Exhibit 99.8

Management’s Discussion and Analysis

TABLE OF CONTENTS

| 4 |

|

|

6

|

|

|

6

|

|

|

8

|

|

|

10

|

|

|

11

|

|

|

12

|

|

|

20

|

|

|

49

|

|

|

55

|

|

|

60

|

2

INTRODUCTION

IM Cannabis Corp. (“IM Cannabis” or the “Company”) is a British Columbia company operating in the international

medical cannabis industry. The Company’s common shares (the “Common Shares”) trade under the ticker symbol “IMCC” on both the NASDAQ Capital Market (“NASDAQ”) and the

Canadian Securities Exchange (“CSE”) as of March 1, 2021 and November 5, 2019, respectively.

This Management’s Discussion and Analysis (“MD&A”) reports on the consolidated financial condition and operating results of IM Cannabis for the year

and three months ended December 31, 2022. Throughout this MD&A, unless otherwise specified, references to “we”, “us”, “our” or similar terms, as well as the “Company” and “IM Cannabis” refer to IM Cannabis Corp., together with its

subsidiaries, on a consolidated basis, and the “Group” refers to the Company, its subsidiaries, and Focus Medical Herbs Ltd.

This MD&A should be read in conjunction with the audited consolidated financial statements of the Company and the notes thereto for the years ended December 31, 2022 and 2021 (the “Annual Financial Statements”). References herein to “Q4 2022” and “Q4 2021” refer to the three months ended December 31, 2022 and December 31, 2021.

The Annual Financial Statements have been prepared by management in accordance with the International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board (“IASB”). IFRS requires management to make certain judgments, estimates and assumptions that affect the reported amount of assets and liabilities at the date of

the Annual Financial Statements and the amount of revenue and expenses incurred during the reporting period. The results of operations for the periods reflected herein are not necessarily indicative of results that may be expected for future

periods. The Annual Financial Statements for the year and three months ended December 31, 2022, include the accounts of the Group, which includes, among others, the following entities:

|

Legal Entity

|

Jurisdiction

|

Relationship with the Company

|

|

I.M.C. Holdings Ltd. (“IMC Holdings”)

|

Israel

|

Wholly-owned subsidiary

|

|

I.M.C. Pharma Ltd. (“IMC Pharma”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

I.M.C. Farms Israel Ltd. (“IMC Farms”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Focus Medical Herbs Ltd. (“Focus”)

|

Israel

|

Private company over which IMC Holdings exercises “de facto control” under IFRS 10

Consolidated Financial Statements (“IFRS 10”)

|

|

R.A. Yarok Pharm Ltd. (“Pharm Yarok”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Rosen High Way Ltd. (“Rosen High Way”)

|

Israel

|

Wholly-owned subsidiary of IMC Holdings

|

|

Revoly Trading and Marketing Ltd. dba Vironna Pharm (“Vironna”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Oranim Plus Pharm Ltd. (“Oranim Plus”)

|

Israel

|

Subsidiary of IMC Holdings

|

|

Trichome Financial Corp. (“Trichome”)*

|

Canada

|

Wholly-owned subsidiary

|

|

Trichome JWC Acquisition Corp. (“TJAC”)*

|

Canada

|

Wholly-owned subsidiary of Trichome

|

|

MYM Nutraceuticals Inc. (“MYM”)*

|

Canada

|

Wholly-owned subsidiary of Trichome

|

|

Highland Grow Inc. (“Highland”)*

|

Canada

|

Wholly-owned subsidiary of MYM International Brands Inc., a wholly-owned subsidiary of MYM

|

|

Adjupharm GmbH (“Adjupharm”)

|

Germany

|

Subsidiary of IMC Holdings

|

* Discontinued operations. Please see note number 24 in the Annual Financial Statements.

3

All intercompany balances and transactions were eliminated on consolidation. All dollar figures in this MD&A are expressed in thousands of Canadian Dollars ($), except per share data and

unless otherwise noted. All references to “NIS” are to New Israeli Shekels. All references to “€” or to “Euros” are to Euros. All references to “US$” or to “U.S. Dollars” are to United States Dollars. The Company’s shares, options, units and

warrants are not expressed in thousands. Prices are not expressed in thousands.

NON-IFRS FINANCIAL MEASURES

Certain non-IFRS financial measures are referenced in this MD&A that do not have any standardized meaning under IFRS, including “Gross Margin”, “EBITDA” and “Adjusted EBITDA”. The Company

believes that these non-IFRS financial measures and operational performance measures, in addition to conventional measures prepared in accordance with IFRS, enable readers to evaluate the Company’s operating results, underlying performance and

prospects in a similar manner to the Company’s management. For a reconciliation of these non-IFRS financial measures to the most comparable IFRS financial measures, as applicable, see the “Metrics and Non-IFRS

Financial Measures” section of the MD&A.

NOTE REGARDING THE COMPANY’S ACCOUNTING PRACTICES

The Company complies with IFRS 10 to consolidate the financial results of Focus, a holder of an Israeli Medical Cannabis Agency (the “IMCA”) license which

allows it to import and supply cannabis products, on the basis of which IMC Holdings exercises “de facto control”. For a full explanation of the Company’s application of IFRS 10, see “Legal and Regulatory –

Restructuring” and “Legal and Regulatory – Risk Factors”.

OVERVIEW – CURRENT OPERATIONS IN ISRAEL AND GERMANY

IM Cannabis is an international cannabis company that is currently focused on providing premium cannabis products to medical patients in Israel and Germany, two of the world’s largest federally

legal cannabis markets. Until recently, the Company was also actively servicing adult-use recreational consumers in Canada, however these operations are being discontinued. The Company leverages a transnational ecosystem powered by a unique

data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to

become a global high-quality cannabis player.

In Israel, the Company imports, distributes and sells cannabis to local medical patients by operating medical cannabis retail pharmacies, online platforms, distribution centers and logistical

hubs operating through IMC Holdings’ subsidiaries and Focus, leveraging proprietary data and patient insights. The Company also cultivate its existing proprietary genetics with third-party cultivation facilities in Israel.

In Germany, the IM Cannabis ecosystem operates through Adjupharm, importing and distributing cannabis to pharmacies for patients, and acting as the Company’s entry point for potential Europe-wide

distribution in the future.

4

On November 7, 2022, the Company announced that it is pivoting its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany, while also

commencing its exit from the Canadian cannabis market. The Canadian operations are currently being wound-down under the Canadian Companies’ Creditors Arrangement Act (“CCAA”) under the supervision of the

Ontario Superior Court of Justice (Commercial List) (the “Court”) (the “CCAA Proceedings”). The CCAA Proceedings afford Trichome and certain of Trichome’s

wholly-owned subsidiaries (collectively, the “Trichome Group”) the stability and flexibility required to orderly wind-down its business and operations. The Trichome Group anticipates completing the

wind-down by April 21, 2023.

The Company has exited its operations in Canada, and deconsolidated Trichome on November 7, 2022 pursuant to IFRS. The CCAA Proceedings are solely in respect of the Trichome Group. As such, the

Company’s other assets or subsidiaries, including those in Israel and Germany, are not parties to the CCAA Proceedings. For more information, see “Corporate Highlights and Events – Key Highlights for the quarter

and year ended December 31, 2022” below.

OUR GOAL – DRIVE PROFITABLE REVENUE GROWTH

Our primary goal is to sustainably increase revenue in each of our core markets, to accelerate our path to profitability and long-term shareholder value while actively managing costs and margins.

HOW WE PLAN TO ACHIEVE OUR GOAL – CORE STRATEGIES

Our strategy of sustainable and profitable growth consists of:

| • |

Continue building on the increasing demand and positive momentum in Israel and Germany, supported by strategic alliances with Canadian suppliers and a highly skilled sourcing team, to cement its leadership position in markets where the

Company operates.

|

| • |

Develop and execute a long-term growth plan in Germany, based on the strong sourcing infrastructure in Israel which is powered by advanced product knowledge and regulatory expertise establishing, in the Company’s view, a competitive

advantage ahead of proposals for the legalization of recreational cannabis in Germany.

|

| • |

Properly position brands with respect to target-market, price, potency and quality, such as our IMC brand in Israel and Germany.

|

| • |

Strong focus on efficiencies and synergies as a global organization with domestic expertise in Israel and Germany.

|

| • |

High-quality, reliable supply to our customers and patients, leading to recurring sales.

|

| • |

Ongoing introduction of new Stock Keeping Unit (“SKUs”) to keep consumers and patients engaged.

|

| • |

Reorganization of the Company's management and operations by reducing its workforce in Israel by 20%-25% across all functions, to strengthen its focus on core activities and drive efficiencies to realize sustainable profitability.

|

5

RESULTS – REVENUE GROWTH IN Q4 2022

The Company operates in the Israeli and German medical cannabis markets. Until recently, the Company was also actively servicing adult-use recreational consumers in Canada, however these

operations are being discontinued, effective November 7, 2022, when the Company commenced the process of exiting the Canadian cannabis market to focus its resources on reinforcing and further pursuing growth opportunities in Israel, Germany and

Europe, implementing a leaner organization strategy with the primary focus on achieving profitability in 2023.

