance and thus highlight trends in our core

business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors and other interested parties frequently use non-IFRS financial measures in the evaluation of issuers. These

financial measures are metrics that have been adjusted from the IFRS statements in an effort to provide readers with a normalized metric in making comparisons more meaningful across the cannabis industry. However, other companies in our industry may

calculate this measure differently, limiting their usefulness as comparative measures.

Our management also uses these non-IFRS financial measures in order to facilitate operating performance comparisons from period to period, to prepare

annual operating budgets and forecasts and to determine components of management compensation. As required by Canadian securities laws, we reconcile these non-IFRS financial measures to the most comparable IFRS measures.

GROSS MARGIN

|

Six months ended

|

June 30, 2023*

|

June 30, 2022

|

||||||

|

Net Revenue

|

$

|

25,736

|

$

|

25,704

|

||||

|

Cost of sales

|

$

|

18,759

|

$

|

20,023

|

||||

|

Gross profit before FV adjustments

|

$

|

6,977

|

$

|

5,681

|

||||

|