Israel

In Israel, we continue to expand IMC brand recognition and supply the growing Israeli medical cannabis market with our branded products. The Company offers medical cannabis patients a rich

variety of high-end medical cannabis products through strategic alliances with Canadian suppliers supported by a highly skilled sourcing team. In addition to the benefits of the Group’s long-term presence in Israel, we believe that with our

strong sourcing infrastructure in Israel, and advanced product knowledge, regulatory expertise and strong commercial partnerships, the Company is well-positioned to address the ongoing needs and preferences of medical cannabis patients in Israel.

The Company entered additional segments of the medical cannabis value chain in Israel, namely the distribution and retail segments. The Company, through IMC Holdings, acquired three licensed

pharmacies in 2022, each selling medical cannabis products to patients: (i) Oranim Plus, Israel’s largest pharmacy in Jerusalem and one of the largest in Israel, (ii) Vironna, a leading pharmacy in the Arab sector, and (iii) Pharm Yarok, the

largest pharmacy in the Sharon plain area and the biggest call centerin the country (Oranim Plus, Vironna, and Pharm Yarok collectively, the “Israeli Pharmacies”).

The Company has also acquired home-delivery services and an online retail footprint, operating under the name “Panaxia-to-the-Home”, which includes a

customer service centerand an Israeli medical cannabis distribution licensed center (the “Panaxia Transaction”), from Panaxia Pharmaceutical Industries Israel Ltd. and Panaxia Logistics Ltd., part of the

Panaxia Labs Israel, Ltd. group of companies (collectively, “Panaxia”).

6

The entrance into the new segments in Israel position IM Cannabis as a large distributor of medical cannabis in Israel. We are strategically focused on establishing and reinforcing a direct

connection with medical cannabis patients, providing direct access to IM Cannabis products, obtaining and leveraging market data and gaining a deeper understanding of consumer preferences. The acquisition of the Israeli Pharmacies allows the

Company to increase purchasing power with third-party product suppliers, offers potential synergies with our established call centerand online operations, achieves higher margins on direct sales to patient and creates the opportunity for up-sales

across a growing range of products.

Germany

In Europe, the Company operates in Germany through Adjupharm, its German subsidiary and EU-GMP certified medical cannabis producer and distributor. We continue to lay our foundation in Germany,

which is currently the European market with the largest number of medical cannabis patients.1 Leveraging our global supply chain, IM Cannabis continues to focus on growing its business in

Germany to be well-positioned through brand recognition in preparation for future regulatory reforms.

Similar to Israel, the Company’s focus in Germany is to import premium dried cannabis from its supply partners, which we believe will satisfy the rapid growth in demand for high-THC premium

cannabis across a variety of strains and qualities. In addition, Adjupharm sells cannabis extracts to meet the existing demand in the German market.

In the Company’s view, the strong sourcing infrastructure in Israel, powered by advanced product knowledge and regulatory expertise, will establish a competitive advantage in Germany ahead of

proposals for the legalization of recreational cannabis. This is based on the premise that the German and Israeli markets share a number of common attributes such as robust commercial infrastructure, highly developed digital capabilities,

favourable demographics and customer preferences.

While the Company does not currently distribute products in other European countries, the Company intends to leverage the foundation established by Adjupharm, its state-of-the-art warehouse and

EU-GMP production facility in Germany (the “Logistics Center”), its vast knowledge in the cannabis market and costumers’ preferences and its network of distribution partners to expand into other

jurisdictions across the continent.

Adjupharm received a revised EU-GMP license in May 2022 that permits it to engage in additional production, cannabis testing and release activities. It allows Adjupharm to repackage bulk

cannabis, to perform stability studies and offer such services to third parties.

1 The European Cannabis Report – Edition 7 https://prohibitionpartners.com/2022/03/31/launching-today-the-european-cannabis-report-7th-edition/ and Visual Capitalist website, A Bird’s Eye

View of the World’s Largest Cannabis Markets https://www.visualcapitalist.com/sp/a-birds-eye-view-of-the-worlds-largest-cannabis-markets/

7

Note on the Canadian operation

On November 7, 2022, the Company announced that it is pivoting its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany, while also

commencing its exit from the Canadian cannabis market. The Canadian operations are currently being wound-down under the CCAA under the supervision of the Court. The CCAA Proceedings afford the Trichome Group the stability and flexibility required

to orderly wind-down its business and operations. The Trichome Group anticipates completing the wind-down by April 21, 2023.

The Company has exited its operations in Canada, and deconsolidated Trichome on November 7, 2022 pursuant to IFRS. The CCAA Proceedings are solely in respect of the Trichome Group. As such, the

Company’s other assets or subsidiaries, including those in Israel and Germany, are not parties to the CCAA Proceedings. For more information, see “Corporate Highlights and Events – Key Highlights for the quarter

and year ended December 31, 2022” below.

The IMC brand is well-known in the Israeli medical cannabis market, with signature reputable brands such as Roma®, highly popular among Israeli consumers. Building on its long-term success in

Israel, the Company launched the IMC brand in Germany in 2020.

Israeli Medical Cannabis Business

The IMC brand has established its reputation in Israel for quality and consistency over the past 10 years and more recently with new high-end, ultra-premium strains that have made it to the

top-sellers list in pharmacies across the country.

The Group maintains a portfolio of strains sold under the IMC umbrella from which popular medical cannabis dried flowers and full-spectrum cannabis extracts are produced.

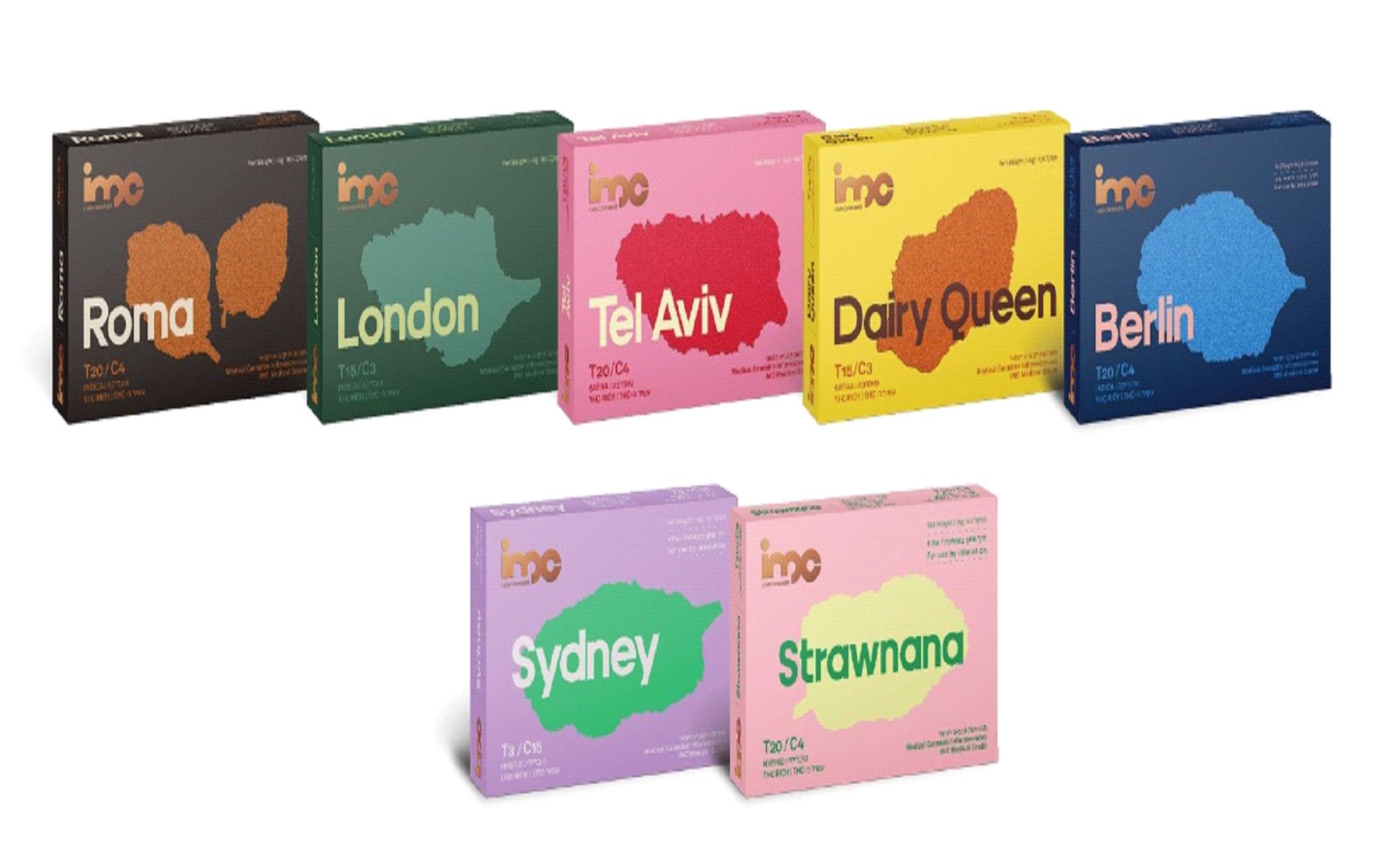

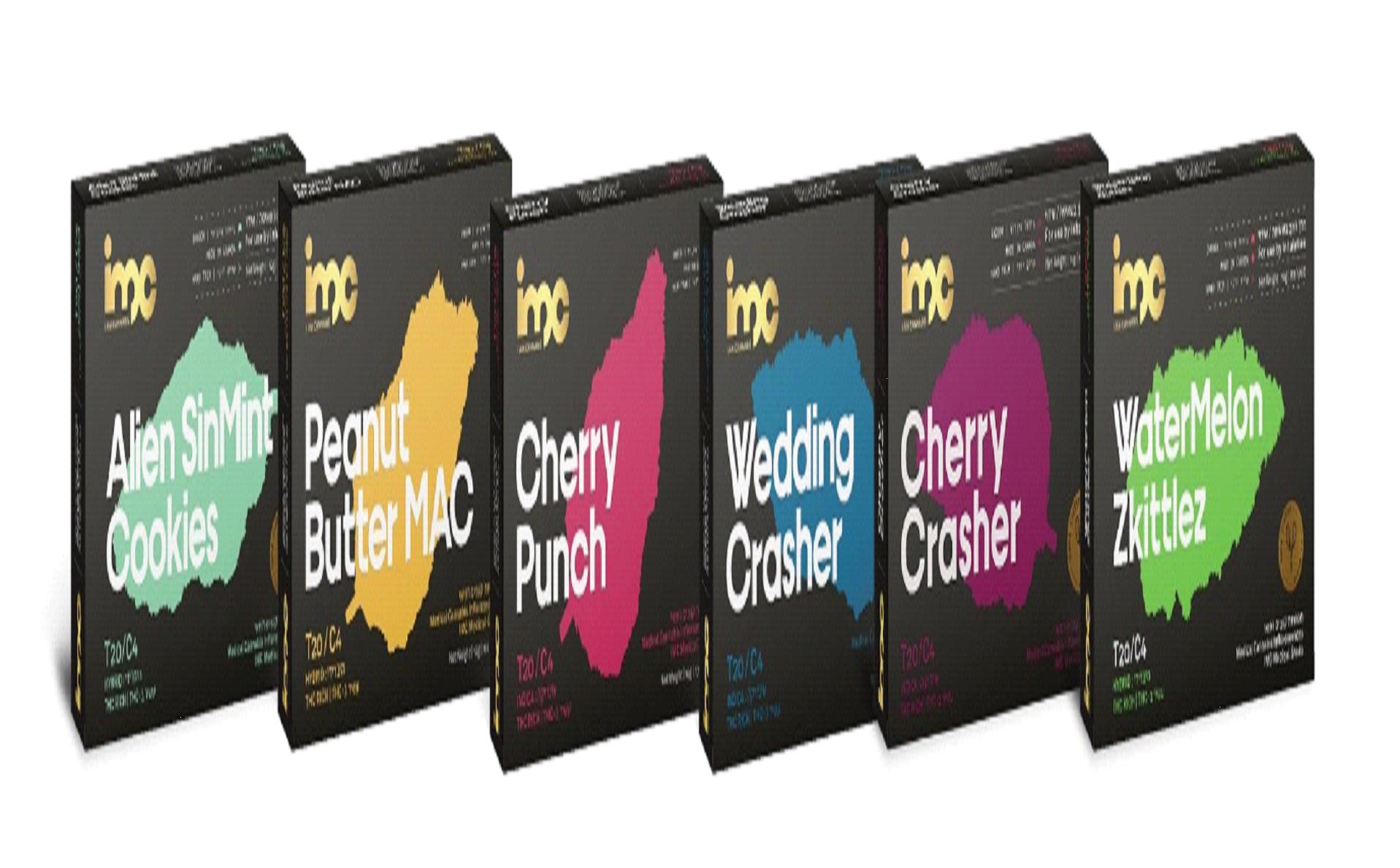

The IMC brand offers four different product lines, leading with the Craft Collection which offers the highest quality Canadian craft cannabis flower and has established IMC as the leader of the

super-premium segment in Israel.

The Craft Collection – The IMC brand’s super-premium product line with indoor-grown, hang-dried and hand-trimmed high-THC cannabis flowers. The Craft

Collection includes exotic and unique cannabis strains such as Cherry Crasher, Peanut Butter MAC and Watermelon Zkittlez.

|

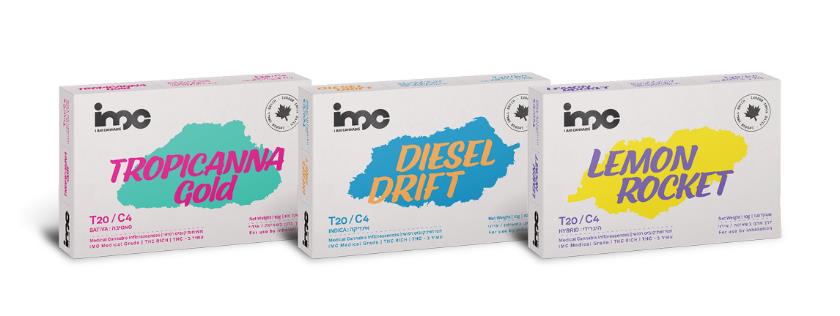

The Top-Shelf Collection – The newest addition to IMC’s brand portfolio, launched in September 2022 as IMC’s premium product line, offers indoor-grown, high-THC

cannabis flowers with strains such as Lemon Rocket and Diesel Drift. Inspired by the 1970’s cannabis culture in America, the Top-Shelf Collection targets the growing segment of medical patients who are cannabis culture enthusiasts.

|

|

8

The Signature Collection – The IMC brand’s high-quality product line with greenhouse-grown or indoor grown, high-THC cannabis flowers. The Signature

Collection currently includes well known cannabis dried flowers such as Roma®, Tel Aviv and London as well as Strawnana, an indoor-grown flower, and Sydney, the Company’s first high-CBD cannabis strain, both launched in Q3 2022.

The Full Spectrum Extracts – The IMC brand’s full spectrum, strain-specific cannabis extracts, including high-THC Roma® oil, balanced Paris oil and Super

CBD oil and the new Roma® T15 oil and Tel Aviv oil, which were launched in Q3 2022.

As part of its recent rebranding the Company expanded its Roma® product portfolio in Q3 2022 to include pre-rolls and oils range, offering the widest range

of different product SKUs for a single strain in the Israeli market. This delivers a variety of formats of IMC’s most successful and well-known strain to Israeli medical cannabis patients. IMC’s Roma® strain is a high-THC medical cannabis flower

that offers a therapeutic continuum and is known for its strength and longevity of effect.

|

The WAGNERS™ brand launched in Israel in Q1 2022, with premium indoor-grown cannabis imported from Canada. The

WAGNERS™ brand was the first international premium, indoor-grown brand introduced to the Israel cannabis market, at a competitive price point. The WAGNERS™ brand includes the Dark Helmet, Cherry Jam launched in Q1 2022, and

Golden Ghost that was launched in Q4 2022.

|

|

|

BLKMKT™, the Company’s second Canadian brand, was introduced to the Israeli market in Q4 2022.

|

|

For more information, see “Strategy in Detail – Brands – New Product Offerings” section of the MD&A.

German Medical Cannabis Business

In Germany, the Company sells IMC-branded dried flower products and full spectrum extracts. The medical cannabis products sold in the German market are branded generically as IMC to increase

recognition of the Company’s brand in establishing a foothold with German healthcare professionals. The Company’s IMC-branded cannabis products were launched in Germany with one high-THC flower strain in 2020. In Q4 2021, Adjupharm launched

another high-THC flower strain and two full spectrum extracts. In Q1 2022 Adjupharm launched a third strain, a high-CBD flower, to offer a more complete portfolio to German physicians and patients. In Q2 2022 the Company’s IMC Hindu Kush strain

was the top selling T20 in the market, strengthening Adjupharm’s position as one of the top 10 cannabis companies in Germany. December 2022 was Adjupharm’s strongest sales month to date.

In July 2021, Adjupharm was recognized by the German Brand Institute with the “German Brand Award 2021”, recognizing its excellence in brand strategy and creation, communication, and integrated

marketing. The Group’s competitive advantage in Germany lies in its track record, experience and brand reputation in Israel and proprietary data supporting the potential effectiveness of medical cannabis for the treatment of a variety of

conditions.

9

Between our various geographies, the strategy for new products varies given that each market is at a different stage of development with respect to regulatory regimes, patient and customer

preferences and adoption rates.

Israel

In Q4 2022, the Company launched the third product in the “Top Shelf” Collection, Tropicanna Gold, a super premium sativa flowers, which together with Diesel Drift and Lemon Rocket launched in

Q3 2022, constitute a full super-premium high THC portfolio with sativa, hybrid and Indica strains.

The Company expect to launch in Q1 2023, two additional products under the “Top Shelf” Collection: Lucy Dreamz and Santa Cruz.

In Q4 2022, Golden Ghost was introduced to WAGNERS™ in Israel as it's first new cultivar since the launch of the WAGNERS™ brand in Israel in Q1 2022, and is the first out of three new cultivars

for the WAGNERS™ brand to be further introduced in Q1 2023. In addition, in Q4 2022 the WAGNERS™ brand entered two new market segments with Dark Helmet pre-rolls, and Dark Helmet minis, a smaller size cannabis flowers with an even more

affordable price offering of its signature strain.

10

In Q4 2022 the company launched the brand BLKMKT™™ as its second Canadian brand introduced into Israeli market, marking the next step in its extensive partnership with Avant Brands. The

Canadian brand is designed to resonate with legacy consumers and experienced connoisseurs who only consume the highest-grade cannabis, has the highest price point in the Israeli market, raising the bar for ultra-premium cannabis in Israel once

again.

Israel

Over the last decade, Focus Medical was the primary cultivator of medical cannabis products sold under the IMC brand in the Israeli market. Until July 2022, Focus Medical held an IMCA license to

cultivate medical cannabis at its cultivation facility (the “Focus Facility”). In Q2 2022, the Company closed the Focus Facility to concentrate on leveraging its skilled sourcing team and strategic

alliances with Canadian suppliers as well as the import of medical cannabis from its Canadian Facilities. In July 2022, Focus Medical received an IMCA license which allows it to continue to import cannabis products and supply medical cannabis to

patients through licensed pharmacies despite the closure of the Focus Facility (the “Focus New License”). To supplement growing demand, the Company plans to continue its relationships with third-party

cultivation facilities in Israel for the propagation and cultivation of the Company’s existing proprietary genetics and for the development of new products.

In addition, in July 2022, IMC Farms obtained a license from the IMCA which allows it, among others, to import cannabis products and supply medical cannabis to patients through licensed

pharmacies (the “IMC Farms License”).

Pursuant to the applicable Israeli cannabis regulations, following the cultivation or import of medical cannabis, medical cannabis products are then packaged by contracted GMP licensed producers

of medical cannabis. The packaged medical cannabis products are then sold by the Group under the Company’s brands to local Israeli pharmacies directly or through contracted distributors.

Germany

The Company continues to expand its presence in the German market by forging partnerships with pharmacies and distributors across the country and developing Adjupharm and its Logistics Center as

the Company’s European hub. Adjupharm sources its supply of medical cannabis for the German market and from various EU-GMP certified European and Canadian suppliers. The Logistics Center is EU-GMP certified, upgrading Adjupharm’s production

technology and increasing its storage capacity to accommodate its anticipated growth. Adjupharm received the certification for primary repackaging in 2022, making it one of a handful of companies in Germany fully licenced to repack bulk.

Adjupharm currently holds wholesale, narcotics handling, manufacturing, procurement, storage, distribution, and import/export licenses granted to it by the applicable German regulatory

authorities (the “Adjupharm Licenses”).

11

KEY HIGHLIGHTS FOR THE QUARTER AND YEAR ENDED DECEMBER 31, 2022

In 2022, the Company continued to integrate the strategic acquisitions completed in Q1 2022. Effective November 7, 2022, the Company began focusing its efforts and resources on growth in the

Israeli and German cannabis markets with a goal of reaching profitability in 2023 and commenced exiting the Canadian cannabis market. The Company’s key highlights and events for the year ended December 31, 2022 include:

First Import to Israel of Cannabis from the Company’s Canadian Facility

On January 19, 2022, Focus imported premium indoor-grown Canadian cannabis flowers from TJAC, and an additional supply partner. The Group commenced the sale of imported cannabis flowers under its

WAGNERS™ brand in the Israeli medical cannabis market as of February 2022.

Focus Revolving Credit Facility

Revolving Credit Facility Agreement with an Israeli Bank- Bank Mizrahi

In January 2022, Focus entered a revolving credit facility with an Israeli bank, Bank Mizrahi (the “Mizrahi Facility”). The Mizrahi Facility is guaranteed

by Focus assets. Advances from the Mizrahi Facility will be used for working capital needs. The Mizrahi Facility has a total commitment of up to NIS 15 million (approximately $6,000) and has a one-year term for on-going needs and 6 months term

for imports and purchases needs. The Mizrahi Facility is renewable upon mutual agreement by the parties. The borrowing base available for draw at any time throughout the Mizrahi Facility and is subject to several covenants to be measured on a

quarterly basis. The Mizrahi Facility bears interest at the Israeli Prime interest rate plus 1.5% (6.25% per annum as of December 31, 2022). As of December 31, 2022, Focus did not meet certain covenants under the Mizrahi Facility. The Company's

CEO and director, provided to the bank a personal guarantee in the amount of the outstanding borrowed amount, allowing the Mizrahi Facility to remain effective. As of December 31, 2022, Focus withdrew $5,084.

Acquisition of Leading Israeli Retailer and Distributor – Pharm Yarok Group

On March 14, 2022, pursuant to an agreement entered into on July 28, 2021, IMC Holdings completed the acquisition of 100% of the issued and outstanding shares of Pharm Yarok, a leading medical

cannabis pharmacy located in central Israel, and Rosen High Way, a trade and distribution center providing medical cannabis storage, distribution services and logistics solutions for cannabis companies and pharmacies in Israel (collectively, the

“Pharm Yarok Transaction”). The Pharm Yarok Transaction closed upon receipt of all requisite approvals, including the IMCA approval, for an aggregate consideration of NIS 11,900 (approximately $4,600), of

which NIS 8,400 (approximately $3,300) was paid in cash upon signing the definitive agreement, and NIS 3,500 (approximately $1,300) paid upon closing. As part of the Pharm Yarok Transaction, the Company also acquired 100% of the shares of and HW

Shinua, an applicant for a medical cannabis transportation license, for no additional payment, however the completion of such acquisition is pending receipt of the requisite approval from the IMCA. In connection with closing of the Pharm Yarok

Transaction, the Company completed a non-brokered private placement with former shareholders of Pharm Yarok and Rosen High Way on March 14, 2022. A total of 52,370 Common Shares were issued at a deemed price of $26.16 for aggregate proceeds of

approximately $1,370. The calculation of the deemed price was based on the average closing price of Common Shares on the CSE over the 8 trading day period immediately preceding March 14, 2022.

12

Acquisition of Leading Israeli Pharmacy – Vironna

On March 14, 2022, pursuant to an agreement entered into on August 16, 2021, IMC Holdings completed the acquisition of 51% of the issued and outstanding ordinary shares of Vironna (the “Vironna Transaction”), a pharmacy licensed to dispense and sell medical cannabis and is one of the leading pharmacies serving patients in the Arab population in Israel. The Vironna Transaction closed upon

receipt of all requisite approvals, including the approval of the IMCA. The Vironna Transaction was completed for total consideration of NIS 8,500 (approximately $3,330), comprised of NIS 5,000 (approximately $1,950) in cash and NIS 3,500

(approximately $1,360) in Common Shares issued on closing. In satisfaction of the cash consideration component, NIS 3,750 (approximately $1,470) was paid at signing of the definitive agreement and the remaining NIS 1,250 (approximately $490) was

paid post-closing of the Vironna Transaction and during the first quarter of 2023. In satisfaction of the share consideration component, the Company issued 48,536 Common Shares at a deemed issue price of US$22.09 per share (approximately $28.09),

calculated based on the average closing price of the Common Shares of on the NASDAQ for the 14 trading day period immediately preceding closing. The shares issued were subject to a staggered three-month lockup commencing on the date of issuance.

Entering the Retail Segment in Israel by Acquiring Panaxia’s Largest Retail and Online Pharmacy Business

On March 14, 2022, IMC Holdings acquired a medical cannabis storage and distribution license (trading house) from Panaxia (the “Panaxia GDP License”)

following receipt of the requisite IMCA approval and assigned it to IMC Pharma in accordance with the terms of the Panaxia Transaction. The Panaxia Transaction (the “Panaxia Transaction”) is further

described in the Company’s annual information form dated March 31, 2022 that is available on the Company’s SEDAR profile at www.sedar.com. For further information on the Panaxia Transaction please see “Subsequent

Events” section below.

Acquisition of Jerusalem’s Leading Medical Cannabis Pharmacy – Oranim Pharm

On March 28, 2022, pursuant to an agreement entered into on December 1, 2021, IMC Holdings completed the acquisition of 51.3% of the outstanding ordinary shares of Oranim Plus, who holds 99.5% of

the rights in the partnership “Oranim Pharm”, resulting in IMC Holdings owning 51% of the rights in “Oranim Pharm”, which is one of the largest pharmacies selling medical cannabis in Israel and the largest pharmacy selling medical cannabis in the

Jerusalem area (the “Oranim Transaction”). The Oranim Transaction closed upon receipt of all requisite approvals, including the approval of the IMCA. The Oranim Transaction was completed for total

consideration of NIS 11,940 (approximately $4,600), comprised of NIS 10,404 (approximately $4,000) and NIS 1,536 (approximately $600) in Common Shares issued on closing. In satisfaction of the cash consideration component, NIS 5,202

(approximately $2,000) paid at signing of the definitive agreement and NIS 5,202 will be payable in several installments throughout 2023 and until February 15, 2024. In satisfaction of the share consideration component, the Company issued 25,100

Common Shares at a deemed issue price of US$19.74 per share (approximately $25.1), calculated based on the average closing price of the Common Shares on the Nasdaq Capital Market for the 14 trading day period immediately preceding March 28, 2022.

The shares issued were subject to a staggered three-month lockup commencing on the date of issuance.

Closure of Sde Avraham Farm in Israel

In Q2 2022, the Company outlined new strategic imperatives designed to enhance organizational efficiency and reduce operating costs while further responding to the increased demand for premium,

indoor-grown Canadian cannabis from Israeli patients. As part of these changes, Focus decided to close the Focus Facility, and such closure was completed in Q2 2022. Despite the closure of the Focus Facility, Focus continues to import cannabis

products and supply medical cannabis to patients through licensed pharmacies through the Focus New License. The Group plans to continue its relationships with third-party cultivation facilities in Israel for the propagation and cultivation of the

Company’s existing proprietary genetics and for the development of new products.

13

Biome Grow Inc. Default

On April 4, 2022, the Company issued a Notice of Event of Default and Acceleration (the “Notice of Default”) to Biome Grow Inc. (the “Guarantor”) and its subsidiary, Cultivator Catalyst Corp. (together with the Guarantor, the “Obligors”), for a total outstanding principal plus accrued and unpaid

interest of approximately $2,680 (the “Biome Loan”). The Company issued the Notice of Default after several failed attempts to engage the Obligors regarding an

extension and repayment of the Biome Loan.

On April 20, 2022, the Company issued a demand letter to the Obligors seeking immediate payment, along with a Notice to Enforce Security pursuant to section 244 of the Bankruptcy and Insolvency Act (Canada). On May 3, 2022, MYM filed an application with the Superior Court of Justice in Ontario (the “Superior Court”) to appoint a receiver to take control

of the Obligors’ assets, including the security, to effect repayment of the Biome Loan.

The Biome Loan and related security agreements were entered into in July 2020, approximately one year prior to the Company’s acquisition of MYM. As part of the Biome Loan, the Obligors agreed to

repay all outstanding principal and accrued and unpaid interest no later than January 31, 2022. The amount of the Biome Loan and interest payable is secured by assets held in escrow by the Obligors pursuant to a general security agreement (the “Collateral”).

On May 12, 2022, the Company applied to and received from the Superior Court an interim order to, among other things, freeze the assets of the Obligors including

the assets, which comprise MYM’s Collateral for the Biome Loan. MYM has applied to the Superior Court, which granted MYM’s request for the receivership of the assets of the Obligors and has scheduled an

in-person hearing for the receivership application on September 12, 2022.

In September 2022, MYM and the Obligors reached an agreement and signed a term sheet for the settlement of the receivership application and amendment to the Biome Loan (the “Biome Term Sheet”). The Biome Term Sheet was signed on September 9, 2022, prior to the September 12, 2022 in-person receivership application hearing with the Superior Court. The Superior Court approved the

adjournment of the receivership application, pending the implementation of the settlement outlined in the Biome Term Sheet, pursuant to which, the Biome Loan will continue to bear interest at a rate of 8% per annum on the principal balance of the

Biome Loan, compounding every four months on the aggregate balance of the outstanding principal balance plus all accrued and unpaid interest (the “Indebtedness”). The Biome Loan matures December 9, 2023

unless extended through mutual agreement by both parties.

Based on the Biome Term Sheet, the Obligors are required to make a payment to MYM on December 31, 2022. The value of the payment on December 31, 2022 will depend on the volume weighted average

price (the “VWAP”) of the Company’s common shares during the final ten trading days of November 2022. The repayment will be 5% or 10% of the total Indebtedness, depending on the VWAP over that period of

time.

On October 4, 2022, a loan amendment agreement (“Settlement Agreement”) was executed in line with the terms noted in the Biome Term Sheet.

14

The Obligors did not make payment to MYM on December 31, 2022 as required under the Biome Settlement Agreement and the parties are discussing modifications to the Settlement Agreement.

As a result of the Settlement Agreement, the Biome Loan was considered extinguished under IFRS 9 Financial Instruments and a gain of $239 was recognized

during 2022. As of November 7, 2022 the Biome Loan is deconsolidated as part of the deconsolidation of Trichome.

NASDAQ Compliance Notice and Common Share Consolidation

In order to maintain the listing of the Common Shares on the Nasdaq, the Company must comply with Nasdaq’s continued listing requirements which require, amongst other things, that the Common

Shares maintain a minimum bid price of at least US$1.00 per share (the “Minimum Share Price Listing Requirement”)

On July 13, 2022, the Company received written notification from Nasdaq (the “Notification Letter”) that the closing bid price of the Common Shares had

fallen below US$1.00 per share over a period of 30 consecutive business days, with the result that the Company was not in compliance with the Minimum Share Price Listing Requirement. The Notification Letter provided that the Company had until

January 9, 2023, being 180 calendar days following receipt of such notice to regain compliance with the Minimum Share Price Listing Requirement.

On October 20, 2022, the Company obtained shareholder approval for the consolidation of the Common Shares on the basis of one (1) post-consolidation Common Share for each ten (10)

pre-consolidation Common Shares (the “Consolidation”) at the Company’s annual and special meeting of shareholders held on October 20, 2022.

On November 17, 2022, the Consolidation was effected and the Company regained compliance with the Minimum Share Price Listing Requirement on December 5, 2022. Following the Consolidation (or

reverse split), the Common Shares continued to trade on Nasdaq under the symbol “IMCC”.

Canadian Restructuring

On August 5, 2022, the Company commenced a restructuring plan in Canada through which it is taking a disciplined approach to spending and implementing cost efficiencies (the “Canadian Restructuring”). The Company entered into an agreement to sell all the issued and outstanding shares of Sublime on an “as is, where is” basis to a group of purchasers that included current and former

members of the Sublime management team for aggregate proceeds of approximately $100 less working capital adjustments, for a final net purchase price of $89 (the “Sublime Transaction”). The Sublime

Transaction included the sale of Sublime’s lease obligation of the approximately 930 square metre cultivation and storage facility and Sublime’s related operations.

The Canadian Restructuring also included halting cultivation at the facility operated by Highland in Antigonish, Nova Scotia, which continues to be used for packaging and storage, and a workforce

reduction throughout its Canadian operations.

On November 7, 2022, in connection with the Company’s efforts to achieve operational efficiencies, the Company announced that it is pivoting its focus and resources on growth in its highest value

markets in Israel and Germany while also commencing its exit from the Canadian cannabis market as part of the Canadian Restructuring. With this move, the Company aims for a leaner organization with a primary focus on achieving profitability in

2023.

The Canadian operations are held through the Trichome Group and being orderly wound-down under CCAA pursuant to an initial order of the Court issued on November 7, 2022 (as amended and restated

by an order made by the Court on November 17, 2022, the “Initial Order”). The Initial Order includes a broad stay (as extended from time to time, the “Stay”) of all

proceedings against the Trichome Group and its assets. Pursuant to the Initial Order, KSV Restructuring Inc. was appointed as monitor (the “Monitor”) in the CCAA Proceedings.

15

In connection with the CCAA Proceedings, TJAC, as borrower (the “Borrower”), the remaining members of the Trichome Group, as guarantors and Cortland Credit

Lending Corporation, as agent for and on behalf of itself and certain lenders (the “DIP Lender”), entered into a debtor-in-possession facility agreement dated November 6, 2022 (as amended, the “DIP Agreement”). Pursuant to the DIP Agreement, the DIP Lender has agreed to provide a super-priority interim revolving credit facility (subject to certain mandatory repayment provisions) to the Borrower (the “DIP Facility”). In accordance with the DIP Agreement, the DIP Facility is to be used during the CCAA Proceedings by the Borrower to fund its working capital needs. The DIP Facility is subject to customary

covenants, conditions precedent, and representations and warranties made by the Trichome Group to the DIP Lender. The current DIP Lender’s charge approved by the Court is up to the maximum amount of $4,875.

On January 9, 2023, the Court issued an order in the CCAA Proceedings in respect of a motion brought by the Trichome Group to approve, among other things: a sale and investment solicitation

process (the “SISP”) in respect of the business and assets of the Trichome Group; and a stalking horse share purchase agreement (the “Stalking Horse Purchase Agreement”)

between the Trichome Group and L5 Capital Inc. (“L5”) dated December 12, 2022. The SISP established a process to solicit interest for investments in, or the sale of any or all of the, Trichome Group’s

business and assets.

On February 22, 2023, the Monitor issued a report (the “Monitor’s Third Report”) in the CCAA Proceedings advising, among other things, that (i) no

qualified bids were received pursuant to the SISP, (ii) L5 informed the Trichome Group that it would not be completing the transaction contemplated by the Stalking Horse Purchase Agreement and, as a result, the Trichome Group terminated the

Stalking Horse Purchase Agreement, and (iii) the Monitor continues to market for sale the Trichome Group’s business and assets, including the brands and other intellectual property owned by the Trichome Group.

The Monitor’s Third Report also reported on the financial situation of the Trichome Group advising that due to the Trichome Group’s financial performance and the termination of the Stalking Horse

Purchase Agreement, the DIP Lender informed the Trichome Group that the DIP Lender would only fund expenses required for a wind-down of the Trichome Group’s business and as such, the Trichome Group will not have the ability to pay unpaid payables

that are not required to be paid in connection with the wind-down. The Trichome Group has advised that it will not purchase additional goods or services without the prior consent of the Monitor.

Most recently, on March 9, 2023, the Court issued an order extending the Stay until April 21, 2023 in order to allow the Trichome Group to complete the orderly wound-down of its operations.

Non-brokered Private Placement of Common Shares

On August 19, 2022, the Company announced a non-brokered private placement offering of Common Shares (the “2022 Private Placement”) for aggregate gross

proceeds of up to US$5,000 led by the Company’s management and executive team.

On August 24, 2022, the Company announced that it closed the first tranche of the 2022 Private Placement, consisting of 488,749 Common Shares at a price of US$5.00 per Common Share for aggregate

proceeds of approximately US$2,444. Certain insiders of the Company, including its Chief Executive Officer (“CEO”) and Director and Chief Financial Officer (“CFO”),

among others, subscribed for an aggregate of 156,349 Common Shares in the first tranche of the 2022 Private Placement for aggregate proceeds of approximately US$782. On October 6, 2022, the Company announced that it closed the second tranche of

the 2022 Private Placement of 111,250 Common Shares at a price of US$5.00 per Common Share for aggregate proceeds of approximately US$556, increasing the total amount raised from the 2022 Private Placement to approximately US$3,000. Marc Lustig,

Executive Chairman and Director of the Company, subscribed for 111,250 Common Shares in the second tranche for aggregate proceeds of US$556.

16

Changes to the Board

On September 13, 2022, the Company announced that Einat Zakariya and Moti Marcus were appointed to the Board. Einat Zakariya and Moti Marcus replaced Vivian Bercovici and Haleli Barath, who

resigned to pursue other opportunities.

Einat Zakariya is the current CEO and partner of LIV collection, a brand subsidiary of Ewave Holdings Ltd., and CEO and Partner of Ewave Nadlan International Investments Ltd. Ms. Zakariya has

proven expertise in the real-estate industry and brings vast experience in CEO roles as well as strategic consulting, marketing, advertising, and sales. She previously sat on the boards of several major organizations.

Moti Marcus is the current CEO of Packer Quality Materials, one of the largest companies in Israel for the sale and processing of special and unique metals. Mr. Marcus has a strong track record

in CFO roles, management, and mergers and acquisitions. He has served on the boards of several institutions and is a member of the Israel Ministry of Finance “Team of Select Directors.”

The Company and SNDL Inc. Export to Israel

On September 15, 2022, the Company and SNDL Inc. (“SNDL”) announced that SNDL completed its initial international export of approximately 167 kilograms of

premium dried flower from Canada to Israel as part of its total commitment with the Company. SNDL and the Company have agreed to the aggregate export of 1,000 kilograms of high-quality dried flower products for processing and distribution in the

Israeli medical cannabis market, according to the terms and conditions of the agreement between the parties.

Loan from ADI

On October 11, 2022, IMC Holdings entered into a loan agreement with A.D.I. Car Alarms Stereo Systems Ltd (“ADI” and the “ADI

Agreement”), to borrow a principal amount of NIS 10,500 (approximately $[4,045]) at an annual interest of 15% (the “ADI Loan”), which is to be repaid within 12 months of the date of the ADI

Agreement. The ADI Loan is secured by a second rank land charge on the Logistics Center of Adjupharm. In addition, CEO and Director of the Company, provided a personal guarantee to ADI should the security not be sufficient to cover the repayment

of the ADI Loan.

Launch of BLKMKT™ Brand in Israeli Medical Cannabis Market

On October 12, 2022, the Company and Avant Brands Inc. (“Avant”) announced the signing of an international trademark licensing agreement (the “Licensing Agreement”) granting the Company the exclusive right to launch the BLKMKT™ brand in the Israeli medical cannabis market. Under the terms of the Licensing Agreement, a subsidiary of Avant will license

the Company’s premium- cannabis flagship BLKMKT™ brand to an Israeli subsidiary of the Company for use on the Company’s medical cannabis product packaging. All such packaging will contain cannabis cultivated exclusively by Avant, and sold to the

Company’s affiliates. The integration of unique and exclusive varieties of the high-quality BLKMKT™ brand into the Company’s current premium product portfolio will serve to bolster the cooperative and synergistic partnership forged between the

Avant and the Company over the past two years. The Licensing Agreement signals the Company’s commitment to implementing a premium strategy and acts as another step to establish the Company’s leadership of the ultra-premium segment in Israel.

17

Annual General and Special Meeting

On October 20, 2022, the Company held an annual and special meeting at which time all matters put to shareholders were approved including, but not limited to, the election of directors to the

Board, appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global as auditor of the Company, the adoption of new modernized articles of the Company, and the approval of the Consolidation, to be effected as and when

determined by the Board. On November 17, 2022, the Consolidation was effected.

Loan to Telecana

On November 29, 2022, the Company’s subsidiary, IMC Holdings entered into a convertible loan agreement (the “Telecana Loan

Agreement”) with Telecana Ltd. (“Telecana”) and the sole shareholder of Telecana, whereby IMC Holdings will loan NIS 1,545 (approximately $[595]) to Telecana according to the following advance

schedule: NIS 45 on January 15, 2023; NIS 250 on January 31, 2023; NIS 500 on February 28, 2023; NIS 500 on April 5, 2023; and NIS 250 on May 5, 2023. Telecana is in the advanced stages of opening a pharmacy, and intends to apply to the IMCA for

a license to dispense medical cannabis products. Pursuant to the Telecana Loan Agreement, the loan can be converted into 51% of the share capital of Telecana at any time at the sole discretion of IMC Holdings.

SUBSEQUENT EVENTS

LIFE Offering

In January and February of 2023, the Company issued an aggregate of issued 2,828,248 units of the Company (each a “Unit”) at a price of US$1.25 per Unit

for aggregate gross proceeds of US$3,535 in a series of closings pursuant to a non-brokered private placement offering to purchasers resident in Canada (except the Province of Quebec) and/or other qualifying jurisdictions relying on the listed

issuer financing exemption under Part 5A of National Instrument 45-106 – Prospectus Exemptions (the “LIFE Offering”). Each Unit consisted of one Common Share and

one Common Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one additional Common Share at an exercise price of US$1.50 for a period of 36 months from

the date of issue.

In addition, a non-independent director of the Company subscribed for an aggregate of 131,700 Units under the LIFE Offering at an aggregate subscription price of US$165. The director's

subscription price was satisfied by the settlement of US$165 in debt owed by the Company to the director for certain consulting services previously rendered by the director to the Company.

18

Concurrent Offering

Concurrent with the LIFE Offering, the Company issued an aggregate of 2,317,171 Units on a non-brokered private placement basis at a price of US$1.25 per Unit for aggregate gross proceeds of

US$2,896 (the “Concurrent Offering”). The Concurrent Offering was led by insiders of the Company. The Units offered under the Concurrent Offering were offered for sale to purchasers in all provinces and

territories of Canada and jurisdictions outside Canada pursuant to available prospectus exemptions other than for the LIFE Offering exemption.

All Units issued under the Concurrent Offering were subject to a statutory hold period of four months and one day in accordance with applicable Canadian securities laws.

Panaxia Transaction Update

On February 13, 2023, the Company announced that it reached an agreement, together with Panaxia, to terminate the option that the Company had, under the Panaxia Transaction, to acquire a pharmacy

licensed to dispense and sell medical cannabis to patients, for no additional consideration. Under the agreement, the Company will not be required to make the fifth installment of approximately $262 of Common Shares owed by the Company to Panaxia

under the Panaxia Transaction and will receive an agreed compensation amount of approximately $95 from Panaxia to be paid by Panaxia in services and cannabis inflorescence in accordance with the terms as agreed by the parties.

The consideration payable by the Company under the Panaxia Transaction was NIS 18,700 (approximately $7,200), comprised of $2,900 in cash, payable in two installments, and $4,300 in Common

Shares, payable in five installments. To date, the Company preformed four installments as was previously announced on August 9, 2021, September 8, 2021, October 20, 2021, and November 18, 2021, respectively.

Restructuring

On March 8, 2023, subsequent to the reporting period, the Company announced its strategy plan in Israel in order to strengthen its focus on core activities and drive efficiencies to realize

sustainable profitability. The Company expects to reduce its workforce in Israel by 20%-25% across all functions (including executives). All actions associated with the workforce reduction are expected to be substantially complete by mid-2023,

subject to applicable Israeli law.

19

FINANCIAL HIGHLIGHTS

Below is the analysis of the changes that occurred for the year and three months ended December 31, 2022, with further commentary provided below.

|

For the year

ended December 31

|

For the three months

ended December 31

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Net Revenues*

|

$

|

54,335

|

$

|

34,053

|

$

|

14,461

|

$

|

9,912

|

||||||||

|

Gross profit before fair value impacts in cost of sales*

|

$

|

11,291

|

$

|

8,595

|

$

|

2,791

|

$

|

1,080

|

||||||||

|

Gross margin before fair value impacts in cost of sales (%)*

|

21

|

%

|

25

|

%

|

19

|

%

|

11

|

%

|

||||||||

|

Operating Loss*

|

$

|

(30,791

|

)

|

$

|

(23,035

|

)

|

$

|

(10,708

|

)

|

$

|

(8,741

|

)

|

||||

|

Net loss*

|

$

|

(24,922

|

)

|

$

|

(664

|

)

|

$

|

(9,650

|

)

|

$

|

(8,360

|

)

|

||||

|

Loss per share attributable to equity holders of the Company – Basic (in CAD)*

|

$

|

(3.13

|

)

|

$

|

0.02

|

$

|

(1.32

|

) |

$

|

(0.19

|

)

|

|||||

|

Loss per share attributable to equity holders of the Company - Diluted (in CAD)*

|

$

|

(3.81

|

)

|

$

|

(3.62

|

) |

$

|

(1.28

|

) |

$

|

(0.19

|

)

|

||||

|

For the year

ended December 31

|

For the three months

ended December 31

|

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Average net selling price of dried flower (per Gram)*

|

$

|

7.12

|

$

|

6.18

|

$

|

5.19

|

$

|

6.87

|

||||||||

|

Quantity harvested and trimmed (in Kilograms1)*

|

-

|

1,935

|

-

|

947

|

||||||||||||

|

Quantity of dried flower sold (in Kilograms2)*

|

6,794

|

4,278

|

2,334

|

1,220

|

||||||||||||

* From continuing operations

Notes:

| 1. |

Including other cannabis products such as Concentrates, Kief, Hash and Pre-rolls.

|

| 2. |

Harvested flowers, after trimming and ready for manufacturing.

|

20

The Overview of Financial Performance includes reference to “Gross Margin”, which is a non-IFRS financial measure that the Company defines as the difference between revenue and cost of revenues

divided by revenue (expressed as a percentage), prior to the effect of a fair value adjustment for inventory and biological assets. For more information on non-IFRS financial measures, see the “Non-IFRS Financial

Measures” and “Metrics and Non-IFRS Financial Measures” sections of the MD&A.

OPERATIONAL RESULTS

In each of the markets in which the Company operates, the Company must navigate evolving customer and patient trends in order to continue to be competitive with other suppliers of medical

cannabis products.

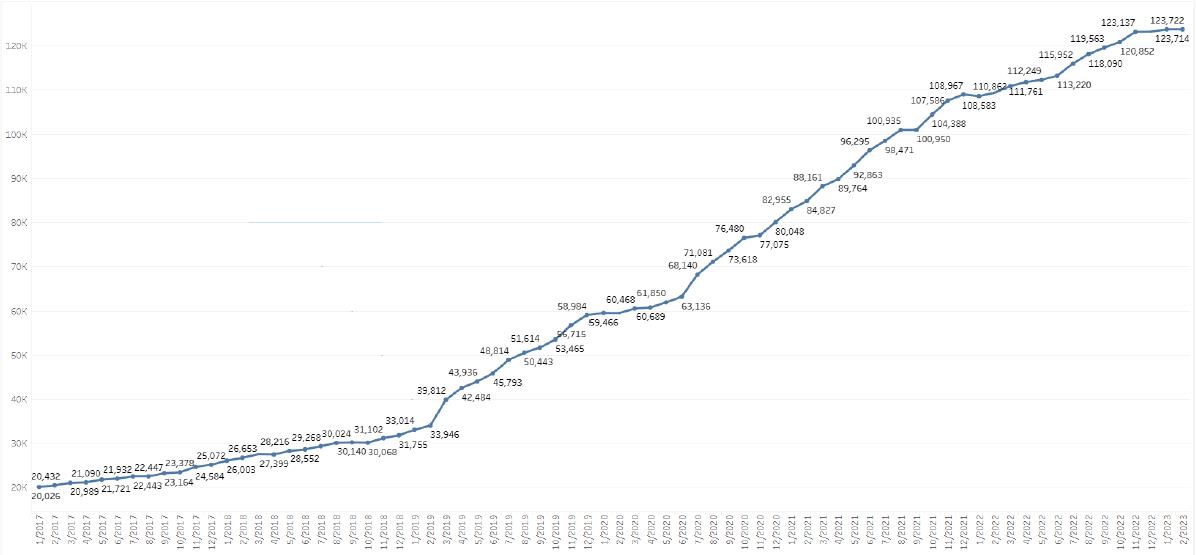

The Company believes that there are several key factors creating tailwinds to facilitate further industry growth. In Israel, the number of licensed medical patients continues to increase and

currently stands at 123,722 as of February 2023. This figure is expected to continue growing in the coming years and may further benefit from regulatory change liberalizing the cannabis market in Israel. Moreover, the acquisitions of the Israeli

Pharmacies positions IM Cannabis as a large distributor of medical cannabis in Israel. As the Israeli cannabis market has become increasingly competitive, the ability to import premium cannabis from Canada is a key determinant of the Company’s

success in Israel.

The German medical cannabis market has been slower to develop due to the difficulty in medical patients accessing prescriptions and insurance reimbursements. The Company has, however, seen an

increase in the number of patients paying out-of-pocket for medical cannabis products in Germany, which the Company believes is supportive of its business plan as it relies less on the need for patient’s insurance coverage for re-imbursement.

The newly elected coalition government in Germany has endorsed the legalization of adult-use cannabis. While no specific legislation has yet been tabled and any implementation is expected to take

time, the Company believes that Germany has the potential to be the second largest federally legal, adult-use market in the world.

The Company’s outlook in Germany is further supported by its focus on the cultivation and distribution of premium and ultra-premium cannabis products exclusively, which the Company believes to be

in the greatest demand in all of its markets. In comparison to other markets, the Company faces less competition in Germany and therefore is less likely to face significant price competition.

The Company is focusing its resources on reinforcing and further pursuing growth opportunities in Israel, Germany and Europe, implementing a leaner organization strategy with the primary focus on

achieving profitability in 2023.

21

REVENUES AND GROSS MARGINS

REVENUES

The revenues of the Group from continuing operations are primarily generated from sales of medical cannabis products to customers in Israel and Germany. The reportable geographical segments in

which the Company operates are Israel and Germany.

For the year ended December 31:

|

Israel

|

Germany

|

Adjustments

|

Total

|

|||||||||||||||||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||||||||||||||

|

Revenues

|

$

|

50,500

|

$

|

25,431

|

$

|

3,835

|

$

|

8,622

|

$

|

-

|

$

|

-

|

$

|

54,335

|

$

|

34,053

|

||||||||||||||||

|

Segment income (loss)

|

$

|

(23,606

|

)

|

$

|

(10,653

|

)

|

$

|

(3,225

|

)

|

$

|

(5,142

|

)

|

$

|

-

|

$

|

-

|

$

|

(26,831

|

)

|

$

|

(15,795

|

)

|

||||||||||

|

Unallocated corporate expenses

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

(3,960

|

)

|

$

|

(7,240

|

)

|

$

|

(3,960

|

)

|

$

|

(7,240

|

)

|

||||||||||||

|

Total operating (loss) income

|

$

|

(23,606

|

)

|

$

|

(10,653

|

)

|

$

|

(3,225

|

)

|

$

|

(5,142

|

)

|

$

|

(3,960

|

)

|

$

|

(7,240

|

)

|

$

|

(30,791

|

)

|

$

|

(23,035

|

)

|

||||||||

|

Depreciation, amortization & impairment

|

$

|

6,747

|

$

|

1,424

|

$

|

200

|

$

|

701

|

$

|

-

|

$

|

-

|

$

|

6,947

|

$

|

2,125

|

||||||||||||||||

For the three months ended December 31:

|

Israel

|

Germany

|

Adjustments

|

Total

|

|||||||||||||||||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||||||||||||||

|

Revenues

|

$

|

13,136

|

$

|

8,472

|

$

|

1,325

|

$

|

1,440

|

$

|

-

|

$

|

-

|

$

|

14,461

|

$

|

9,912

|

||||||||||||||||

|

Segment income (loss)

|

$

|

(10,280

|

)

|

$

|

(4,425

|

)

|

$

|

(517

|

)

|

$

|

(2,738

|

)

|

$

|

-

|

$

|

-

|

$

|

(10,797

|

)

|

$

|

(7,163

|

)

|

||||||||||

|

Unallocated corporate income (expenses)

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

90

|

$

|

(1,578

|

)

|

$

|

90

|

$

|

(1,578

|

)

|

||||||||||||||

|

Total operating (loss) income

|

$

|

(10,280

|

)

|

$

|

(4,425

|

)

|

$

|

(517

|

)

|

$

|

(2,738

|

)

|

$

|

90

|

$

|

(1,578

|

)

|

$

|

(10,707

|

)

|

$

|

(8,741

|

)

|

|||||||||

|

Depreciation, amortization & impairment

|

$

|

4,957

|

$

|

(1,217

|

)

|

$

|

48

|

$

|

635

|

$

|

-

|

$

|

-

|

$

|

5,005

|

$

|

(582

|

)

|

||||||||||||||

The consolidated revenues of the Group from continuing operations for the year ended December 31, 2022, were attributed to the sale of medical cannabis products in Israel and Germany.

| ● |

Revenues from continuing operations for the year ended December 31, 2022 and 2021 were $54,335 and $34,053, respectively, representing an increase of $20,282 or 60%. Revenues for the three months ended December 31, 2022, and 2021 were

$14,461 and $9,912, respectively, representing an increase of $4,549 or 46%. The increase in revenues is primarily attributed to the increase in the quantity of medical cannabis products sold, as well as from the higher average selling

price per gram the Company realized from its portfolio of premium branded cannabis products in Israel. Additional increases were derived from the Company’s organic growth and related synergies in the areas where it operates.

|

22

| ● |

Revenues from the Israeli operation were attributed to the sale of medical cannabis through the Company’s agreement with Focus Medical and the revenues from the Israeli Pharmacies the Company owns, mostly from cannabis products.

|

| ● |

In Germany, Company revenues were attributed to the sale of medical cannabis through Adjupharm.

|

| ● |

Total dried flower sold for the year ended December 31, 2022, was 6,794kg at an average selling price of $7.12 per gram compared to 4,278kg for the same period in 2021 at an average selling price of $6.18 per gram, mainly attributable

to the higher average selling price per gram the Company recognized through the acquisition of the Israeli Pharmacies. Total dried flower sold for the three months ended December 31, 2022, was 2,334kg at an average selling price of $5.19

per gram compared to 1,220kg for the three months ended December 31, 2021, at an average selling price of $6.87 per gram.

|

COST OF REVENUES

Cost of revenues is comprised of purchase of raw materials and finished goods, cultivation costs, utilities, salary expenses and import costs, production costs, product laboratory testing,

shipping and sales related costs. At harvest, the biological assets are transferred to inventory at their fair value which becomes the deemed cost for the inventory. Inventory is later expensed to the cost of sales when sold. Direct production

costs are expensed through the cost of sales.

The fair value of biological assets is categorized within Level 3 of the fair value hierarchy. The inputs and assumptions used in determining the fair value of biological assets include:

| 1. |

Selling price per gram - calculated as the weighted average historical selling price for all strains of cannabis sold by the Group, which is expected to approximate future selling prices.

|

| 2. |

Post-harvest costs - calculated as the cost per gram of harvested cannabis to complete the sale of cannabis plants post-harvest, consisting of the cost of direct and indirect materials, depreciation and labor as well as labelling and

packaging costs.

|

| 3. |

Attrition rate - represents the weighted average percentage of biological assets which are expected to fail to mature into cannabis plants that can be harvested.

|

| 4. |

Average yield per plant - represents the expected number of grams of finished cannabis inventory which are expected to be obtained from each harvested cannabis plant.

|

| 5. |

Stage of growth - represents the weighted average number of weeks out of the average weeks growing cycle that biological assets have reached as of the measurement date. The growing cycle is

approximately 12 weeks.

|

23

The following table quantifies each significant unobservable input, and also provides the impact that a 10% increase/decrease in each input would have on the fair value of biological assets grown

by the Company:

|

10% change as of

|

||||||||||||||||

|

December 31, 2022

|

December 31, 2021

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||

|

In CAD

|

In Thousands of CAD

|

|||||||||||||||

|

Average selling price per gram of dried cannabis

|

$

|

3.21

|

$

|

3.64

|

$

|

60

|

$

|

296

|

||||||||

|

Average post-harvest costs per gram of dried cannabis

|

$

|

0.75

|

$

|

1.16

|

$

|

17

|

$

|

140

|

||||||||

|

Attrition rate

|

51

|

%

|

27

|

%

|

44

|

%

|

100

|

%

|

||||||||

|

Average yield per plant (in grams)

|

38

|

47

|

42

|

228

|

||||||||||||

|

Average stage of growth

|

82

|

%

|

47

|

%

|

39

|

%

|

212

|

%

|

||||||||

The cost of revenues from continuing operations for the year ended December 31, 2022 and 2021 were $43,044 and $25,458, respectively, representing an increase of $17,586 or 69%. Cost of revenues

for the three months ended December 31, 2022 and 2021 were $11,670 and $8,832, respectively, representing an increase of $2,838 or 32%.

GROSS PROFIT

The Company’s formula for calculating gross profit includes:

| ● |

production costs (current period costs that are directly attributable to the cannabis growing and harvesting process);

|

| ● |

materials and finished goods purchase costs;

|

| ● |

a fair value adjustment on sale of inventory (the change in fair value associated with biological assets that were transferred to inventory upon harvest); and

|

| ● |

a fair value adjustment on growth of biological assets (the estimated fair value less cost to sell of biological assets as at the reporting date).

|

Gross profit also includes the net change in fair value of biological assets, inventory expensed and production costs. Biological assets consist of cannabis plants at various after-harvest stages

which are recorded at fair value less costs to sell after harvest.

Gross profit from continuing operations for the year ended December 31, 2022, and 2021 was $9,162 and $6,333, respectively, representing an increase of $2,829 or 45%. For the three months ended

December 31, 2022, and 2021 gross profit was $2,603 and $979, respectively, representing an increase of $1,624 or 166%.

Gross profit included losses from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold of $(2,129) and $(2,262) for the year ended December

31, 2022, and 2021, respectively. Losses from unrealized changes in fair value of biological assets and realized fair value adjustments on inventory sold for the three months ended December 31, 2022, and 2021 were $(188) and $(101), respectively.

Fair value adjustments were impacted primarily due to lower valuation to unrealized biological assets during the year ended December 31, 2022.

In the year ended December 31, 2022, the impact of global inflation on the Company resulted in higher than usual operating costs, and in particular higher costs of raw materials, shipping and

transport services and the cost of hiring skilled labor to ensure the Company remains on track with scheduled manufacturing and regulatory milestones. There is no assurance that inflation will not continue to have similar impacts on the Company’s

operations in the first quarters of 2023.

24

EXPENSES

GENERAL AND ADMINISTRATIVE

General and administrative expenses from continuing operations for the year ended December 31, 2022, and 2021 were $21,460 and $17,221, respectively, representing an increase of $4,239 or 25%.

For the three months ended December 31, 2022, and 2021, general and administrative expenses were $9,790 and $5,377, respectively, representing an increase of $4,413 or 82%.

The increase in the general and administrative expense is attributable mainly to a full year consolidation of the previously acquired Israeli entities that were not fully consolidated in 2021, as

well as non-recurring costs related to fair value adjustment of Company’s purchase option of a pharmacy. The general and administrative expenses are comprised mainly from salaries to employees in the amount of $4,027, professional fees in the

amount of $4,689, depreciation and amortization in the amount of $819, insurance costs in the amount of $1,566, and other general and administration costs in the amount of $10,358 comprised mainly of non-recurring costs.

SELLING AND MARKETING

Selling and marketing expenses from continuing operations for the year ended December 31, 2022, and 2021 were $11,473 and $6,725, respectively, representing an increase of $4,748 or 71%. For the

three months ended December 31, 2022, selling and marketing expenses were $3,094, compared to $2,880 for the three months ended December 31, 2021, representing an increase of $214 or 7%. The increase in the selling and marketing expenses was due

mainly to the Company’s increased marketing efforts in Israel, increased distribution expenses relating to the growth in sales, and full year consolidation of entities acquired in 2021. The increase in cost is also partially attributed to the

rising distribution costs of the Company’s products.

RESTRUCTURING EXPENSES

On April 6, 2022, Focus Medical announced its decision, from March 30, 2022, to close the Focus Facility in Israel and therefore the Company recorded restructuring expenses related to impairment

of property, plant and equipment, biological assets and right of use asset and liabilities, in the total amount of $4,383.

SHARE-BASED COMPENSATION

Share-based compensation expense from continuing operations for the year ended December 31, 2022, and 2021 was $2,637 and $5,422, respectively, representing a decrease $2,785 or 51%. For the

three months ended December 31, 2022, and 2021, share-based compensation expense was $428 and $1,467, respectively, representing a decrease of $1,039 or 71%. The decrease for the year ended December 31, 2022, was mainly due to the cancellation of

incentive stock options (“Options”) held by employees who no longer worked for the Company as well as to fair value adjustments to options held by Company’s consultants.

25

FINANCING

Financing income (expense), net, from continuing operations for the year ended December 31, 2022, and 2021 was $4,731 and $22,871, respectively, representing a decrease of $18,140 or 79% in the

financing income. For the three months ended December 31, 2022, and 2021, financing income (expense), net was $949 and $675, respectively, representing an increase of $274 or 41%.

The change for the year was mainly due to the updated Company’s warrants valuation that was impacted by the Company’s decreased share price leading to financial income in the amount of $(21,638).

NET INCOME/LOSS

Net loss from continuing operations for the year ended December 31, 2022, and 2021 was $24,922 and $664, respectively, representing a net loss increase of $24,258 or 3,653%. For the three months

ended December 31, 2022, and 2021, Net loss was $9,651 and $8,360 respectively, representing a net loss increase of $1,291 or 15%. The net loss increase related to factors impacting net income from operations described above, and financing income

driven by revaluation of warrants and other financial instruments in the amount of $6,001 which were recorded against liability on the grant day and were re-evaluated at December 31, 2022 through profit or loss.

NET INCOME (LOSS) PER SHARE BASIC AND DILUTED

Basic loss per share is calculated by dividing the net profit attributable to holders of Common Shares by the weighted average number of Common Shares outstanding during the period. Diluted

profit per Common Share is calculated by adjusting the earnings and number of Common Shares for the effects of dilutive warrants and other potentially dilutive securities. The weighted average number of Common Shares used as the denominator in